The contrasting opinions on @avacta's valuation on FinTwit is fascinating.

Those who think #AVCT is overvalued, just can't seem to get their heads around the possibility that a £250m British biotech could be on the cusp of revolutionizing cancer treatment.

The bull case⬇️

1/25

Those who think #AVCT is overvalued, just can't seem to get their heads around the possibility that a £250m British biotech could be on the cusp of revolutionizing cancer treatment.

The bull case⬇️

1/25

https://twitter.com/MylesMcNulty/status/1484564887682625542

#AVCT has four platform technologies:

1) Affimer Diagnostics

2) Affimer Therapeutics

3) pre CISION

4) TMAC (a combo of 2+3)

The purpose of this thread is to focus on and explain pre CISION and its potential value. This is the greatest near-term value driver for @avacta.

2/25

1) Affimer Diagnostics

2) Affimer Therapeutics

3) pre CISION

4) TMAC (a combo of 2+3)

The purpose of this thread is to focus on and explain pre CISION and its potential value. This is the greatest near-term value driver for @avacta.

2/25

pre CISION - what is it? The most basic of explanations would be:

"Chemotherapy with dramatically reduced side-effects."

Chemotherapies are highly effective treatments for cancer, and have been used for decades. The issue with them, however, is that their effects are...

3/25

"Chemotherapy with dramatically reduced side-effects."

Chemotherapies are highly effective treatments for cancer, and have been used for decades. The issue with them, however, is that their effects are...

3/25

...indiscriminate on tumor and healthy tissues alike.

For example, the well known anthracycline chemotherapy, doxorubicin, kills heart cells as much as it kills cancer cells.

This 'dose limiting toxicity' caps the effectiveness of chemotherapy.

4/25

For example, the well known anthracycline chemotherapy, doxorubicin, kills heart cells as much as it kills cancer cells.

This 'dose limiting toxicity' caps the effectiveness of chemotherapy.

4/25

#AVCT has exclusively licensed the pre CISION platform - for life of patents - from Tufts University School of Medicine and Bach BioSciences (the company of the scientist who invented the tech).

A single, must-read page on how pre CISION works:

5/25

avacta.com/therapeutics/p…

A single, must-read page on how pre CISION works:

5/25

avacta.com/therapeutics/p…

The first pre CISION, pro-chemotherapy that @avacta has brought into human clinical trials is AVA6000 - a targeted form of doxorubicin.

The data generated in preclinical mouse models was extraordinary.

If only 20% of the targeting achieved in animals is achieved in man...

6/25

The data generated in preclinical mouse models was extraordinary.

If only 20% of the targeting achieved in animals is achieved in man...

6/25

...then #AVCT will have a blockbuster drug on its hands.

Doxorubicin is a $1 billion dollar drug, even now in its current form (major side-effects), and when it's off patent (so must charge less).

If @avacta's AVA6000 can reduce side-effects at all, then it's going to...

7/25

Doxorubicin is a $1 billion dollar drug, even now in its current form (major side-effects), and when it's off patent (so must charge less).

If @avacta's AVA6000 can reduce side-effects at all, then it's going to...

7/25

...rapidly displace the majority of the generic doxorubicin market. If it can reduce side-effects by 90%+ (as it did in mice), then it'll take the entire market.

But, as #AVCT itself has stated, a working pre CISION platform could multiply that market.

How?

8/25

But, as #AVCT itself has stated, a working pre CISION platform could multiply that market.

How?

8/25

MORE patients would be eligible for AVA6000 than would be for standard doxorubicin, and ALL patients could endure more doses.

Furthermore, a patented drug could be sold on the market for much more than a generic (off-patent) drug.

#AVCT would patent a successfully... 9/25

Furthermore, a patented drug could be sold on the market for much more than a generic (off-patent) drug.

#AVCT would patent a successfully... 9/25

...developed and trialed AVA6000 (the pro-drug form of dox.).

I have written previously of the chances of success of AVA6000 working in man ⬇️

We are now approaching six months into the Phase 1 trial that is ongoing in three UK hospitals, with three further UK hospitals.. 10/25

I have written previously of the chances of success of AVA6000 working in man ⬇️

We are now approaching six months into the Phase 1 trial that is ongoing in three UK hospitals, with three further UK hospitals.. 10/25

...and an unknown number in the US to begin recruiting shortly.

I also suggested four possible news items that could be taken as indicators that AVA6000 was working in the first cohort of three patients:

1) Additional hospitals start recruiting.

11/25

I also suggested four possible news items that could be taken as indicators that AVA6000 was working in the first cohort of three patients:

1) Additional hospitals start recruiting.

11/25

https://twitter.com/MylesMcNulty/status/1447981706594639874

2) #AVCT RNSing dose escalation of next cohort (of 3 patients).

3) IND filing for AVA6000.

4) #AVCT selecting a clinical candidate for AVA3996 (pro-velcade).

The rationale for them being good indicators is described in the thread ⬆️

Three of the four have now occurred.

12/25

3) IND filing for AVA6000.

4) #AVCT selecting a clinical candidate for AVA3996 (pro-velcade).

The rationale for them being good indicators is described in the thread ⬆️

Three of the four have now occurred.

12/25

We wait only on dose escalation and launch of the second cohort of patients. This will be the indisputable evidence that pre CISION works in man.

#AVCT would be dosing these next patients with an AVA6000 that is 1.5x or more the potency of standard doxorubicin.

13/25

#AVCT would be dosing these next patients with an AVA6000 that is 1.5x or more the potency of standard doxorubicin.

13/25

We could be waiting on patients 2 and 3 from the first cohort to finish their last cycles;

Their could be NHS delays owing to Covid;

Their could be issues with patient recruitment.

Dose escalation (and the timing of) is in the hands of the Principal Investigator.

14/25

Their could be NHS delays owing to Covid;

Their could be issues with patient recruitment.

Dose escalation (and the timing of) is in the hands of the Principal Investigator.

14/25

But back to #AVCT's pre CISON platform, and its potential value.

AVA6000 is not a new drug. Its efficacy is not being tested, per se. @avacta is simply trying to reduce its side-effects.

The same technology - William Bachovchin's chemistry - can also be applied to... 15/25

AVA6000 is not a new drug. Its efficacy is not being tested, per se. @avacta is simply trying to reduce its side-effects.

The same technology - William Bachovchin's chemistry - can also be applied to... 15/25

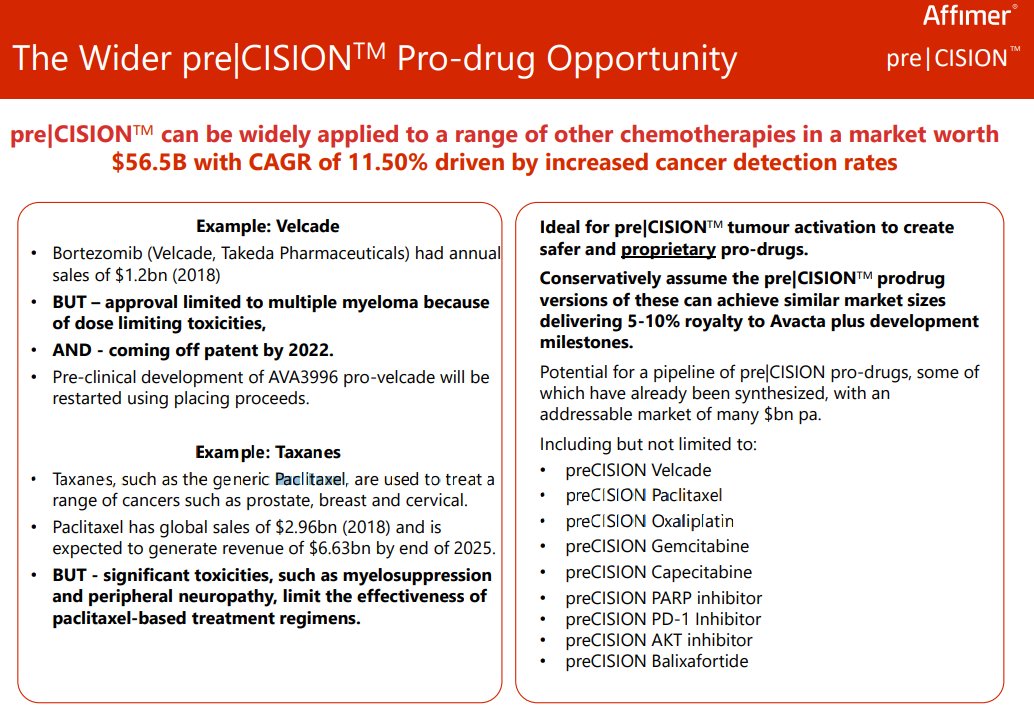

...other types of chemotherapies: besides anthracyclines such as dox, it can be applied to taxanes, to protease inhibitors, to platinum-based chemos, etc.

I believe #AVCT already has a dozen or more existing chemotherapies in the pipeline - not including AVA3996, which...

16/25

I believe #AVCT already has a dozen or more existing chemotherapies in the pipeline - not including AVA3996, which...

16/25

...has already evidently yield positive results in animals (see latest RNS ⬇️)

To reiterate: #AVCT is NOT making new drugs from scratch. Efficacy of its pro-chemos will not be under question. It is whether pre CISION can simply improve the safety profile of these...

17/25

To reiterate: #AVCT is NOT making new drugs from scratch. Efficacy of its pro-chemos will not be under question. It is whether pre CISION can simply improve the safety profile of these...

17/25

...existing, already highly effective anti-cancer drugs.

Because of this, #AVCT's prodrugs will not be required to go through Phases 1-3 like novel drugs under development.

They will require only Phase 1, and then a Pivotal Phase 2 (from 2.20 ⬇️)

18/25

avacta.com/alastair-smith…

Because of this, #AVCT's prodrugs will not be required to go through Phases 1-3 like novel drugs under development.

They will require only Phase 1, and then a Pivotal Phase 2 (from 2.20 ⬇️)

18/25

avacta.com/alastair-smith…

And so we arrive at the crux of the @avacta #AVCT investment proposition:

If - I acknowledge, it's a BIG IF - pre CISION works in man, then the owner/licensee of the platform will be able to remake, rebrand and relaunch the majority of drugs on the existing chemo market.

19/25

If - I acknowledge, it's a BIG IF - pre CISION works in man, then the owner/licensee of the platform will be able to remake, rebrand and relaunch the majority of drugs on the existing chemo market.

19/25

Provided the owner of the drugs doesn't make them prohibitively expensive (take the piss!), why would the range of prodrugs not rapidly displace the entire market?

But remember: these prodrugs could also MULTIPLY the conventional chemo market (already $74bn pa by 2027).

20/25

But remember: these prodrugs could also MULTIPLY the conventional chemo market (already $74bn pa by 2027).

20/25

It's simple to perceive how pre CISION working in man could turn the oncology industry on its head. How many years and tens of $ billions have gone into alternative drug types and products, partially as a result of the dose limiting toxicities of chemo?

21/25

21/25

If AVA6000 shows signs of working, it's obvious to see how Big Pharma will make a move immediately.

A major could put a dozen pre CISION drugs into pre-clinical simultaneously.

A sole owner of pre CISION - with deep pockets - could monopolize the global chemo market.

22/25

A major could put a dozen pre CISION drugs into pre-clinical simultaneously.

A sole owner of pre CISION - with deep pockets - could monopolize the global chemo market.

22/25

With regards to #AVCT: people simply cannot believe that an AIM company could possess this technology.

Moreover, many invested in #AVCT in the past 20 months because of @AvactaDx's SARS-CoV-2 LFT, perhaps with little knowledge of the (at the time) pre-clinical AVA6000...

23/25

Moreover, many invested in #AVCT in the past 20 months because of @AvactaDx's SARS-CoV-2 LFT, perhaps with little knowledge of the (at the time) pre-clinical AVA6000...

23/25

...and the pre CISION platform. Many crystallized big losses and resent the stock. Everyone reading this will have seen the extraordinary trolling of #AVCT. Losing money can drive intense hatred.

And for the two shorters, thinking they can close on a placing: consider ⬇️

24/25

And for the two shorters, thinking they can close on a placing: consider ⬇️

24/25

Finally: the DISCLAIMER.

pre CISION has not yet been proved to work in man. We may get told next week that it has not worked. Or, that it does, but that AVA6000 has had some specific issues.

This is HIGH RISK biotech.

But: my view is that the R/R is complete nonsense.

25/25

pre CISION has not yet been proved to work in man. We may get told next week that it has not worked. Or, that it does, but that AVA6000 has had some specific issues.

This is HIGH RISK biotech.

But: my view is that the R/R is complete nonsense.

25/25

*There *There 🤦🏻♂️🤦🏻♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh