Manchester City’s 2020/21 accounts covered a season when they won the Premier League for the third time in four years, reached the Champions League final for the first time in the club’s history, won the League Cup and reached the FA Cup semi-finals. Some thoughts follow #MCFC

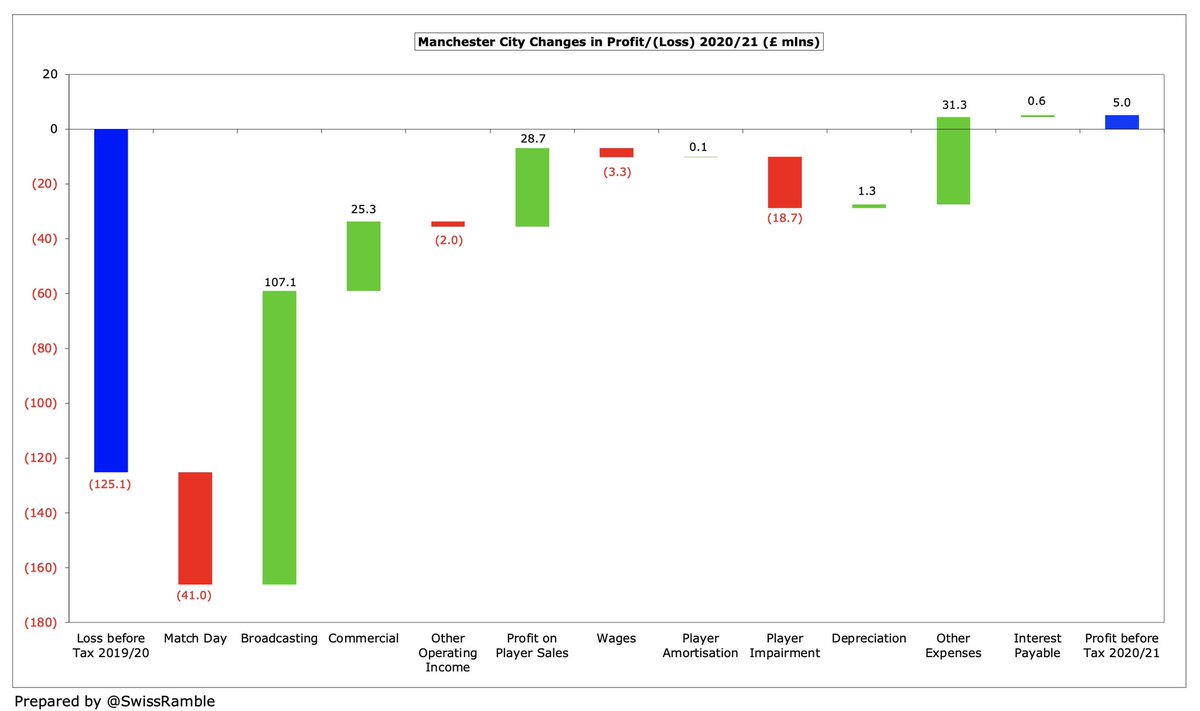

#MCFC swung from £125m loss before tax to £5m profit (£2m after tax), despite the adverse impact of COVID, as revenue increased £92m (19%) from £478m to club record £570m, profit from player sales rose £29m to £69m and operating expenses fell £11m (2%).

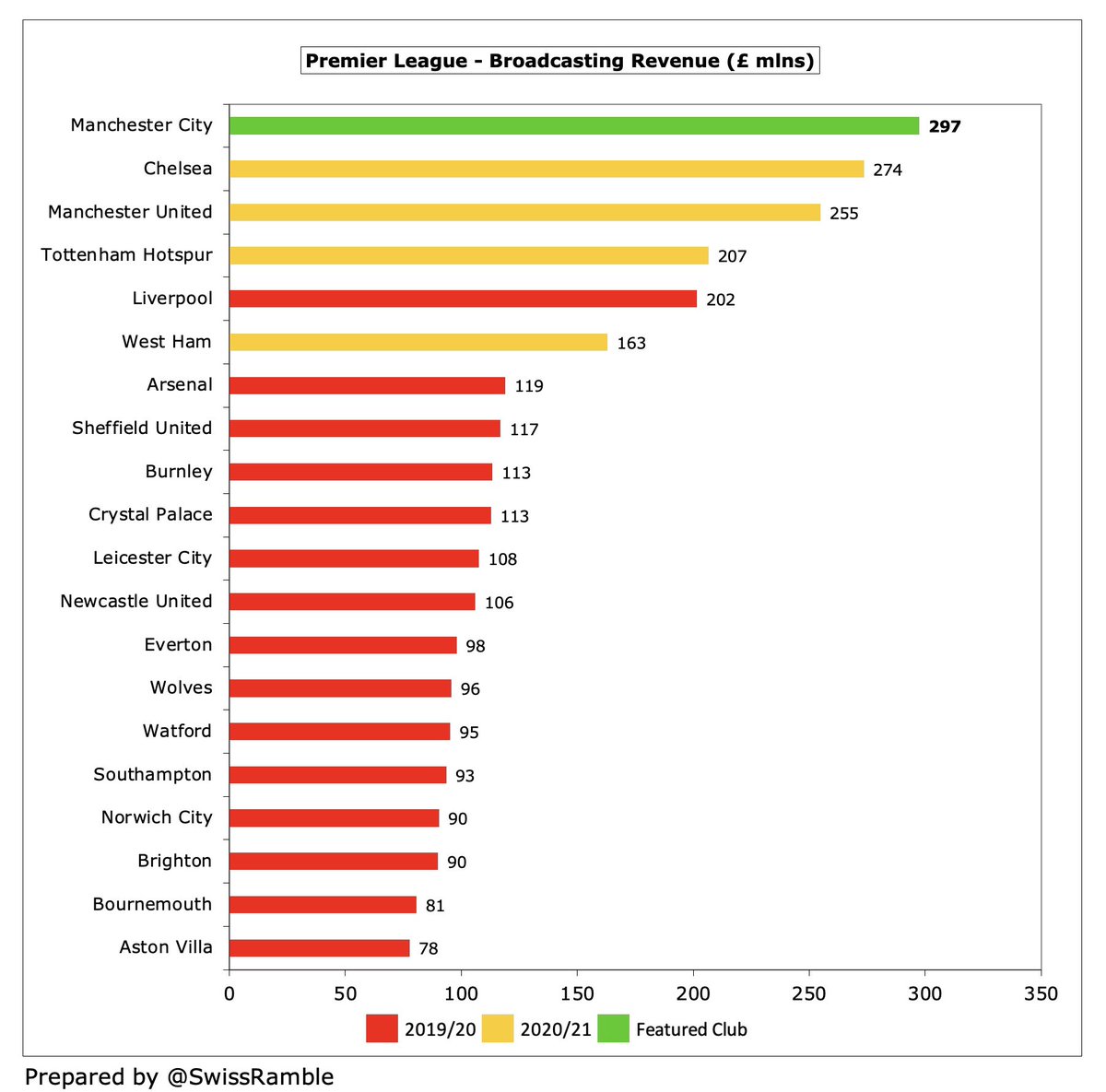

Main reason for #MCFC revenue growth was £107m (56%) increase in broadcasting from £190m to £297m, including deferred revenue from 2019/20 and higher CL money, plus £25m (10%) growth in commercial to £272m, which offset COVID driven reduction in match day, down £41m (98%) to £1m.

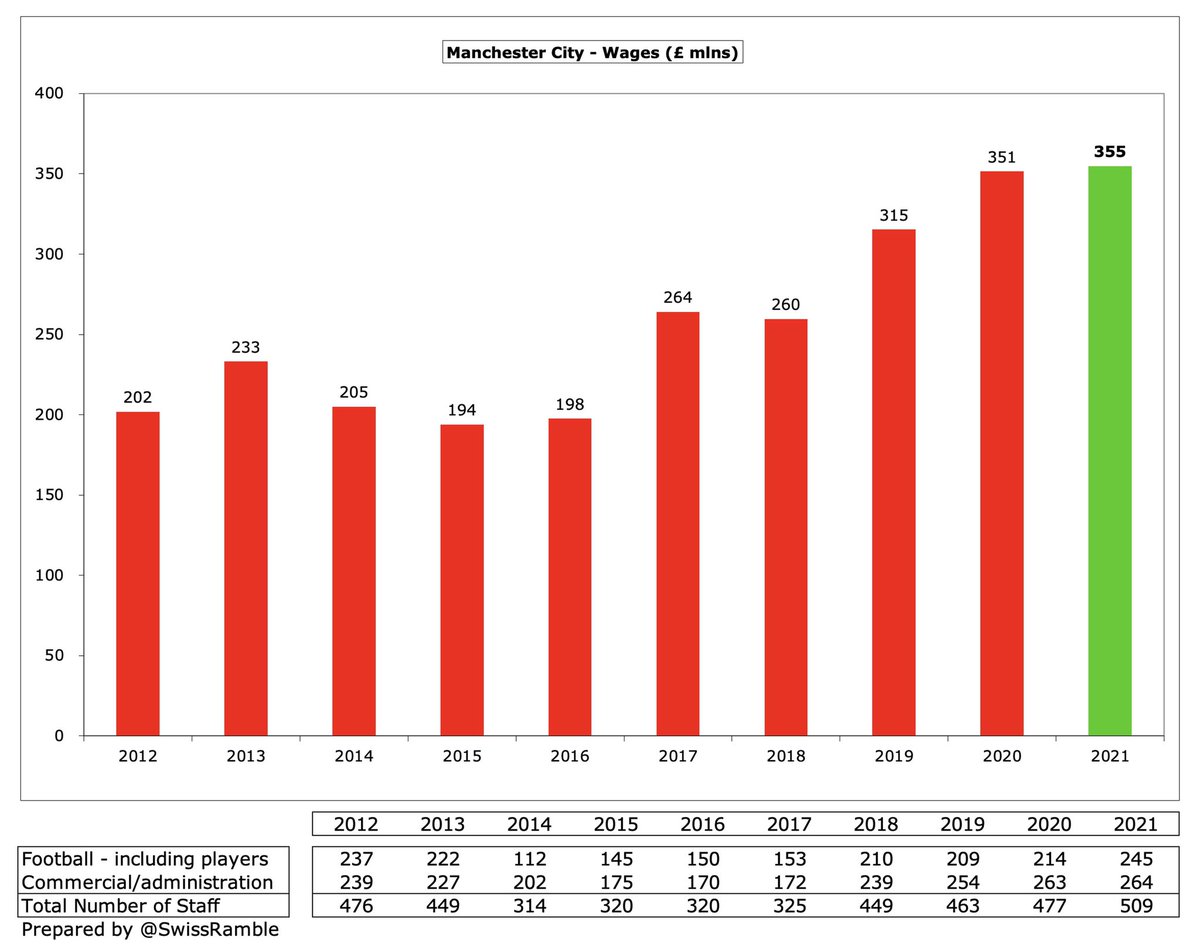

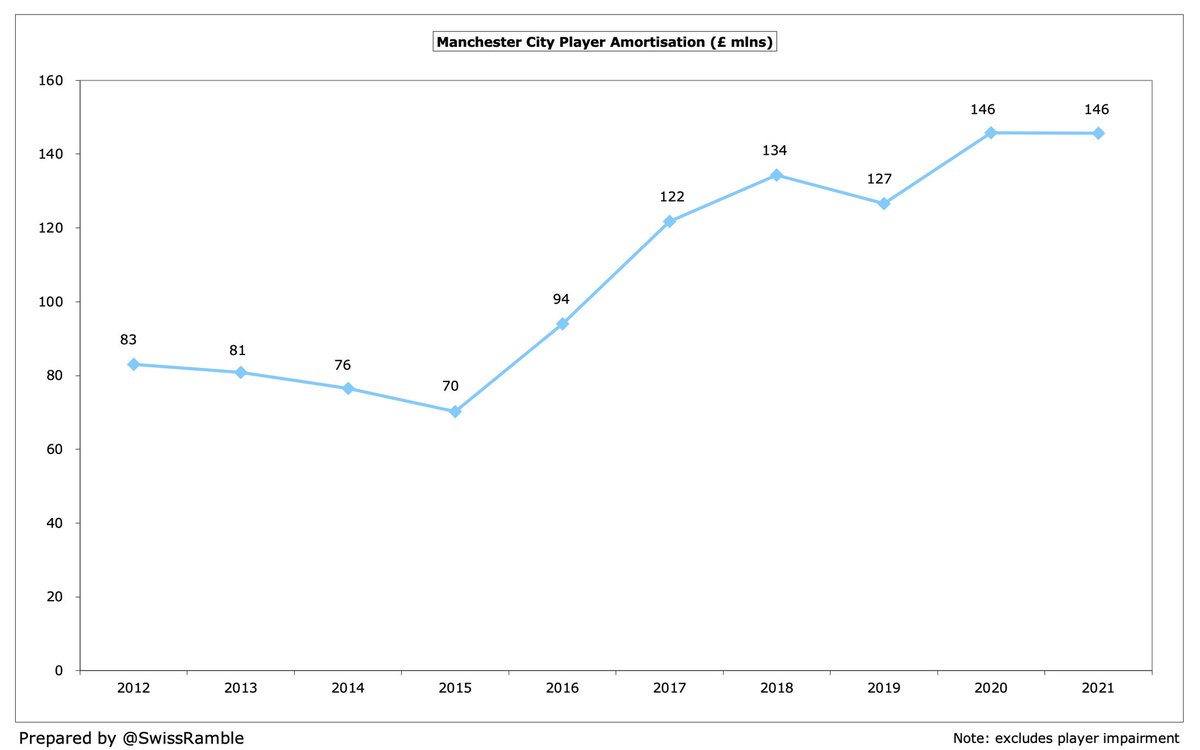

#MCFC wage bill increased by £3m (1%) to £355m, while player amortisation was flat at £146m, though the club also booked £19m player impairment. Other expenses were cut £32m (24%) to £100m and depreciation fell £1m (11%) to £11m. Other operating income down £2m to £1m.

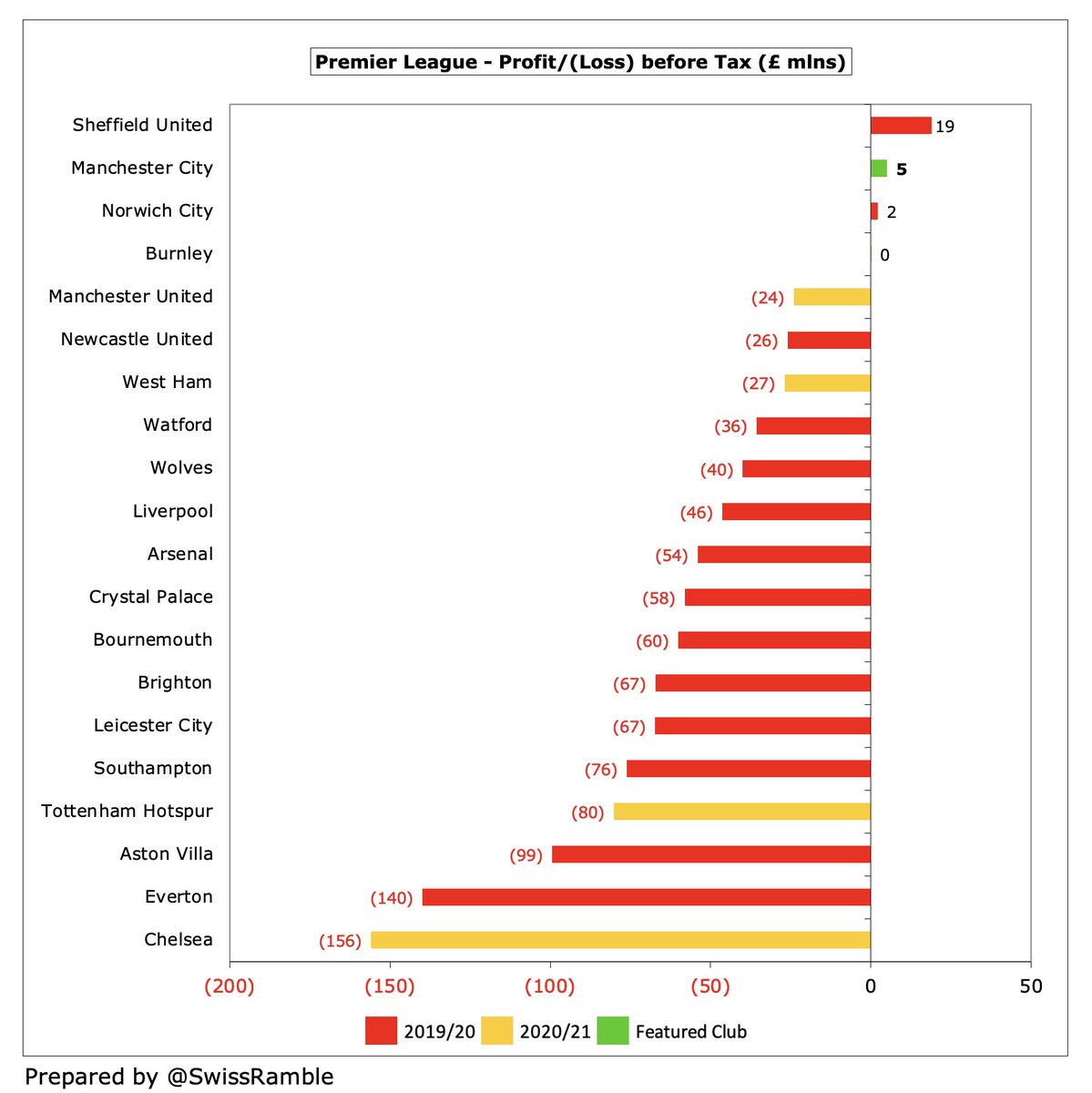

It is a pretty impressive feat for #MCFC to post a profit in 2020/21, when all clubs had to contend with a full year of the pandemic. The other Premier League clubs that have published accounts to date have all made big losses: #CFC £156m, #THFC £80m, #WHUFC £27m and #MUFC £24m.

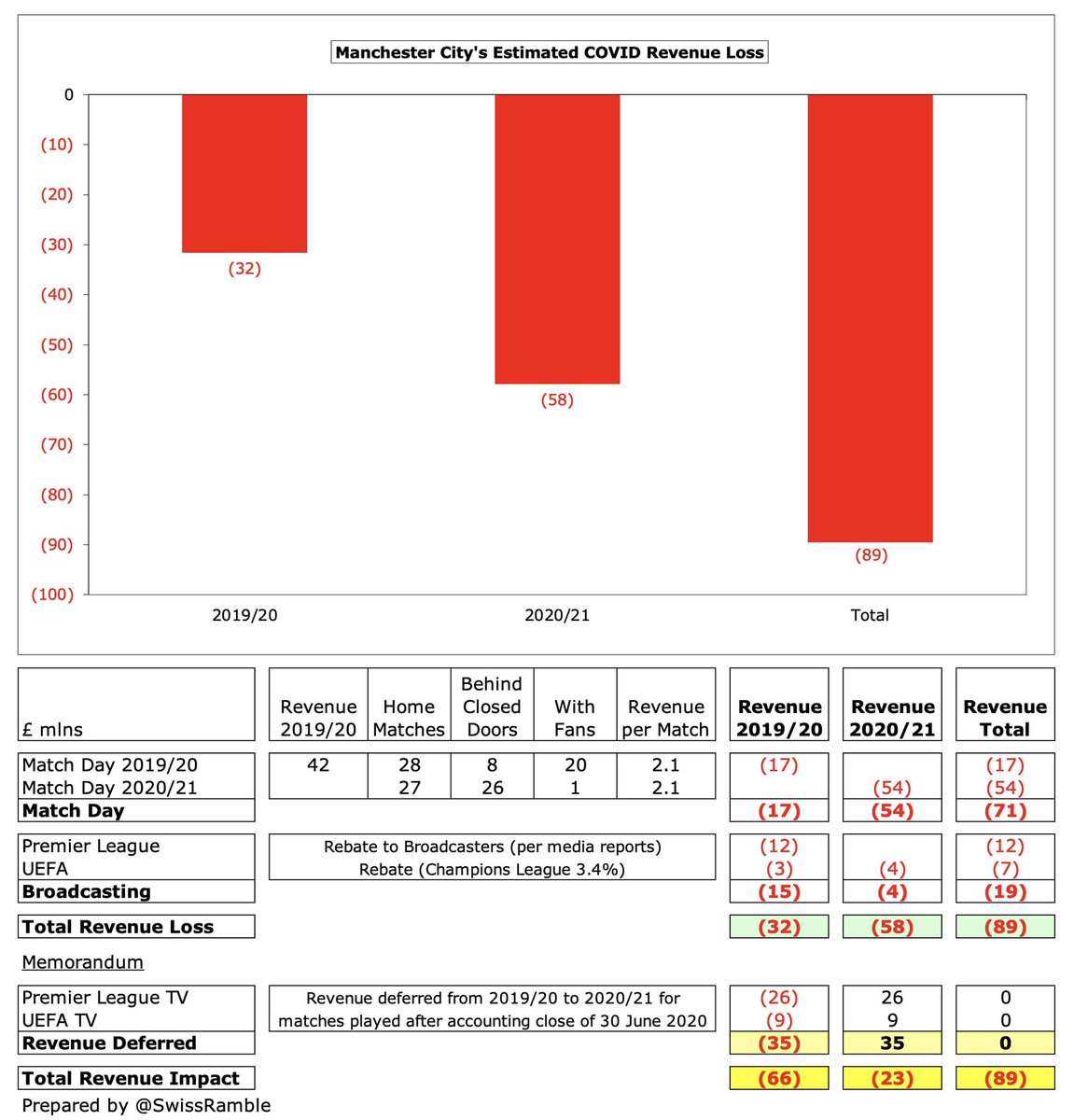

#MCFC managed to make money, despite revenue being significantly impacted by COVID. I estimate the revenue loss as £58m in 2020/21 (mainly match day), which would make £89m lost over the last 2 years. Around £35m of TV money was deferred from prior year accounts to 2020/21.

While #MCFC join Porto, Bayern Munich and Real Madrid in delivering a profit in 2020/21, other European clubs have suffered hugely, partly due to COVID, but also large operating losses, most notably Barcelona £422m, Inter £215m, Juventus £184m and Roma £163m.

Few clubs have made big money in a transfer market somewhat deflated by COVID, but #MCFC profit from player sales rose £29m from £40m to £69m, mainly Leroy Sané to Bayern Munich, Nicolas Otamendi to Sevilla and Angelino to RB Leipzig. Highest by far in 2020/21 Premier League.

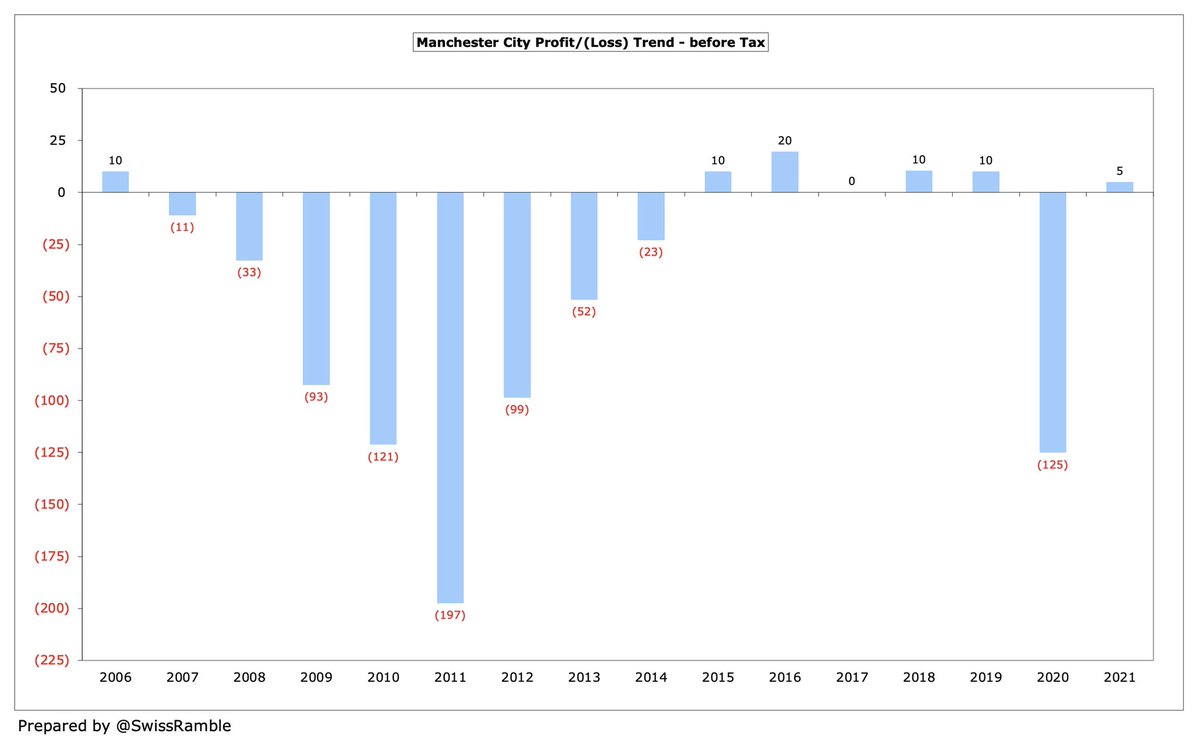

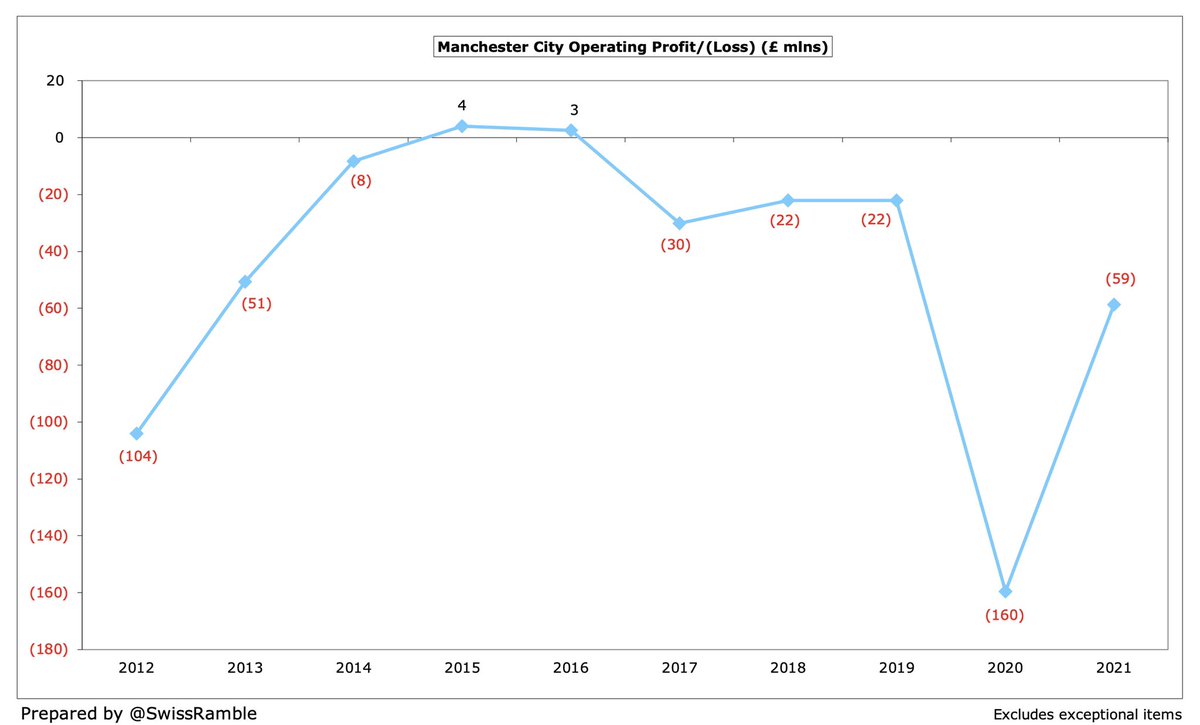

After five profitable years in a row, #MCFC made a £125m loss in 2019/20, though have returned to profitability in 2020/21, as a result of deferred TV revenue and success on the pitch. That said, they have posted five of the 11 highest ever losses in the Premier League.

Player sales have not been as high at #MCFC as many others (e.g. #CFC £462m since 2016), but have become increasingly important. This season will feature sales of Torres to Barcelona, Harrison to #LUFC, Nmecha to Wolfsburg and Ilic to Verona plus Jadon Sancho sell-on clause.

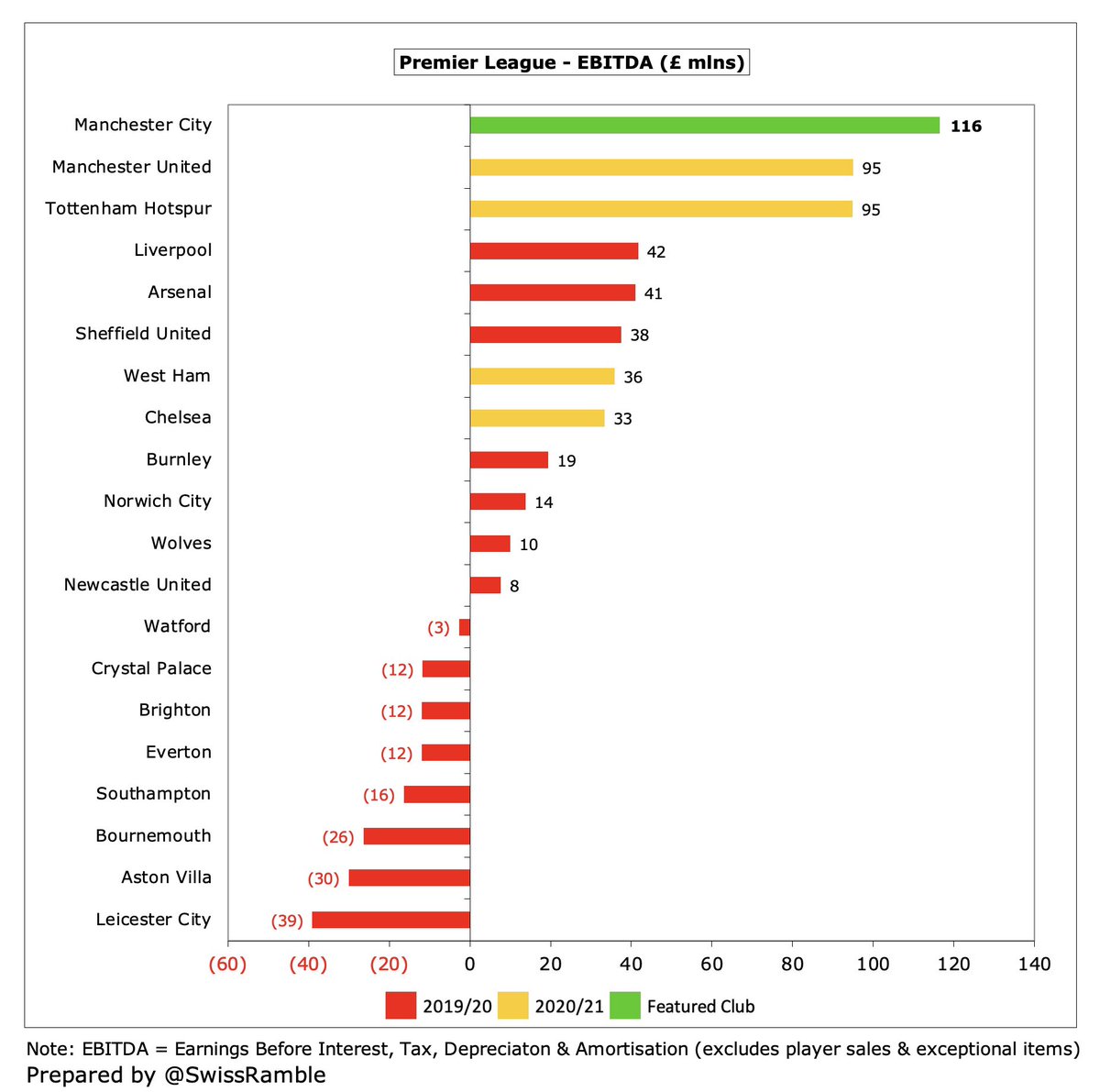

#MCFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £(2)m to £116m which is the highest reported to date in 2020/21, ahead of #MUFC and #THFC, both £95m, and especially #CFC £33m.

#MCFC operating loss (i.e. excluding player sales and interest) reduced from £160m to £59m. Although this is clearly still quite high, in fairness very few clubs make operating profits, while some post huge losses, e.g. City are a full £100m better than #CFC £159m.

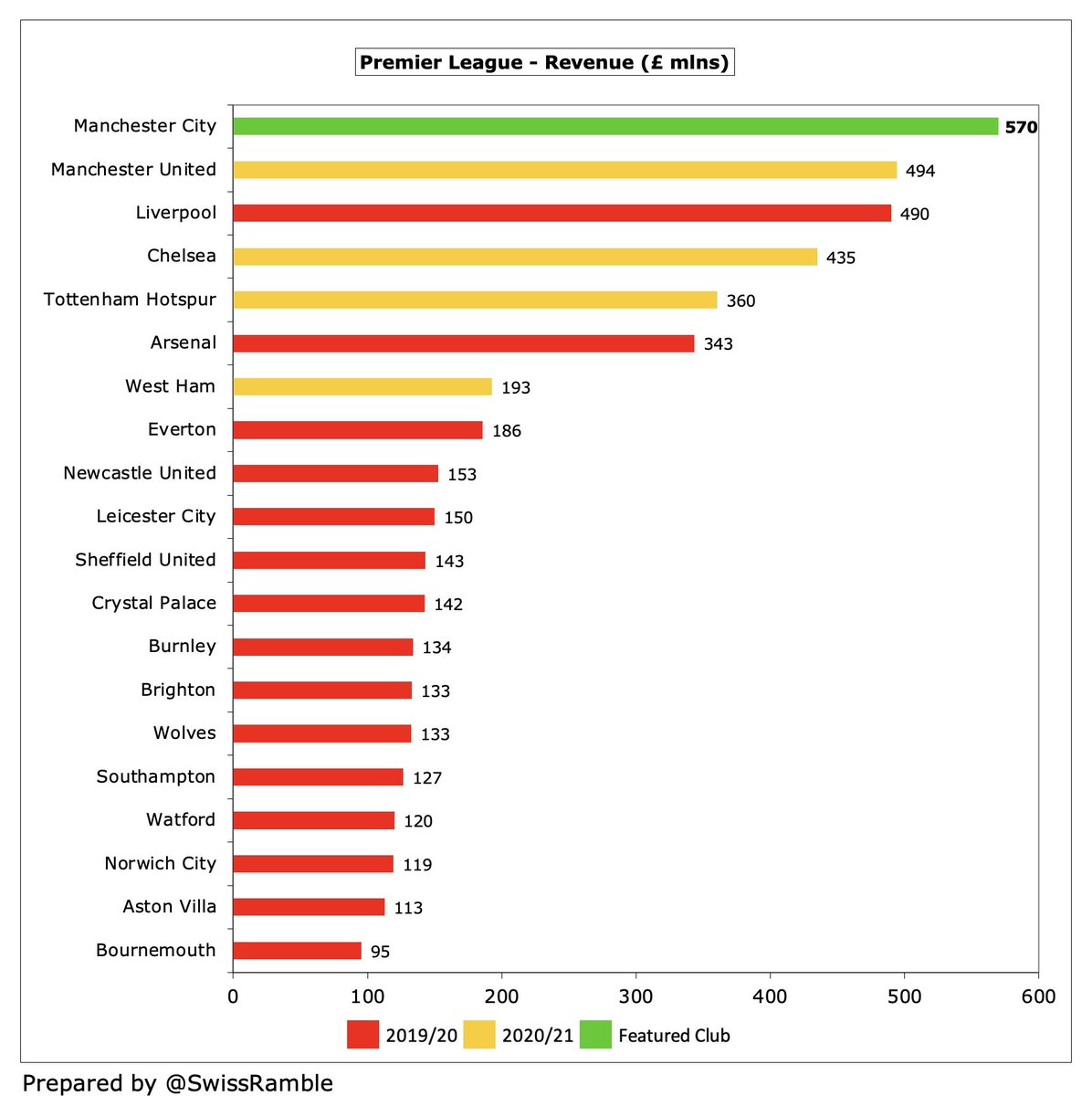

#MCFC £570m revenue is actually £35m (6%) higher than the 2019 pre-pandemic level, despite a significant £54m (99%) fall in match day, as broadcasting rose £44m (17%), partly due to deferred revenue from 2019/20, and there was good growth in commercial, up £45m (20%).

In fact, #MCFC £570m revenue has overtaken rivals #MUFC for the first time ever with a hefty £76m difference. This might be a short-lived victory, as United have suffered more from reduced match day income, but City’s sporting success will hold them in good stead.

So #MCFC £570m revenue is now the highest in England. Given the different impact of the pandemic on clubs, comparisons this season are a little misleading, but there is clear water between City and #CFC £435m, followed by #THFC £360m. #LFC have not yet released 2020/21 accounts.

Based on 2019/20 accounts, #MCFC were 6th in the Deloitte Money League, which ranks clubs globally by revenue, a fair way below the Spanish giants, Barcelona & Real Madrid, both £627m. However, City could be as high as 2nd when the 2020/21 report is published, only behind Madrid.

#MCFC broadcasting income rose £107m (56%) from £190m to £297m, mainly due to revenue from games played in July/August 2020 included in the 2020/21 accounts plus progress to Champions League final. Highest ever recorded in the Premier League for this revenue stream.

As the 2019/20 season was extended beyond the 30th June accounting close, there was a significant deferral of revenue into the 2020/21 accounts. The estimated #MCFC PL deferral is £26m, which means £52m year-on-year growth (reduction in first year plus increase in second year).

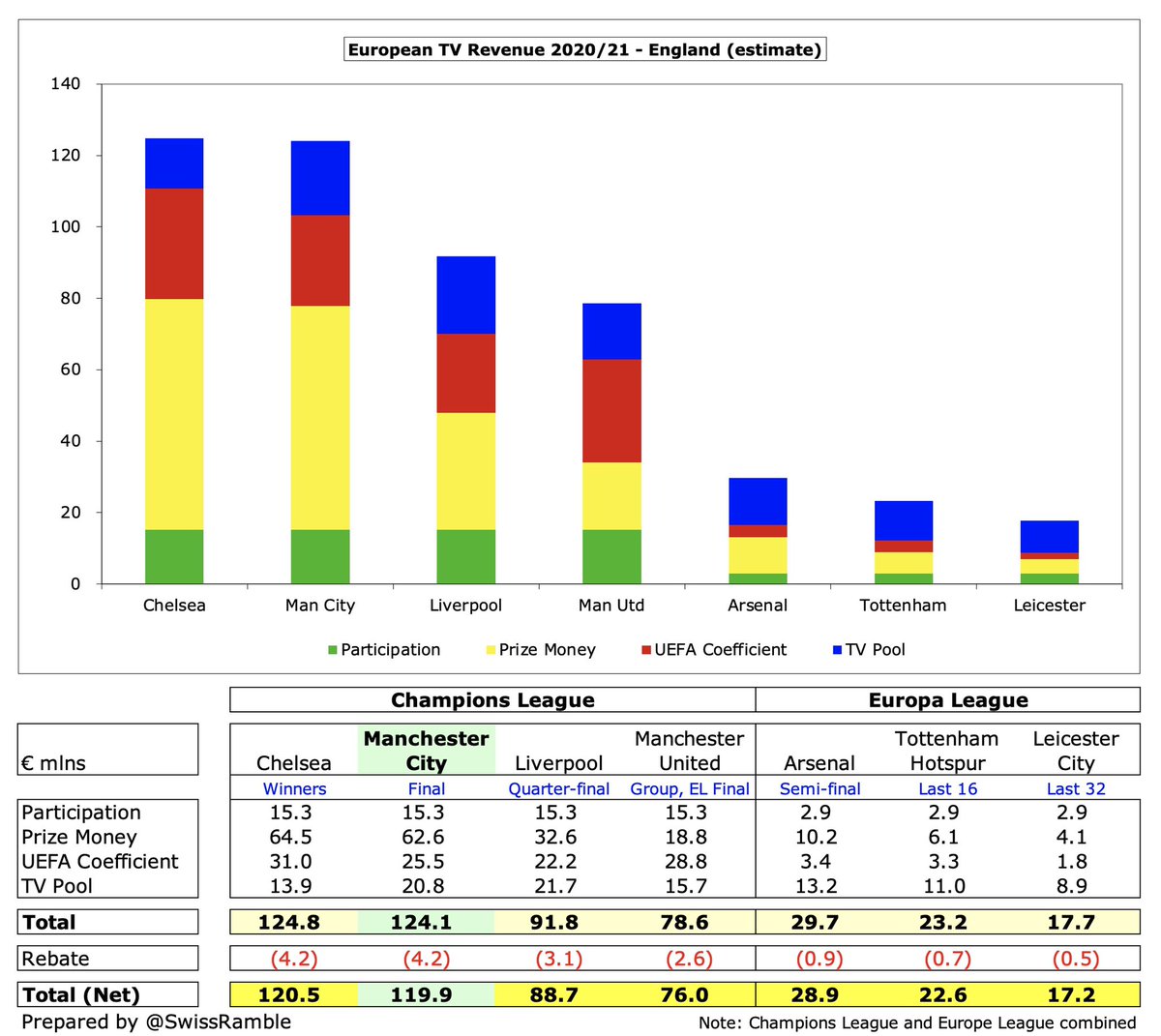

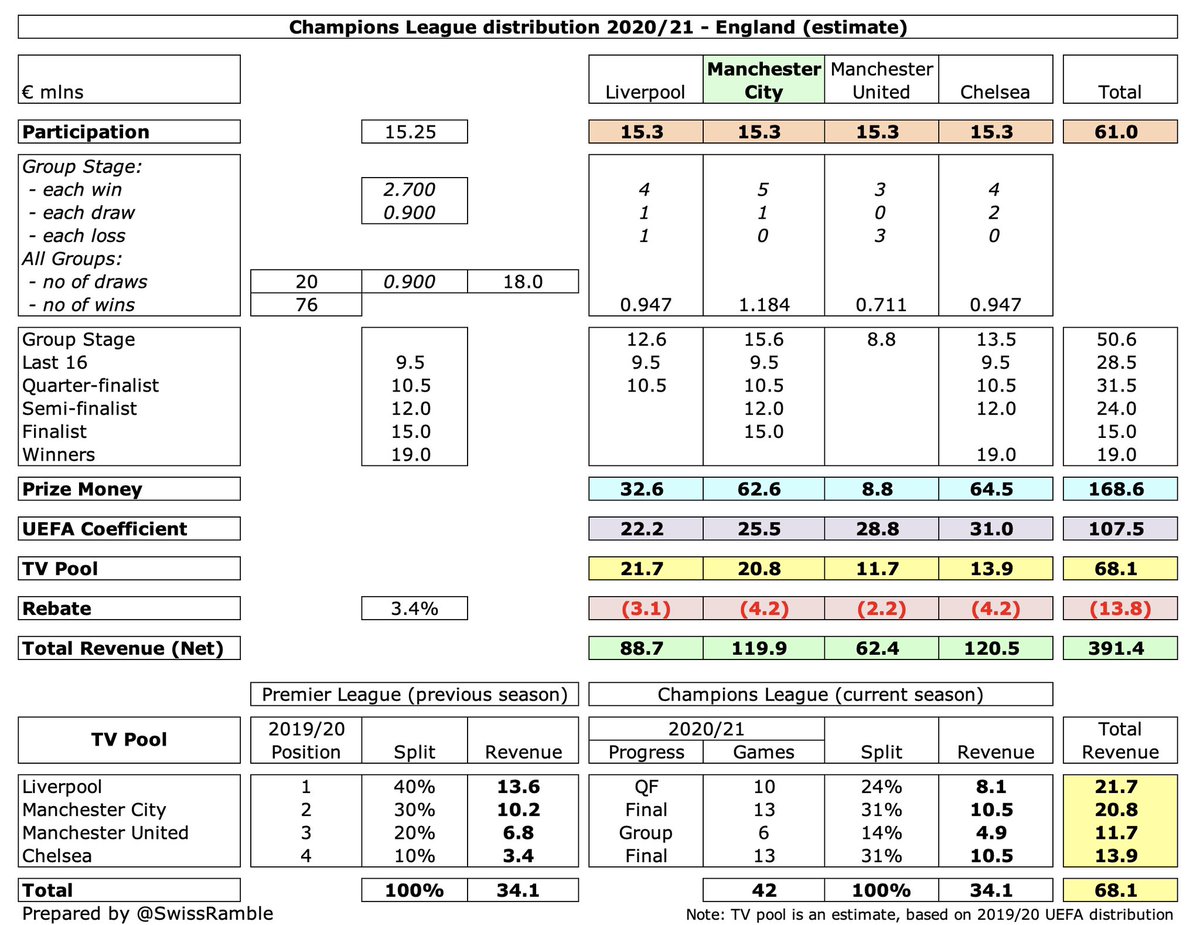

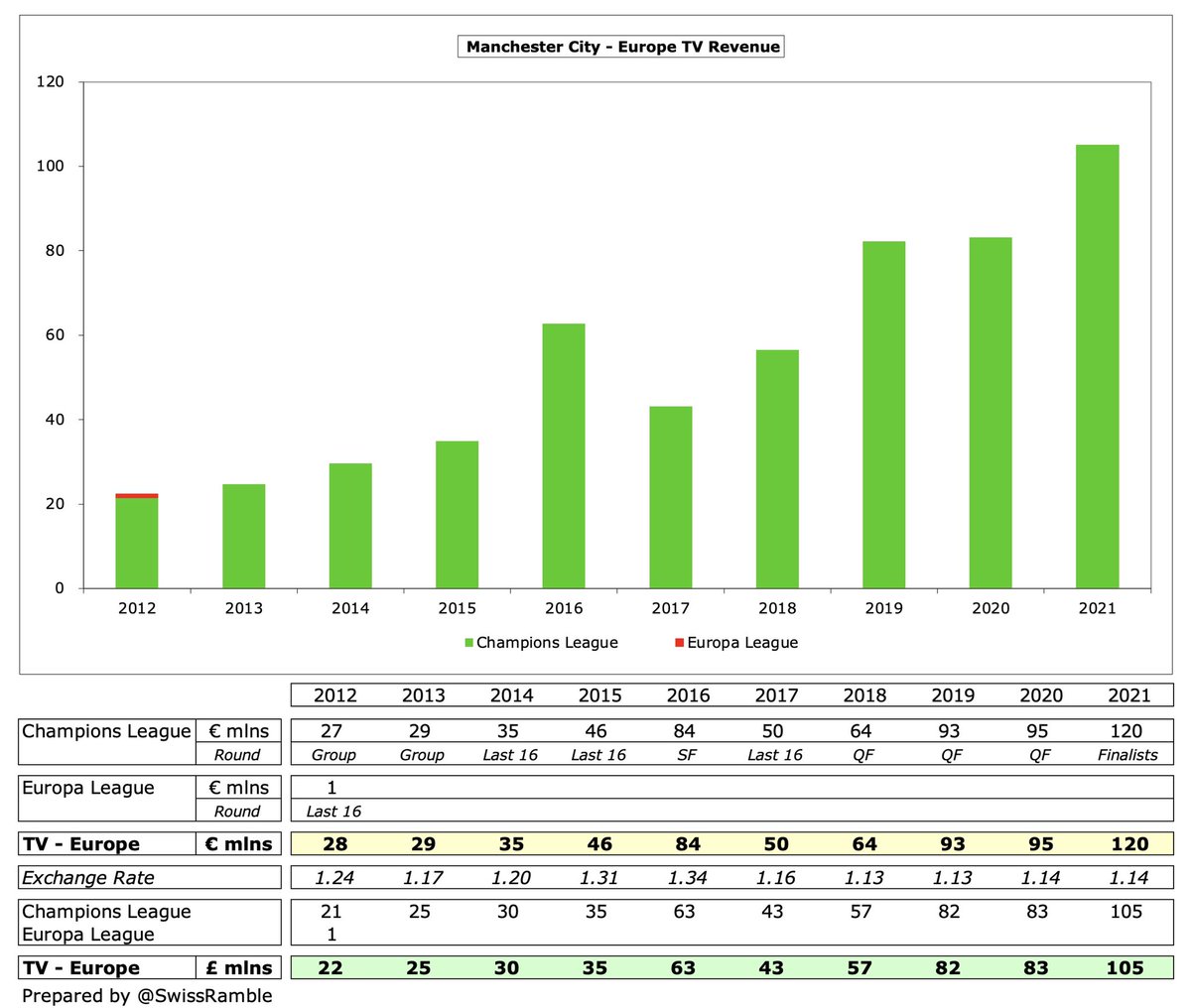

I estimate that #MCFC earned €120m for reaching the Champions League final, just below winners #CFC €121m, but much more than previous season €95m. Money for 2019/20 quarter-final also deferred to 2020/21, while prior year reduced by €10m UEFA FFP fine.

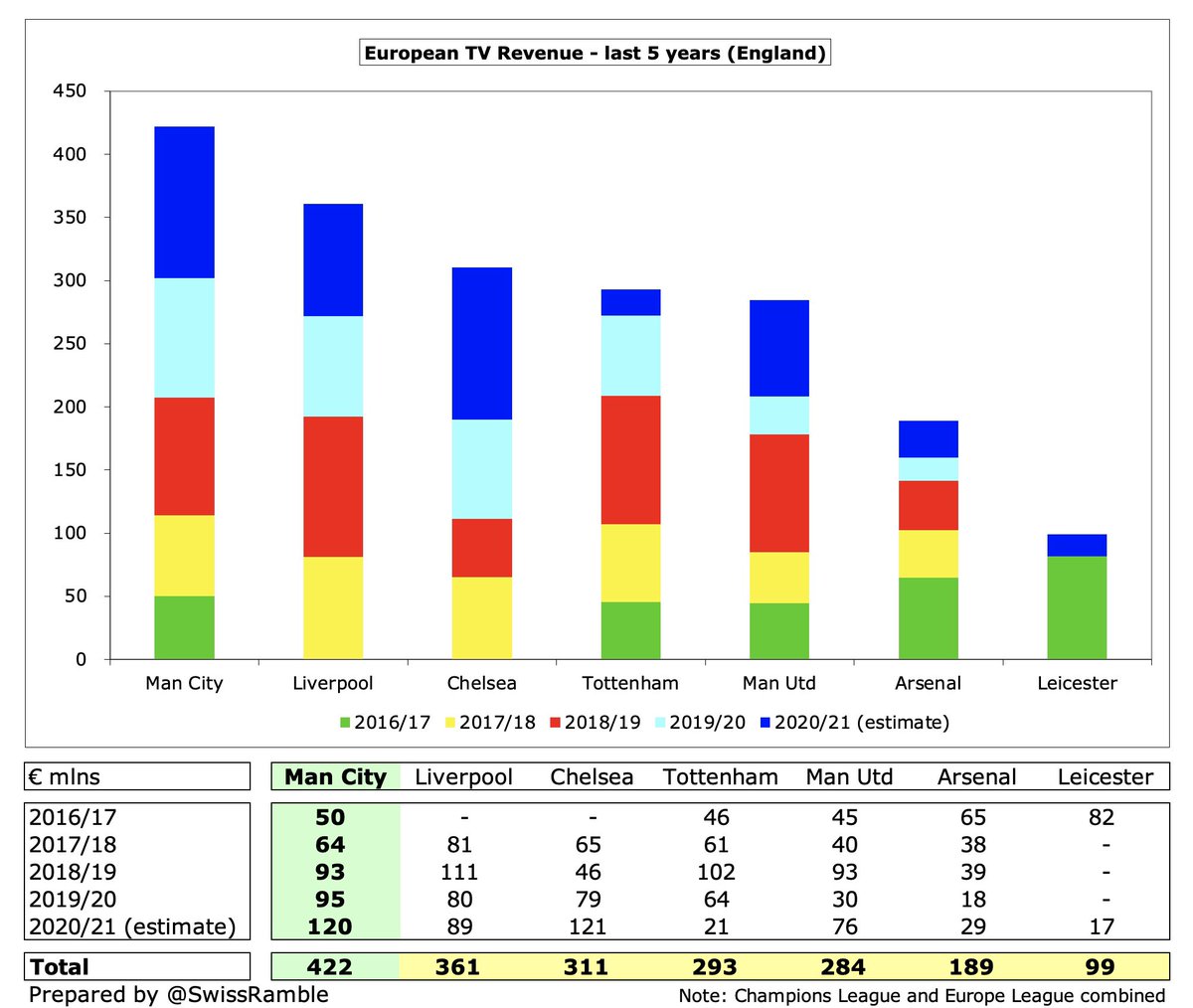

In fact, despite City’s issues with UEFA, the Champions League has been a nice little earner for #MCFC with an impressive €422m received in the last five years, the highest of any English club, well ahead of #LFC €361m and #CFC €311m.

So the huge #MCFC £107m growth in TV income can be largely explained by: deferrals from 2019/20 accounts £70m (PL £52m, CL £18m), success on pitch £24m (CL £22m, PL £2m); prior year reductions £21m (Premier League broadcasters rebate £12m, UEFA FFP fine £9m).

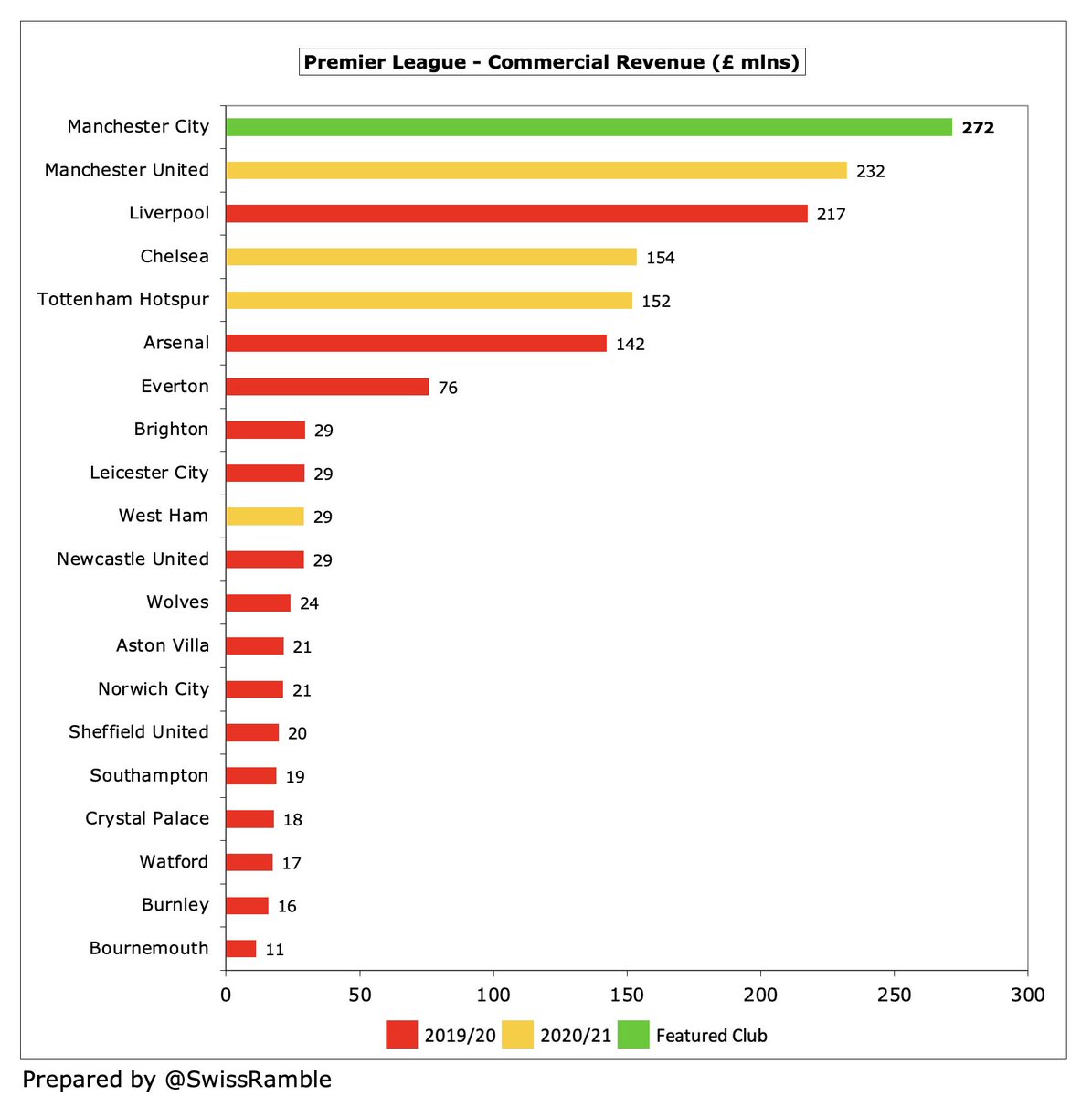

#MCFC commercial income increased £25m (10%) to £272m, mainly thanks to new partners (Cadbury, AxiTrader and Noon.com), plus renewal of long-term partnerships (Nissan, Unilever and Intel), though partly offset by lower merchandising and no pre-season tour.

As a result, #MCFC £272m commercial income is now the highest in England, having overtaken #MUFC £232m. In the past two years City have grown £45m, while United have dropped £43m, as their fortunes have contrasted on the pitch. Also steep growth in past few years at #LFC & #THFC.

#MCFC Etihad deal worth £65m (shirt sponsorship £45m, naming rights £20m). Also have Puma kit supplier £65m, Nexen Tire sleeve sponsor £10m and Marathonbet training kit £10m. #MUFC Chevrolet shirt sponsorship was £64m, but since replaced by TeamViewer at just £47m.

#MCFC match day income fell £41m (98%) to just £732k, as all home games were played behind closed doors (except final game with 10,000 restricted capacity). Pre-pandemic City’s £55m income was the smallest of the Big Six, only around half #MUFC £111m.

#MCFC 2019/20 average attendance of 54,219 (for those games played with fans), was the fifth highest in the Premier League, around 18,000 below their Manchester neighbours #MUFC 72,726, and just above Liverpool 53,143.

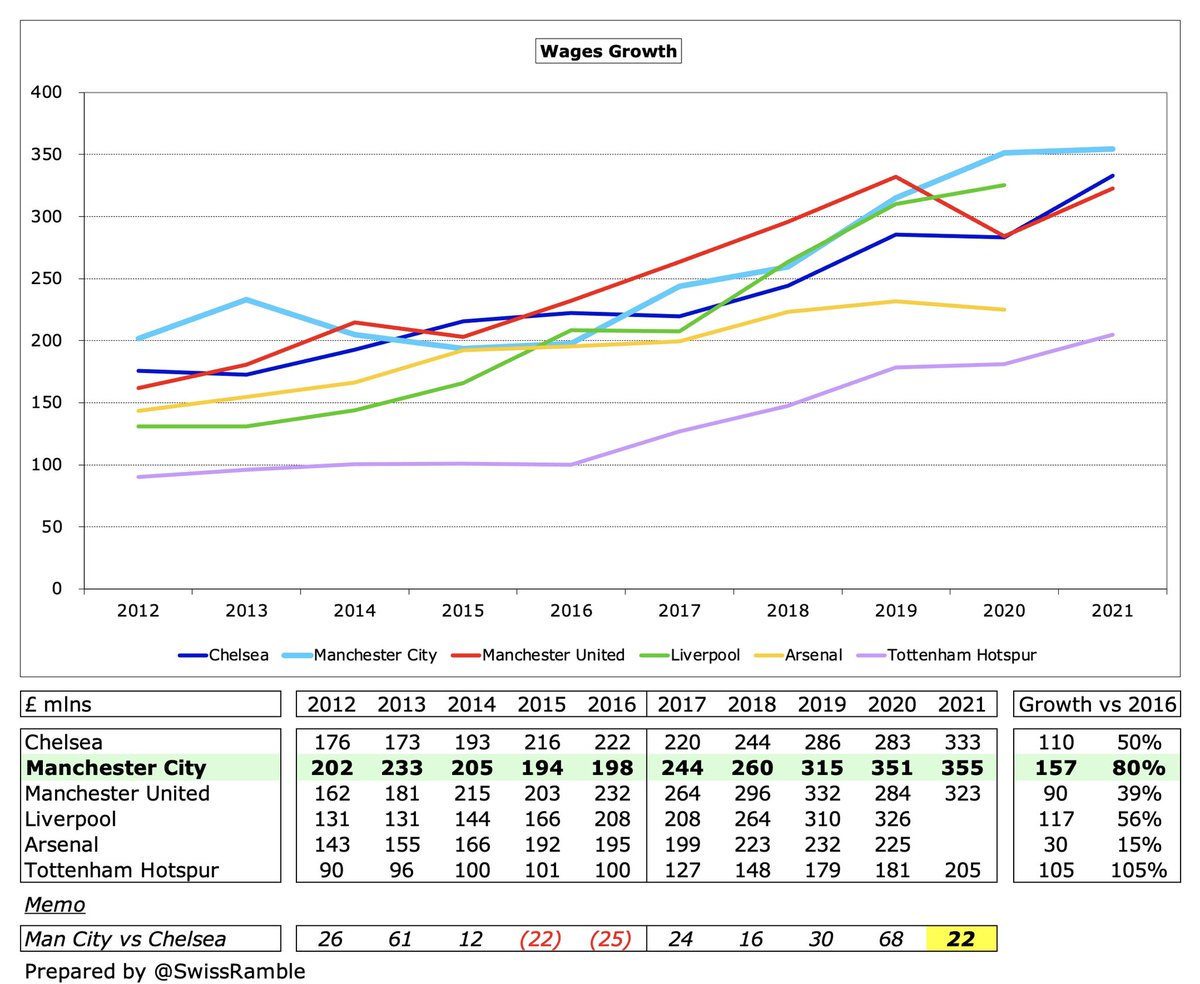

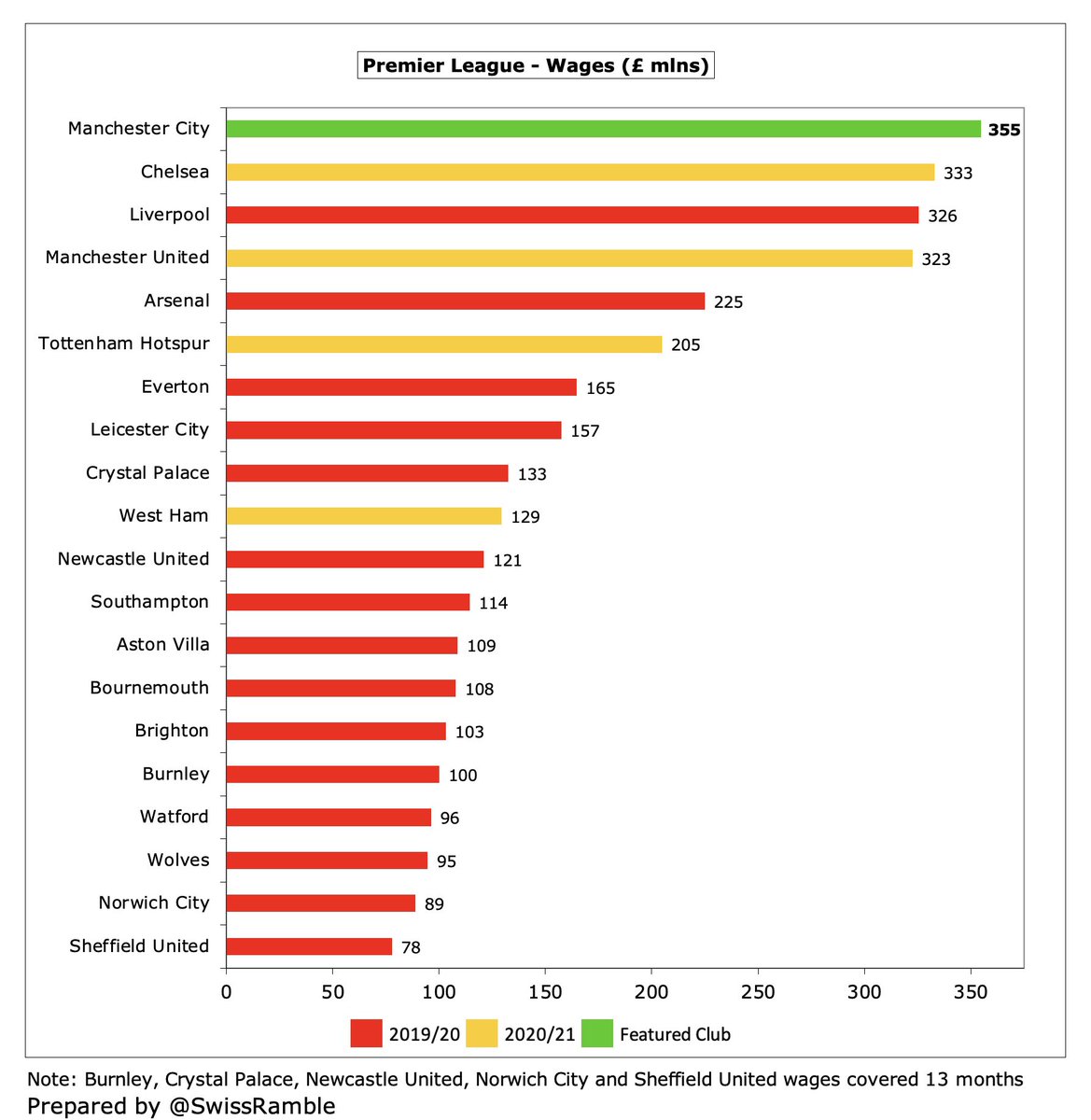

#MCFC wage bill rose £3m (1%) to £355m, a new club record, due to a combination of new signings and contract extensions. Wages have increased by £157m (80%) in the last 5 years, the highest growth of the Big Six, though 3 other clubs also grew more than £100m: #LFC, #CFC & #THFC.

#MCFC £355m wages are the highest in the Premier League, having overtaken #MUFC in 2020. In fact, this is the highest ever wage bill reported in England. Four clubs are above £300m (also including #CFC £333m and #LFC £326m), significantly more than the chasing pack.

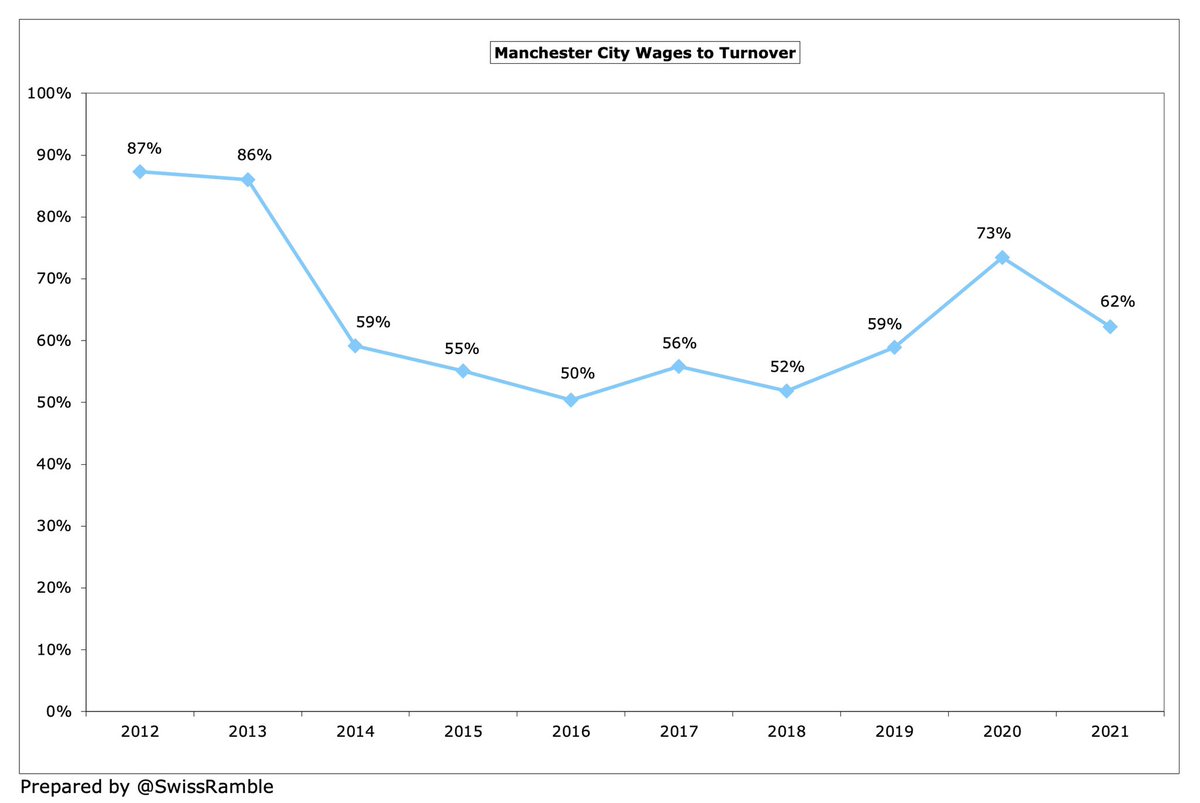

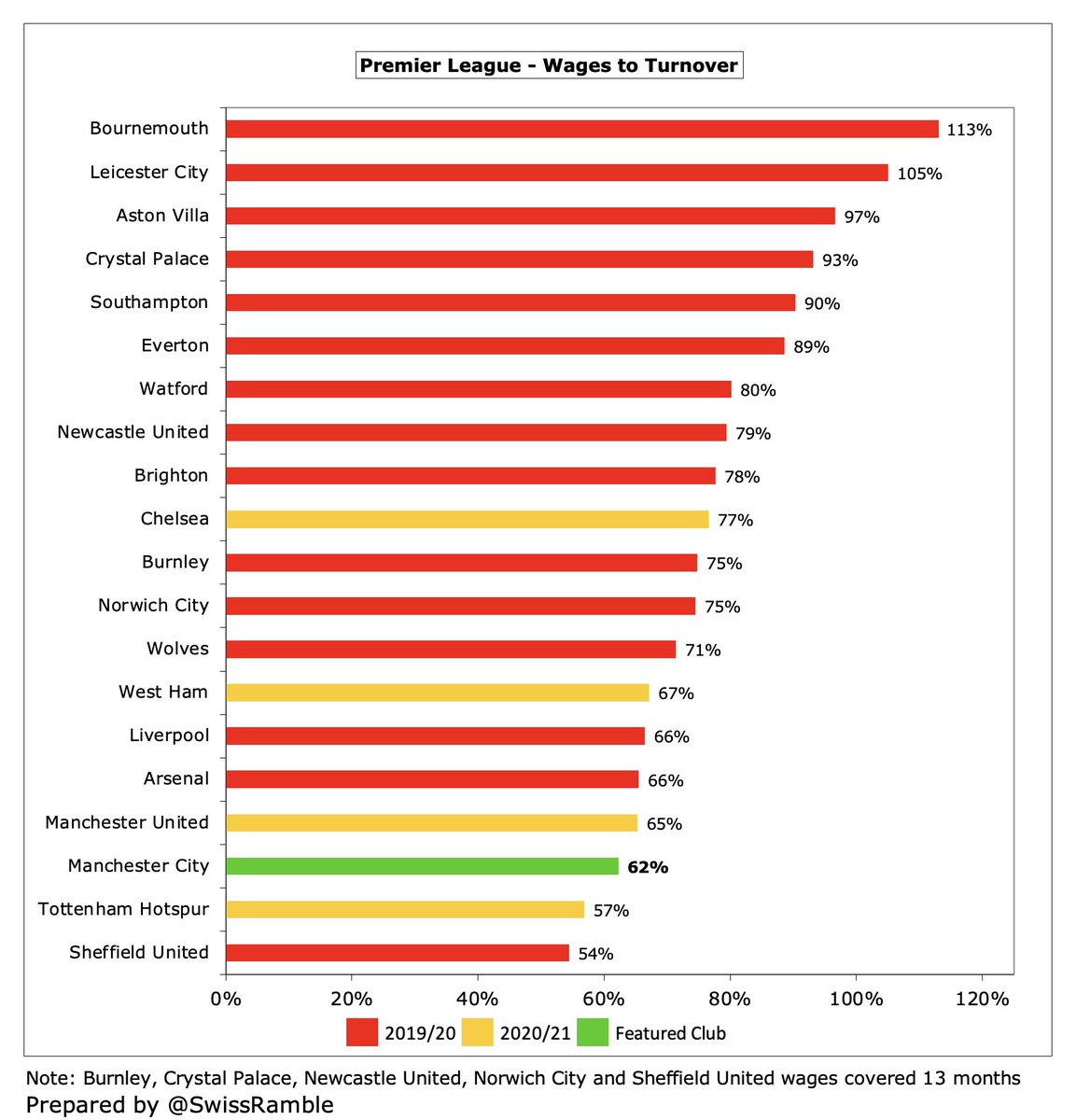

#MCFC wages to turnover ratio improved from 73% to 62%, one of the lowest (best) in the Premier League, though the club noted that this indicator was “not representative”, as impacted by COVID (revenue deferred from 2019/20 offsetting gate receipts reduction).

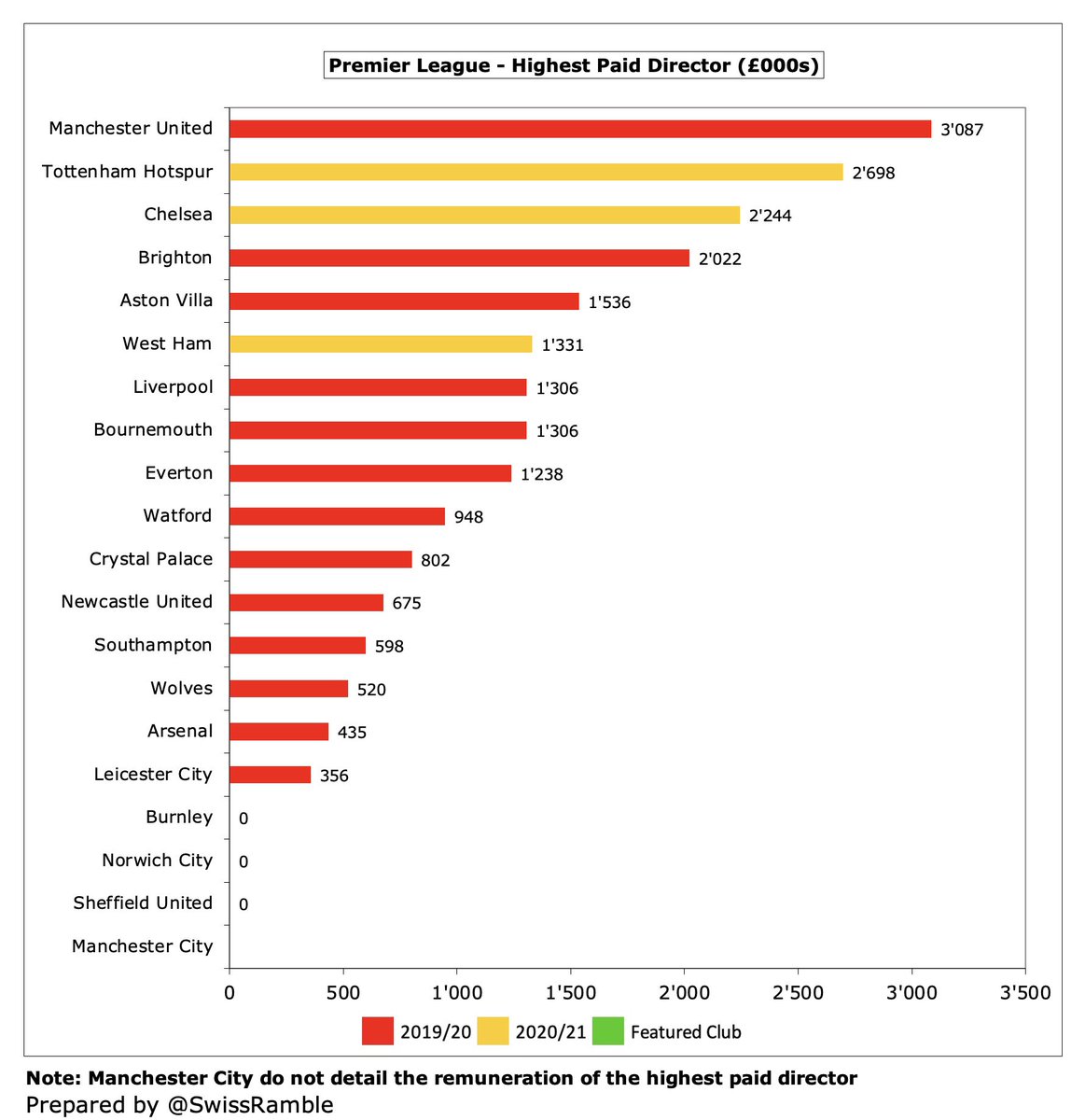

#MCFC do not provide details of their highest paid director, so we cannot say whether the remuneration is in the same ball park as Ed Woodward at #MUFC and Daniel Levy at #THFC, who trousered £3.1m and £2.7m respectively.

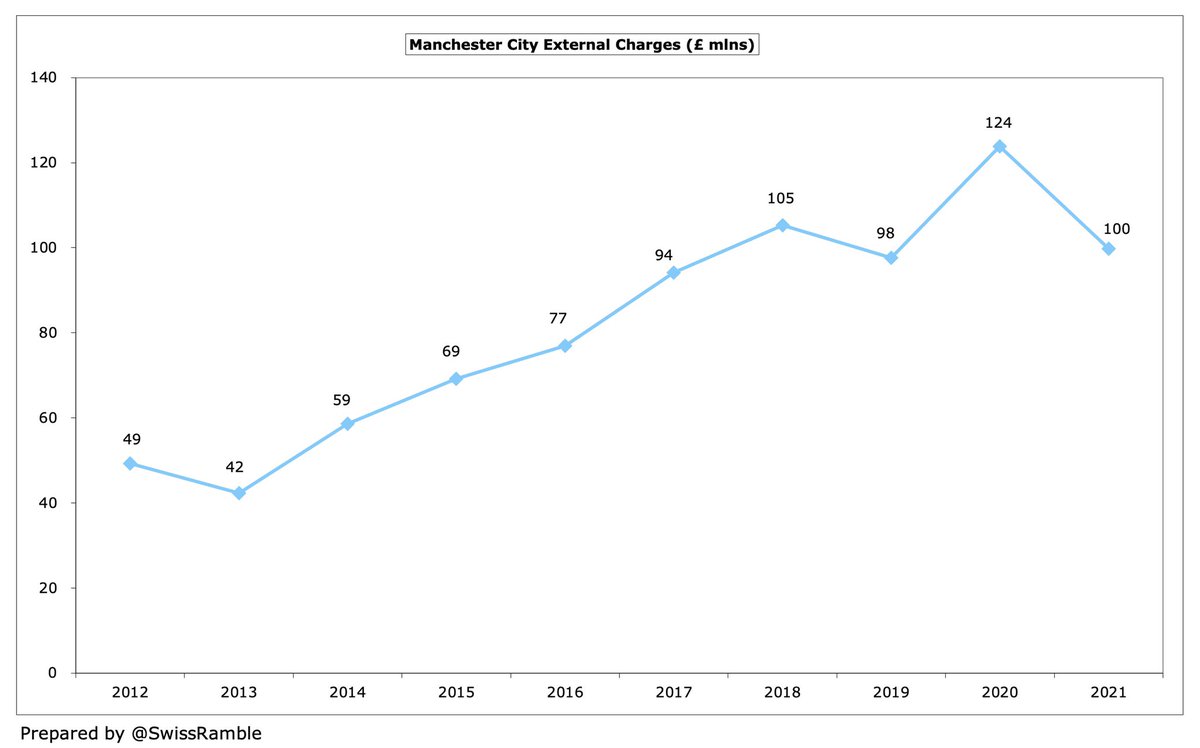

#MCFC external charges decreased £24m (19%) from £124m to £100m, due to reduced match day costs, as games were played behind closed doors. This had previously nearly tripled from £42m in 2013.

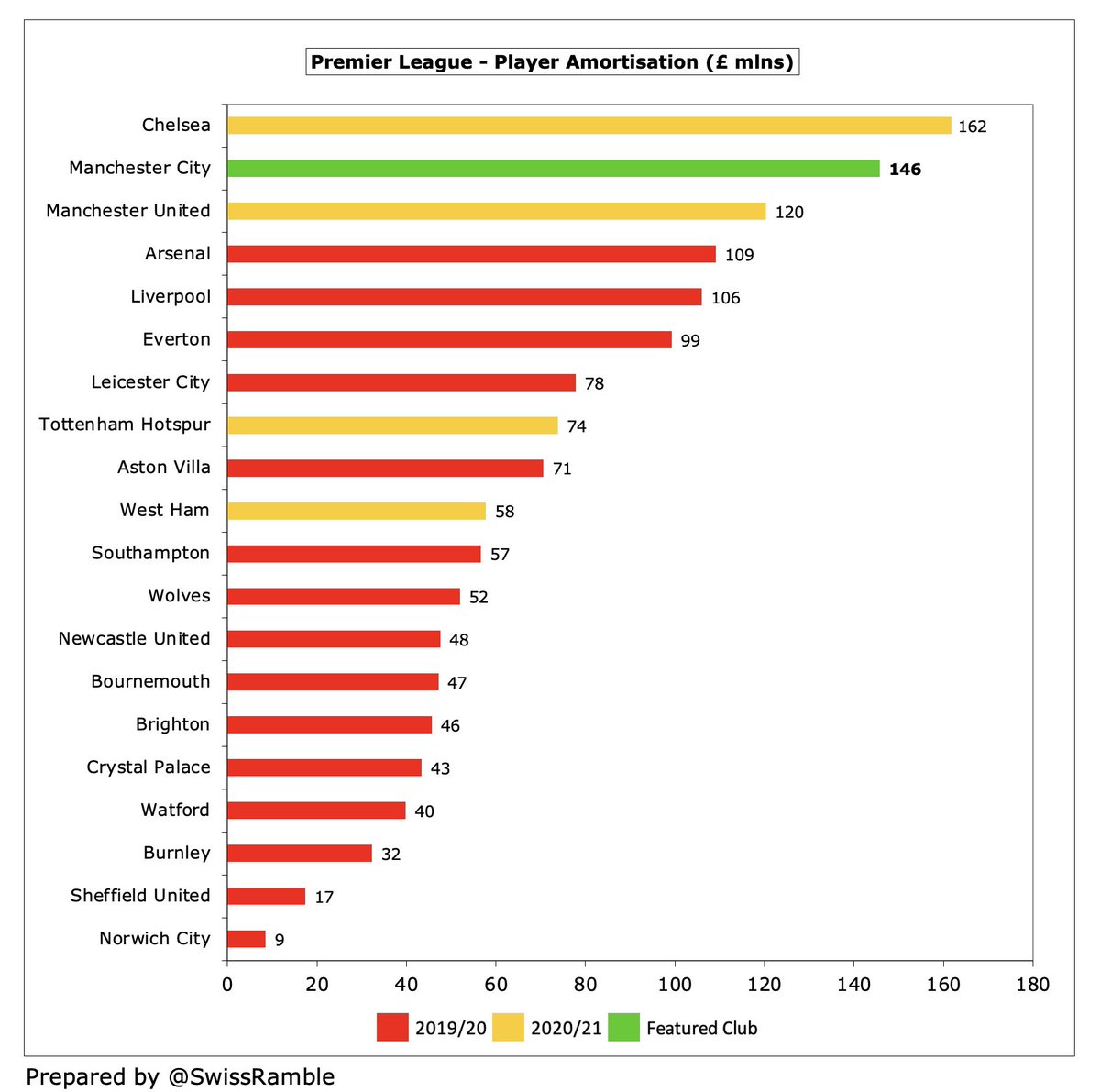

#MCFC player amortisation, the annual charge to expense transfer fees over a player’s contract, was unchanged at £146m, though only surpassed by #CFC 162m in the Premier League. Also booked £19m impairment after assessment of value of first team players.

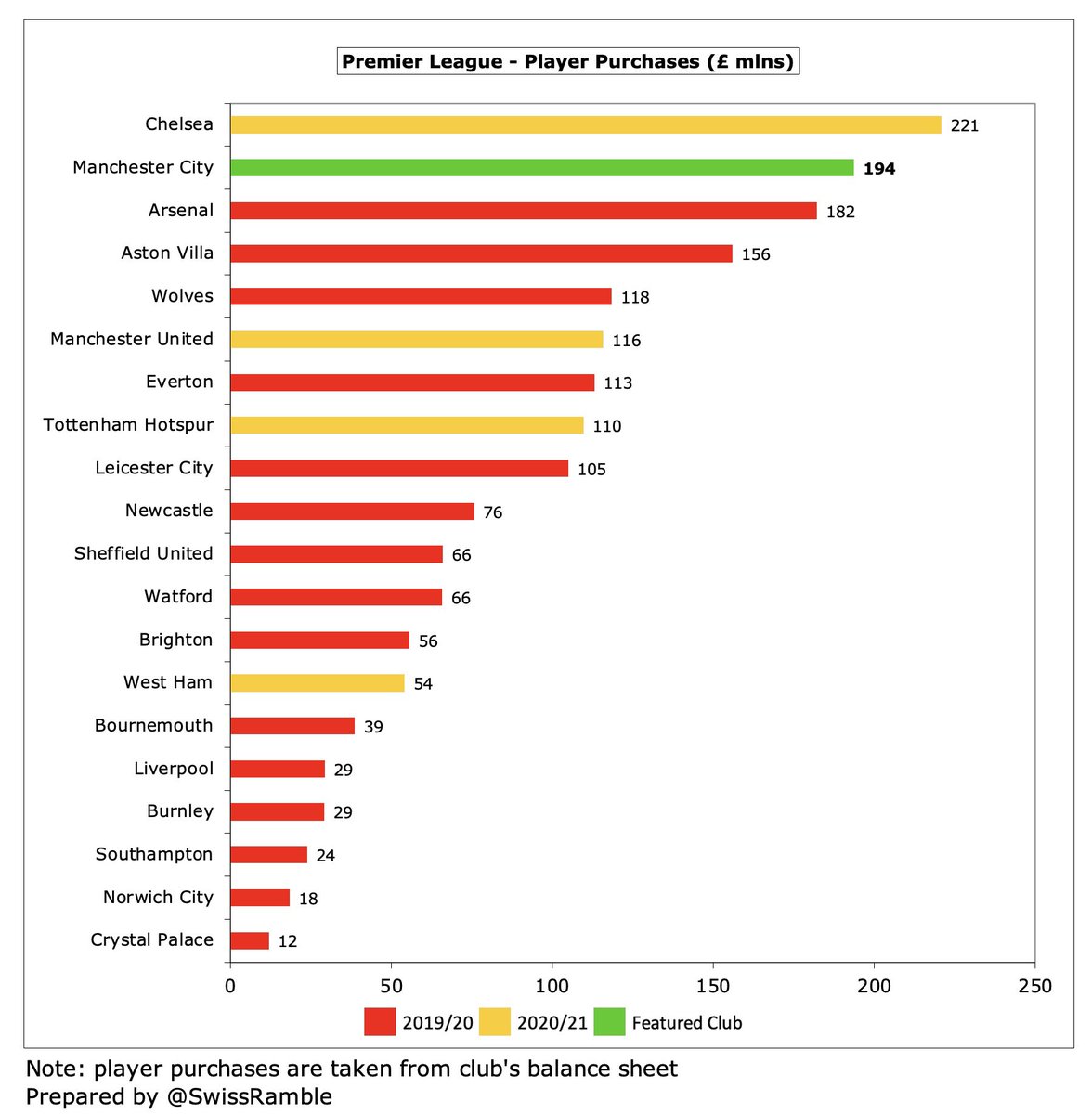

#MCFC spent £194m on player purchases in 2020/21, up £14m compared to prior year. This was less than #CFC £221m, but well ahead of #MUFC £116m and #THFC £110m. Included the signings of Ruben Dias from Benfica, Nathan Aké from #AFCB and Ferran Torres from Valencia.

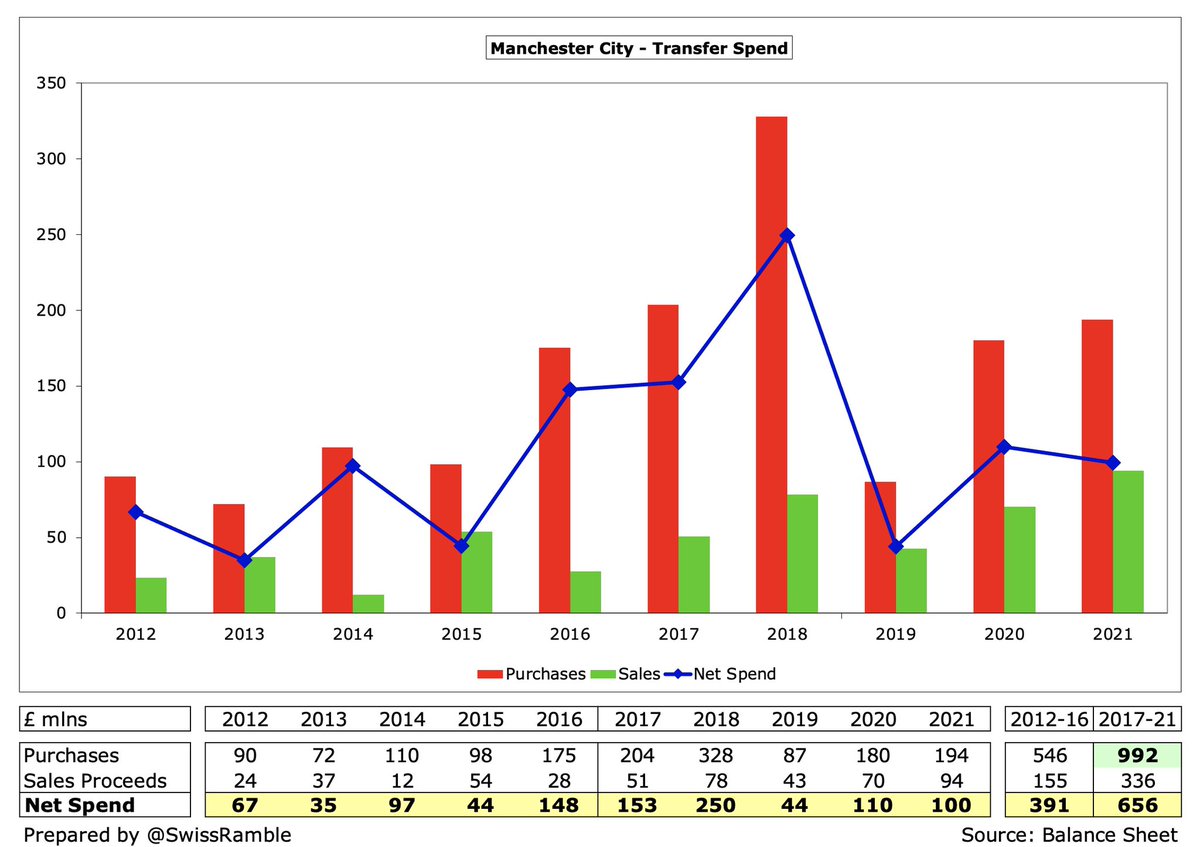

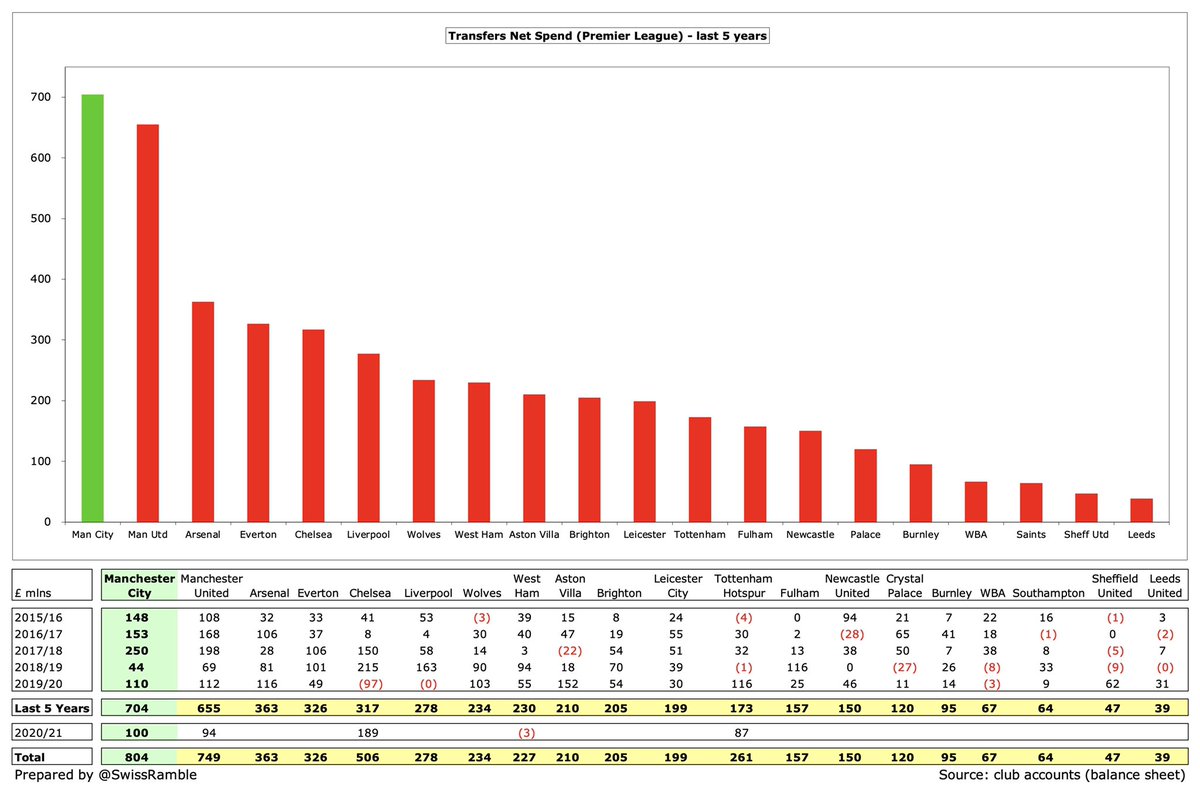

#MCFC have splashed out nearly a billion (£992m) on player recruitment in the last 5 years, much more than £546m in the preceding 5-year period. This season they spent big on Jack Grealish from #AVFC plus Kayky from Fluminense, but made few other purchases.

In fact, #MCFC have the highest transfer expenditure in the Premier League over the last six years, with their gross spend being around £150m higher than #MUFC. Similar story for net spend, though in this case City’s £804m is only £55m more than United.

#MCFC £65m debt is for leases on the Etihad stadium. This is one of the lowest in the Premier League, way below the likes of #THFC £854m (mainly new stadium), #MUFC £530m (even after all the Glazers’ re-financings), #EFC £409m, #BHAFC £306m and #LFC £268m.

Similarly, #MCFC have very low annual interest payments of £1m, far below #MUFC £21m, #THFC £18m and #AFC £11m, the latter two due to stadium financing. City’s funding via additional share capital (instead of debt) provides a competitive advantage here.

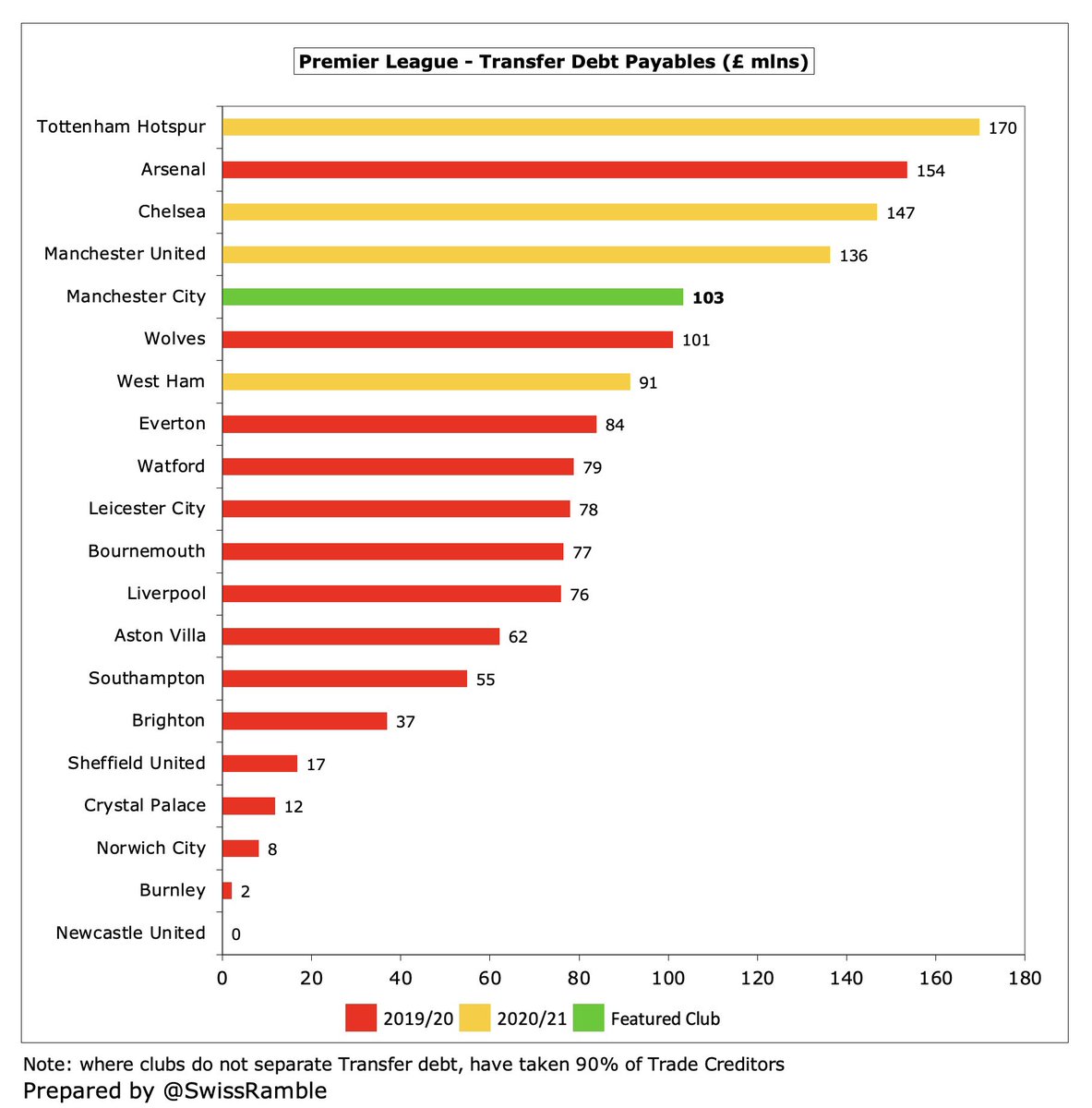

#MCFC transfer debt rose £30m to £103m, though still less than £141m three years ago and fair bit lower than #THFC £170m and #AFC £154m. However, also have massive contingent liabilities of £228m, up from £158m, based on achievement of certain contractual clauses.

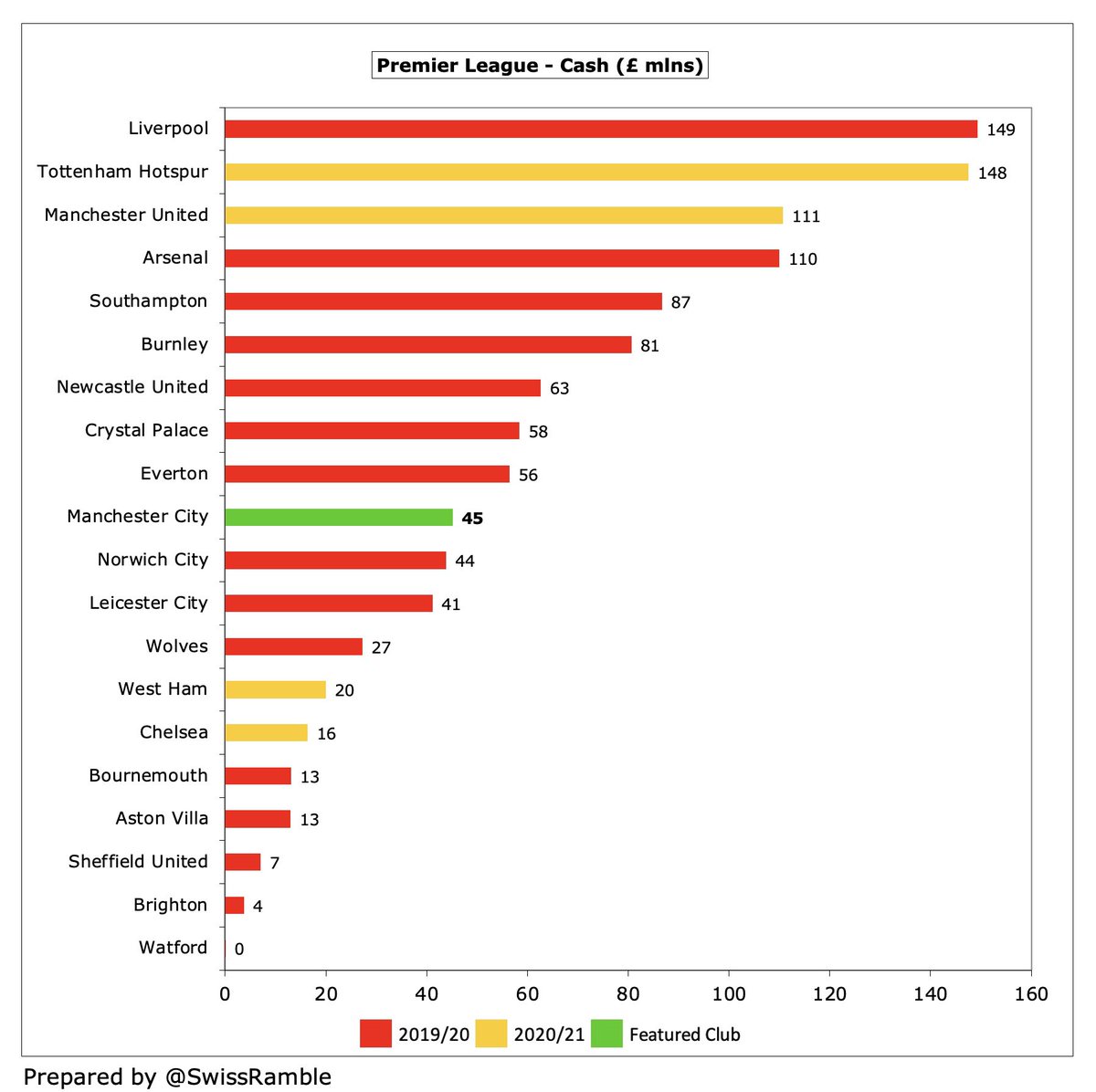

#MCFC cash balance increased from £18m to £45m. The club’s holding company, City Football Group Ltd, completed a $650m term loan and secured £80m revolving credit facility to “strengthen the group’s working capital”. Not due for repayment until June 2028.

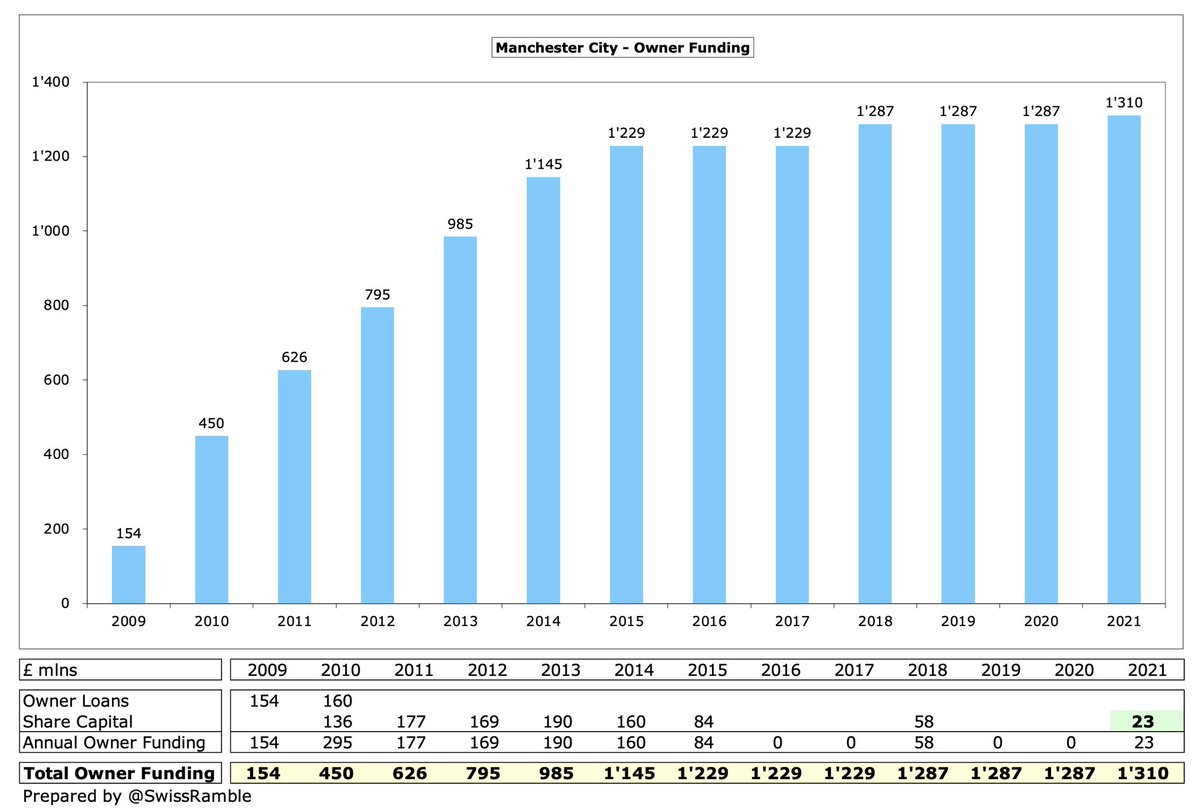

#MCFC have become largely self-sufficient in recent years (excluding the impact of COVID), but the club did receive £23m additional share capital in 2020/21. To date, the owners have provided the football club more than £1.3 bln of funding via new shares or loans.

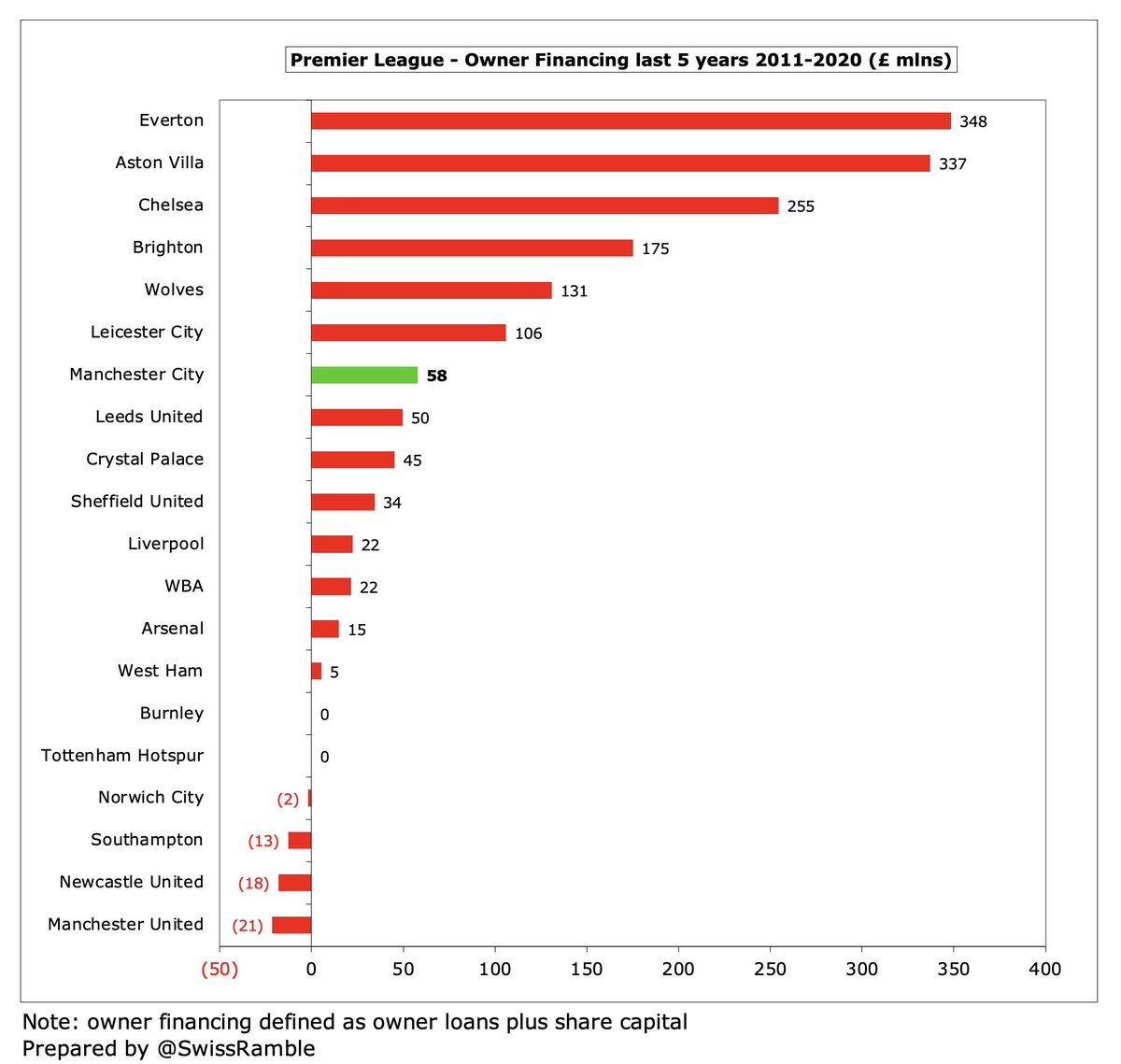

#MCFC have benefited from the highest owner funding in the Premier League in the 10 years up to until 2020 with £837m, followed by #CFC £559m. However, it’s a very different story for the 5 years up to 2020, when City’s £58m is much lower than #EFC £348m and #AVFC £337m.

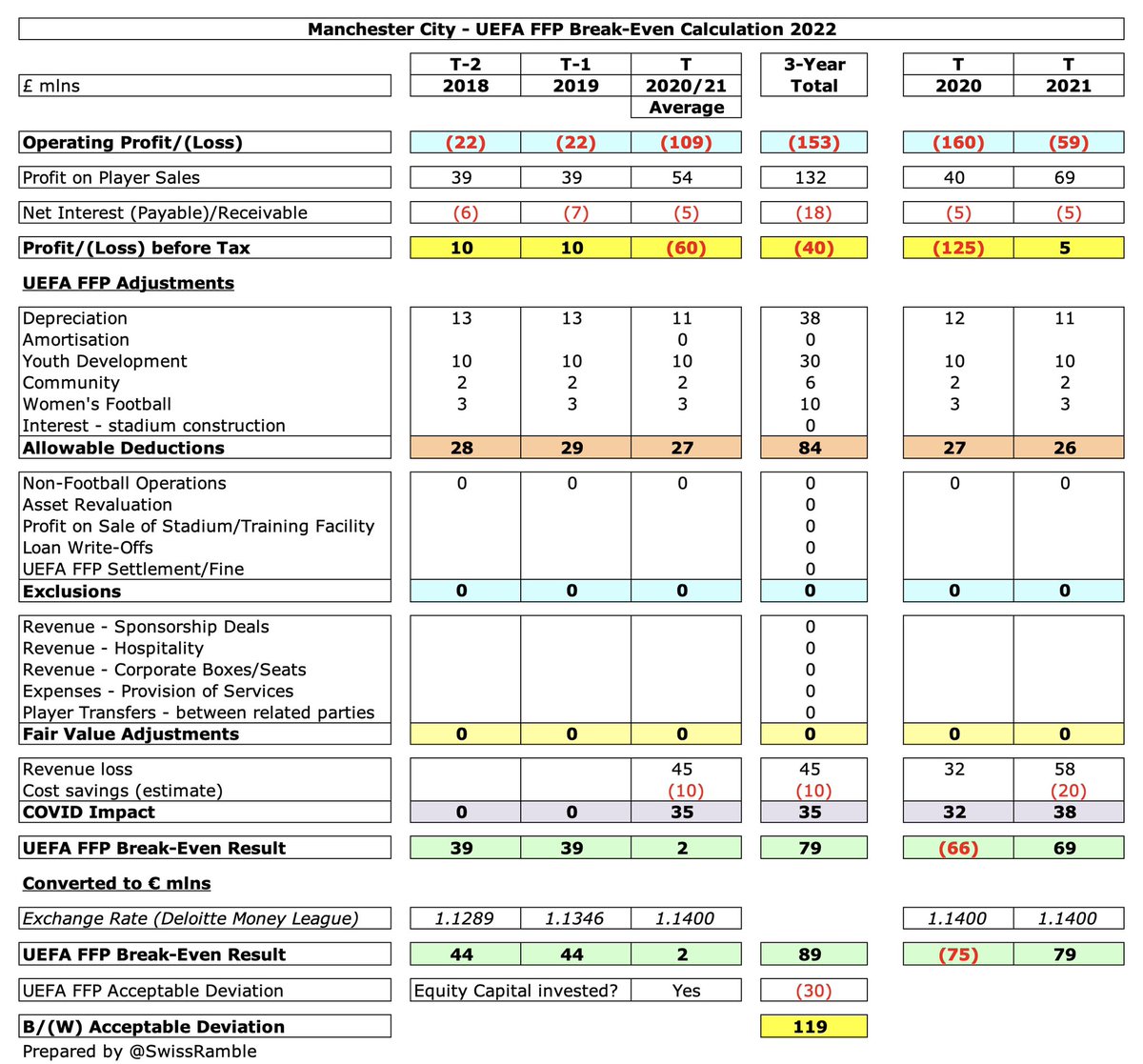

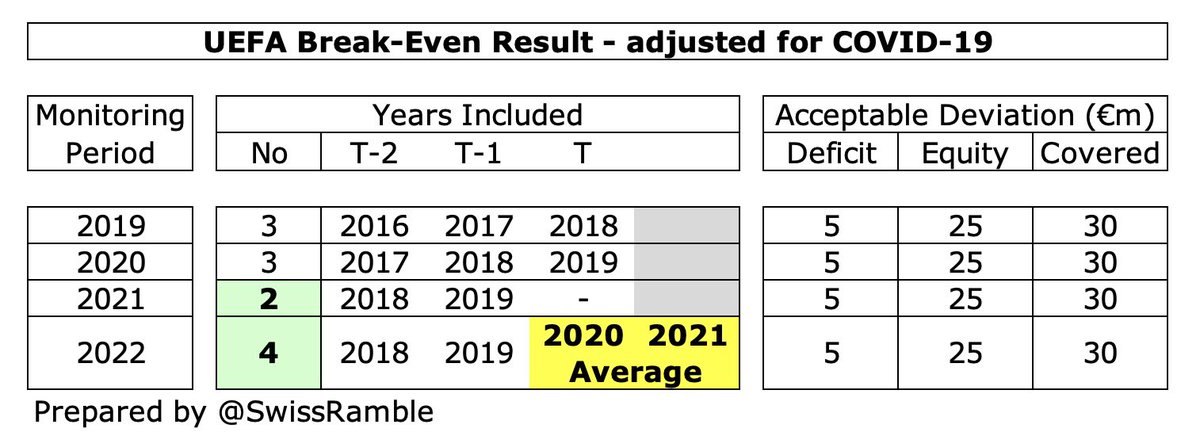

#MCFC have had a few issues with UEFA’s FFP in the past, but the club is confident of meeting the more relaxed regulations with financial results currently assessed over two years to take into consideration the impact of COVID.

#MCFC were keen to emphasise that the 2020/21 results should be viewed alongside 2019/20, due to the “misleading” impact of COVID (including deferred revenue), but a profit is still a pretty good achievement, driven by sporting success and significant player trading gains.

• • •

Missing some Tweet in this thread? You can try to

force a refresh