NEW REPORT from @hale_shale, out today: The UK’s trade agreement with India could deliver economic benefits eventually comparable in scale to the now defunct US trade deal - but it also carries far more uncertainty and risk: economy2030.resolutionfoundation.org/reports/a-pres…

A UK-India FTA could be a big deal: UK business services exports under-perform in India relative to other Indo-Pacific regions – accounting for just 1.8% of imports to India, compared to 4.2% in Malaysia – so the potential for future growth is huge.

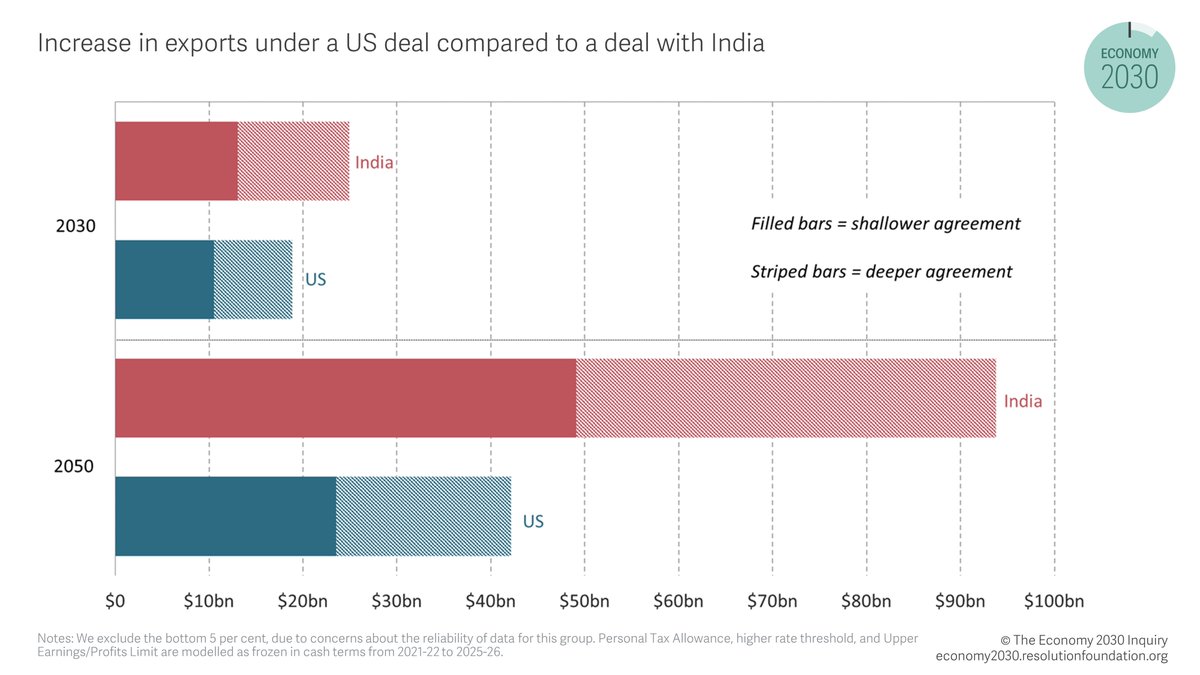

A UK-India deal could also be a bigger, but riskier, deal than a US FTA. India is forecast to become the world’s third largest import market by 2050. Demand for business, telecommunications and computer services, where UK export firms perform well, is expected to treble in 2020s.

But while the benefits of trade liberalisation with India are clear, UK firms will also be exposed to far more competition from Indian exporters. 8 sectors have emerged as new comparative advantages for India in the past decade, compared to just 1 for the US.

Join our online event at 9.30am today to find out more about our new analysis, take part in the discussion and submit your questions to our panel: resolutionfoundation.org/events/pivot-p…

• • •

Missing some Tweet in this thread? You can try to

force a refresh