1/3

Crypto twitter is standing on their head to convince (themselves?) that the correlation between legacy markets and BTC is broken.

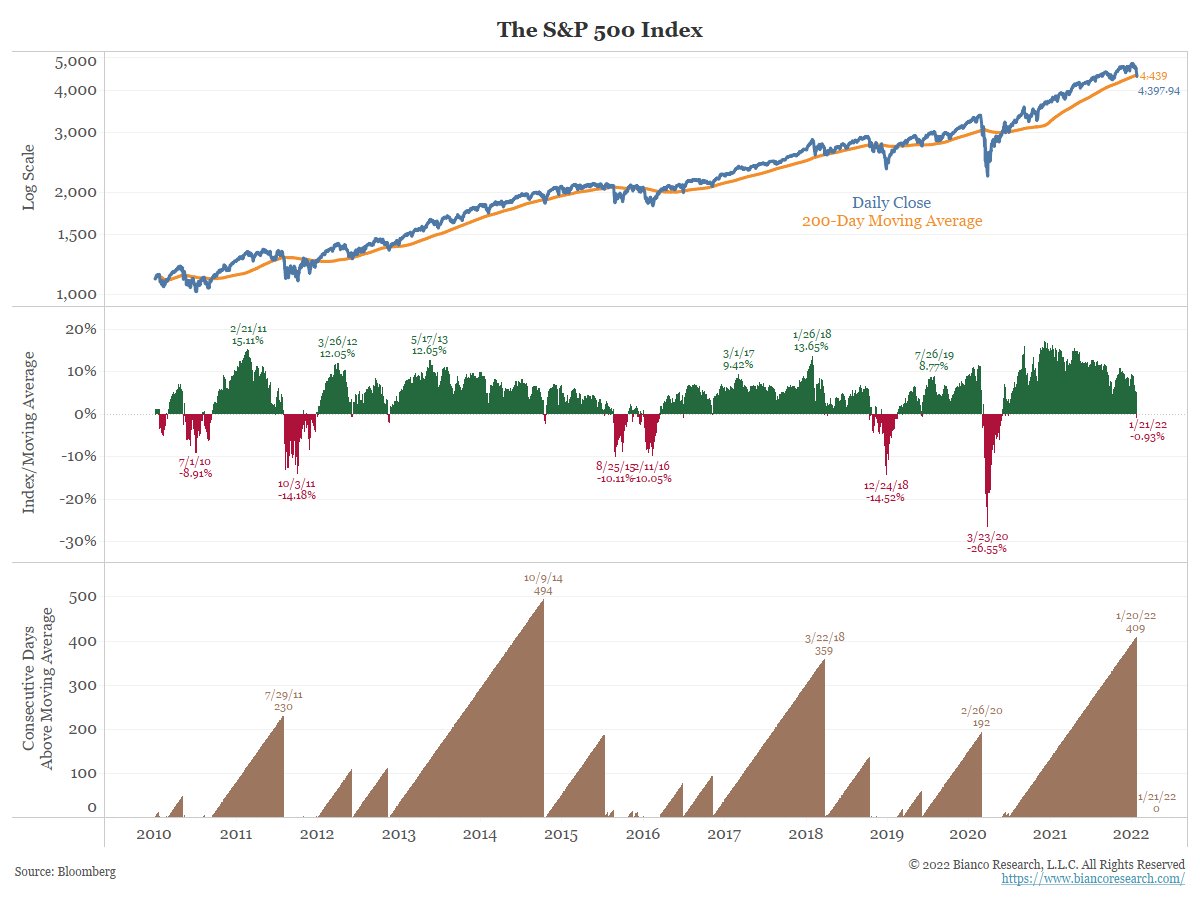

Instead, as these two charts shows, the correlation has INCREASED to a new all-time high (over the last 2-months, or 8-weeks).

Crypto twitter is standing on their head to convince (themselves?) that the correlation between legacy markets and BTC is broken.

Instead, as these two charts shows, the correlation has INCREASED to a new all-time high (over the last 2-months, or 8-weeks).

2/3

And legacy market people show restrain from gloating. As the title of one chart above asks, is BTC a 24/7 VIX? (h/t @jdorman81)

I think it is and the BTC sell-off this weekend, IF IT HOLDS UNTIL LEGACY MARKETS REOPEN, suggests more legacy markets pain coming.

And legacy market people show restrain from gloating. As the title of one chart above asks, is BTC a 24/7 VIX? (h/t @jdorman81)

I think it is and the BTC sell-off this weekend, IF IT HOLDS UNTIL LEGACY MARKETS REOPEN, suggests more legacy markets pain coming.

3/3

This is the consequence of institutional adoption of crypto.

Bluntly, tradfi is a bunch of degens wanting number go up and not (yet) exploring DeFi or other aspects of a new financial system.

For the foreseeable future, crypto/BTC is the extreme of the legacy risk curve.

This is the consequence of institutional adoption of crypto.

Bluntly, tradfi is a bunch of degens wanting number go up and not (yet) exploring DeFi or other aspects of a new financial system.

For the foreseeable future, crypto/BTC is the extreme of the legacy risk curve.

Ben explains what I show

https://twitter.com/epsilontheory/status/1495029341717204992

• • •

Missing some Tweet in this thread? You can try to

force a refresh