Scared of being ambushed by a cake? Getting slightly bored with pre-Gray-gate? Join us to discuss the UK's economic future - and what Global Britain could mean UK exporters - at 9.30am! resolutionfoundation.org/events/pivot-p…

Starting now - our discussion on the UK's trade pivot towards the Indo-Pacific region with @hale_shale @TorstenBell @Annaisaac @JohnAlty1 & @SallyJJonesEY Watch here resolutionfoundation.org/events/pivot-p…

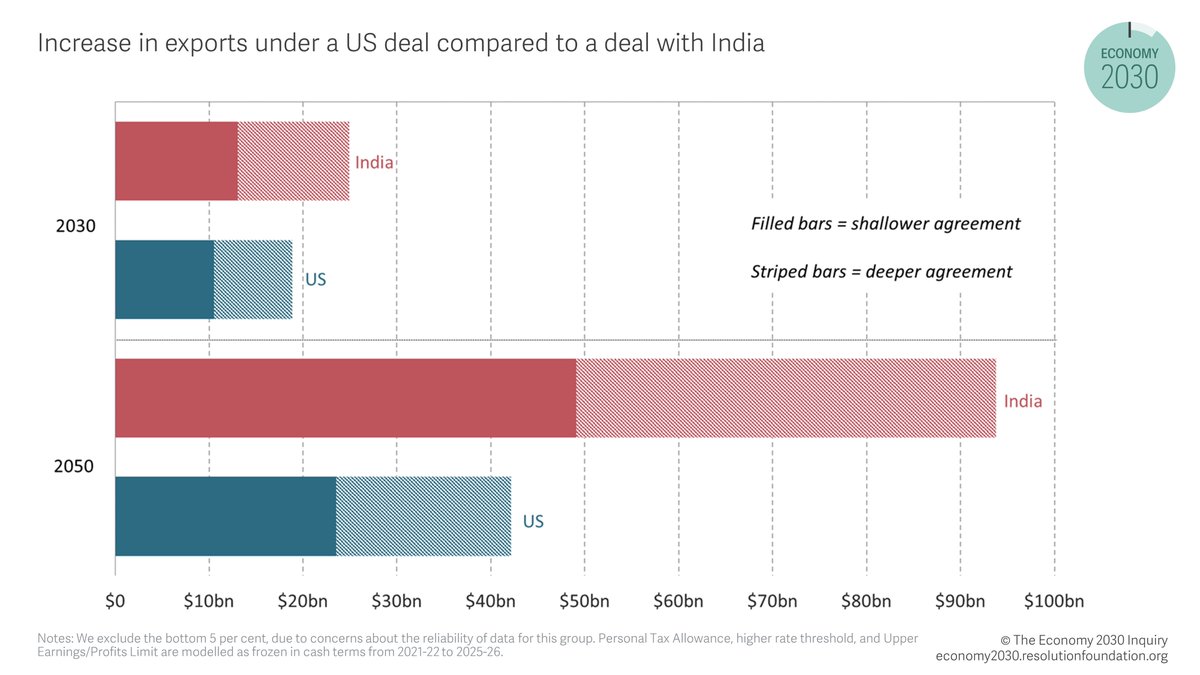

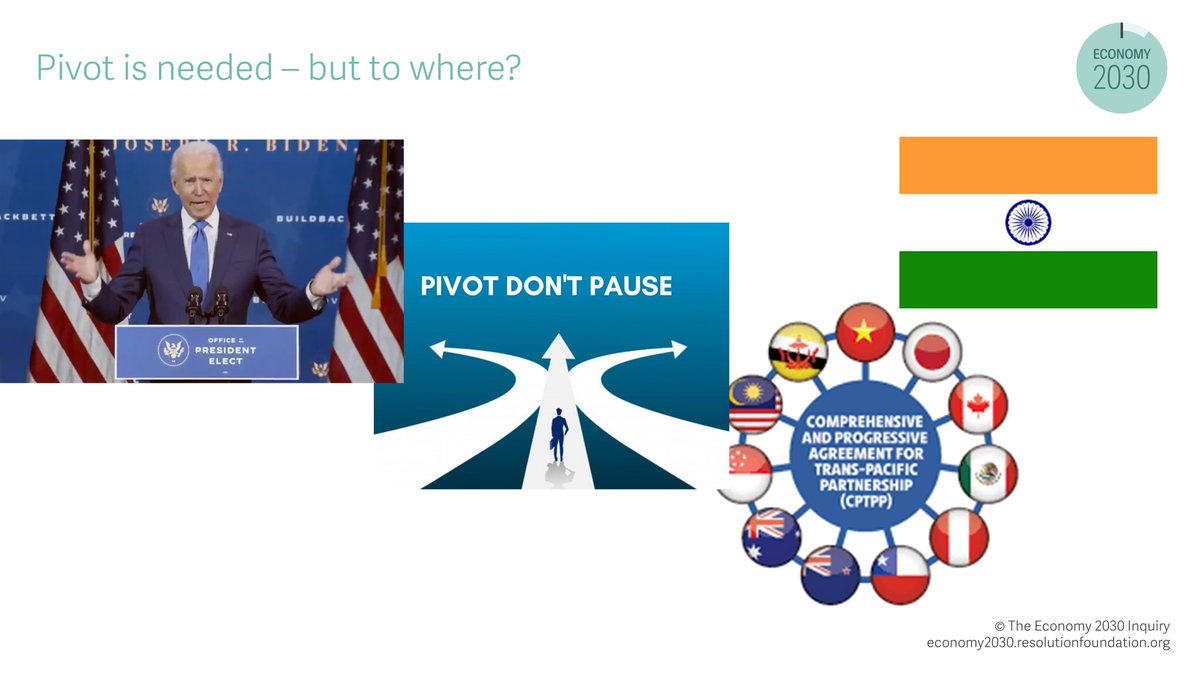

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY Kicking off our event @hale_shale notes that the US-focused Global Britain is paused, and the new focus is the Indo-Pacific region (and particularly India)

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY On the face of it, this pivot is focused on the UK becoming the first European nation to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) – an agreement that could cover eight per cent of current UK trade.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY However, as the UK already has Free Trade Agreements (FTAs) with the majority of CPTPP members, with 95 per cent of CPTPP trade already covered by FTAs, a trade agreement with India could have a far bigger impact.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY What would a Free Trade Agreement with India look like in the short-term? The UK buying more textiles, and selling more manufacturing

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY What a trade deal with India WONT mean - a replacement for lost trade access to the EU. The UK and Indian import and export markets are far less complimentary than the UK-EU or UK-US markets.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY Looking at the longer-term, the economic benefits from a trade deal with India could be even bigger. India is forecast to become the world’s third largest import market by 2050.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY There is a big opportunity for greater UK business services exports to India. UK firms currently under-perform relative to other Indo-Pacific regions – accounting for just 1.8% of imports to India, compared to 4.2% in Malaysia.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY But the bigger potential gains from trade liberalisation with India come with bigger uncertainty and risk as India is a fast changing economy. It has developed 8 areas of comparative advantage over the past decade - including construction and pharmaceuticals. Stiffer competition.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY UK firms most exposed to greater competition from Indian exporters - such as business services firms - are heavily concentrated in London.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY The good outcome - a China-German relationship delivering more competitive and productive manufacturing, and higher demand both ways.

The bad outcome - repeating the US 'China shock' where under-performing UK services firms are replaced by more competitive India exports.

The bad outcome - repeating the US 'China shock' where under-performing UK services firms are replaced by more competitive India exports.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY Summary - the UK's pivot towards the Indo-Pacific region, and specifically it's potential trade deal with India are a big deal (bigger even than a US FTA) but also more uncertain and riskier. So our new trade strategy MUST be aligned with our wider economic strategy in the 2020s.

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY A successful #GlobalBritain trade pivot towards the Indo-Pacific region will mean avoiding a services version of the ‘China-shock’ by unlocking UK exports of higher value-added services, says @hale_shale

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY If we want trade=jobs in the Indo-Pacific region we need to get better at specialising in the services our export markets demand. And that requires a greater investment in education at home, says @Annaisaac

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY Businesses aren't that bothered by FTAs with Australia and New Zealand (unless they work in the wine and spirits sector), but they are very interested in trade liberalisation with India. A population of 1.4 billion helps, says @SallyJJonesEY

@hale_shale @TorstenBell @Annaisaac @JohnAlty1 @SallyJJonesEY Another key long-term benefit of further trade liberalisation from @JohnAlty1 - Indians are getting richer, and that should make higher-value UK services exports more appealing, further increasing demand (especially if access is easier).

• • •

Missing some Tweet in this thread? You can try to

force a refresh