Macro shorts commodities on 1bps of inflation deceleration. Mind u though: demand is half the story nor the real story!

Years of underinvestment should make shorting oil, EU/A gas or metals risky business this time & in absence of a deep recession due to Fed mistake.

Thread

Years of underinvestment should make shorting oil, EU/A gas or metals risky business this time & in absence of a deep recession due to Fed mistake.

Thread

Nickel - the battery metal - first. If you short Nickel, you deserve to lose all your capital. Reason: ignorance!

https://twitter.com/BurggrabenH/status/1481626271083909120?s=20

#Nickel maybe in for a historical squeeze here.

https://twitter.com/BurggrabenH/status/1481630939650437124?s=20

Where is the #Tin? Energy crisis impacted smelter production across most metals. Tin's was tight all year (3 months spreads; short term) & has nothing to offer on the development pipeline (long-term). Zero!

#Copper anybody? We will not have the copper the energy transition requires. #Copper may see inventory draws (unreported system; reported already low) for years to come. Chile's Boric election does not help. Pls check our dozens of Tweets/Threads.

https://twitter.com/BurggrabenH/status/1471509472904237057?s=20

#Aluminum is 3rd most plentiful element in earth's crust; but let's mine it first! Trafigura predicts years of deficits: “It requires a mindset change - some viewed buying aluminum similar to buying groceries. It’s not going to work like this anymore.”

https://twitter.com/BurggrabenH/status/1481639684925128709?s=20

#Cobalt is another battery metal, although the industry will figure out how to avoid. But that is for tomorrow. Today? It is in short supply & high demand. Even better, 70% of it is mined in the DRC and China wants all of that. But VW or Northvolt need it too. Good luck.

#Zinc like Cobalt is a minor metal. But used to galvanise other metals (iron ore to prevent rust) - a bit like the chip to the car industry: u better have it when needed. LME stocks at 132kt; prices near decade highs. Why would that go lower on 100bpd less core CPI?

The physical crude market is not under stress, but will be come 2023. After 8y of underinvestment, the outlook is for years of structural deficits. KSA/US shale will not change that post 2023 & once interconti-flights returned. Check our Tweets on everything.

H/t @antoine_halff

H/t @antoine_halff

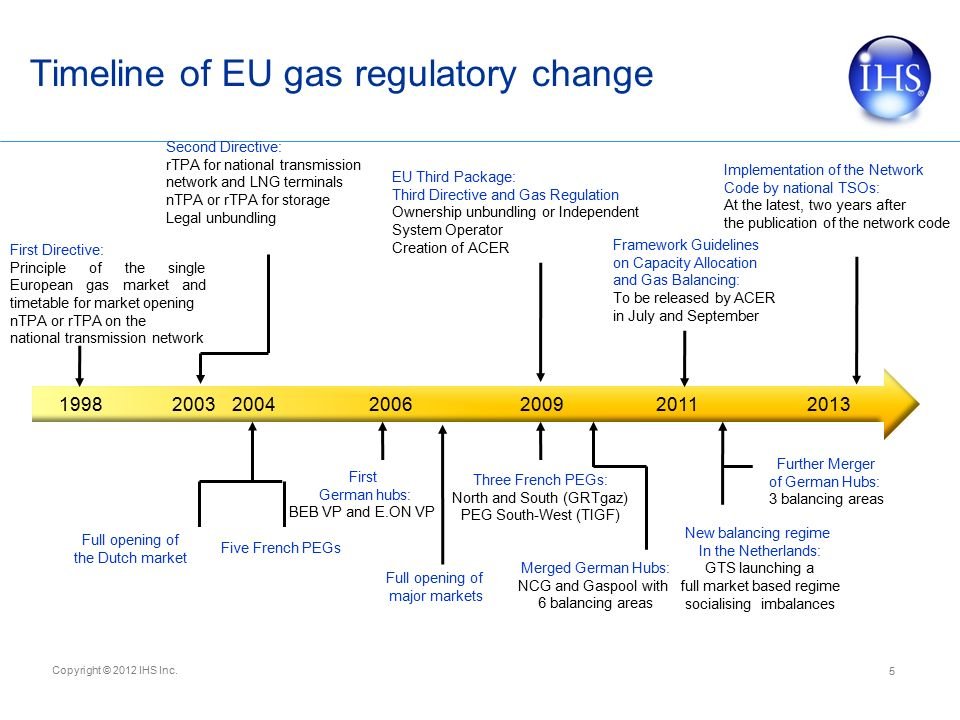

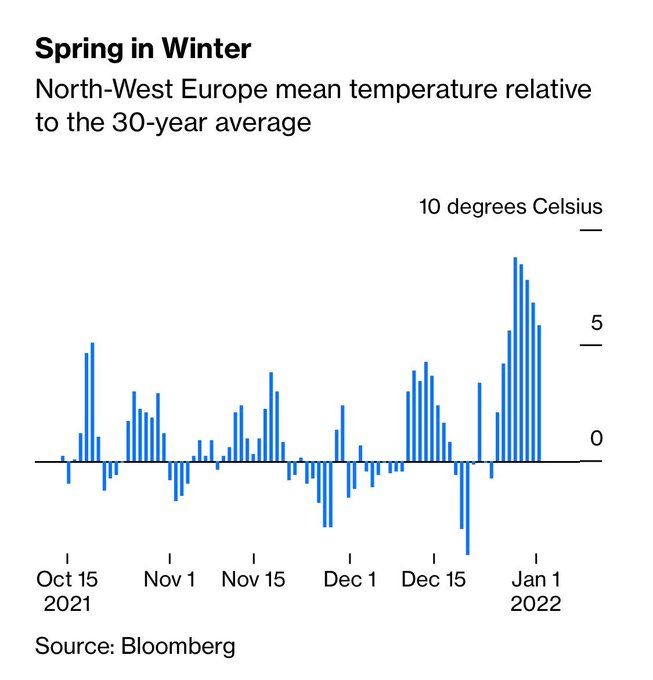

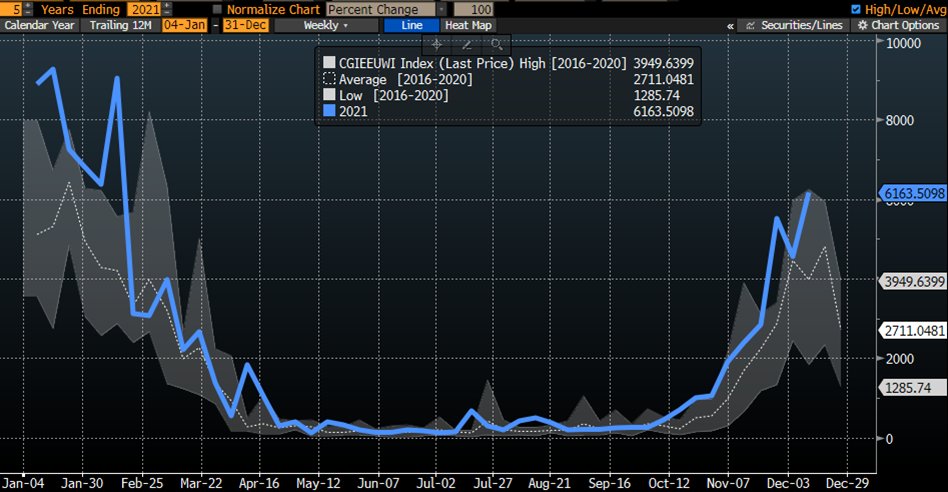

EU has short/mid/long-t issues as 300bcm pa net importer of natgas from FSU/Africa/LNG. So has China AND wants to consume more each year. US/AUS/Qatar better get exp. terminals u/c, b/c RoW needs all it can import. Russian fields? Go figure.

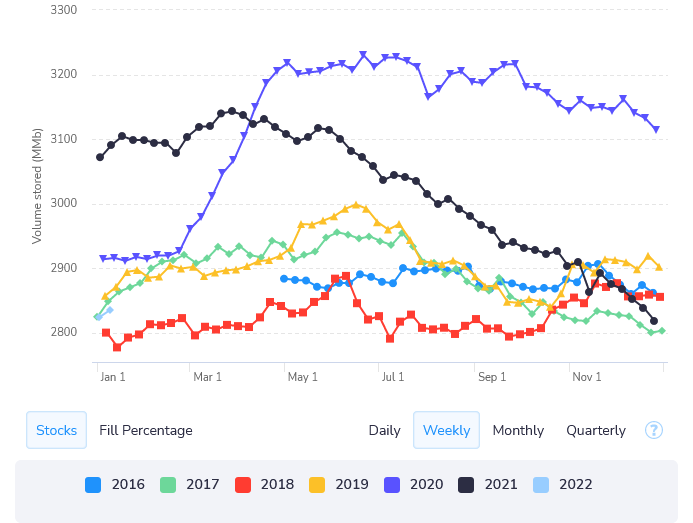

#TTF

#TTF

https://twitter.com/BurggrabenH/status/1479929914711330826?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh