🚨🚨 Update: Our hourly view chart is showing a rising whales ratio indicating more incoming whales tokens on exchanges. The 30D average whales ratio rised up overnight and is falling right now. However, since yesterday we have detected more positive netflows

#BTC #ETH #XRP

#BTC #ETH #XRP

indicating bigger inflows linked to whales than outflows. Stablecoin supply keeps rising and stablecoin reserve on exchanges is lifting up. Since yesterday I have detected almost $500m in #tether outflows from #Binance to "unknown". That's what we are noticing since weeks. They

have withdrawed billions in #tether already from #Binance.

Our block view is showing a rising whales ratio indicating more whales inflows arriving on exchanges. The dump in whales ratio I have detected 01-11-2022 was, as expected, an accurate indicator for a coming pump. Since

Our block view is showing a rising whales ratio indicating more whales inflows arriving on exchanges. The dump in whales ratio I have detected 01-11-2022 was, as expected, an accurate indicator for a coming pump. Since

then we have lifted up from 42.5k to 44k. The happend 01-08-2022 before we lifted up from 40.5k to 42.8k. Whales ratio combined with more metrics is showing a very good performance and indicator.

Anyway, in our block view we are registring some bigger inflows. Tonight we had the

Anyway, in our block view we are registring some bigger inflows. Tonight we had the

biggest netflow move showing a positive netflow of almost 600 #BTC indicating more inflows than outflows to exchanges. Interesting also is the rising stablecoin reserves on exhanges and at the same time a rising stablecoin supply in the market in general. Both is bullish imo

indicating more stablecoin demand on exchanges.

Also interesting is the comparison between exchange activity to network activity. If we check our recent pump we can detect a pump in network activity while our exchange activity maintains low. That could be indicating some

Also interesting is the comparison between exchange activity to network activity. If we check our recent pump we can detect a pump in network activity while our exchange activity maintains low. That could be indicating some

OTC desk activity involved in our last pump. In general is the exchange spot activity ultra low indicating a crypto winter for exchanges. Also interesting in this chart, the activity outside of exchanges also rised two times in our dump phase. Everytime before we had a bigger

dump. If we check the trading behavior of entities with 1,000 - 10,000 #BTC classified as the smart money by myself due their awesome trade behavior the activity outside of exchanges and their behavior correlates perfectly. Since 01-08-2022 they have rised their balances from

5.17m #BTC to 5.2m #BTC indicating an accumulation of 30,000 #BTC since then. Also an indicator that big whales are playing with us. At the moment their balances are in downward trend. They buy the local bottom to sell in the local top making gains and dumping more tokens than

accumulated in the local bottom and so reducing their total balances. Since 10-21-2021 they have reduced their balances by 130,000 #BTC.

Our current price action correlates with our max pain of 44k for our next expiry 14Jan. For our expiry 28Jan we still have a max pain of 48k. The 28Jan max pain should be very accurate due its total volume of almost $2 billion. So, imo we will lift up to 48k until 28Jan.

The 2 top traded option instruments are for our expiry 25MAR indicating a Calls volume of $76m at 70k and a Puts volume of $70m at 30k. That's not bearish imo. The puts could be part of an option trade strategy.

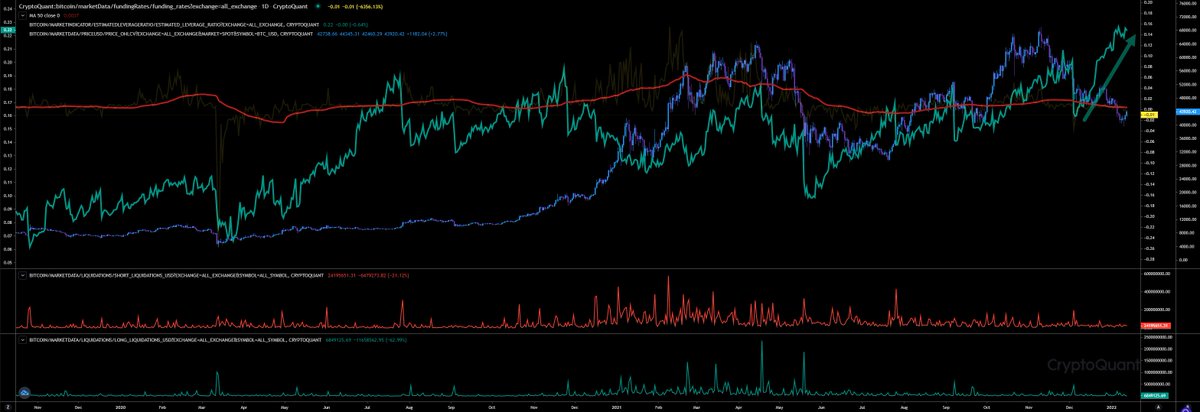

Our Future trading chart is showing a rising leverage ratio in the daily view since 12-05-2021. Since 01-06-2022 the leverage ratio has declined a bit, but not that much. It's still close to ATH indicating risky positions still remaining and easy to liquidate with a rising

volatility. Funding rates are almost neutral, a bit mire negative showing more shorts than longs. But imo not a big gap. So, if we start to make some big price moves that could cause a cascade in high leverage longs and shorts letting the volaility rising even more. Would

explain the long gamma strategy by option traders I have mentioned last week.

If we check the hourly view of the chart we can detect a falling funding rate indicating more shorts coming in than longs while the leverage ratio maintains its level.

If we check the hourly view of the chart we can detect a falling funding rate indicating more shorts coming in than longs while the leverage ratio maintains its level.

Today later on I will tweet my trade strategy for the next 2 weeks. So, stay tuned.

Imo we will almost maintain our current price level. Even if I'm expecting a rising volatility due the remaining events for today and tomorrow. In 1:15 hours we will get our Dec data for PPI

Imo we will almost maintain our current price level. Even if I'm expecting a rising volatility due the remaining events for today and tomorrow. In 1:15 hours we will get our Dec data for PPI

and Initial Jobless Claims. The CPI yesterday was not more bearish than before due it was very close to the forecast. With Powells testify $DXY has started to dump and let $DXY breakout from its support. Yesterdays CPI report just let the sell pressure rise. $DXY is holding on

its big support between 94.8 - 94. If the PPI also shows that the forecast was correct it will dump more imo because its priced in already. That could let $NDX and $SPX pump up again. Crypto would follow. Imo we need to see.

I'm struggling here as I cannot assess the impact of a supply chain cut due Covid. Due Flurona, Omicron, etc. that could have a bigger impact. If so, and we get a bigger deviation of the forecast that could let the sell pressure rise in stocks but also in crypto.

But here some bullish news. 🧐

So folks, don't make any risky trades. Sometimes it's better to stay away and wait to get a strong bullish or bearish signal. Imo even if the PPI is bullish and we pump to 46k, we will retrace back

https://twitter.com/wallstreetpro/status/1476568798606106627?s=20

https://twitter.com/FinanceLancelot/status/1481450285285494787?s=20

So folks, don't make any risky trades. Sometimes it's better to stay away and wait to get a strong bullish or bearish signal. Imo even if the PPI is bullish and we pump to 46k, we will retrace back

to 44k until friday. Also if we dump heading 40k due a bad report we will lift up afterwards back to 44k until friday. The 14Jan expiry has a total volume of $700m. That should be a reason to go back to 44k. 😜

Be careful, create a trade stragey and stick to it! Don't let you guide by price action or fear! Stay safe!

Hmm, momentum indicator indicating a dump soon. I will short with low leverage just for fun. Just mentioning it, no advise!

• • •

Missing some Tweet in this thread? You can try to

force a refresh