Review what's new in the Cosmosverse with our weekly ecosystem update.⚛️

🚀The @Cosmos ecosystem is growing by leaps and bounds.

🔍Let's check out this week's developments!

🚀The @Cosmos ecosystem is growing by leaps and bounds.

🔍Let's check out this week's developments!

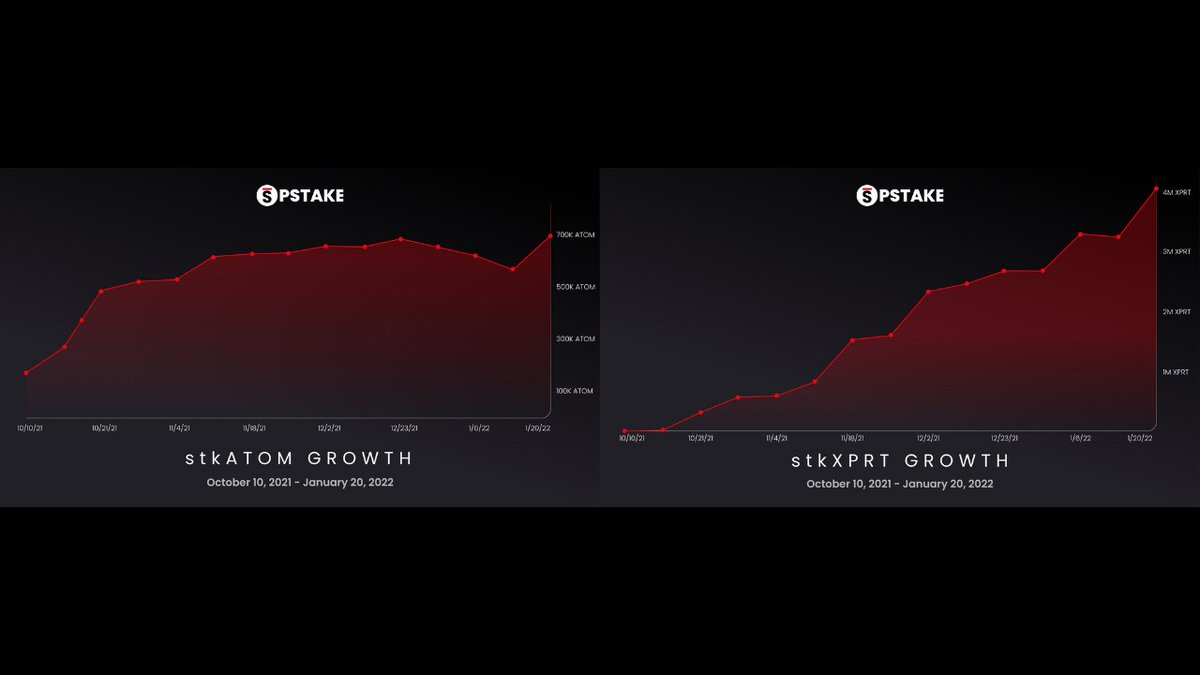

Great job, pSTAKE, for the substantial increase in stkTOKENs minted! 🙌

📈Since @pStakeFinance launched, the demand for $ATOM and $XPRT liquid staking is increasing dramatically; with stkTOKEN mints up 17.7% on the year.

🌐Stake with pSTAKE: pstake.finance

📈Since @pStakeFinance launched, the demand for $ATOM and $XPRT liquid staking is increasing dramatically; with stkTOKEN mints up 17.7% on the year.

🌐Stake with pSTAKE: pstake.finance

Amazing work, Injective Protocol, for achieving 100K Twitter Followers! 🐦

👀@InjectiveLabs has been picking up steam regarding project activity and turning head as a result.

🥳Congratulations on joining the six-figure follower club!

👀@InjectiveLabs has been picking up steam regarding project activity and turning head as a result.

🥳Congratulations on joining the six-figure follower club!

Bravo, Akash, for enabling $AKT deposits on Kava Network.👏

🔋@akashnet_ and @kava_platform have teamed up to allow $AKT deposits and will be hosting $AKT #Surge.

💰$AKT investors will be able to enjoy increased APYs on their holdings.

📅 Feb 24th

📍bit.ly/3HDnMLO

🔋@akashnet_ and @kava_platform have teamed up to allow $AKT deposits and will be hosting $AKT #Surge.

💰$AKT investors will be able to enjoy increased APYs on their holdings.

📅 Feb 24th

📍bit.ly/3HDnMLO

Awesome job, Chihuahua, for getting listed on Injective Pro!🐶

💰Now it's possible to trade the @Cosmos ecosystem's cutest meme coin on @InjectiveLabs!

♦️Trading pair: $HUAHUA / $USDT

🌐Read more: bit.ly/34mxLqF

📲Trade now: bit.ly/3JdrWKP

💰Now it's possible to trade the @Cosmos ecosystem's cutest meme coin on @InjectiveLabs!

♦️Trading pair: $HUAHUA / $USDT

🌐Read more: bit.ly/34mxLqF

📲Trade now: bit.ly/3JdrWKP

Join the movement:

♦️Website: comdex.one/home

♦️Twitter: twitter.com/ComdexOfficial

♦️Telegram: t.me/ComdexChat

♦️Medium: blog.comdex.one

♦️Reddit: reddit.com/r/ComdexOne/

♦️Website: comdex.one/home

♦️Twitter: twitter.com/ComdexOfficial

♦️Telegram: t.me/ComdexChat

♦️Medium: blog.comdex.one

♦️Reddit: reddit.com/r/ComdexOne/

• • •

Missing some Tweet in this thread? You can try to

force a refresh