NEW: US, UK, EU, France, Germany, Italy,, Canada commit

- to ensuring selected Russian banks removed from SWIFT system.

- imposing restrictive measures preventing Russian Central Bank from deploying its international reserves to undermine sanctions bbc.co.uk/news/world-605…

- to ensuring selected Russian banks removed from SWIFT system.

- imposing restrictive measures preventing Russian Central Bank from deploying its international reserves to undermine sanctions bbc.co.uk/news/world-605…

“we commit to taking measures to limit the sale of citizenship—so called golden passports—that let wealthy Russians connected to the Russian government become citizens of our countries and gain access to our financial systems”…

We “committed to employing sanctions and other financial and enforcement measures on additional Russian officials and elites close to the Russian government, as well as their families, and their enablers to identify and freeze the assets they hold in our jurisdictions…”

First time G20 central bank has ever been sanctioned… Russian central bank in same company as N Korea, Iran & Venezuela….

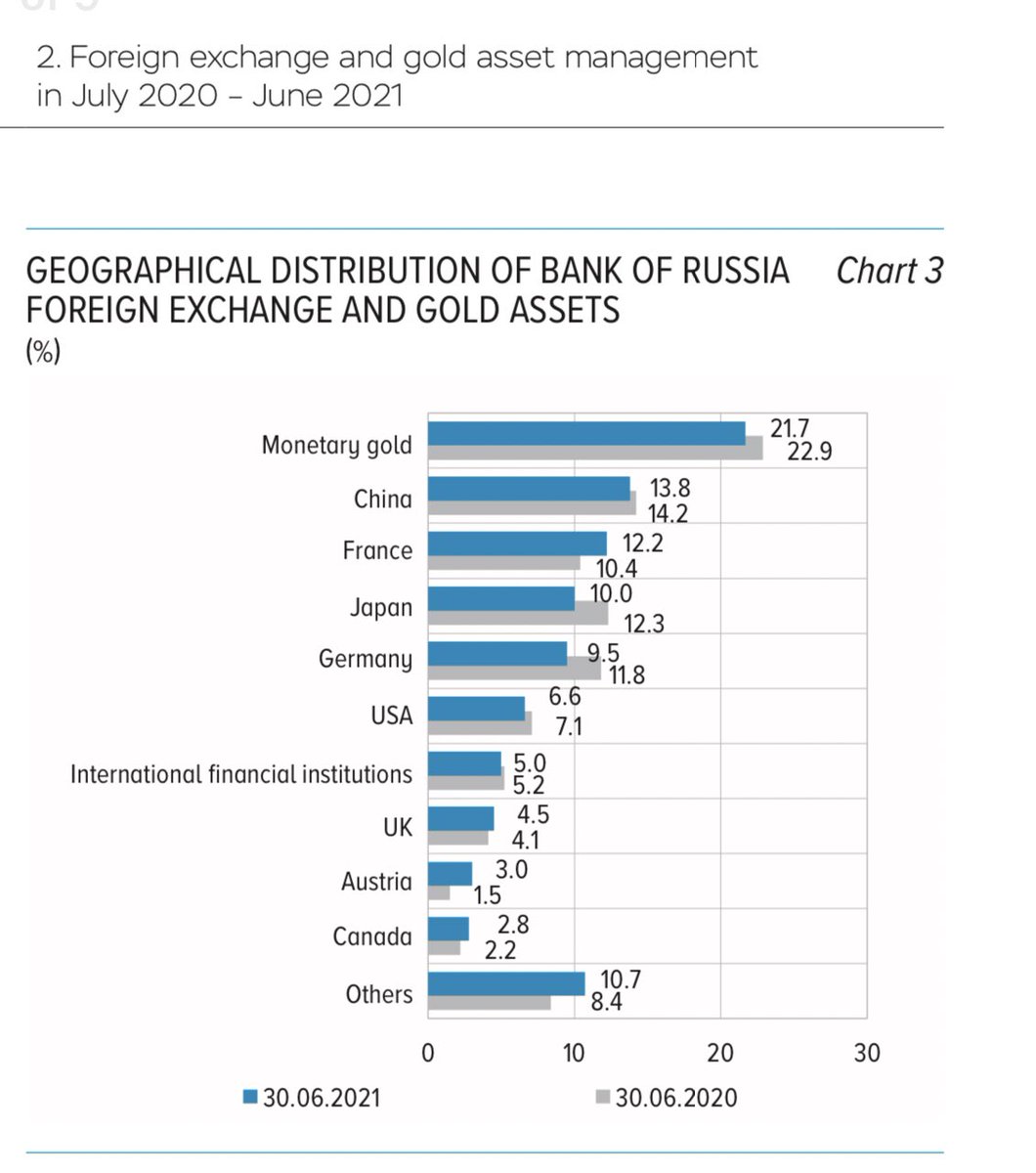

Aimed at interfering with ability of RCB to deploy $630bn warchest of currency reserves. It intervened on invasion day after rouble plunged to record lows.

Aimed at interfering with ability of RCB to deploy $630bn warchest of currency reserves. It intervened on invasion day after rouble plunged to record lows.

This is how the EU chief describes the actions against the Russian Central Bank / will prevent “liquidation” of its assets…

https://twitter.com/vonderleyen/status/1497696378461593605

“We will paralyze the assets of Russia’s Central Bank,” says EU commission president VDL… if that’s all $630bn, that’s quite the economic weapon deployed.

others argue almost explicit NATO counter strategy here to allow invasion to inflict massive recession/ bank runs on Russia

others argue almost explicit NATO counter strategy here to allow invasion to inflict massive recession/ bank runs on Russia

How tough this is obviously depends on what the Russian central bank is limited from doing, and what “selected banks” being cut out of Swift means…

But what this is, is nations representing half the world’s economy, using many levers of financial might against one representing 2% of the world economy, albeit one with lots of hydrocarbons and nuclear weapons.

Interesting consequences beginning…

https://twitter.com/rafsanchez/status/1497710808683491342

“We’re doing all we can to degrade the Russian economy” Foreign Sec @trussliz tells Sophie Raworth after allied agreement over Swift/ Russian central bank #SundayMorning …

Backs up above - “degrade” is military terminology, causing max financial chaos & deepest possible Russian recession, incl counteracting Russias forex reserve warchest “defences” is a “theatre” of war here. Some close to US banking system say obvious plan to provoke bank runs

White House explicitly says that the aim of the Russian Central Bank sanction is to prevent it supporting its currency with its massive foreign exchange reserves, as it did after the rouble fell to record lows on invasion day…

This will cause havoc.

No precedent within G20.

This will cause havoc.

No precedent within G20.

https://twitter.com/whitehouse/status/1497707467874185220

Russian Central Bank statement announcing unlimited rouble liquidity… having to reassure public

“The Russian banking system is stable, has sufficient capital and liquidity to function smoothly in any situation. All customer funds on the accounts are saved and available”…

“The Russian banking system is stable, has sufficient capital and liquidity to function smoothly in any situation. All customer funds on the accounts are saved and available”…

Rouble will tank when markets start to open in Asia late tonight & then in Moscow.

RCB will be busy intervening, if it can.

Also expect to hear more about which Russian banks are targeted by Swift dismissal..market talk about exempting oil & gas payments focussed eg Gazprombank

RCB will be busy intervening, if it can.

Also expect to hear more about which Russian banks are targeted by Swift dismissal..market talk about exempting oil & gas payments focussed eg Gazprombank

Obviously seen on here pics of queues at some Russian cash machines, but not yet verified

Important to stress what I’ve said all this week. Sanctions/ economics not being used just as punishment, but as a non-military conflict tactic. Cen Banks normally have sovereign immunity.

Important to stress what I’ve said all this week. Sanctions/ economics not being used just as punishment, but as a non-military conflict tactic. Cen Banks normally have sovereign immunity.

NEW Oligarch Mikhail Fridman calls for “bloodshed to end” in text of letter released to press (first reported in FT)

“I do not make political statements, I am a businessman, I am convinced however that war can never be the answer. ..”

“I do not make political statements, I am a businessman, I am convinced however that war can never be the answer. ..”

Former Russian PM Kasyanov

“the West is freezing Russia's international reserves (of the Central Bank, $630b). There is nothing more to support the rouble. Turn on the printing press. Hyperinflation and economic catastrophe are just around the corner.”

“the West is freezing Russia's international reserves (of the Central Bank, $630b). There is nothing more to support the rouble. Turn on the printing press. Hyperinflation and economic catastrophe are just around the corner.”

https://twitter.com/mkasyanov/status/1497823742461890565?s=21

In early trade Rouble down 20% to new record lows against the dollar - though pretty thin trade…

Meanwhile the former Russian central banker Alekashenko says that the RCB has indeed attempted to limit sales of Russian securities, as per Reuter report…

Meanwhile the former Russian central banker Alekashenko says that the RCB has indeed attempted to limit sales of Russian securities, as per Reuter report…

https://twitter.com/saleksashenko/status/1498068219441160194?s=21

“Transactions related to the management of reserves as well as of assets of the Central Bank of Russia are prohibited“. German Chancellery saying:

https://twitter.com/joergkukies/status/1498071872914739201?s=21

NEW: Sberbank Europe, EU subsidiary of Russia’s biggest bank assessed by European Central Bank as “failing or likely to fail owing to deterioration in liquidity” after experiencing “significant deposit outflows”

bankingsupervision.europa.eu/press/pr/date/…

bankingsupervision.europa.eu/press/pr/date/…

• • •

Missing some Tweet in this thread? You can try to

force a refresh