Look at that....Primo directorship of a UK company with GBP1Billion of capital (US$1.Billion give or take). Pretty cool hey.....and even better....he had the best investors....

Himself. Why have outside investors when you can write the cheque yourself. pretty cool being able to write a single check for $1.4billion.....

but then again....things might not have gone to plan. Someone forgot to file accounts and got struck off...Geewizz how much bad luck can you have...

maybe it was the name.....I mean what kind of name is E.C.C.I.B.T. anyway.....maybe that was the problem.

for those who couldn't be arsed googling ECCIBT is European charter of commerce for investments banks and trust...

follow the links and check out Ronny's attempt to create authenticity by leaving a trail of web crumbs. He failed but not as much as his choice of logo's

check out the melting pot of naffness; from the obligatory lion head, creepy Illuminati thistle head and some crazy crab arms its literally the most rubbish logo ever. Ronny should get his money back from fivver

But instead he doubles down by making up the obviously fake financial services authority logo. Remember this clown allegedly wrote out a cheque for $1.4Billion....

(yeah the clown bits my addition)...

(yeah the clown bits my addition)...

good to see someone had a word in his ear about the logo shocker as it was later replaced with....he must have liked this (or run out of credit with his fivver guy) as this logo has been reused a couple of times for branding up associates......oh Ronny your are a dipshit.

oh yeah don't click on this....web has long disappeared the link's dodgy and likely be clicking a malicious script of some kind.

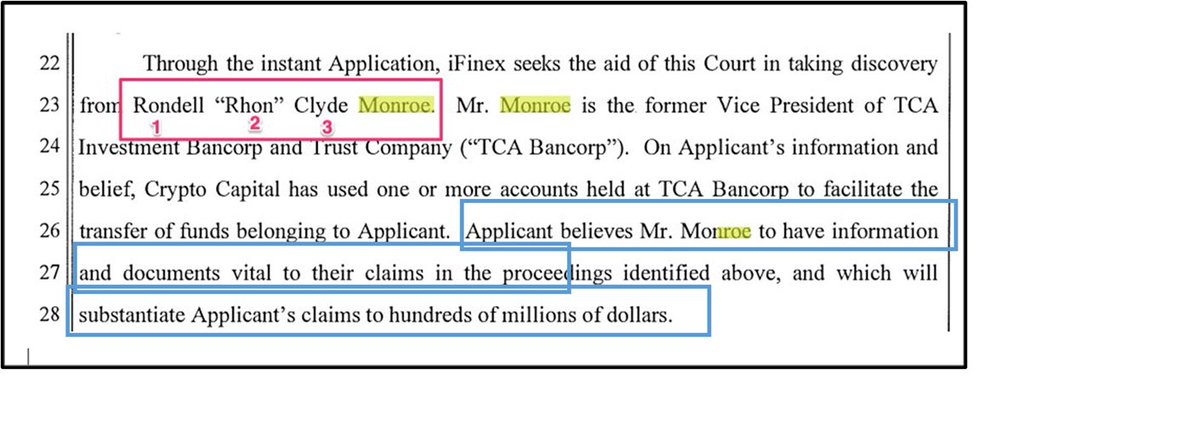

Just a refresher on how critically important Ronnny is to #bitfinex and the #wiz and the recovery of a few hundred million. You know the one that they never worked out how to spell his name and couldn't find him due to his shadow hiding ninja like skills.

• • •

Missing some Tweet in this thread? You can try to

force a refresh