(ENG) AGF AARHUS -

@AGFFodbold dropped a minor grenade yesterday by signing @JackWilshere on a 6-month contract with a possible extension over 2022/23.

Let’s dive deeper into the club that Mr Wilshere signed for!

THREAD 👇👇👇

#ksdh #sldk @AgfEnglish @SteenHouman

@AGFFodbold dropped a minor grenade yesterday by signing @JackWilshere on a 6-month contract with a possible extension over 2022/23.

Let’s dive deeper into the club that Mr Wilshere signed for!

THREAD 👇👇👇

#ksdh #sldk @AgfEnglish @SteenHouman

I have previously done a few threads on the two major Copenhagen clubs @FCKobenhavn and @BrondbyIF (in Swedish) and one on @BrentfordFC sister-club @fcmidtjylland (in English)

https://twitter.com/andersnorlen/status/1481610851324989444?s=20&t=UGIlajnVu3lTAmN5SddOWg

Note! Numbers below refer to AGF A/S (formerly AGF Elite A/S up until January 2018), the publicly listed company that runs the football side of things.

All numbers below in DKKm (1 EUR = 7.45 DKK)

All numbers below in DKKm (1 EUR = 7.45 DKK)

AGF is one of the oldest clubs in the world, founded in 1880 as “Aarhus Gymnastikforening af 1880” (“Aarhus gymnastics association of 1880”) and picked up football in 1902

AGF has won 5 Danish championships; 4 in between 1954-60 and last one in 86 + 9 cups

“Denmarks Everton?”

AGF has won 5 Danish championships; 4 in between 1954-60 and last one in 86 + 9 cups

“Denmarks Everton?”

AGF A/S is listed on the Copenhagen stock exchange and has seen its equity value increase by 50% from the start of covid to DKK 223m making it the third highest valued - listed! - football business in Denmark behind @FCKobenhavn (DKK 851m) and @BrondbyIF (DKK 286m)

AGF A/S runs the mens and women’s teams as well as an e-sport business.

They also operate the stadium Ceres Park that is leased from Aarhus municipality.

agf.dk/klubben/ceres-…

They also operate the stadium Ceres Park that is leased from Aarhus municipality.

agf.dk/klubben/ceres-…

AGF has seen its operating revenues double since the clubs last spell in Denmarks second tier 2014/15 and up 20% since 2019/20 driven by higher broadcasting revenues and covid-19 support money.

Offsetting drop in hospitality due to restrictions.

Offsetting drop in hospitality due to restrictions.

Higher revenues have largely been spent on wages and salaries, up 18% 2020/21 compared to 2019/20.

Surprising to see match- and player costs and sales and marketing grow during year of restrictions.

Surprising to see match- and player costs and sales and marketing grow during year of restrictions.

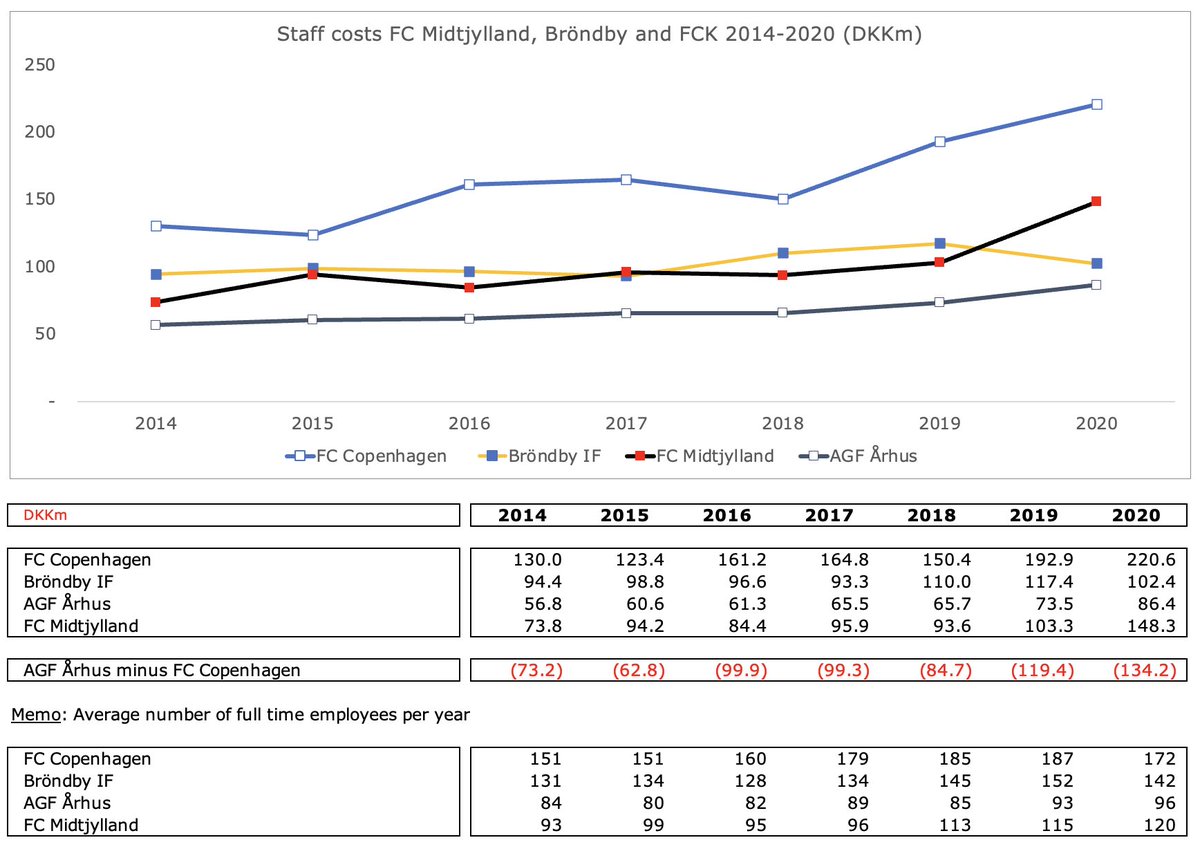

Despite AGFs increase in cost of staff to DKK 86.4m (EUR 11.6m) they are miles behind FCK, with gap doubling between 2015 and 2020 from DKK 63m to 134m.

Also behind competitors FC Midtjylland and Bröndby.

Also behind competitors FC Midtjylland and Bröndby.

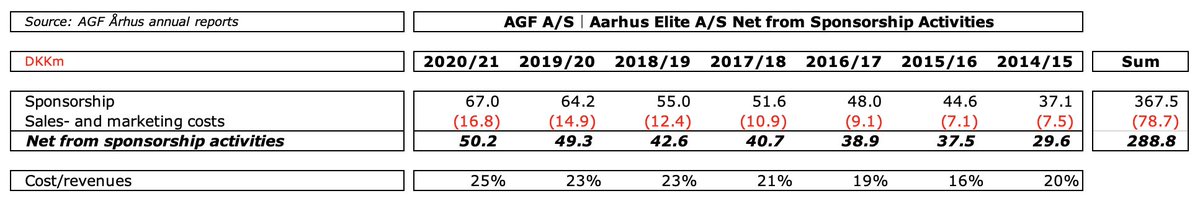

Main engine in creating room to spend resources on staff is sponsorship activities.

AGF has had a clear strategy in mobilizing the business community in Aarhus around the club, which has clearly paid off as net contributions have grown to DKK 50m from 30m 7 years ago.

AGF has had a clear strategy in mobilizing the business community in Aarhus around the club, which has clearly paid off as net contributions have grown to DKK 50m from 30m 7 years ago.

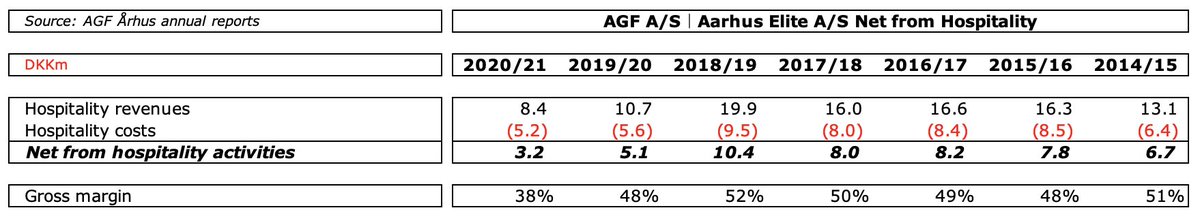

And at the same time the hospitality business has struggled to add a positive contribution.

For obvious reasons…

For obvious reasons…

AGFs operations have been balanced for many years with EBITDA consistently positive since the club got promoted back to Superligaen 2015/16.

Now it starts getting interesting:

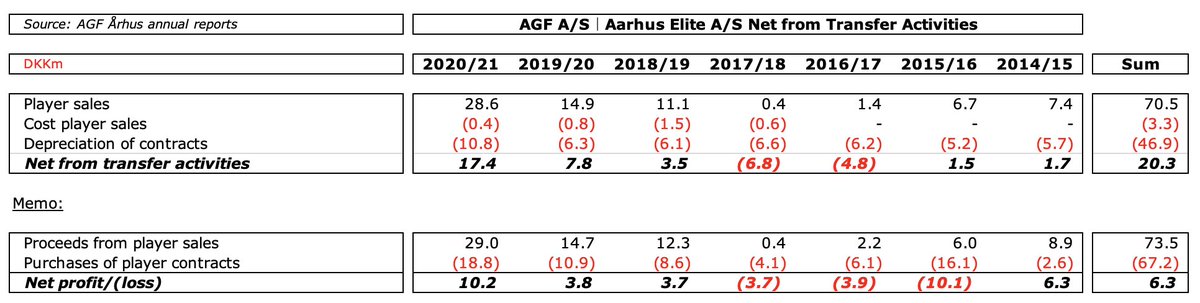

Non-cash expenses has increased from around DKK 10m per year to almost 20m - driven by amortisation of contracts AGF has invested in.

But in stark contrast to previous years, player sales have jumped up last three years…

Non-cash expenses has increased from around DKK 10m per year to almost 20m - driven by amortisation of contracts AGF has invested in.

But in stark contrast to previous years, player sales have jumped up last three years…

…moving net profit from consistent losses to profits.

Or in other words: there has been a shift in strategy from only focusing on funneling operating profits to the pitch to taking on more risk and ride the transfer market boom.

AGF has watched Midtjylland.

Or in other words: there has been a shift in strategy from only focusing on funneling operating profits to the pitch to taking on more risk and ride the transfer market boom.

AGF has watched Midtjylland.

This break with the past has to date been successful, in that AGF has managed to turn its net from transfer activities from losses to profits.

I.e. talent improvement bigger than price paid for talent…

I.e. talent improvement bigger than price paid for talent…

…much bigger even, as results on the pitch have also improved at the same time as talent has left the club.

2020/21 AGF made their first appearance in a UEFA competition in many years.

2020/21 AGF made their first appearance in a UEFA competition in many years.

This shift is also visible in the balance sheet -

+ Intangiable assets (players) growing

+ Receivables from player transfers up on sales (counterparty risks!)

+ Accounts payable - partly money owed other clubs - also up

+ Intangiable assets (players) growing

+ Receivables from player transfers up on sales (counterparty risks!)

+ Accounts payable - partly money owed other clubs - also up

The cash flow statement lays out the history of the club in a good way:

+ 2014/15-2017/18: operating profits unable to cover investments in players -> owners stepping in with equity injections.

+ Last three years: Both aggressive buying and selling has paid off…

+ 2014/15-2017/18: operating profits unable to cover investments in players -> owners stepping in with equity injections.

+ Last three years: Both aggressive buying and selling has paid off…

…with investments into new contracts increasing to almost DKK 20m but proceeds from sales being even higher.

Net-net a business that covers its cost and at the same time increased its on-the-pitch performance.

But is it enough?

Net-net a business that covers its cost and at the same time increased its on-the-pitch performance.

But is it enough?

AGF is not a top-3 club in Denmark.

@fcmidtjylland is outstanding on talent development and @FCKobenhavn in generating cash that is spent on talent almost assuring on-the-pitch success.

So management looking at either doubling down on talent strategy or…

@fcmidtjylland is outstanding on talent development and @FCKobenhavn in generating cash that is spent on talent almost assuring on-the-pitch success.

So management looking at either doubling down on talent strategy or…

…accepting the position it is now, continuing to leverage the brand in and around Aarhus but not jacking up the risk level trying to reach for the stars.

Because they do have a comparatively large and loyal fan base plus room to grow in current ground.

Because they do have a comparatively large and loyal fan base plus room to grow in current ground.

Therefor fun to see out-of-the-box moves like the one yesterday where @JackWilshere all of a sudden is announced as the clubs latest signing.

Similar to @IFKGoteborg signing Marek Hamsik on a short-term deal last year.

In line with strategy? Probably not.

But it is fun.

Similar to @IFKGoteborg signing Marek Hamsik on a short-term deal last year.

In line with strategy? Probably not.

But it is fun.

So bottom line -

Fairly well-managed business breaking with the past and jumping on the talent development / transfer market train that has served other Danish clubs well over last years (FCM, FCN, FCK).

Not stupid move with eyes from bigger leagues fixed on Denmark…

Fairly well-managed business breaking with the past and jumping on the talent development / transfer market train that has served other Danish clubs well over last years (FCM, FCN, FCK).

Not stupid move with eyes from bigger leagues fixed on Denmark…

…translating into higher prices paid for players sold from Denmark compared to Sweden, which @osynligahanden has shown on his blog (in Swedish).

Guess the limelight on Wilshere from abroad isn’t a liability in that sense.

- END -

osynligahanden.com/2022/01/21/hog…

Guess the limelight on Wilshere from abroad isn’t a liability in that sense.

- END -

osynligahanden.com/2022/01/21/hog…

• • •

Missing some Tweet in this thread? You can try to

force a refresh