🚨🚨 My #Bitcoin Quick Market Update [02Feb22]!

OUr block view shows what happenend before our recent dump. Whales stopped to send tokens to exchanges and let the price lift up heading 38.7k where again, they met low demand. Even if #BTC is and was following

#BTC #ETH #XRP

OUr block view shows what happenend before our recent dump. Whales stopped to send tokens to exchanges and let the price lift up heading 38.7k where again, they met low demand. Even if #BTC is and was following

#BTC #ETH #XRP

$SPX, its reaction wasn't driven by $SPX. Our whales ratio 30block average is rising again. But without big netflows. I just have detected one big inflow today and that was #Gemini and 1,000 #BTC.

Our hourly view is showing here imo the preparation of the incoming downward

Our hourly view is showing here imo the preparation of the incoming downward

trend. The whales ratio is more becoming a dump prepration indicator at least in the daily and hourly view. The whales ratio doesn't show its effect immediately afterwards, instead more preparations. Whales sent tokens days before and wait for the opportunity to dump as soon they

notice a cut in demand. Imo it's not the same rules like last summer. It's not about to generate fear and to dump hard on retailers. It's more about to distribute and try to maintain a price level while they are doing it. That's a challenge due the low demand atm. Imo we are

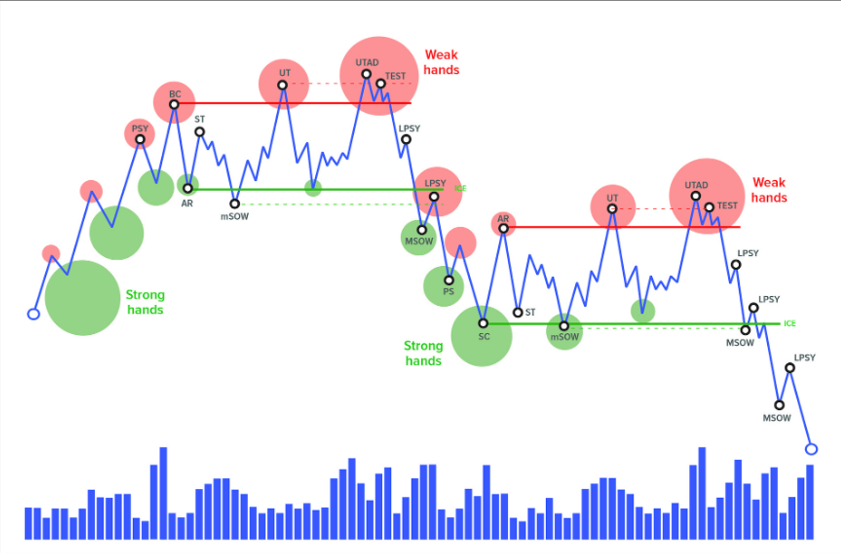

wittness of a beautiful re-distribution schematic. Means, we didn't reach the bottom yet. Some of you sent me a DM asking me, why I'm so sure that we will retrace after retesting our resistance, and we did that 3 times since 21Jan22! Because that's part of the game. For a better

understanding how re-distribution looks like I will attach the schematic. Our destination should be the bottom and the accumulation schematic. That's the time where we have to accumulate for mid- and long-term. To trade swings due fake rallies and resistance and support retests.

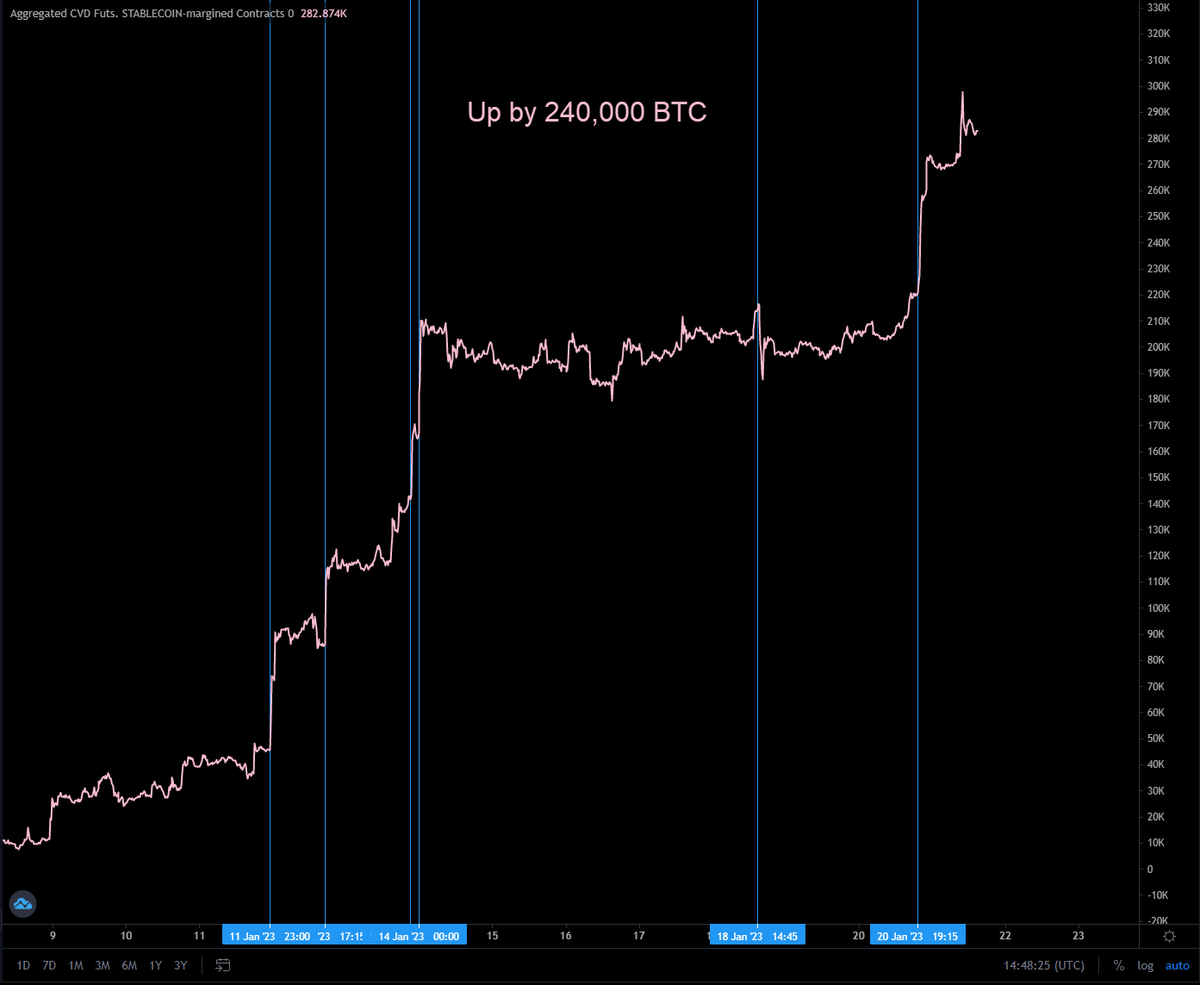

The inflow MA75 has started to rise 01Feb indicating big inflows were happening. The price was on a level of 38.5k - 38.8k also indicating their distribution. More inflows happenend while the demand was declining, the consequence, dump.

Option traders are more and more trading the March expiry instead. The 25Feb22 expiry still maintains a volume of $1.1b compared to the March one of almost $1.8b. But both showing the same trend. More puts coming in. However, for both expiries we have more calls than puts in

upper price levels. Many of them placed weeks before. The max pain for the 25Feb22 expiry is 40k atm and for the 25Mar22 expiry 45k atm. The biggest trade volume within the last 24h was $55m Puts at 30k related to the 25Mar22. So, imo the 25Feb22 isnt going to become very

important it seems and March is starting to flip to bearish now. We have a lot of time until end of march, so we need to keep track the progress here.

Related to futures we can see that the demand for shorts within the last 8h is rising again. Even the BTC Long/Short Ratio is

Related to futures we can see that the demand for shorts within the last 8h is rising again. Even the BTC Long/Short Ratio is

showing more shorts than longs.

With our recent dump the funding rate is retracing back up and the leverage ratio rising. It looks like future traders are expecting a pump afterwards. The thing is, why I'm struggling here a bit. I see SPX pumping hard right now, DXY falling

With our recent dump the funding rate is retracing back up and the leverage ratio rising. It looks like future traders are expecting a pump afterwards. The thing is, why I'm struggling here a bit. I see SPX pumping hard right now, DXY falling

and #BTC not following. Instead showing a constant sell pressure. If happens what I think they will rekt all these late longs.

Coinbase leading the recent price action in my opinion. They are pushing the price down with a lot of orders. But they limited the way down too.

Coinbase leading the recent price action in my opinion. They are pushing the price down with a lot of orders. But they limited the way down too.

35k - 40k is the expected trade range here.

Bitfinex has placed a lower wall since yesterday at 34,65k.

Kraken was limiting the way up at 40k too and has a wall at 32.5k and some orders at 33.4k.

Binance also well prepared. They placed new walls in lower ranges. 35k is the

Bitfinex has placed a lower wall since yesterday at 34,65k.

Kraken was limiting the way up at 40k too and has a wall at 32.5k and some orders at 33.4k.

Binance also well prepared. They placed new walls in lower ranges. 35k is the

first one. BTW was also limiting the way up at 40 with a low volume wall.

Inspos Conclusion and personal opinion

It looks like, we are ready to fall the way down heading our support at 33k. We will retrace the way down. But it seems exchanges are prepared for a rising sell

Inspos Conclusion and personal opinion

It looks like, we are ready to fall the way down heading our support at 33k. We will retrace the way down. But it seems exchanges are prepared for a rising sell

pressure. Imo I'm not expecting big inflows anymore, whales accumulated enough on the exchanges. Whales ratio block and hourly view will rise, but daily not imo indicating, they are done sending tokens to exchanges. If so, that wouuld confirm my prediction from 24Jan22 indicating

a last big dump that should bring us to our bottom.

As many of you I'm shorting. As my entry is relatively high at 38.7k (now as I have add more funds at 38.3k) I will maintain the position open with a SL in case they surprise me. I think the volatility will rise soon with a

As many of you I'm shorting. As my entry is relatively high at 38.7k (now as I have add more funds at 38.3k) I will maintain the position open with a SL in case they surprise me. I think the volatility will rise soon with a

a rising sell pressure at the same time. So please, be careful and max your risk management. It's not time to gamble. If you trade futures then with low leverage or with low budget. I will check how the market reacts, but I would expect a retrace at 35k. So I will take profit

there and wait to find another good entry for another short. They will try to liquidate late shorts there imo!

Anyway, play safe and always good trades!

I hope I can use Substack again tomorrow. Sorry for any trouble to my paid subs.

Anyway, play safe and always good trades!

I hope I can use Substack again tomorrow. Sorry for any trouble to my paid subs.

BTW, in case volume starts to decline they will let it lift up heading 37.9k - 38k to rise the sell pressure again. Keep in mind, they just want to sell not to generate fear. Not yet. 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh