🐻♉️↗️↘️↔️⚠️🚩🔺🔻🧮

Global Macro Review

01/16/2022

1/13

With #CPI +7.0% and #PPI +9.7% y/y, #inflation is 💪 both in the 🗞 and inthe 📈 with $WTIC +5.6% (w) and +10.78% YTD, while 🛍 -1.9% and consumer sentiment ↘️ to decade low.

Let’s dig into the 🧮!

Global Macro Review

01/16/2022

1/13

With #CPI +7.0% and #PPI +9.7% y/y, #inflation is 💪 both in the 🗞 and inthe 📈 with $WTIC +5.6% (w) and +10.78% YTD, while 🛍 -1.9% and consumer sentiment ↘️ to decade low.

Let’s dig into the 🧮!

2/13

Featured prominently on last week’s Barron’s cover, the $CRB +3.17% obliged and put in a new cycle high.

Image: Barron's cover 01/10/2022

Featured prominently on last week’s Barron’s cover, the $CRB +3.17% obliged and put in a new cycle high.

Image: Barron's cover 01/10/2022

2a/13

Commodities inflation is a problem for the “inflation rolling, #Quad4 cometh” narrative.

Chart: $CRB 💪

Commodities inflation is a problem for the “inflation rolling, #Quad4 cometh” narrative.

Chart: $CRB 💪

3/13

Hydrocarbons en fuego 🔥 over the past week (w) and month (t)

$WTIC +5.6% (w) +17.8% (t)

$BRENT +5.4% (w) +18.6% (t)

$GASO +5.2% (w) + 14.7% (t)

$NATGAS +8.7% (w), +15.45% (t)

Chart: $BRENT has flipped back to ♉️ (T) = 3 months +1.7% and taking out October high

Hydrocarbons en fuego 🔥 over the past week (w) and month (t)

$WTIC +5.6% (w) +17.8% (t)

$BRENT +5.4% (w) +18.6% (t)

$GASO +5.2% (w) + 14.7% (t)

$NATGAS +8.7% (w), +15.45% (t)

Chart: $BRENT has flipped back to ♉️ (T) = 3 months +1.7% and taking out October high

4/13

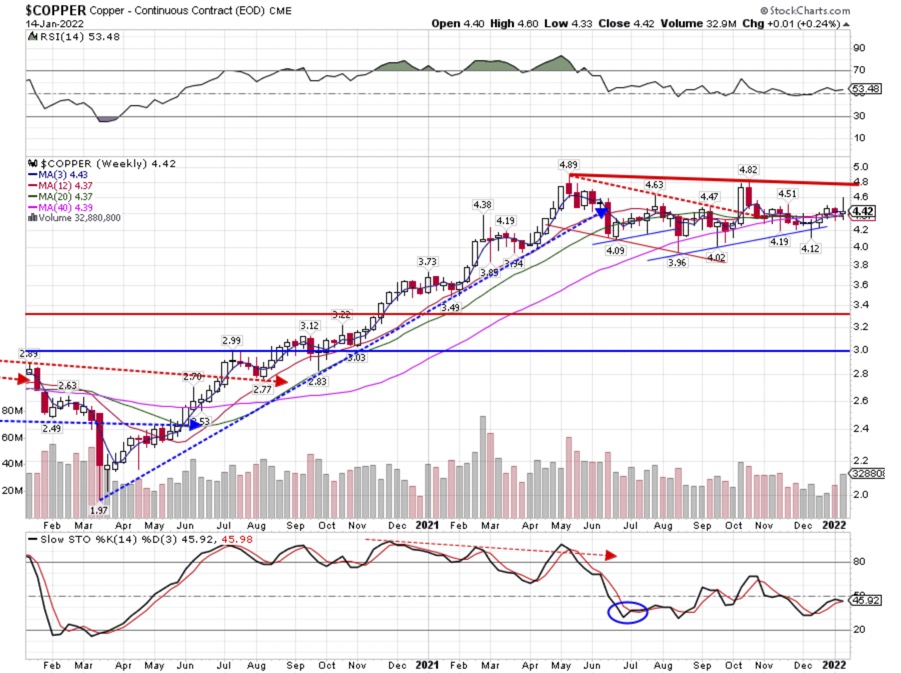

Led by $SILVER +2.3%, metals closed the week ↗️ but the messages are ↔️ from a trend (T) = 3 months perspective

$SILVER +2.3% (w); $VXSLV 25.91 🔻

$GOLD +1.05% (w); $GVZ 14.73 🔻

$PLAT +0.95% (w)

$COPPER +0.23% (w)

Chart: 🧑🏾⚕️ $COPPER +2.8% (t), but -6.55 (T) 🐻

Led by $SILVER +2.3%, metals closed the week ↗️ but the messages are ↔️ from a trend (T) = 3 months perspective

$SILVER +2.3% (w); $VXSLV 25.91 🔻

$GOLD +1.05% (w); $GVZ 14.73 🔻

$PLAT +0.95% (w)

$COPPER +0.23% (w)

Chart: 🧑🏾⚕️ $COPPER +2.8% (t), but -6.55 (T) 🐻

5/13

Not contributing to $CRB, grains were mostly ↘️ for the week

$CORN -1.75% (w) +0.5% (t)

$WHEAT -2.25% (w), -4.3% (t)

$SOYB -2.9% (w) +6.6% (t)

$SUGAR +1.4% (w) -7.6% (t)

Chart: $SUGAR with a 🔨 is 🐻 (t) and (T) -7.6% #STFR

Not contributing to $CRB, grains were mostly ↘️ for the week

$CORN -1.75% (w) +0.5% (t)

$WHEAT -2.25% (w), -4.3% (t)

$SOYB -2.9% (w) +6.6% (t)

$SUGAR +1.4% (w) -7.6% (t)

Chart: $SUGAR with a 🔨 is 🐻 (t) and (T) -7.6% #STFR

6/13

With #inflation and $CRB ↗️, bonds took it on the chin 👊 with MOVE to 76.6 🔺

2Y .969% + 9.9 BPS

5Y 1.559% +5.5 BPS

10Y 1.793 +2.7 BPS

30Y 2.127% +1.0 BPS

BUT, 10/2s -7.2 BPS to 82.4 BPS 🔻 and 30/5s -4.5 BPS to 56.8 BPS 🔻

Chart: $UST2Y with a relentless bid

With #inflation and $CRB ↗️, bonds took it on the chin 👊 with MOVE to 76.6 🔺

2Y .969% + 9.9 BPS

5Y 1.559% +5.5 BPS

10Y 1.793 +2.7 BPS

30Y 2.127% +1.0 BPS

BUT, 10/2s -7.2 BPS to 82.4 BPS 🔻 and 30/5s -4.5 BPS to 56.8 BPS 🔻

Chart: $UST2Y with a relentless bid

6a/13

Chart: The $UST10Y put in a nominal new cycle high, but struggled with ↗️ follow-thru in the face of weakening economic data

Chart: The $UST10Y put in a nominal new cycle high, but struggled with ↗️ follow-thru in the face of weakening economic data

7/13

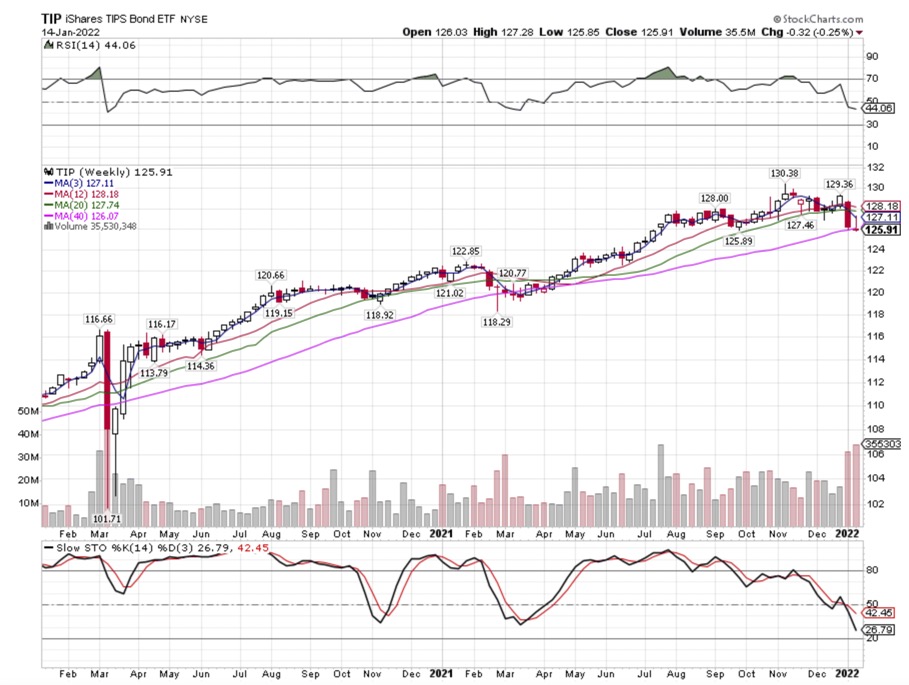

Bonds ETFs are a 🐻’s playground 🤾🏿 for now

$IVOL -0.68%

$CWB -0.6%

$LWD -0.43%

$BND -0.3%

$TIP -0.25%

$IEF -0.14%

$TLT -0.11%

$BNDX +0.26%

$HYG +0.26%

$BNDD +0.4%

Chart: $TLT broke to 🐻 (T) -2.02%

Bonds ETFs are a 🐻’s playground 🤾🏿 for now

$IVOL -0.68%

$CWB -0.6%

$LWD -0.43%

$BND -0.3%

$TIP -0.25%

$IEF -0.14%

$TLT -0.11%

$BNDX +0.26%

$HYG +0.26%

$BNDD +0.4%

Chart: $TLT broke to 🐻 (T) -2.02%

8/13

🇺🇸 indices ↘️ on the week

$SPX -0.3% (w) +0.9% (t)

$COMPQ -0.28% (w) -1.82% (t)

$IWM -0.8% (w) -0.39% (t)

Chart: With $VXN 25.72, $COMPQ on the verge of 🐻 (T) -0.02%

🇺🇸 indices ↘️ on the week

$SPX -0.3% (w) +0.9% (t)

$COMPQ -0.28% (w) -1.82% (t)

$IWM -0.8% (w) -0.39% (t)

Chart: With $VXN 25.72, $COMPQ on the verge of 🐻 (T) -0.02%

9/13

Energy stocks lead US Sectors for the week…

$XLE +5.17% (w) +20.2% (t)

$XLC +0.16% (w), +0.31% (t)

…while consumer & bond proxies ↘️

$XLRE -1.9% (w) -2.7% (t)

$XLY -1.5% (w), +0.8% (t)

$XLU -1.4% (w) -0.1% (t)

Chart: $XLP is the 2nd 💪 sector over (T) duration +8.8%

Energy stocks lead US Sectors for the week…

$XLE +5.17% (w) +20.2% (t)

$XLC +0.16% (w), +0.31% (t)

…while consumer & bond proxies ↘️

$XLRE -1.9% (w) -2.7% (t)

$XLY -1.5% (w), +0.8% (t)

$XLU -1.4% (w) -0.1% (t)

Chart: $XLP is the 2nd 💪 sector over (T) duration +8.8%

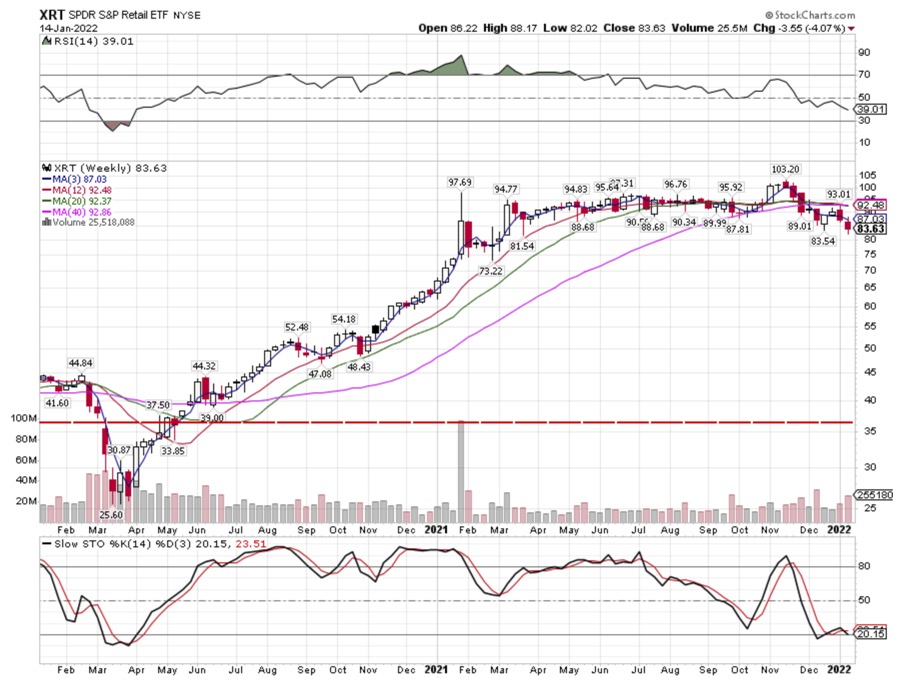

9a/13

Chart: $XRT -8.8% (T) starting signaling in late November, all was not well in the retail sector.

Unfortunately, I was $BTFD but exited when it broke (T)

Chart: $XRT -8.8% (T) starting signaling in late November, all was not well in the retail sector.

Unfortunately, I was $BTFD but exited when it broke (T)

10/13

International equity indices also under pressure - mostly ↘️

$SSEC -1.6% (w) -3.05% (t)

$NIKK -1.25% (w) -1.5% (t) 🐻

$KOSPI -1.1% (w) -3.2% (t)

$CAC -1.05% (w)+3.2% (t) ♉️

$DAX -0.4% (w) +2.25% (t)

$HSI +3.8% (w) +5.1% (t) 🐻

Chart: $HSI 🐻 is showing signs of 💪

International equity indices also under pressure - mostly ↘️

$SSEC -1.6% (w) -3.05% (t)

$NIKK -1.25% (w) -1.5% (t) 🐻

$KOSPI -1.1% (w) -3.2% (t)

$CAC -1.05% (w)+3.2% (t) ♉️

$DAX -0.4% (w) +2.25% (t)

$HSI +3.8% (w) +5.1% (t) 🐻

Chart: $HSI 🐻 is showing signs of 💪

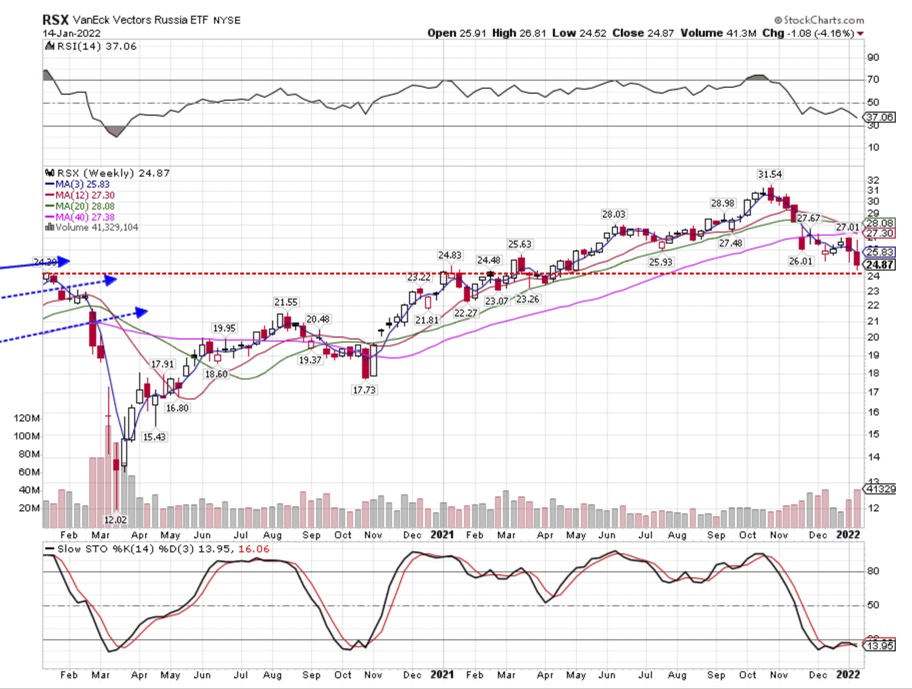

11/13

With a weaker $USD, country ETFs outperformed their local indices

Top Countries

$EWZ +6.75%

$FXI +4.2%

$EWH +2.2%

$EWC +2.15%

Poor performers

$RSX -4.15%

$VNM -3.1%

$EDEN -2.35%

Chart: Despite strong🛢&⛽️, $RSX 🪆 is -4.1% (t) and -23.8% (T) #putin #urkraine 🐻🐻

With a weaker $USD, country ETFs outperformed their local indices

Top Countries

$EWZ +6.75%

$FXI +4.2%

$EWH +2.2%

$EWC +2.15%

Poor performers

$RSX -4.15%

$VNM -3.1%

$EDEN -2.35%

Chart: Despite strong🛢&⛽️, $RSX 🪆 is -4.1% (t) and -23.8% (T) #putin #urkraine 🐻🐻

12/13

In #FX, the $USD ↘️ with $USDJPY back to neutral Trend (T)

$USD 95.16 -0.59%

$GBP 1.368 +0.66%

$AUD 0.722 +0.56%

$EUR 1.141 +0.44%

$USDCAD 1.254 -0.87%

$USDCHF 0.914 -0.5%

$USDJPY 114.25 -1.13%

Chart: The 💹 stopped going ↘️ vs. 💵

In #FX, the $USD ↘️ with $USDJPY back to neutral Trend (T)

$USD 95.16 -0.59%

$GBP 1.368 +0.66%

$AUD 0.722 +0.56%

$EUR 1.141 +0.44%

$USDCAD 1.254 -0.87%

$USDCHF 0.914 -0.5%

$USDJPY 114.25 -1.13%

Chart: The 💹 stopped going ↘️ vs. 💵

13/13

Slowing 🛍 and 🙁 sentiment reinforce growth ↘️, but #inflation is still 💪

#stagflaton #quad3 in Q1?

Clearly, this is a market in flux 🪓🪣

Short week with #VIXX on Wednesday and #OPEX on Friday 🌊

Enjoy #MLK day and have a super profitable 💰 week 🧲🧲🧲

Slowing 🛍 and 🙁 sentiment reinforce growth ↘️, but #inflation is still 💪

#stagflaton #quad3 in Q1?

Clearly, this is a market in flux 🪓🪣

Short week with #VIXX on Wednesday and #OPEX on Friday 🌊

Enjoy #MLK day and have a super profitable 💰 week 🧲🧲🧲

• • •

Missing some Tweet in this thread? You can try to

force a refresh