$SQZ is rock solid: 58mboe 2P Res from 5 fields with soild maturity mix (Columbus); comes off milestone payments for BKR acqu.; N&S Egg growth pipe; UK lowest E&P tax rate ex US; access to services; conventional fields; top mgmt; zero EV in 2022?

GB 500p intrinsic value.

1/3

GB 500p intrinsic value.

1/3

Check out its potential cash flow profile (without growth capex for North & Egg) or potential well interventions for BKR in 2022 for, perhaps, $80m. FCF would be $537m. Deduct $50-80m and it may still be zero EV by year-end due to gas price futures curve. Insane!

2/3

2/3

Here is the NBP gas price Future curve as of today. We modelled Serica below that to leave room for their 20% hedging which could be below that.

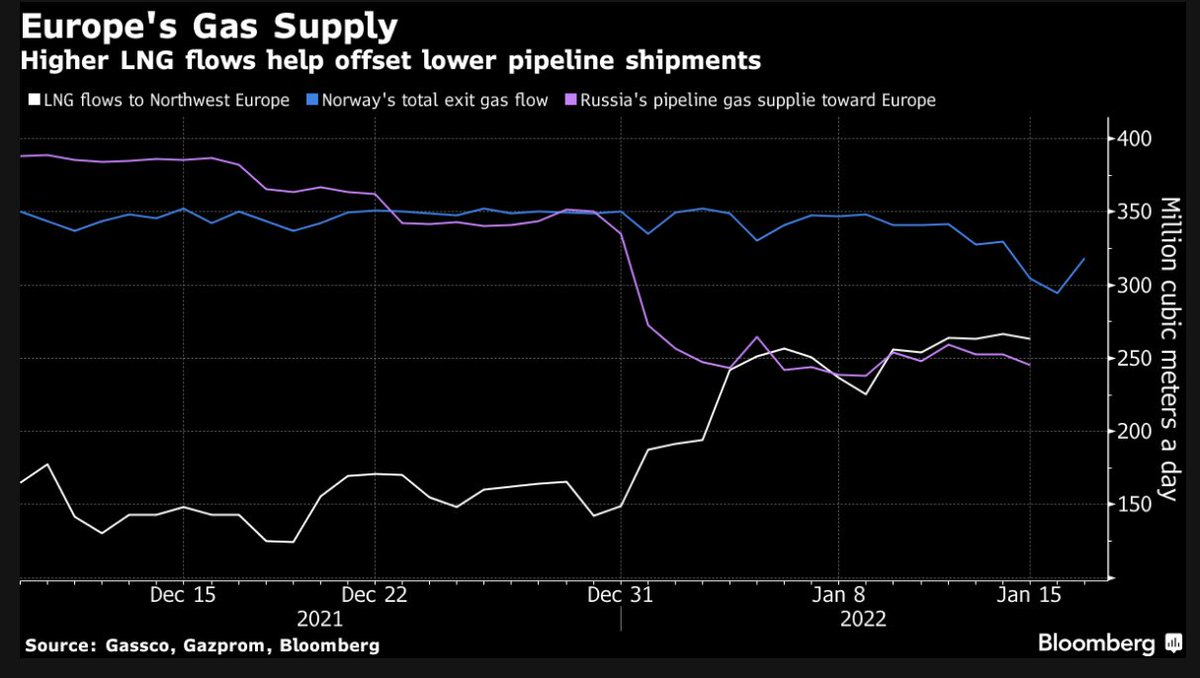

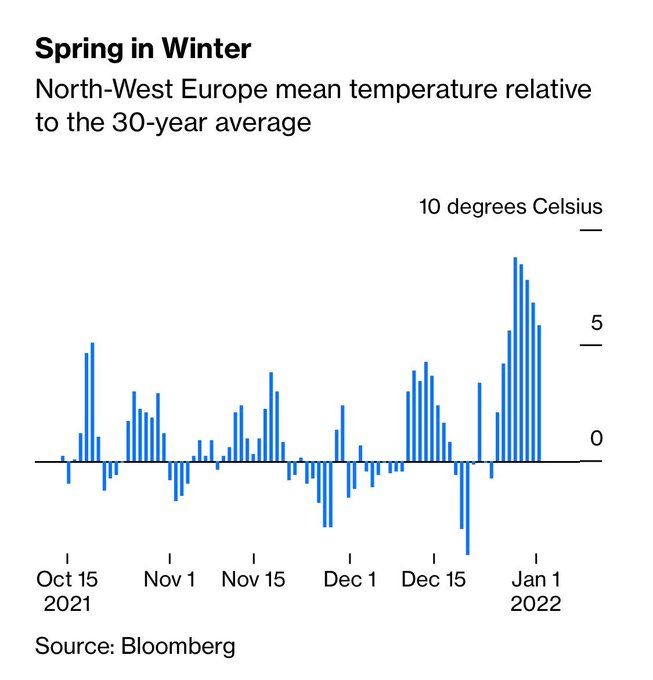

$SQZ is also a hedge against potential Ukraine disruption. Better than $IOG as proven fields;

3/3

$SQZ is also a hedge against potential Ukraine disruption. Better than $IOG as proven fields;

3/3

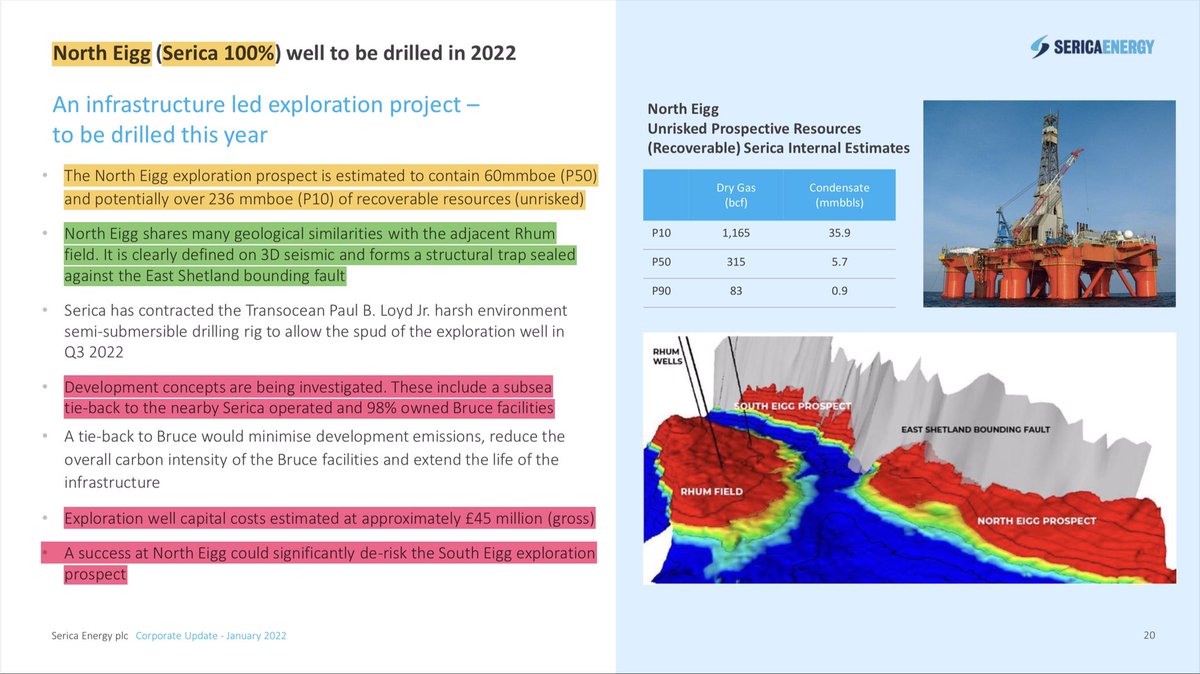

Finally, North Egg may add up to 100% intrinsic value. 2P (p50) resource = 60mboe. Exploration well going to spud in July (plus 70days campaign; floater contracted). If successful, would become an inexpensive tie-back with Rhum (existing field of Serica). Watch out for this.

$SQZ has an exceptionally low Beta of 1.0 for an E&P in case factor style (high beta) in a risk off macro environment (sell high beta) is a worry.

• • •

Missing some Tweet in this thread? You can try to

force a refresh