DEBT IS SEXY.

Broke: Debt is for poor people.

Woke: Taking on debt is a weirdly smart thing to do in 2022.

Bespoke: Debt is the best kept secret separating the upper-class from middle-class.

🧵 on HOW DEBT CAN MAKE U RICHER

- as a trader

- as an entrepreneur

- as a business

👇

Broke: Debt is for poor people.

Woke: Taking on debt is a weirdly smart thing to do in 2022.

Bespoke: Debt is the best kept secret separating the upper-class from middle-class.

🧵 on HOW DEBT CAN MAKE U RICHER

- as a trader

- as an entrepreneur

- as a business

👇

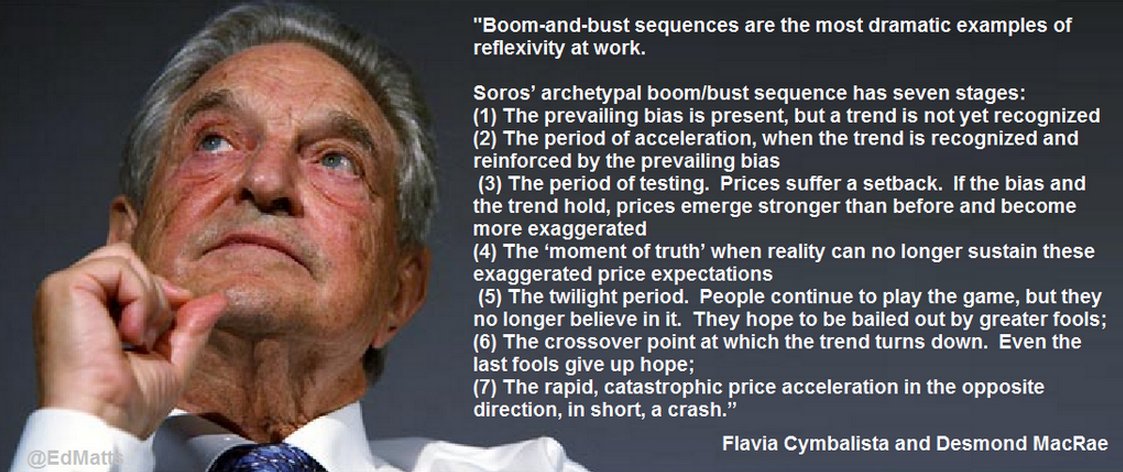

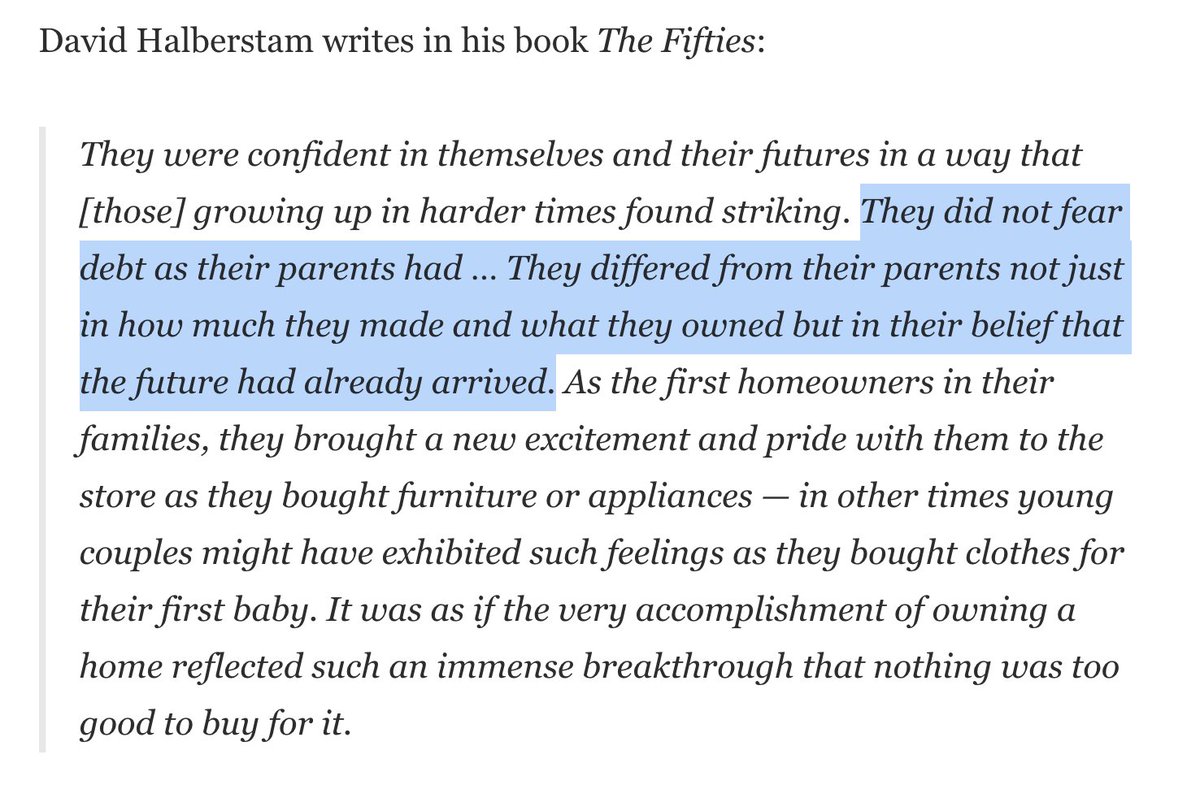

1/ How debt got such a bad rap culturally

Back in the '50s the GI Bill spurred an explosion in consumer credit & new mortgages. Middle-class families stretched to live "like upper-class."

This continued til '08 when it all snapped. Millennials saw parents lose a shit ton of $$.

Back in the '50s the GI Bill spurred an explosion in consumer credit & new mortgages. Middle-class families stretched to live "like upper-class."

This continued til '08 when it all snapped. Millennials saw parents lose a shit ton of $$.

So Millennials learned to associate debt with decadence & poor financial decision-making.

Debt was/is so "eww" of a term that in Silicon Valley it hinders customer acquisition & depresses one's valuation.

Founder friend: "We don't touch debt; we run revenue-based financing!" 🤣

Debt was/is so "eww" of a term that in Silicon Valley it hinders customer acquisition & depresses one's valuation.

Founder friend: "We don't touch debt; we run revenue-based financing!" 🤣

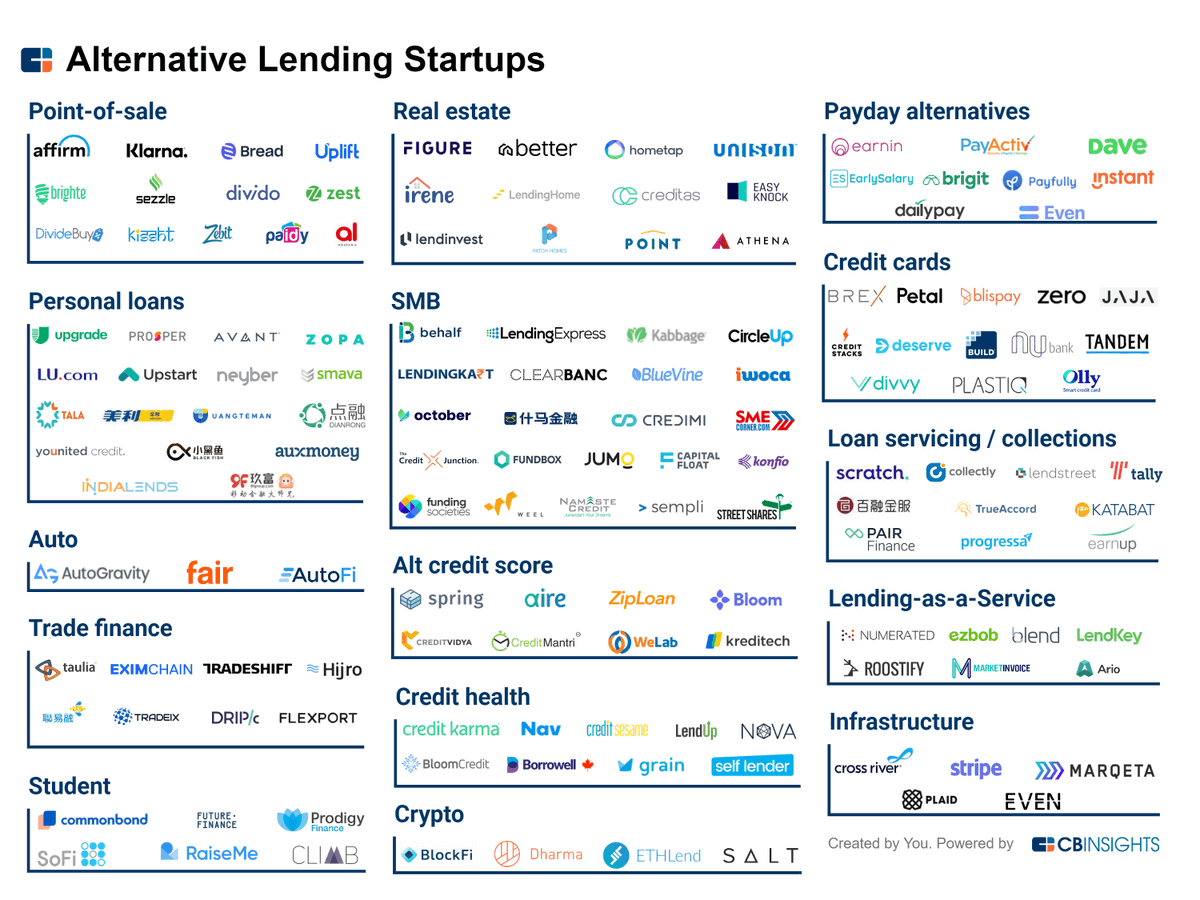

2/ What's in a name?

Rev-based financing...

Inventory financing...

BNPL (buy now pay later)...

100x Leverage...

Embedded lending.

Why did so many financing/BNPL/leverage startups spring up during COVID?

Turns out debt is a FANTASTIC biz to get into when money printer goes brr!

Rev-based financing...

Inventory financing...

BNPL (buy now pay later)...

100x Leverage...

Embedded lending.

Why did so many financing/BNPL/leverage startups spring up during COVID?

Turns out debt is a FANTASTIC biz to get into when money printer goes brr!

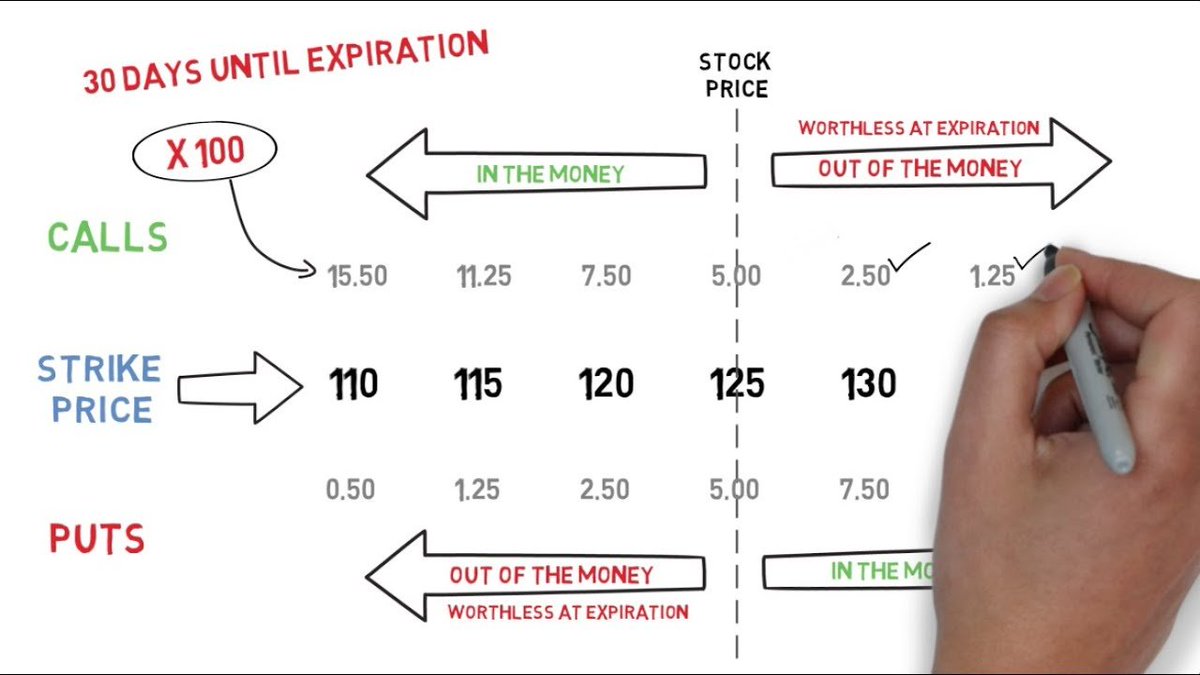

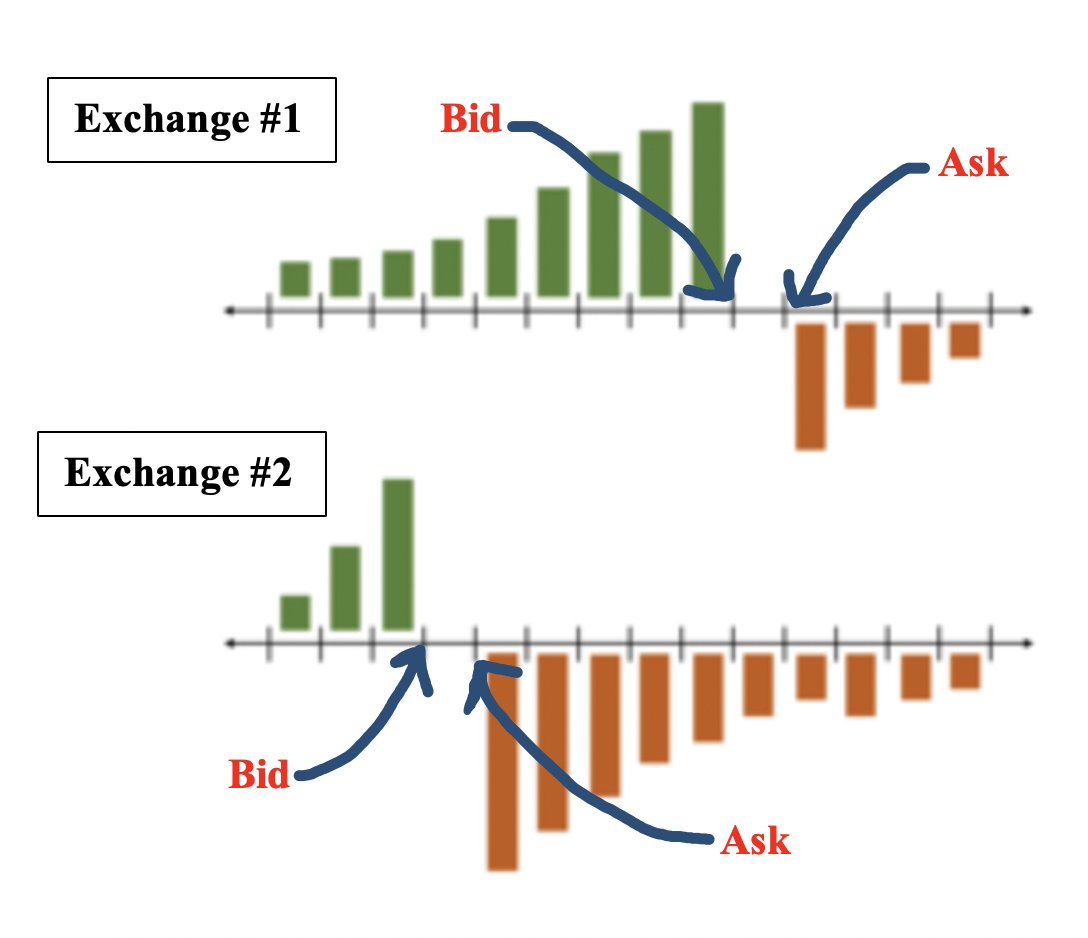

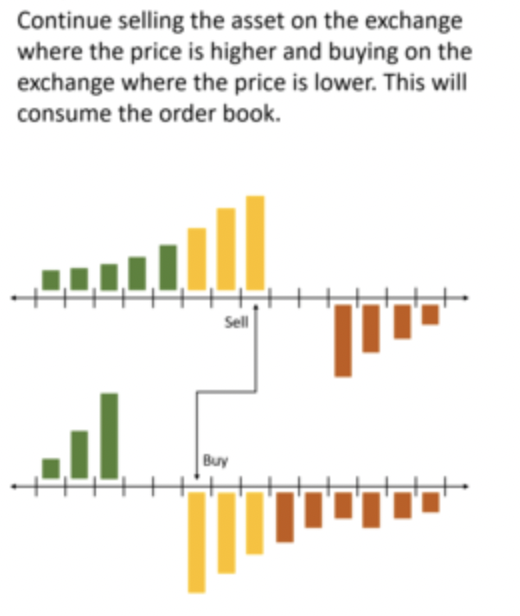

3/ How debt helps traders

A. leverage

B. margin lending

A. leverage

B. margin lending

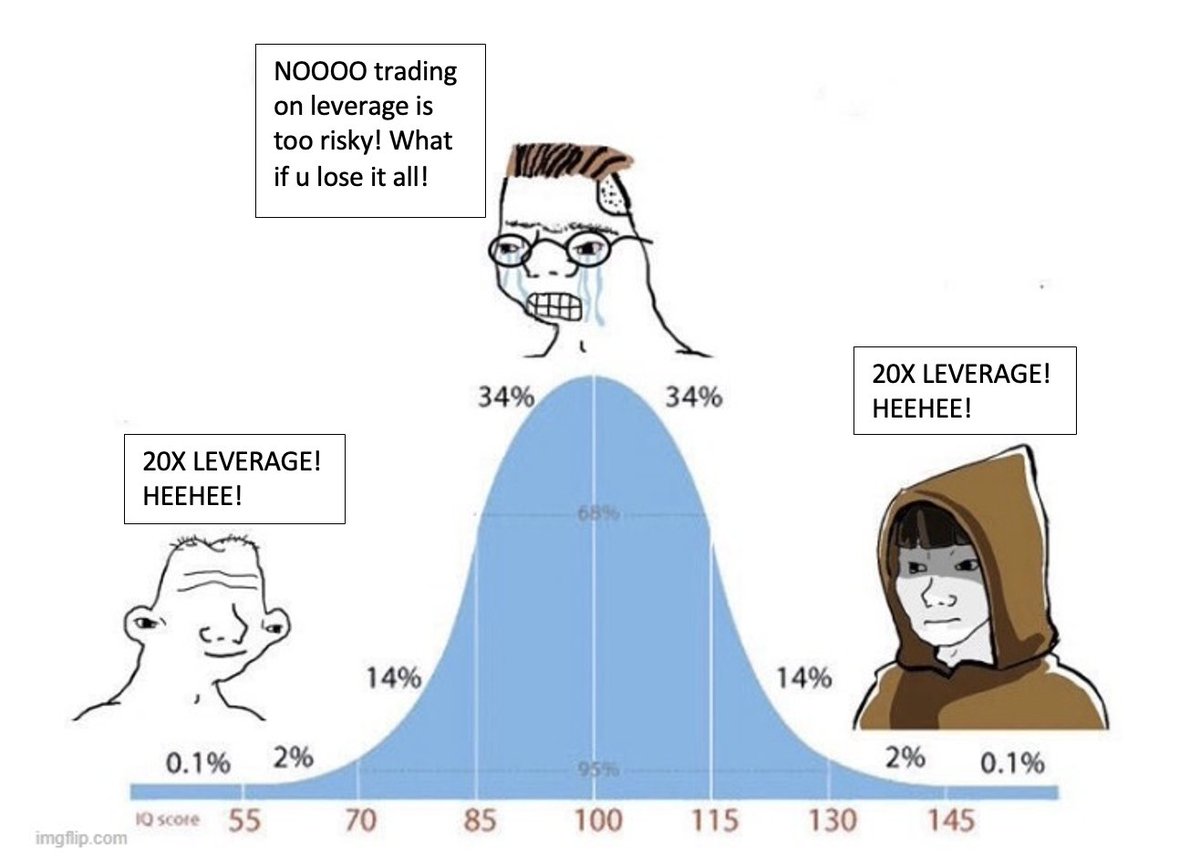

Leverage

Ask any profitable day trader why s/he didn't make more money & the #1 reason is: "I didn't have a bigger capital base!"

The way u can punch gains above ur capital base is:

(i) invest in higher-volatility stuff

or

(ii) put existing trades on leverage

Ask any profitable day trader why s/he didn't make more money & the #1 reason is: "I didn't have a bigger capital base!"

The way u can punch gains above ur capital base is:

(i) invest in higher-volatility stuff

or

(ii) put existing trades on leverage

Investing in higher-vol stuff (e.g. shitcoins) often makes no sense: it's lower sharpe & fades edge into random chance. Better to 2x or 5x on a trade w/ known asymmetric upside.

Fact:

>95% of hedge funds trade on margin

<10% of retail has access to margin accounts

Coincidence?

Fact:

>95% of hedge funds trade on margin

<10% of retail has access to margin accounts

Coincidence?

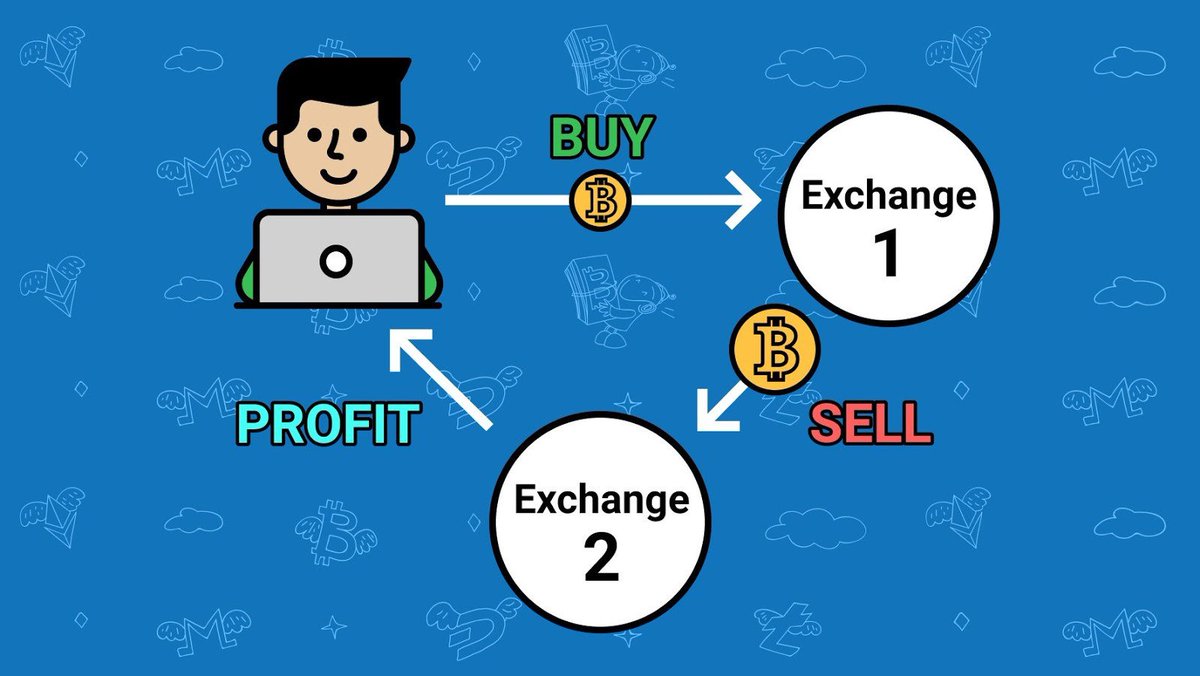

Margin lending

First of all, what is it?

e.g. Say u r fully-invested (no cash left). U own 10 $TSLA. Now u want to buy $BTC cuz it's cheap as fuck, but don't wanna cash out of $TSLA & miss out on potential further gains.

What do u do?

Offer up TSLA as collateral to get a loan.

First of all, what is it?

e.g. Say u r fully-invested (no cash left). U own 10 $TSLA. Now u want to buy $BTC cuz it's cheap as fuck, but don't wanna cash out of $TSLA & miss out on potential further gains.

What do u do?

Offer up TSLA as collateral to get a loan.

4/ How debt helps entrepreneurs & early employees

Savvy traders aren't the only ones who should take advantage of margin lending.

In fact founders + employees of growth-stage startups (whose shares regularly feed hungry hyenas in secondary markets) have ever more reason.

Why?

Savvy traders aren't the only ones who should take advantage of margin lending.

In fact founders + employees of growth-stage startups (whose shares regularly feed hungry hyenas in secondary markets) have ever more reason.

Why?

A) Virtue signaling

What ur telling investors when u collateralize (vs sell) ur shares for liquidity: "those idiot founders taking money off the table.. i'm above them; i guarantee u i'll run my company well next year & generate much higher returns than whatever 5% interest."

What ur telling investors when u collateralize (vs sell) ur shares for liquidity: "those idiot founders taking money off the table.. i'm above them; i guarantee u i'll run my company well next year & generate much higher returns than whatever 5% interest."

B) It's strategic

As a late-stage founder u should obsess about defensibility, i.e. getting stickier & establishing more distribution/industry partnerships to erect barriers to entry.

It makes sense to angel invest in strategic partners! Margin lending enable u this liquidity.

As a late-stage founder u should obsess about defensibility, i.e. getting stickier & establishing more distribution/industry partnerships to erect barriers to entry.

It makes sense to angel invest in strategic partners! Margin lending enable u this liquidity.

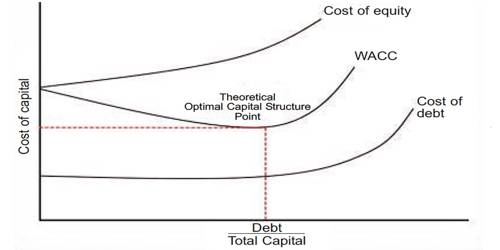

5/ How debt helps businesses

a) lowers cost of capital

"WACC", i.e. weighted-average cost of capital

b) increases IRR (internal rate of return)

i.e. the PE strategy of leveraged buyouts

a) lowers cost of capital

"WACC", i.e. weighted-average cost of capital

b) increases IRR (internal rate of return)

i.e. the PE strategy of leveraged buyouts

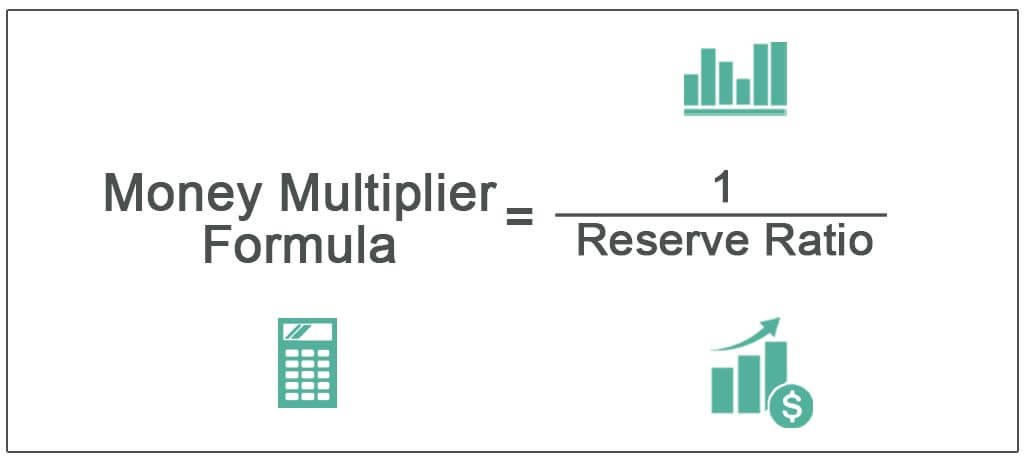

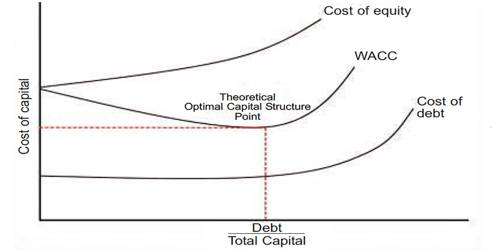

Cost of capital

Financing comes from 2 sources: equity & debt.

At first equity is more expensive. So u borrow. The more u borrow, the higher ur default risk & more expensive the next loan. At some point cost of debt catches up to equity, i.e. the optimal capital structure point.

Financing comes from 2 sources: equity & debt.

At first equity is more expensive. So u borrow. The more u borrow, the higher ur default risk & more expensive the next loan. At some point cost of debt catches up to equity, i.e. the optimal capital structure point.

While it's financially optimal to take on just enough debt to achieve minimum WACC (weighted avg cost of capital), late-stage startups are notorious for skirting venture debt in favor of never-ending equity rounds to mark-to-market a higher valuation & stroke founders' egos.

IRR

If u've ever wondered "how does KKR/Carlyle/3G make all its money?" the answer is: leveraged buyouts.

Say u buy a biz for 20% cash, 80% debt. The biz's own cashflows pay down ur interest. In 10 yrs, ur interest is cleared & u own 100% of the biz. U flip it for insane gains.

If u've ever wondered "how does KKR/Carlyle/3G make all its money?" the answer is: leveraged buyouts.

Say u buy a biz for 20% cash, 80% debt. The biz's own cashflows pay down ur interest. In 10 yrs, ur interest is cleared & u own 100% of the biz. U flip it for insane gains.

One way for companies to take advantage of the benefits of leveraged buyoutism is during M&A (i.e. go for 60% cash, 40% debt rather than 100% cash).

Another is to just stop being a meglomaniac dud and/or an unquestioning Paul Graham yesman, financing on 100% venture equity.

Another is to just stop being a meglomaniac dud and/or an unquestioning Paul Graham yesman, financing on 100% venture equity.

6/ SIDE NOTE: whether as a trader, entrepreneur, or startup, only channel debt into APPRECIATING assets.

There's nothing more pathetic than debt for a lavish lifestyle or to impress a hot girl.

Both ur hedonism & the girl are depreciating assets at best, liabilities at worst.

There's nothing more pathetic than debt for a lavish lifestyle or to impress a hot girl.

Both ur hedonism & the girl are depreciating assets at best, liabilities at worst.

End/

TLDR:

Debt is highly underrated as an asset class.

Most of us would be in a better financial position if we understood how to strategically layer more debt into our lives as traders, consumers, and entrepreneurs.

TLDR:

Debt is highly underrated as an asset class.

Most of us would be in a better financial position if we understood how to strategically layer more debt into our lives as traders, consumers, and entrepreneurs.

• • •

Missing some Tweet in this thread? You can try to

force a refresh