2/7

First, "nine for nine" is not really that far from what is priced in.

As of Friday's close, the market was pricing in "eight for nine."

First, "nine for nine" is not really that far from what is priced in.

As of Friday's close, the market was pricing in "eight for nine."

3/7

From Jun-04 to Jul-06 the Fed hiked rates 17 times in 17 meetings, from 1.0% to 5.5%. So, 9 for 9 is not unprecedented.

When the Fed was done in 2006, the yield curve inverted, housing prices peaked 2-months later (Case Schiller) and following next year was the GFC.

From Jun-04 to Jul-06 the Fed hiked rates 17 times in 17 meetings, from 1.0% to 5.5%. So, 9 for 9 is not unprecedented.

When the Fed was done in 2006, the yield curve inverted, housing prices peaked 2-months later (Case Schiller) and following next year was the GFC.

4/7

The Fed does not when they have achieved their goal.

So, every rate hike “campaign” ends with the Fed going too far and breaking something.

The warning they WENT too far is an inverted yield curve.

Currently the curve is NOT inverted but moving in that direction, fast.

The Fed does not when they have achieved their goal.

So, every rate hike “campaign” ends with the Fed going too far and breaking something.

The warning they WENT too far is an inverted yield curve.

Currently the curve is NOT inverted but moving in that direction, fast.

5/7

I noted a “campaign” ends with the Fed going too far. There are examples of 1 or 2 rates hikes that don't break things (1997).

But once the hikes stretch into at least 3 or 4, then the Fed does not know when they have done enough, invert the curve and break something.

I noted a “campaign” ends with the Fed going too far. There are examples of 1 or 2 rates hikes that don't break things (1997).

But once the hikes stretch into at least 3 or 4, then the Fed does not know when they have done enough, invert the curve and break something.

6/7

It is up to the Fed to convince everyone why “this time is different” … that they will raise rates a bunch of times, enough to satisfy inflation hawks that they “did something” but not go too far and break something.

To date they have not made this case.

It is up to the Fed to convince everyone why “this time is different” … that they will raise rates a bunch of times, enough to satisfy inflation hawks that they “did something” but not go too far and break something.

To date they have not made this case.

7/7

So, is Goldman's "9 for 9" validating the market pricing of "8 for 9" implies the Fed will go too far and break something?

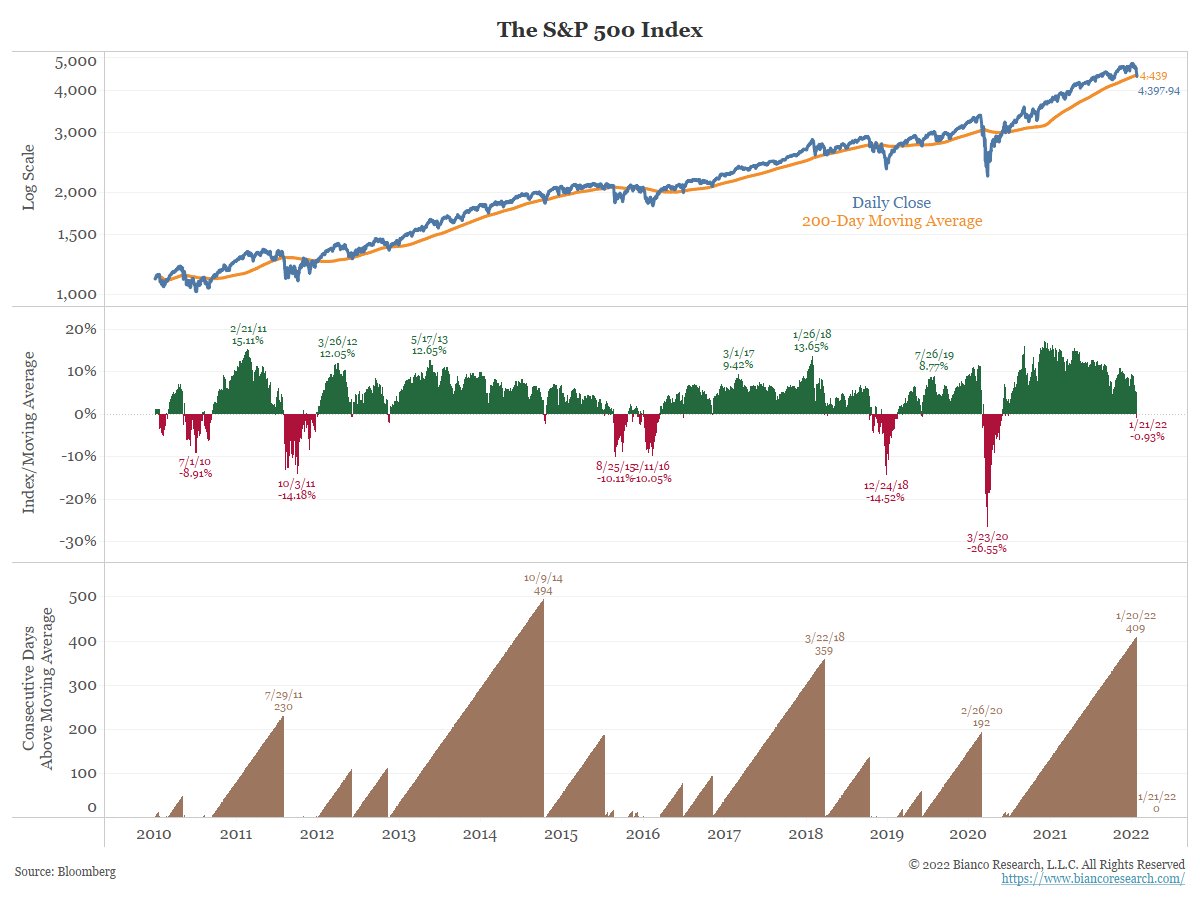

See the plunge in equity prices, do markets have no faith in the Fed and are pricing in something breaking?

Is this what Goldman is really saying?

So, is Goldman's "9 for 9" validating the market pricing of "8 for 9" implies the Fed will go too far and break something?

See the plunge in equity prices, do markets have no faith in the Fed and are pricing in something breaking?

Is this what Goldman is really saying?

• • •

Missing some Tweet in this thread? You can try to

force a refresh