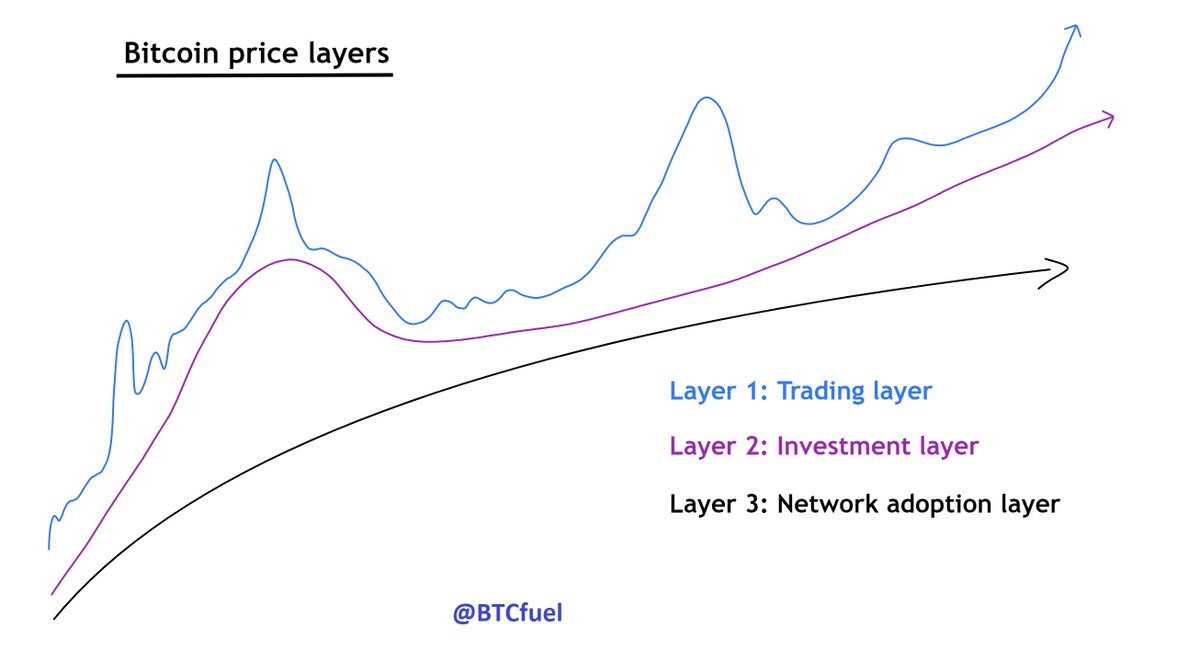

#Bitcoin and #Altcoins have a different cycle length

They were almost aligned in 2017, but are now shifting apart. I believe #altcoins will peak before #Bitcoin.

These are the patterns I'm looking at right now to have an idea where altcoins and Bitcoin could be heading to.

They were almost aligned in 2017, but are now shifting apart. I believe #altcoins will peak before #Bitcoin.

These are the patterns I'm looking at right now to have an idea where altcoins and Bitcoin could be heading to.

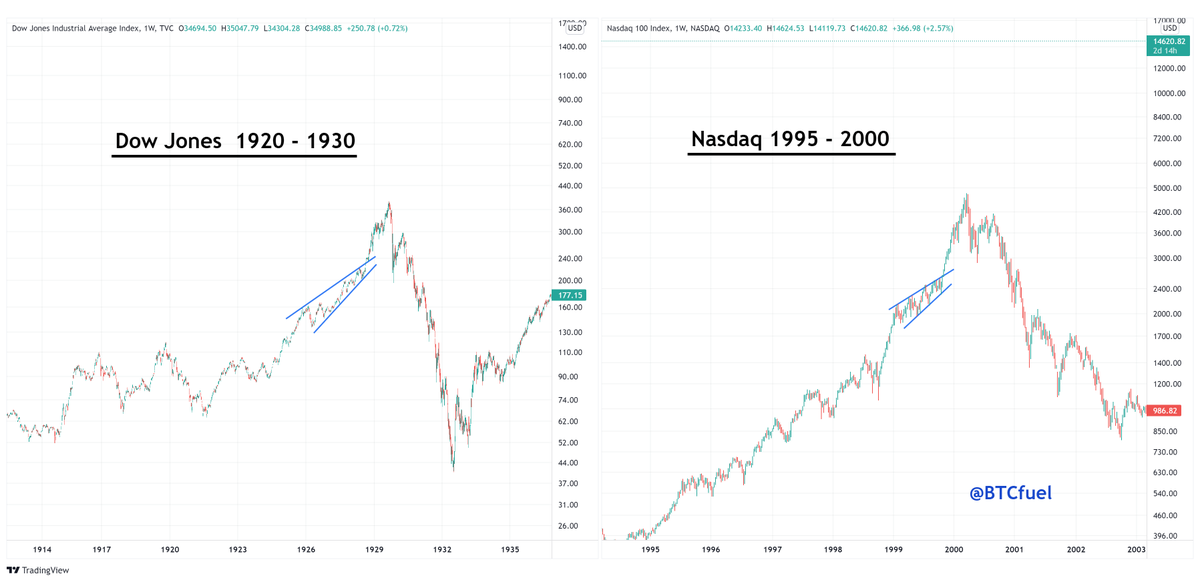

#Altcoins are in the hype phase, like Dotcom bubble Nasdaq and Bitcoin 2010-2014

#Bitcoin is now its lifoff phase following Gold 1999-2011 in the same phase

#Bitcoin is now its lifoff phase following Gold 1999-2011 in the same phase

The NASDAQ pattern is an interesting example for #Altcoins because both are 2 hyper-innovative techmarkets with an enormous size. Because of the size and same characteristics it wouldn't suprise me that history will repeat, like it always does

https://twitter.com/BTCfuel/status/1491765769126002695

The risk-on vs risk-off difference for #Bitcoin and #Altcoins in this period is also an important reason why I think they will peak at differents moments in time

https://twitter.com/BTCfuel/status/1492154368300310535

To be complete, this is the "market curve" for gold vs #Bitcoin. So for now I'm looking 1999 - 2011 gold for Bitcoin to follow

https://twitter.com/BTCfuel/status/1491422837697290240

• • •

Missing some Tweet in this thread? You can try to

force a refresh