1/n Architecture Diagrams on Mainnets/L2

Link below to explore on the whiteboard (feel free to comment)

miro.com/app/board/uXjV…

#ETH #SOL #AVAX #DOT #ATOM #OSMOSIS #JUNO #LUNA #EVMOS #CELESTIA

Link below to explore on the whiteboard (feel free to comment)

miro.com/app/board/uXjV…

#ETH #SOL #AVAX #DOT #ATOM #OSMOSIS #JUNO #LUNA #EVMOS #CELESTIA

2/n Ethereum

Lot of scaling tech currently fighting for attention and liquidity.

ORUs and ZKRUs will probably start competing with tokens soon.

👉 zk-based general smart contracts looking like the next big advancement @StarkWareLtd vs @zksync

Lot of scaling tech currently fighting for attention and liquidity.

ORUs and ZKRUs will probably start competing with tokens soon.

👉 zk-based general smart contracts looking like the next big advancement @StarkWareLtd vs @zksync

3/n Ethereum

👉 Big updates include the POS transition in July 2022(no code-freeze yet tho)

General architecture direction is transitioning from a monolithic one to more modular architecture.

Central beacon-chain with shards(eta 2023) and rollups in the future

👉 Big updates include the POS transition in July 2022(no code-freeze yet tho)

General architecture direction is transitioning from a monolithic one to more modular architecture.

Central beacon-chain with shards(eta 2023) and rollups in the future

4/n Solana

One of the fastest blockchains in the market

Out-of-the-box asynchronous txns could become the standard way to build financial/gaming applications in the future

👉 @neonlabsorg also working to bring EVM to Solana (currently pre-alpha)

One of the fastest blockchains in the market

Out-of-the-box asynchronous txns could become the standard way to build financial/gaming applications in the future

👉 @neonlabsorg also working to bring EVM to Solana (currently pre-alpha)

5/n Avalanche

Has a modular architecture and aims to solve scale using subnets

Interestingly, different subnets can have different consensus algorithms

Currently the C-Chain(the EVM one) is a smash hit, onboarding plenty of developers and users to the platform

Has a modular architecture and aims to solve scale using subnets

Interestingly, different subnets can have different consensus algorithms

Currently the C-Chain(the EVM one) is a smash hit, onboarding plenty of developers and users to the platform

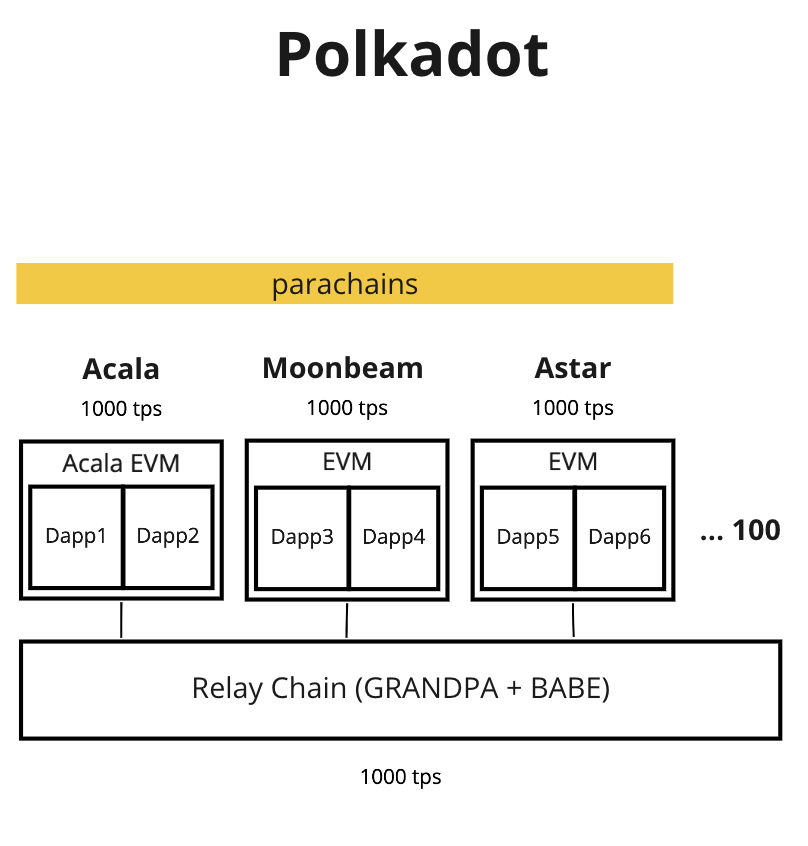

6/n Polkadot

Has a modular architecture and aims to scale using parachains

Each parachain is a sovereign blockchain which are auctioned off every epoch with the relay chain acting as shared security.

Polkadot can currently support up to 100 parachains

Has a modular architecture and aims to scale using parachains

Each parachain is a sovereign blockchain which are auctioned off every epoch with the relay chain acting as shared security.

Polkadot can currently support up to 100 parachains

7/n Cosmos Ecosystem

These include blockchains built using the cosmos-sdk

Out of the box interoperability from IBC is a huge plus considering the inefficiency/risks of liquidity-based bridges

👉 EVMOS @EvmosOrg launching on 28 Feb will be the major event in the near term

These include blockchains built using the cosmos-sdk

Out of the box interoperability from IBC is a huge plus considering the inefficiency/risks of liquidity-based bridges

👉 EVMOS @EvmosOrg launching on 28 Feb will be the major event in the near term

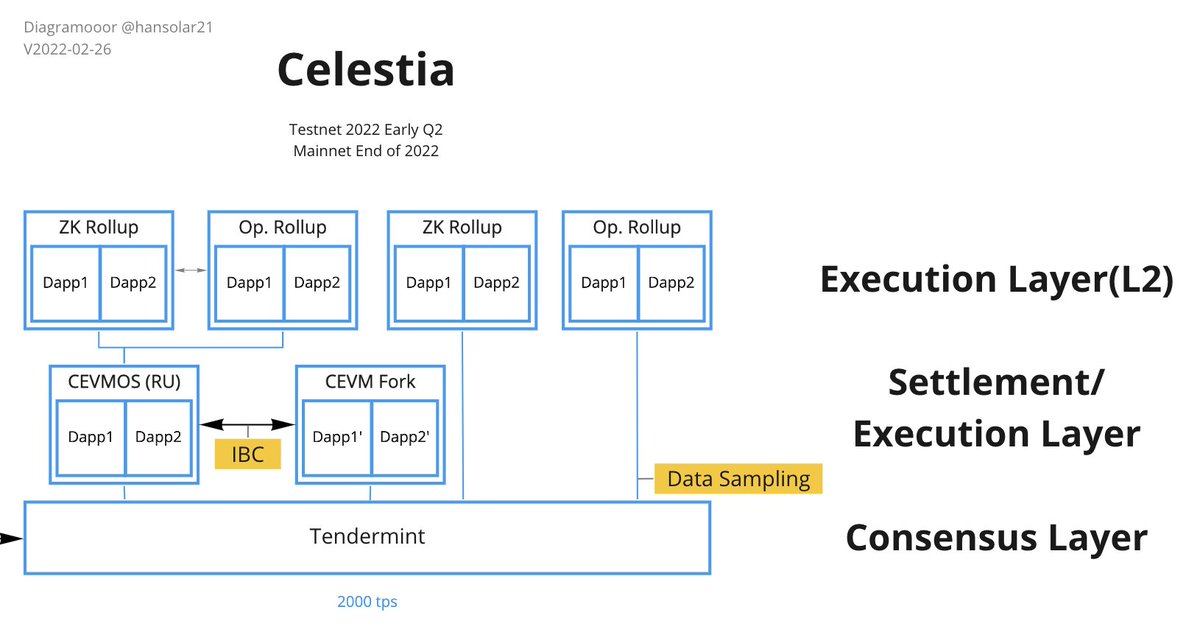

8/n Celestia

A novel modular blockchain using a mix of tech from the cosmos and ethereum ecosystems

Testnet coming early Q2 (incentivized) and mainnet in end of 2022

Aims to achieve

👉 scale through rollups & data sampling tech

👉 interoperability through IBC

A novel modular blockchain using a mix of tech from the cosmos and ethereum ecosystems

Testnet coming early Q2 (incentivized) and mainnet in end of 2022

Aims to achieve

👉 scale through rollups & data sampling tech

👉 interoperability through IBC

h/t

@epolynya on eth architecture

@bc1siiimon on the Cosmos eco

@0xHarrington @PEHH_1 on Avalanche

@nickwh8te @likebeckett on Celestia

@InternDAO's Project Masterlist [internal]

@epolynya on eth architecture

@bc1siiimon on the Cosmos eco

@0xHarrington @PEHH_1 on Avalanche

@nickwh8te @likebeckett on Celestia

@InternDAO's Project Masterlist [internal]

• • •

Missing some Tweet in this thread? You can try to

force a refresh