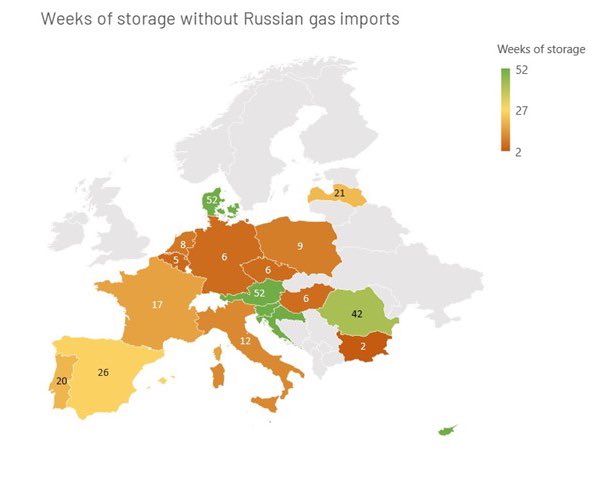

Europe Unplugged: can we give up Russian gas? In our latest ESG investor letter, we find that 🇪🇺 could make up for ~62% of energy needs tied to 🇷🇺 gas, at high economic and political cost. The remaining gas deficit would exhaust reserves in 5-10 months. 1/ algebris.com/insights/green…

🇪🇺 gas production declined by 20% over the past 20 years. Today 🇷🇺 supplies ~38% of European gas imports. With gas accounting for 45% of all energy imports and 🇷🇺 providing 95% of imported gas, 🇭🇺 is by far the most exposed. 🇩🇪 and 🇮🇹 would also bear much pain from cut-off. 2/

Substituting 🇷🇺 gas with LNG is difficult, for logistic and price reasons. The historical avg of European gas prices has been around 20 EUR per MWh. Paying for an additional 1300 TWh of LNG imports would translate into an annual cost of approximately 26bn euro for the EU. 3/

Assuming an increase of price to 125 EUR per MWh – in line with what observed on Monday after EU sanctions were announced – the cost would set at around 162 billion euro, a six-fold increase compared to historical rates. And European gas prices have been even higher in 12/2021 4/

The spike in gas prices would come together with similar dynamics across the oil market – already showing signs of pressure in view of increased logistic and insurance prices from the military developments in Eastern Europe. 5/

Other commodities would follow: 🇷🇺🇺🇦 together account for a quarter of global wheat exports and a fifth of corn sales, 🇷🇺 is a major supplier for strategic raw materials and commodities such as aluminum, nickel, iron ore and palladium. 6/

We expect logistical complexities to exert upward pressure on shipping and insurance premiums for these products. We estimate the combined effect on EU CPI inflation to be ~1.4%. Absent EU-wide price support, we believe some member states could lack fiscal space to afford it. 7/

Pressure on fiscal coffers would be further intensified by the need to (1) support households in covering energy costs (v limited elasticity of that part of demand); (2) avoid a collapse of the industrial sector, already announcing curtailment of production. 8/

In light of recent events, we believe that unplugging from the geopolitical shackles of 🇷🇺 gas is vital, for Europe. We argue that common EU support should be provided for tackling this challenge, in the form of a joint energy security plan. 9/

This should feature prioritization of residential energy efficiency initiatives and fast track of renewable capacity, all while building the infrastructure needed to exploit the full potential of LNG and diversifying as much as possible from 🇷🇺 in the short term. 10/

There is no doubt that this will be extremely costly, and solidarity will be needed. We believe that EU financial support should be provided to the countries that are most dependent on Russian gas, to mitigate rising energy bills and the other costs discussed. 11/

As it serves a common strategic goal, we believe support should be financed through common EU debt issuance – on the blueprint of Net Generation EU – and underpinned by increased own resources. The challenge we face is no less existential than the pandemic, and no less urgent.

• • •

Missing some Tweet in this thread? You can try to

force a refresh