Following Pierre-Emerick Aubameyang’s move to Barcelona, questions have again been asked about Arsenal’s recruitment policy, as the club has once more left a lot of money on the table after the free transfer of an expensive purchase #AFC

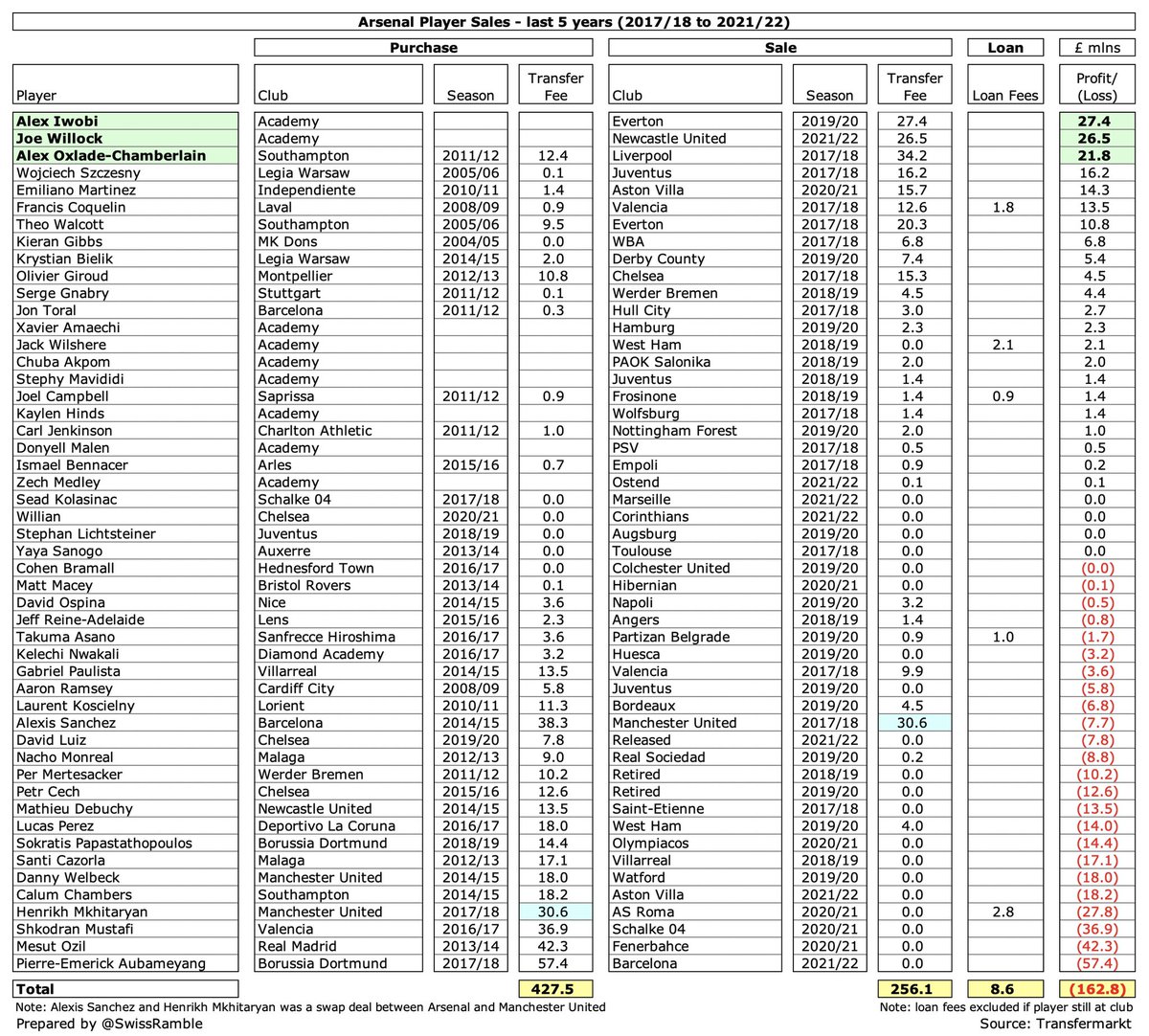

Looking at players that #AFC have sold in the last 5 years (2017/18 to 2021/22), we can see that the club has lost £163m (in cash terms) in this period with £136m of that coming from just 3 acquisitions: Aubameyang £57m, Mesut Ozil £42m and Shkodran Mustafi £37m.

In this period #AFC have rarely made big money on any transfers with only 3 deals generating gains above £20m: Alex Iwobi to #EFC £27m, Joe Willock to #NUFC £26m and Alex Oxlade-Chamberlain to #LFC £22m. The first two are homegrown with only The Ox being a purchase.

Some of the players recruited are still at the club, which means that #AFC have over £500m of transfer cost in their squad, including Nicolas Pépé £72m, Alexandre Lacazette £48m and Granit Xhaka £41m. Realistically, it is unlikely that any of these will be sold for a profit.

On the other hand, #AFC would expect to generate significant gains if they were to sell some of their exciting Academy products. For example, if Bukayo Saka and Emile Smith Rowe were to move on (very much against the fans’ wishes), they would both command hefty fees.

The question is whether other clubs have fared better than #AFC in player trading? This can be answered by looking at the rest of the Big Six. Note: all deal figures have been sourced from Transfermarkt, so might not be 100% accurate, though we can still draw some conclusions.

In stark contrast to #AFC, in the last 5 years #CFC have made £199m of gains from player sales, largely driven by the sales of Eden Hazard to Real Madrid £72m, Tammy Abraham to Roma £36m, Kurt Zouma to #WHUFC £32m and Fikayo Tomori to Milan £26m.

#LFC have also managed to make good money from player sales with a £93m gain in the last 5 years, mainly due to the highly lucrative £110m sale of Philippe Coutinho to Barcelona, while Academy product Rhian Brewster also generated £23m.

#MCFC lost £132m from player sales in the last 5 years, though this highlights one of the issues with this analysis, as much is due to players giving some of the best years of their career to City, so having little residual value, e.g. David Silva, Yaya Touré and Sergio Aguero.

#MUFC have lost the most money of the Big Six from player sales in the last 5 years with £192m, though this includes £33m on Wayne Rooney, who provided great service. Only one profit above £10m (Daniel James to #LUFC). Even made £10m loss when sold Lukaku to Inter for £67m.

#THFC lost £51m from player sales in the last 5 years, including losses above £20m on 3 players, namely Moussa Sissoko £28m, Erik Lamela £27m and Serge Aurier £23m. The only departure that produced a substantial gain was Kyle Walker to #MCFC £42m.

So it is actually not that unusual for major clubs to lose money on player sales with only two of the Big Six managing to generate gains in the last 5 years, namely #CFC £199m and #LFC £93m. That said, #AFC £163m loss was one of the largest, only surpassed by #MUFC £192m.

But here’s the thing: #AFC can ill afford to lose so much money on player trading while others with similar losses can. United’s commercial revenue is much stronger than the Gunners, while City’s finances benefit from success on the pitch plus they have owners with deep pockets.

Of course, the picture looks very different from an accounting perspective, as some of the cash losses will have been shown as profits on player sales, calculated as sales proceeds less remaining value in the accounts (reduced each year via player amortisation).

In this way, all of the Big Six have reported profits on player sales in the accounts with #CFC leading the way with nearly half a billion. Although the period covered is not quite the same as the cash analysis, #AFC had £201m profit from player trading in the 5 years up to 2020.

At this stage we have to get a bit technical to understand how football clubs account for player trading. The fundamental point is that when a player is purchased costs are spread over a few years, but any profit made from selling players is immediately booked to the accounts.

Basically, football clubs consider players to be assets, so do not fully expense transfer fees in the year a player is purchased, but instead write-off the cost evenly over the length of the player’s contract via player amortisation.

So if a player is purchased for £30m on a 5-year contract, the annual amortisation in the accounts would be £6m, i.e. £30m divided by 5 years. This means that the player’s book value reduces by £6m a year, so after three years his value in the accounts would be £12m.

If the player were to be sold at this point for £20m, profit on player sales from an accounting perspective would be £8m (sales proceeds of £20m less remaining book value of £12m) – even though the cash loss is £10m (sales proceeds of £20m less £30m purchase price).

Another way of looking at this is that the cash loss is £10m (sales proceeds of £20m less £30m purchase price), but we then add back £18m of player amortisation already booked in the accounts to give the £8m accounting profit.

However, there’s no such thing as a free lunch, so clubs will be “paying” for the purchase via player amortisation, which has significantly increased for most football clubs, e.g. it has grown by over 20% (nearly £100m) since 2016 for the Big Six alone with #CFC up to £162m.

Another important consideration is that football clubs do not buy/develop players purely to generate financial gains, but to help deliver improved performance and hopefully success on the pitch, so a more holistic view would be required to properly assess player recruitment.

Furthermore, from a financial perspective, some players sold at a loss will have still contributed to the club by helping to drive revenue growth, e.g. Champions League qualification, commercial income, broadcasting merit payments (prize money), etc.

In addition, it sometimes makes sense to offload players for free (or a low transfer fee), as it makes space in the wage bill, but it’s fair to say that #AFC poor record on player trading has still hurt Arsenal financially with consequences for the club’s ability to compete.

• • •

Missing some Tweet in this thread? You can try to

force a refresh