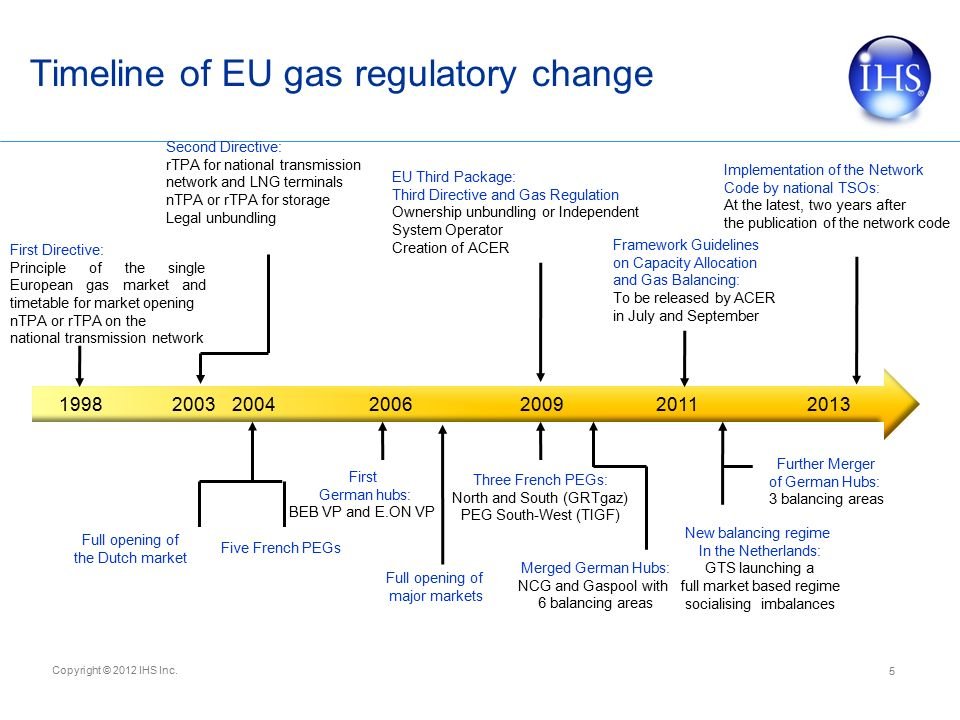

EU gas: Right now & hear, #Gazprom uses gas export as political weapon. It books but does not use; bookings became useless indicator of what might flow in pipes. Latest: even NS flows reduce.

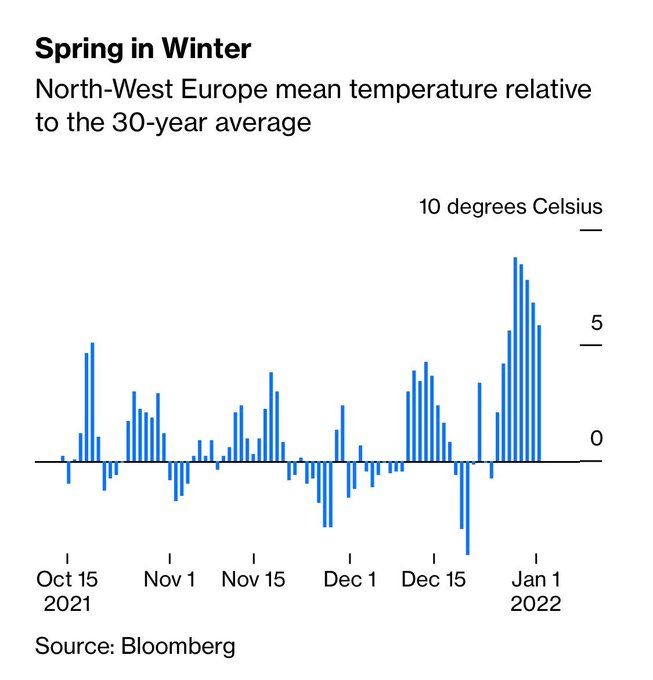

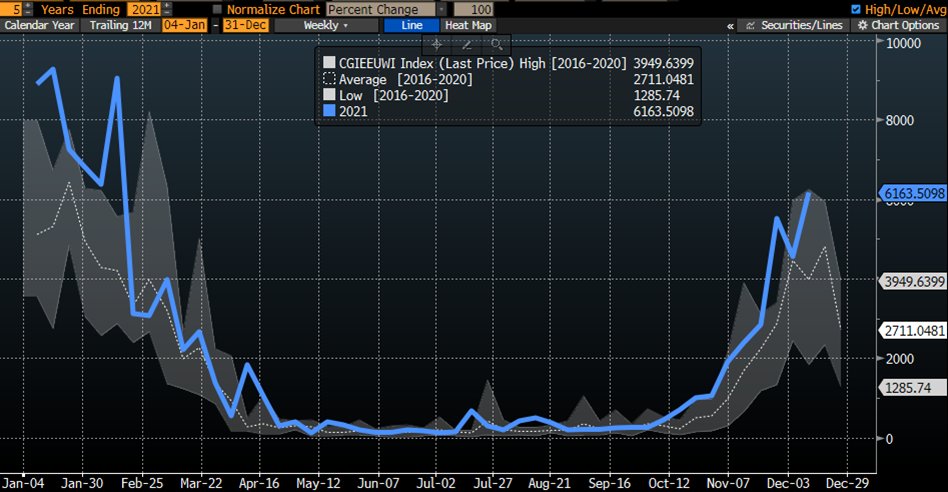

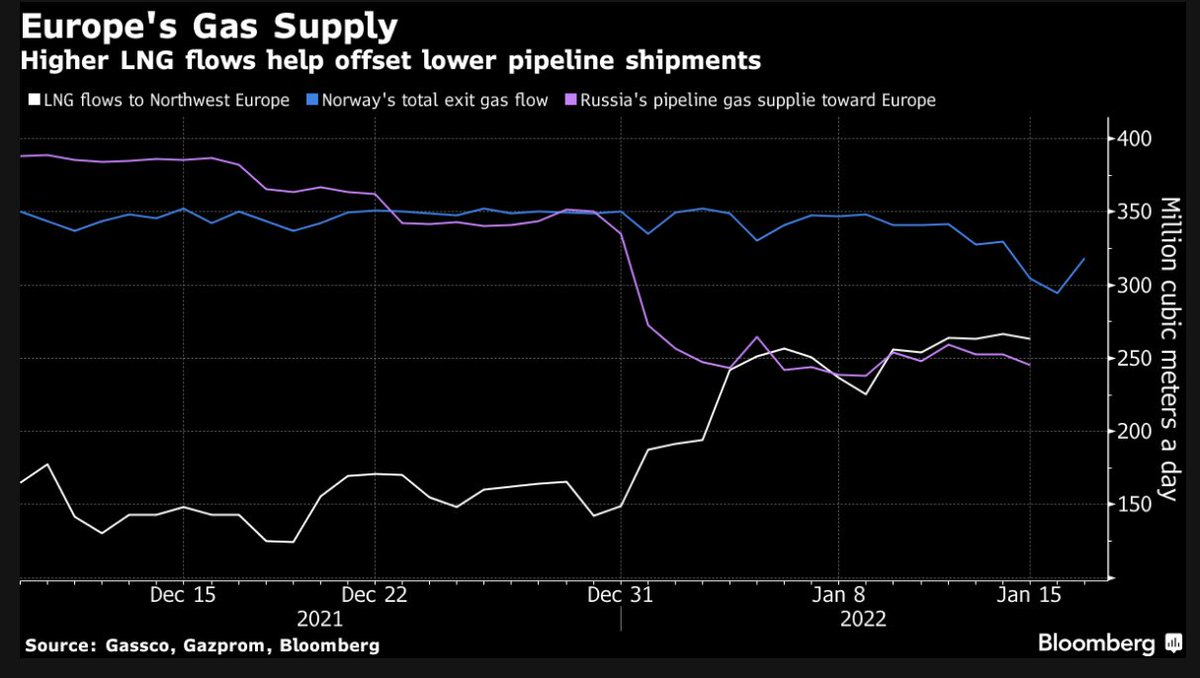

So far, EU compensated with warmer weather & LNG, as illustrated below.

1/4

So far, EU compensated with warmer weather & LNG, as illustrated below.

1/4

Last month, Gazprom booked 21% of Mallnow’s (GER entry from PL) capacity for Jan, yet there have been no flows. In Dec, the company used daily pipe allocations for that route after opting against booking capacity for the whole month. Nor do Flows enter Poland (from BL).

2/4

2/4

On the Ukrainian route, some capacity was booked on Monday for gas shipments to Slovakia via Velke Kapusany border point for Feb. Yet, current flows through that station, even though an extra booking was also made for this month, are a fraction of contractual volumes.

3/4

3/4

Where it gets disturbing is the recent noticeable drop for contractual flows to Germany via Nord Stream. They never dropped in Jan since the pipe’s capacity is in full use for past 5 years!

#payattention 4/4

#payattention 4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh