Liverpool’s 2020/21 financial results covered a season when they finished third in the Premier League and reached the quarter-finals of the Champions League. Period also included 2019/20 league title win. Finances adversely impacted by the pandemic. Some thoughts follow #LFC

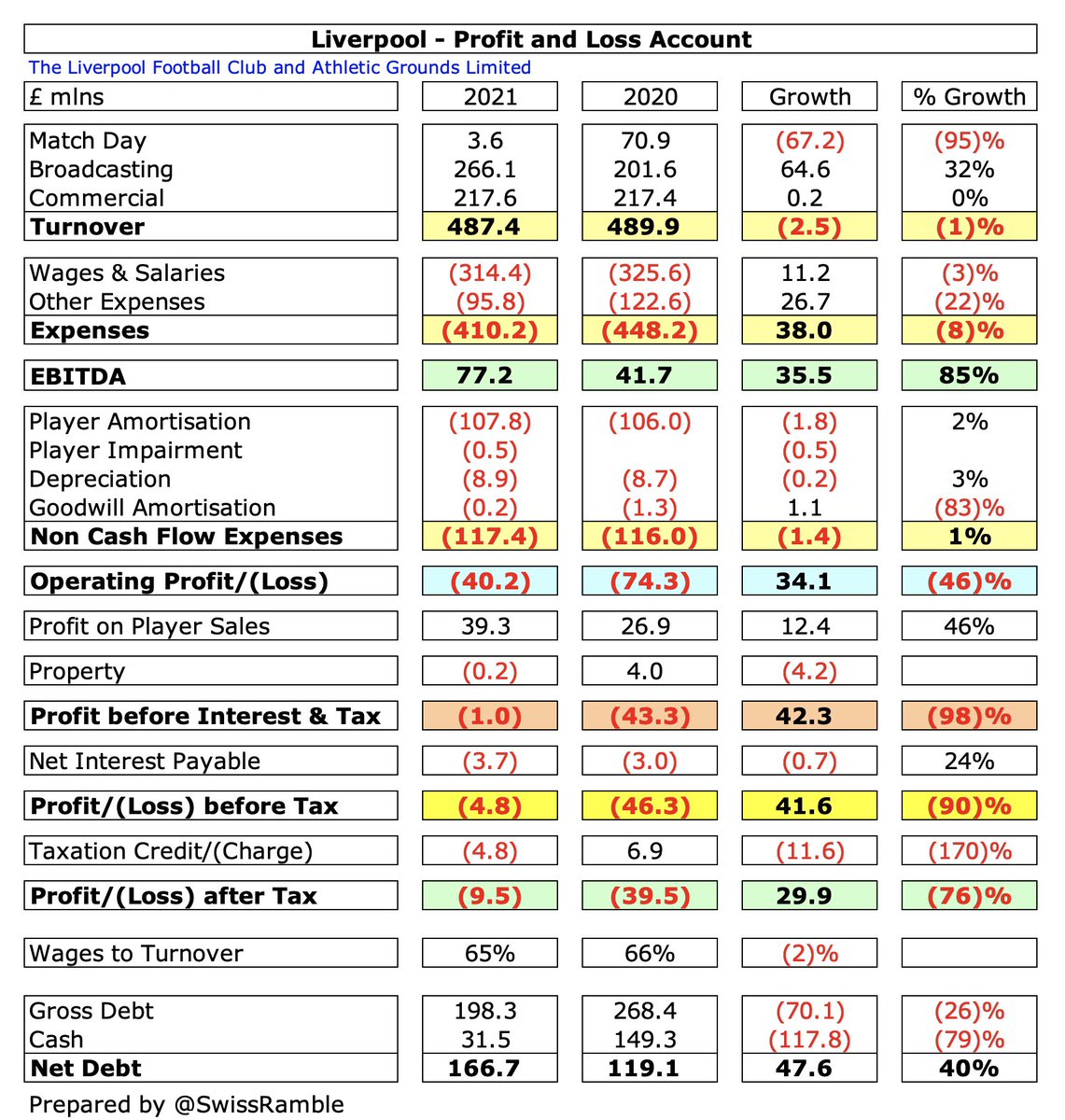

#LFC reduced pre-tax loss from £46m to £5m, driven by operating expenses falling £37m (6%). Revenue overall was slightly lower at £487m, but profit from player sales increased £12m to £39m. Loss after tax narrowed from £39m to £10m.

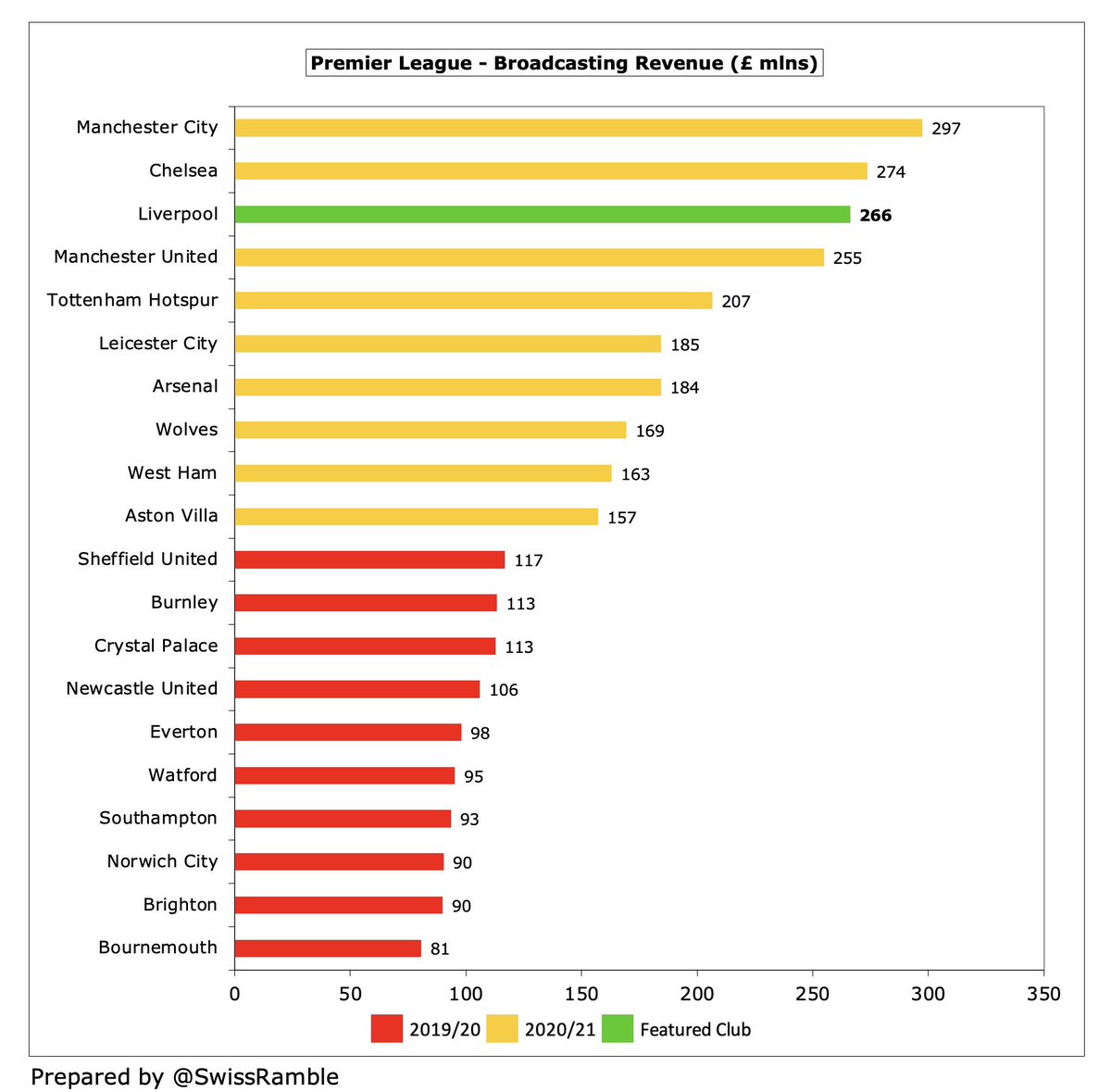

#LFC broadcasting revenue rose £64m (32%) from £202m to £266m, mainly due to deferred money from 2019/20, which offset COVID driven reduction in match day, down £67m (95%) to just £4m. Commercial was flat at £218m, as sponsorship growth offset losses caused by the pandemic.

#LFC wage bill fell £11m (3%) to £314m, while other expenses were cut £27m (22%) mainly due to reduced cost of staging games. Player amortisation rose £2m (2%) to £108m, while net interest payable was up £1m to £4m. No repeat of prior year £4m property gain from sale of Melwood.

#LFC small £5m loss is pretty impressive, given there was a full year of the pandemic. The only Premier League clubs that have posted profits in 2020/21 are #WWFC £145m (loan write-off) and #MCFC £5m. Others have made big losses, e.g. #CFC £156m, #AFC £127m & #THFC £80m.

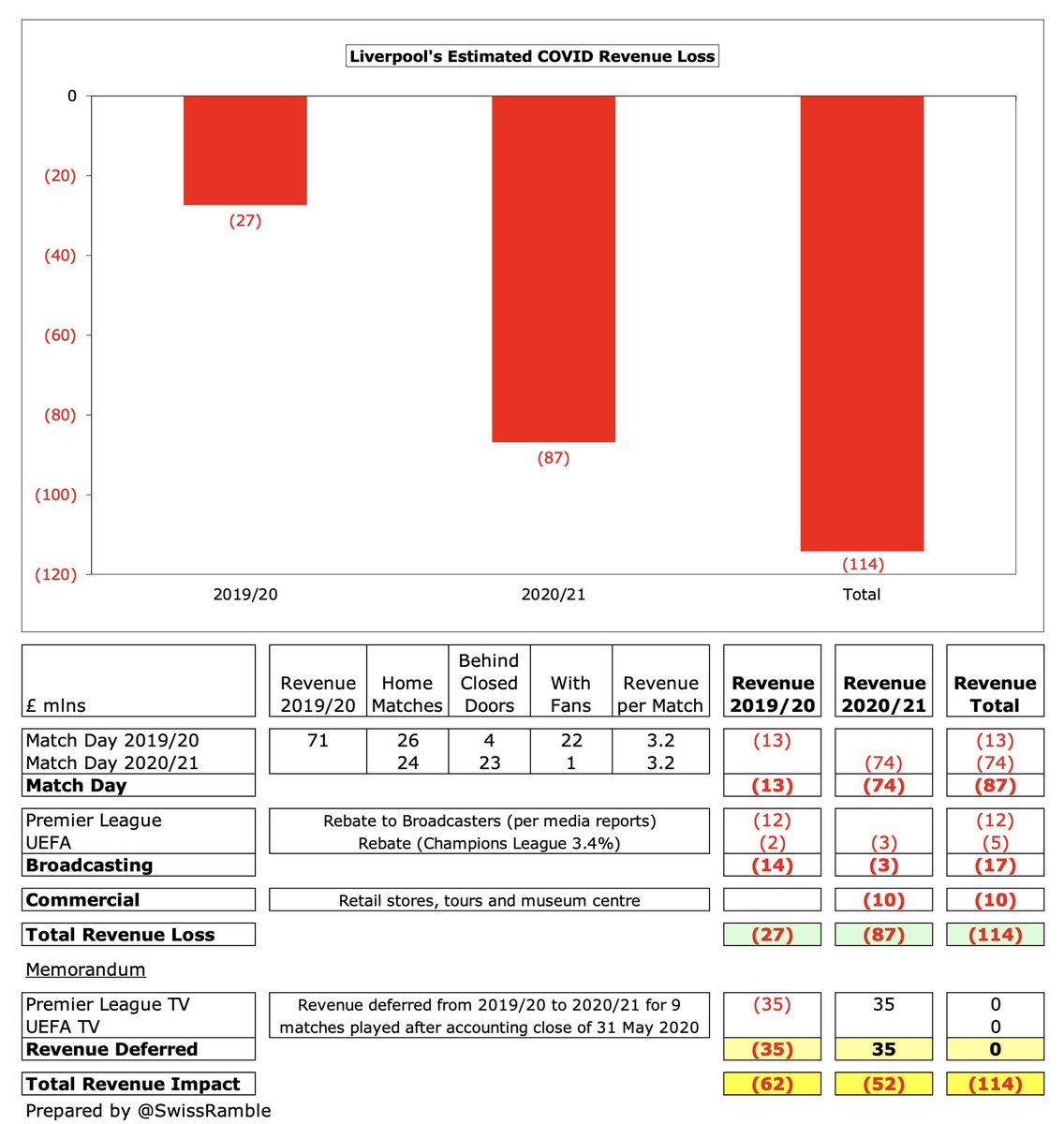

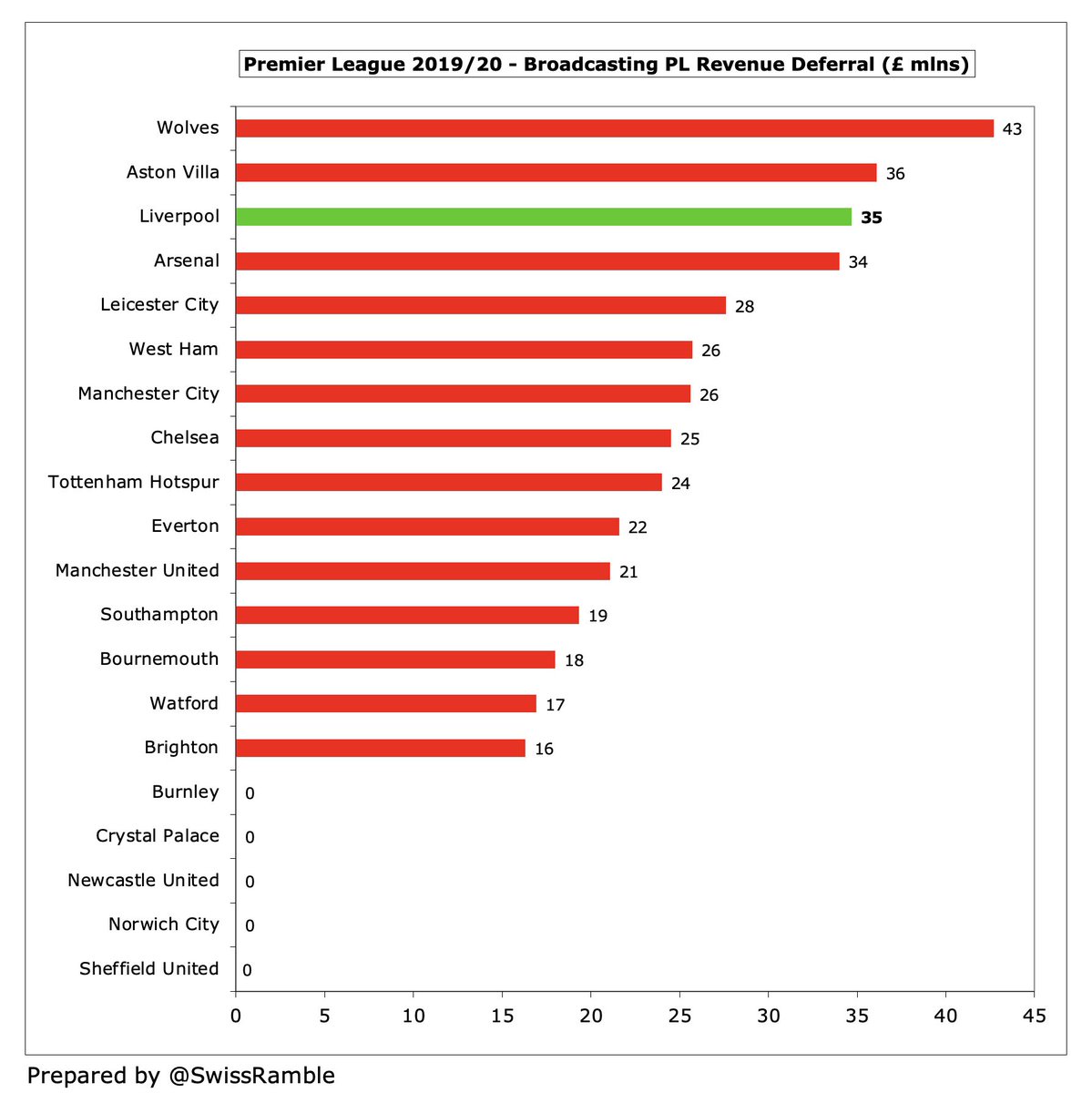

#LFC revenue was significantly impacted by COVID. I estimate the loss as £87m in 2020/21 (match day £74m, commercial £10m and broadcasting £3m), which would make £114m lost over the last 2 years. Partly offset by £35m of TV money deferred from prior year accounts to 2020/21.

While #LFC managed to restrict losses in 2020/21, other European clubs have suffered hugely, partly due to COVID, but also because they make large operating losses, e.g. Barcelona £422m, Inter £215m, Juventus £184m & Roma £163m. Porto, Bayern Munich & Real Madrid were profitable.

#LFC profit on player sales rose £12m from £27m to £39m, mainly Rhian Brewster to #SUFC, Dejan Lovren to Zenit Saint Petersburg, Ki-Jana Hoever to #WWFC and Ovie Ejaria to Reading. Only surpassed in 2020/21 by #MCFC £69m, #WWFC £61m and #LCFC £44m.

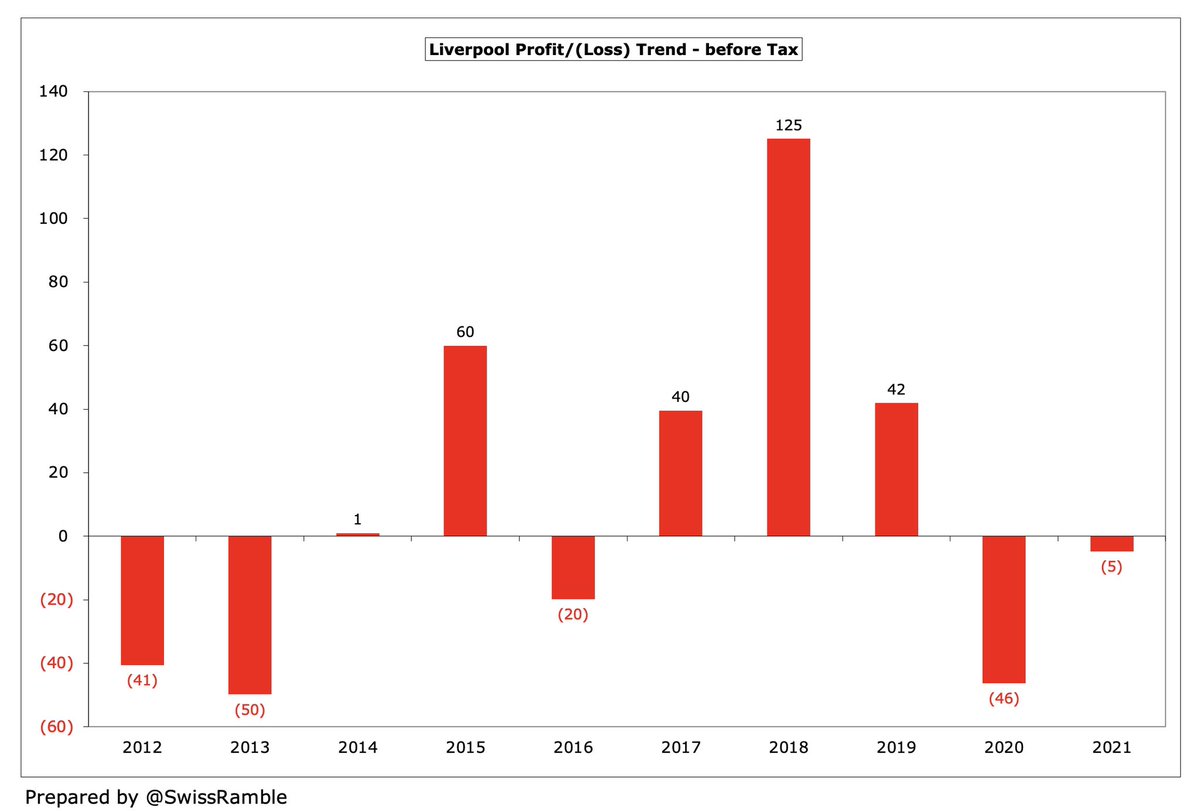

#LFC have lost a total of £51m in the last two years, having made £207m profits in the preceding three years. That included a huge £125m profit in 2018, which is the third highest ever profit in the Premier League, plus £42m in 2019 and £40m in 2017.

In recent years #LFC have also benefited from the absence of exceptional charges, which had increased their costs by £113m in the 10 years up to 2016, mainly stadium development £61m and sacked managers £47m.

#LFC have become increasingly reliant on profit from player sales, generating an impressive £370m from this activity since 2015, in stark contrast to the losses they made in each of the 3 preceding years. This season will include the sales of Wilson, Shaqiri, Grujic and Awoniyi.

A key element of #LFC strategy is they have become a club that sells well. In last 5 years only #CFC have made more from player trading than the Reds with £413m, but Liverpool £274m is well ahead of the rest of the Big Six: #MCFC £221m, #AFC £211m, #THFC £158m and #MUFC £81m.

#LFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £42m to £77m, though this is below #MCFC £116m, #MUFC £95m and #THFC £95m (and also lower than #LFC 2019 peak of £124m).

#LFC operating loss (excluding player sales and interest) reduced from £74m to £40m, which is the best of the Big Six, around the same level as #MUFC. Very few clubs generate operating profits, while some have huge losses, e.g. #CFC £159m, #AFC £91m, #THFC £60m and #MCFC £59m.

#LFC revenue has now fallen £46m (9%) from the £533m peak pre-pandemic two years ago to £487m, as the COVID-driven £81m reduction in match day has been partly offset by £30m increase in commercial. I estimate a club record £540-560m for this season.

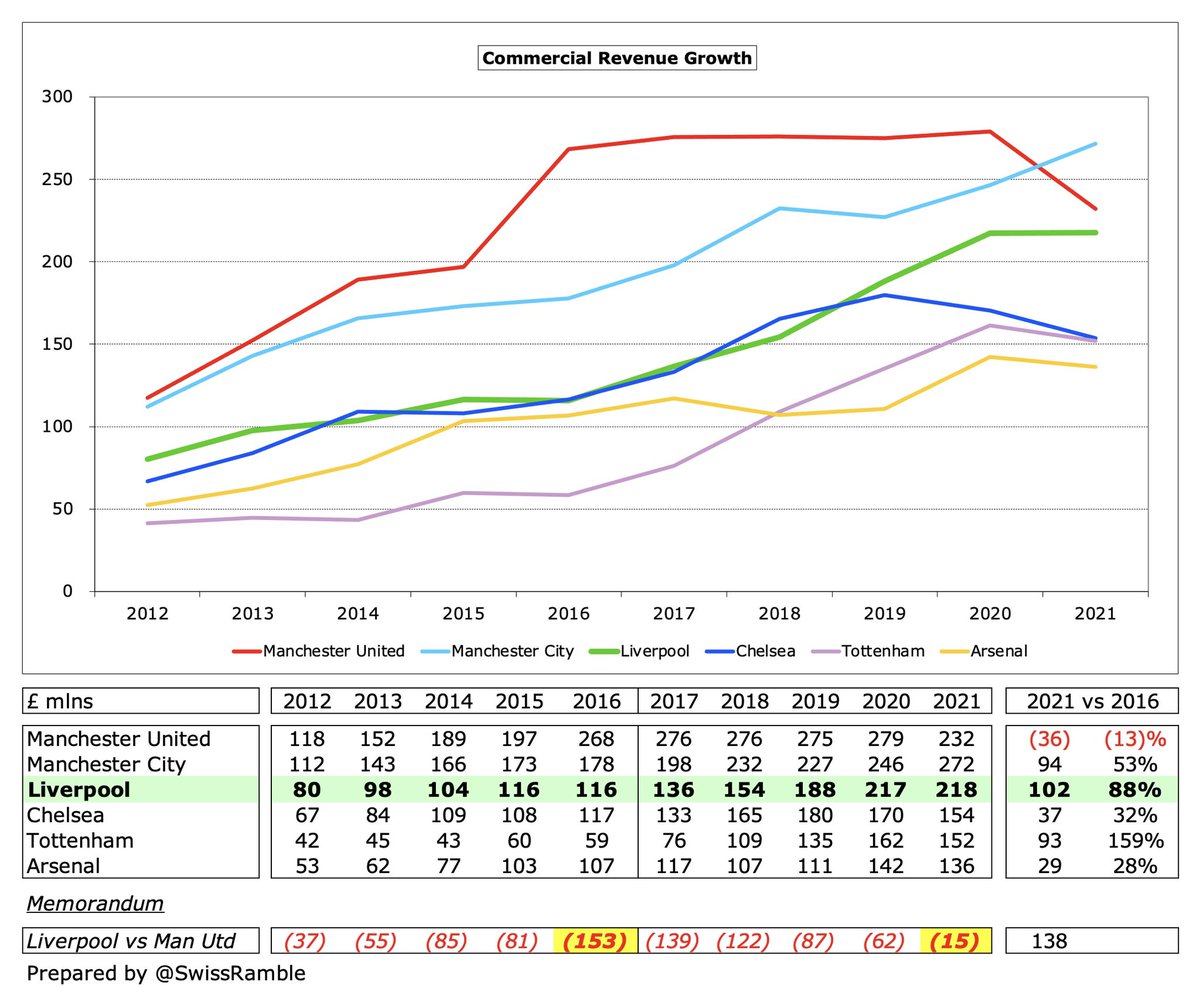

Interestingly, #LFC £186m revenue growth in the last 5 years is highest in Big Six, ahead of #MCFC £178m, #THFC £151m and #CFC £106m. Both #AFC and #MUFC have actually fallen, by £23m and £21m respectively. The gap between #LFC and #MUFC has narrowed from over £200m to just £7m.

As a result, #LFC £487m revenue is the third highest in England, within touching distance of #MUFC £494m, but nearly £100m below #MCFC £570m. There is then a fair sized gap to the following clubs: #CFC £435m, #THFC £360m, #AFC £328m and #LCFC £226m.

#LFC climbed two places to 5th in the 2019/20 Deloitte Money League, which ranks clubs globally by revenue. This is the first time they have been in the top five since 2002, though still a long way behind Barcelona and Real Madrid, both £627m, and Bayern Munich £556m.

#LFC broadcasting income rose £64m (32%) from £202m to £266m, mainly due to revenue from games deferred from 2019/20, partly offset by PL reductions (contributions to EFL clubs, cost of COVID tests, lost Chinese TV deal). Only below Champions League finalists, #MCFC and #CFC.

As 2019/20 season was extended, £35m revenue was booked in 2020/21 accounts. driving £70m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs like #LFC with May year-end had largest revenue deferrals, while those with a July close had nothing deferred.

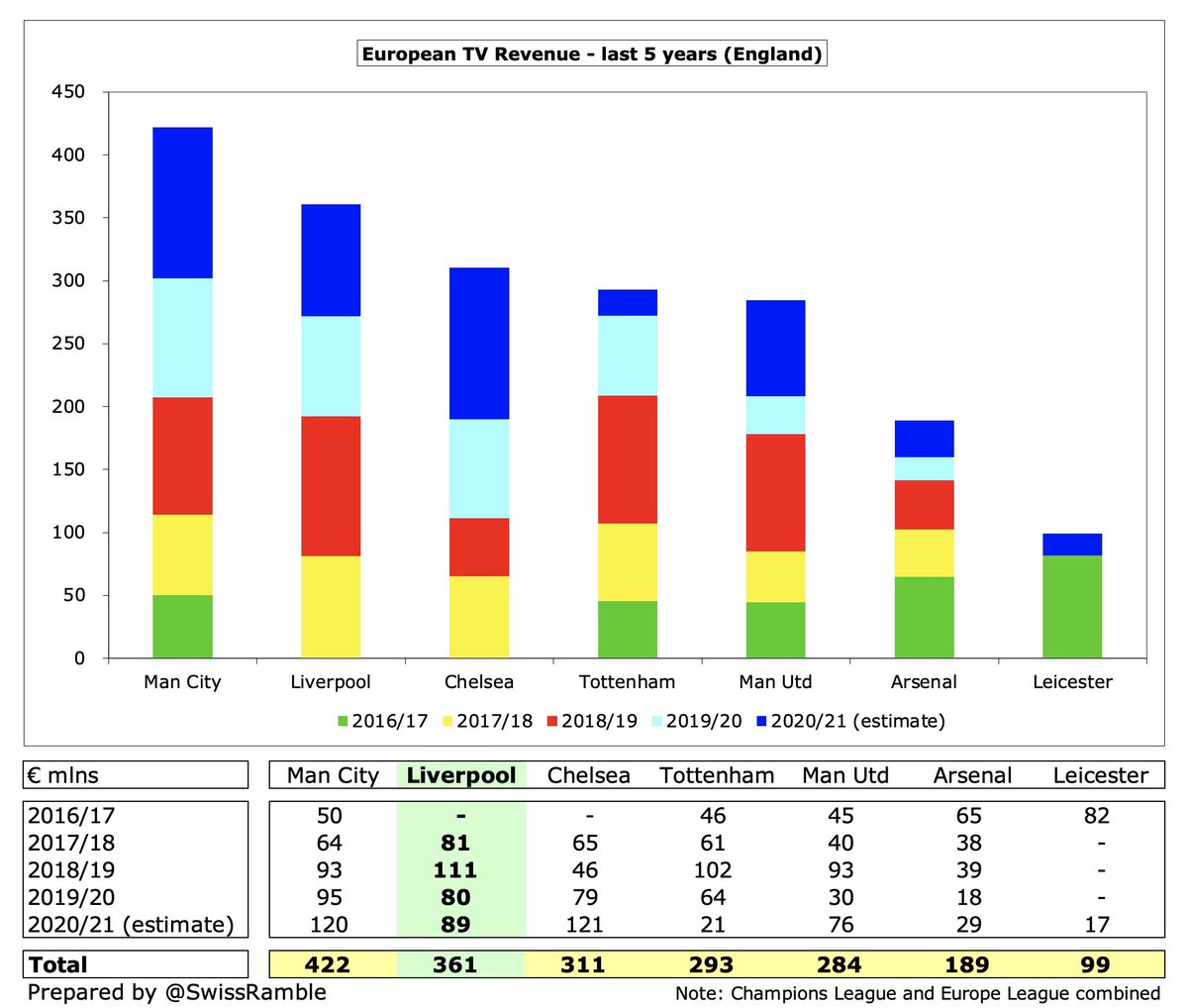

I estimate that #LFC earned €89m for reaching the Champions League quarter-finals, €9m more than prior year (when they only reached the last 16). That’s pretty good, though a fair bit lower than finalists #CFC and #MCFC, who both received around €120m.

The Champions League has been an important driver of #LFC revenue growth with an impressive €361m earned in the last 5 years, even though they did not qualify for Europe in 2017. Only surpassed by #MCFC €422m in England. Very important for Liverpool’s business model.

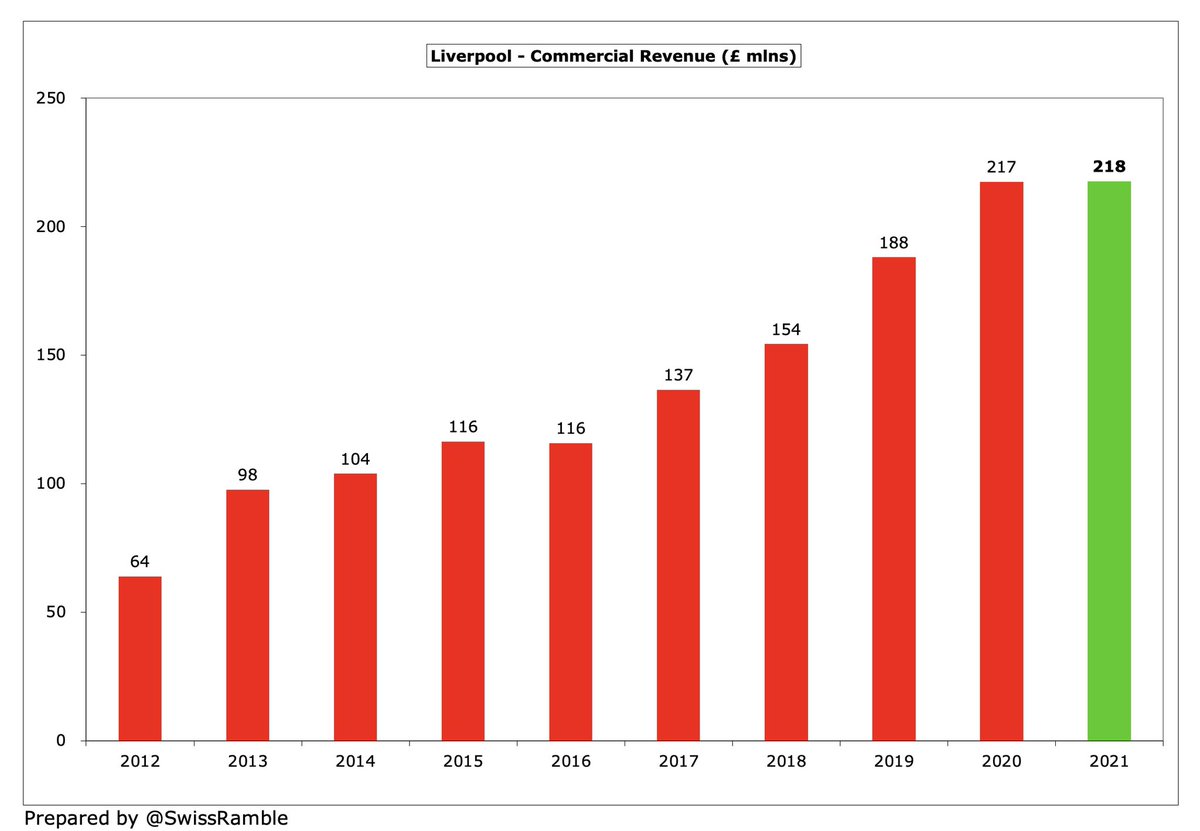

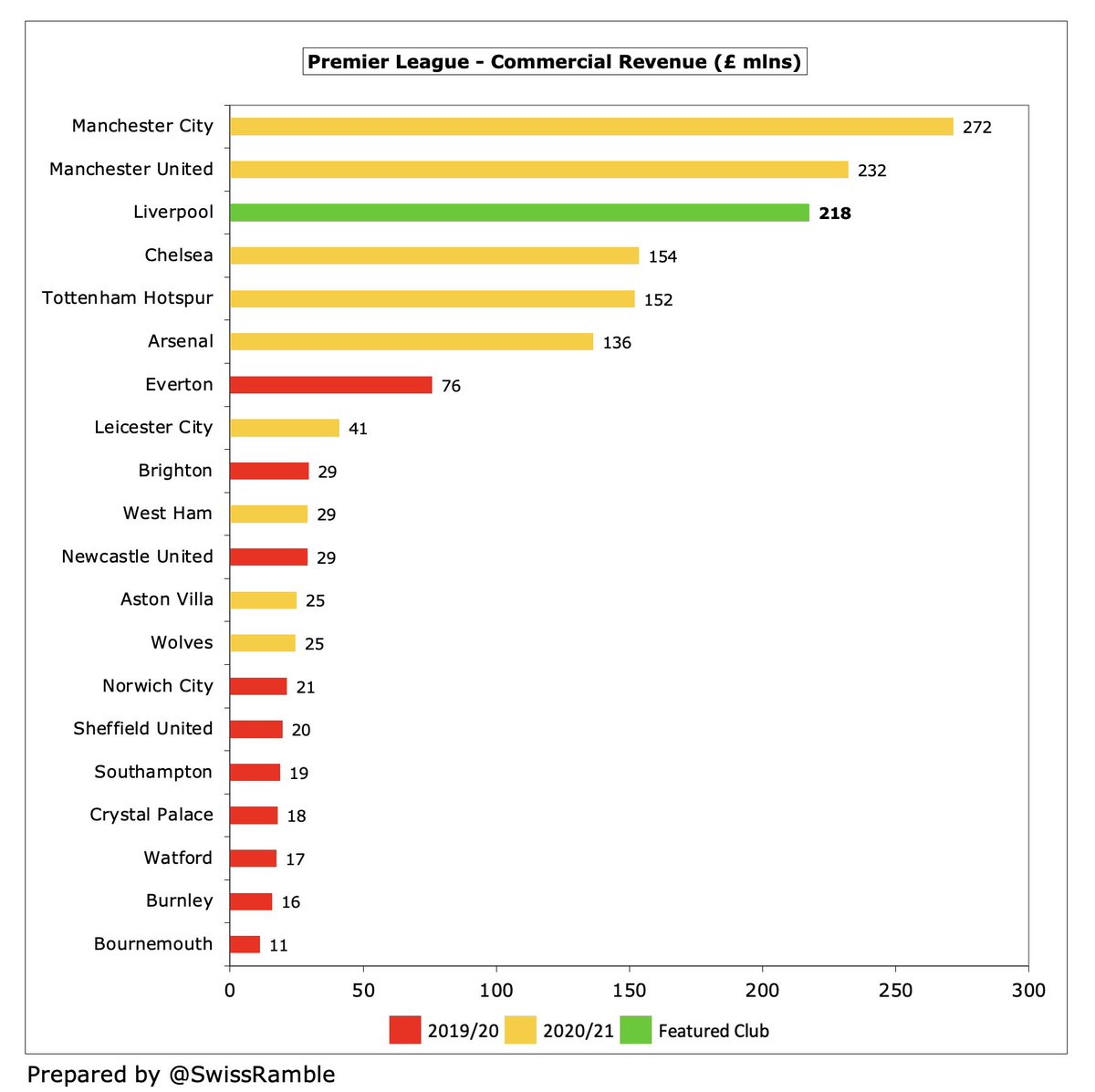

#LFC commercial income rose slightly from £217m to £218m, despite the COVID impact on retail stores, tours and the museum, thanks to “strong growth” in partnerships. Highest increase in Big Six since 2016 of £102m, even ahead of #MCFC, while #MUFC have seen a £36m decline.

Nevertheless, #LFC £218m remains third highest commercial revenue in England, still a fair way behind #MCFC £272m, though quite close to #MUFC £232m. Post-pandemic Liverpool will expect a significant rise in this revenue stream, especially with the new Nike deal.

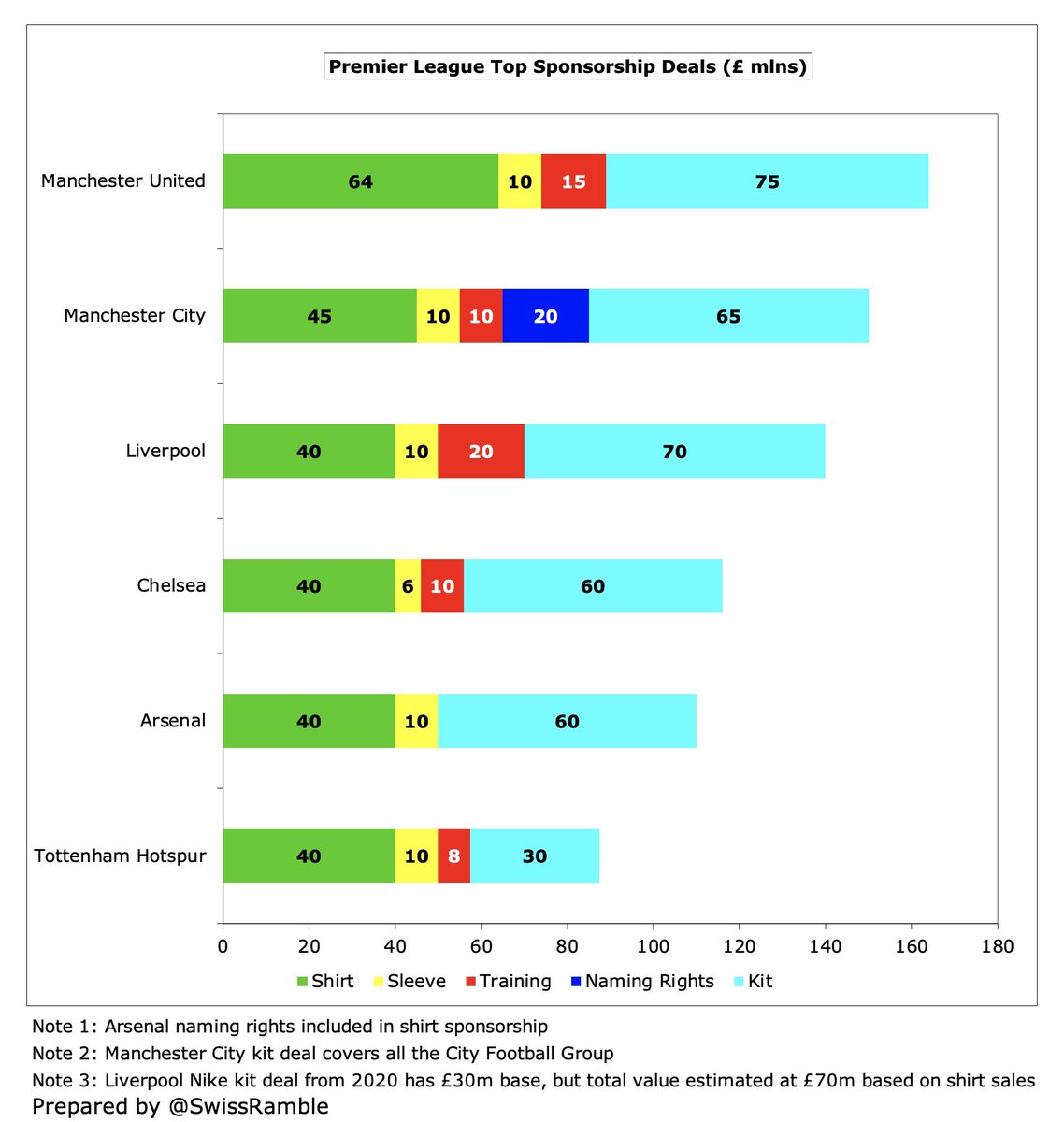

#LFC Nike kit deal replaced New Balance in 2020/21: lower £30m base, but 20% merchandising royalty takes it to estimated £70m. Standard Chartered shirt sponsorship £40m. AXA training kit £20m expanded to include training centre. Expedia replaced Western Union as sleeve sponsor.

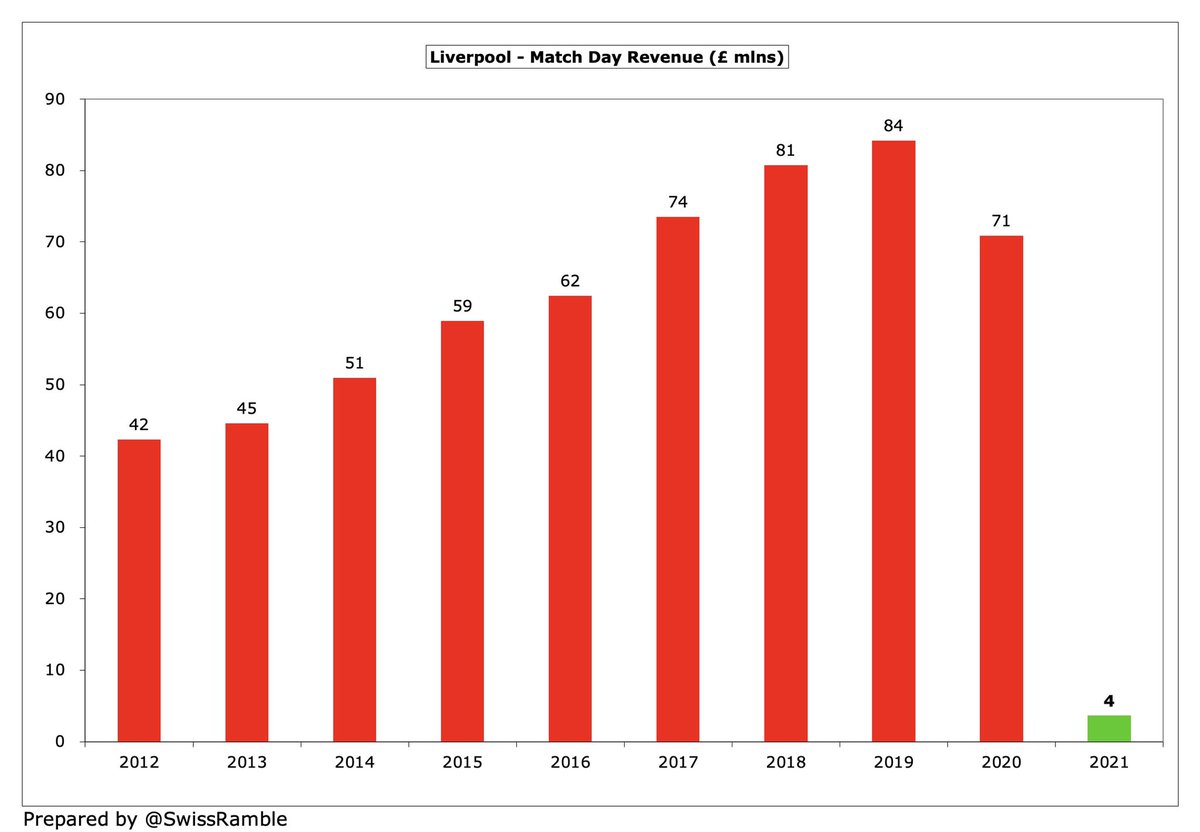

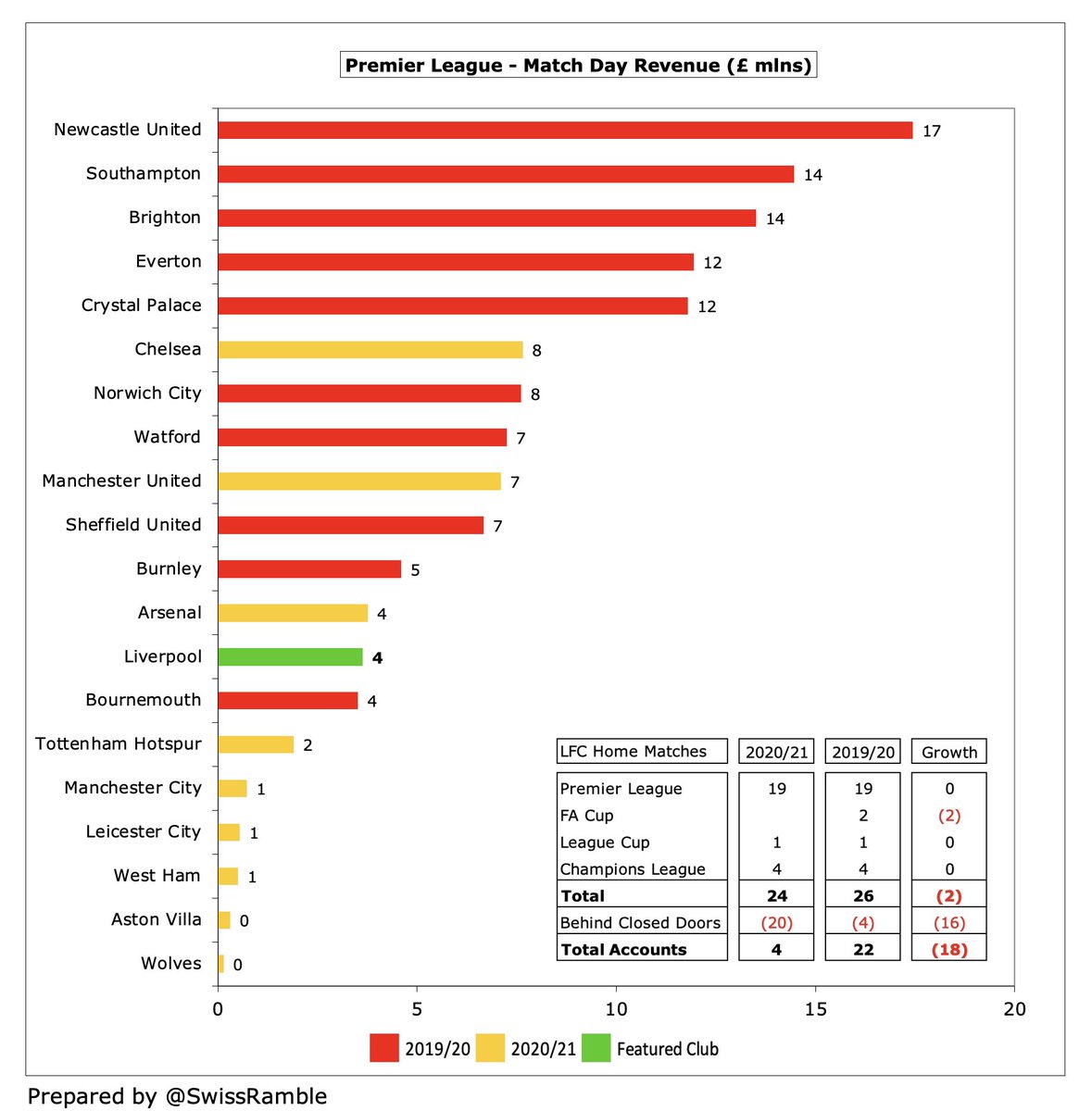

#LFC match day revenue fell £67m (95%) to just £4m, as all home games were played behind closed doors (except a few with restricted capacity). Before the pandemic, had grown from £62m to £84m after main stand expansion, but less than #THFC £95m due to the Londoners’ new stadium.

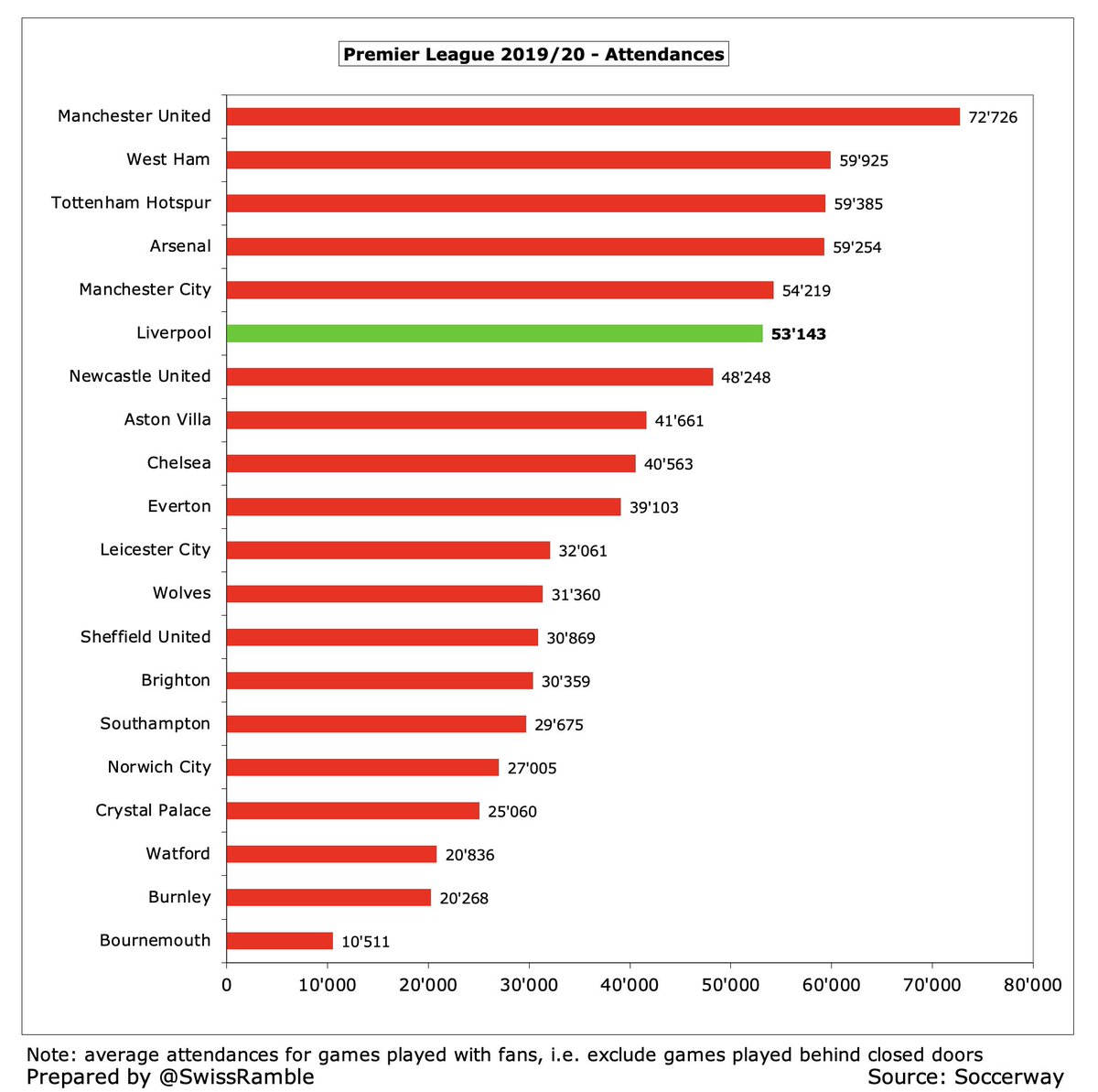

#LFC 2019/20 average attendance of 53,143 (for games played with fans), was 6th highest in the Premier League. Anfield Road expansion will increase capacity to 61,000 for 2023/24 at an estimated cost of £80m. Ticket prices frozen in 2021/22 for sixth consecutive season.

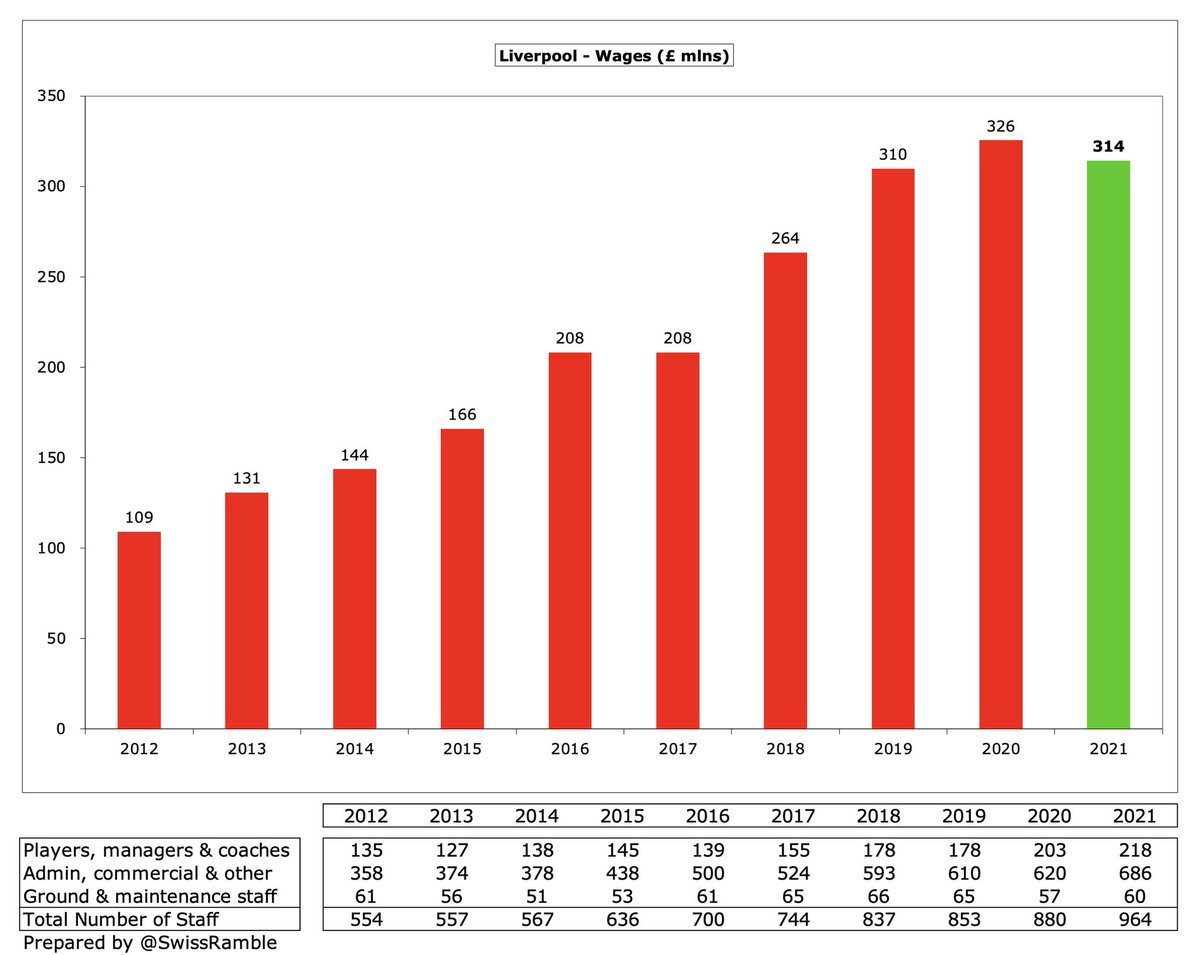

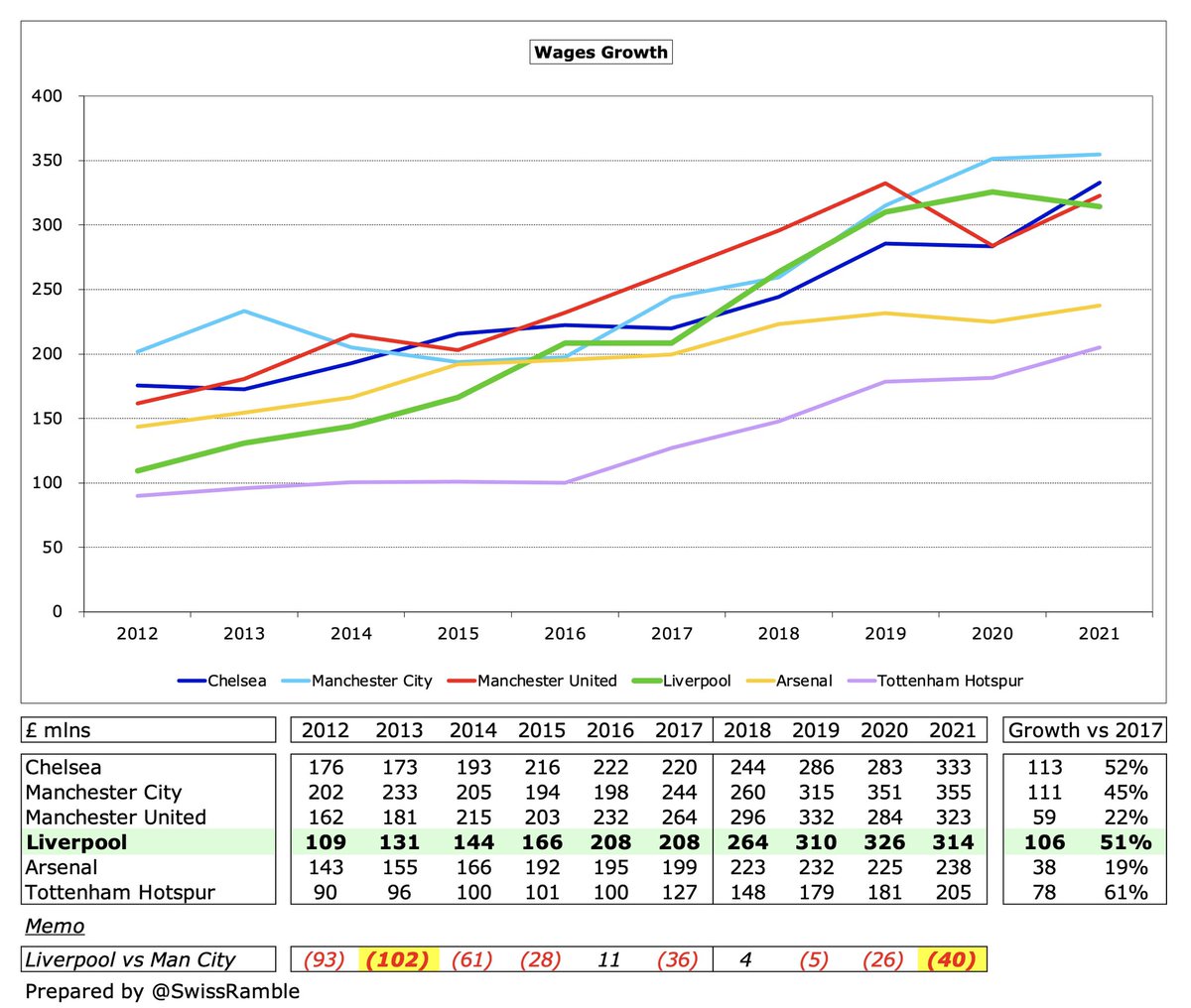

#LFC wage bill fell £12m (3%) from £326m to £314m, as prior year included bonuses for winning 2019 Champions League (played in June 2020) and 2020 Premier League (accrued). Wages have increased by £107m (56%) in the last 4 years, around the same as #CFC and #MCFC.

Following this fall, #LFC £314m wages are 4th highest in the Premier League, below #MCFC £355m, #CFC £333m and #MUFC £323m, then a big gap to #AFC £238m. Underlying growth due to 12 player contract renewals, including Virgil van Dijk, Fabinho, Trent and Harvey Elliott.

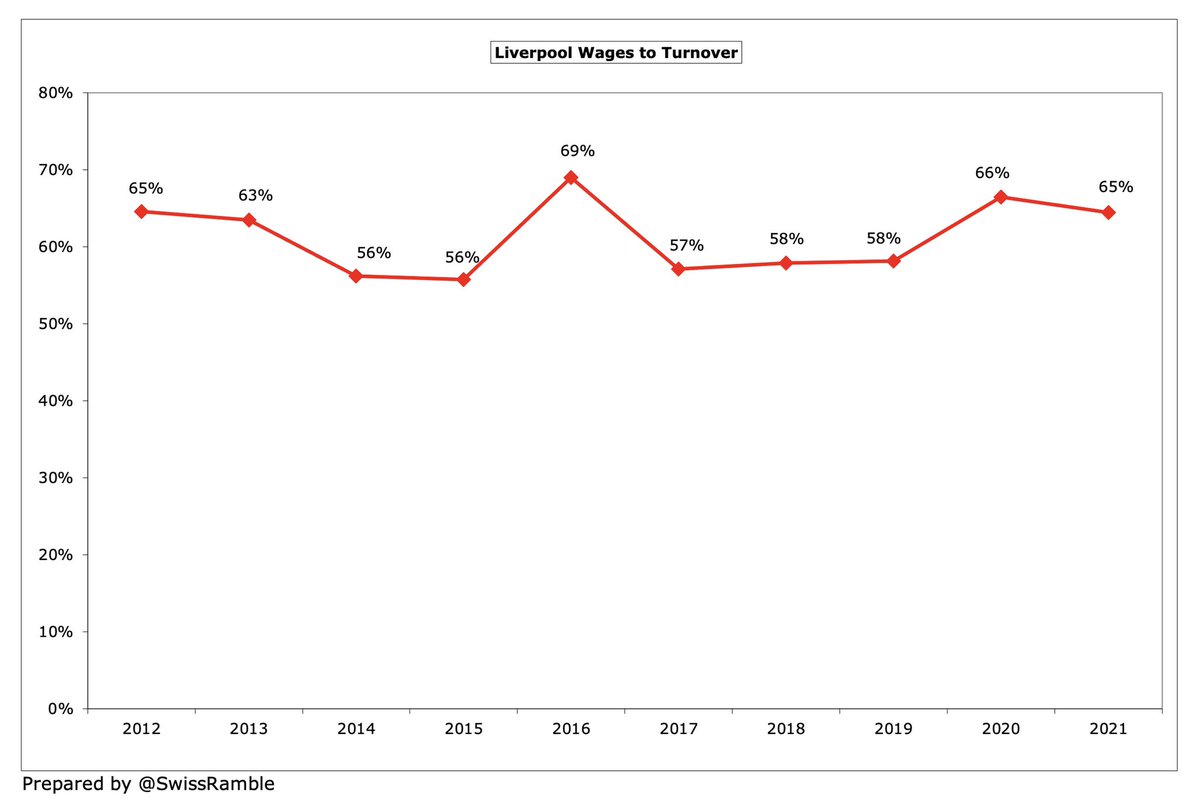

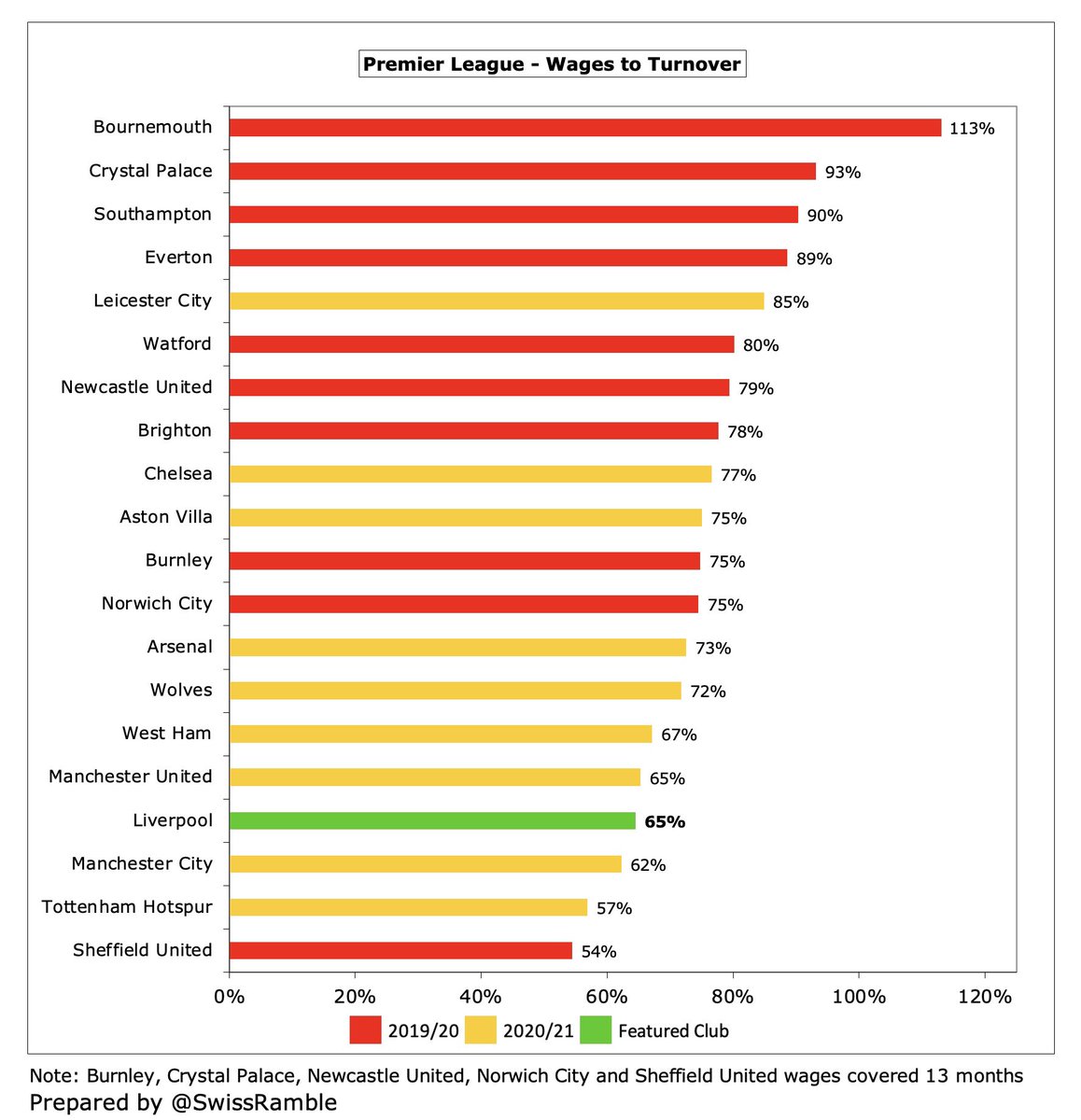

#LFC wages to turnover ratio slightly improved from 66% to 65%, which is not too bad, given the estimated net £52m COVID revenue impact. Also one of the better results in the Premier League, sandwiched between #MCFC 62% and #MUFC 65%, though much better than #CFC 77%.

#LFC highest paid director remuneration rose 27% from £1.3m to £1.7m. That’s a lot of money, but in fairness it’s much less than Ed Woodward #MUFC and Daniel Levy #THFC, who trousered £2.9m and £2.7m respectively. Total directors remuneration increased 45% from £2.2m to £3.1m.

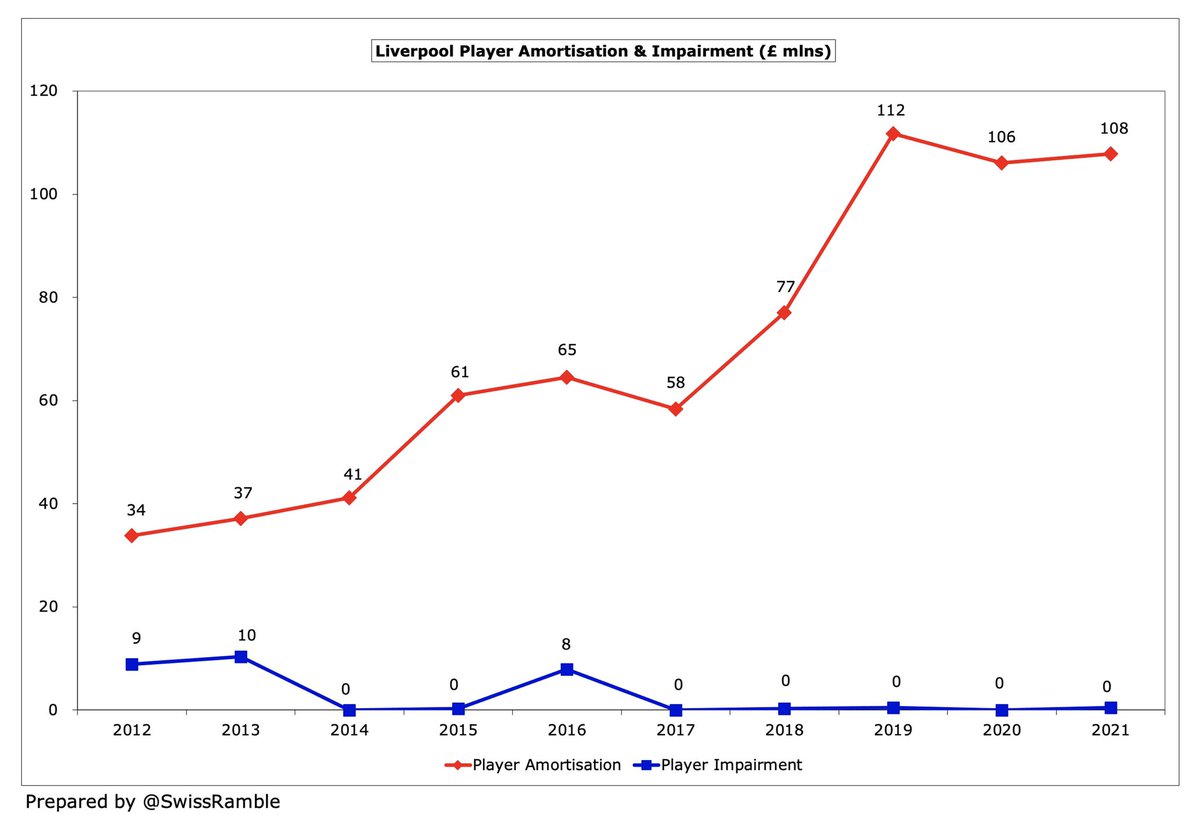

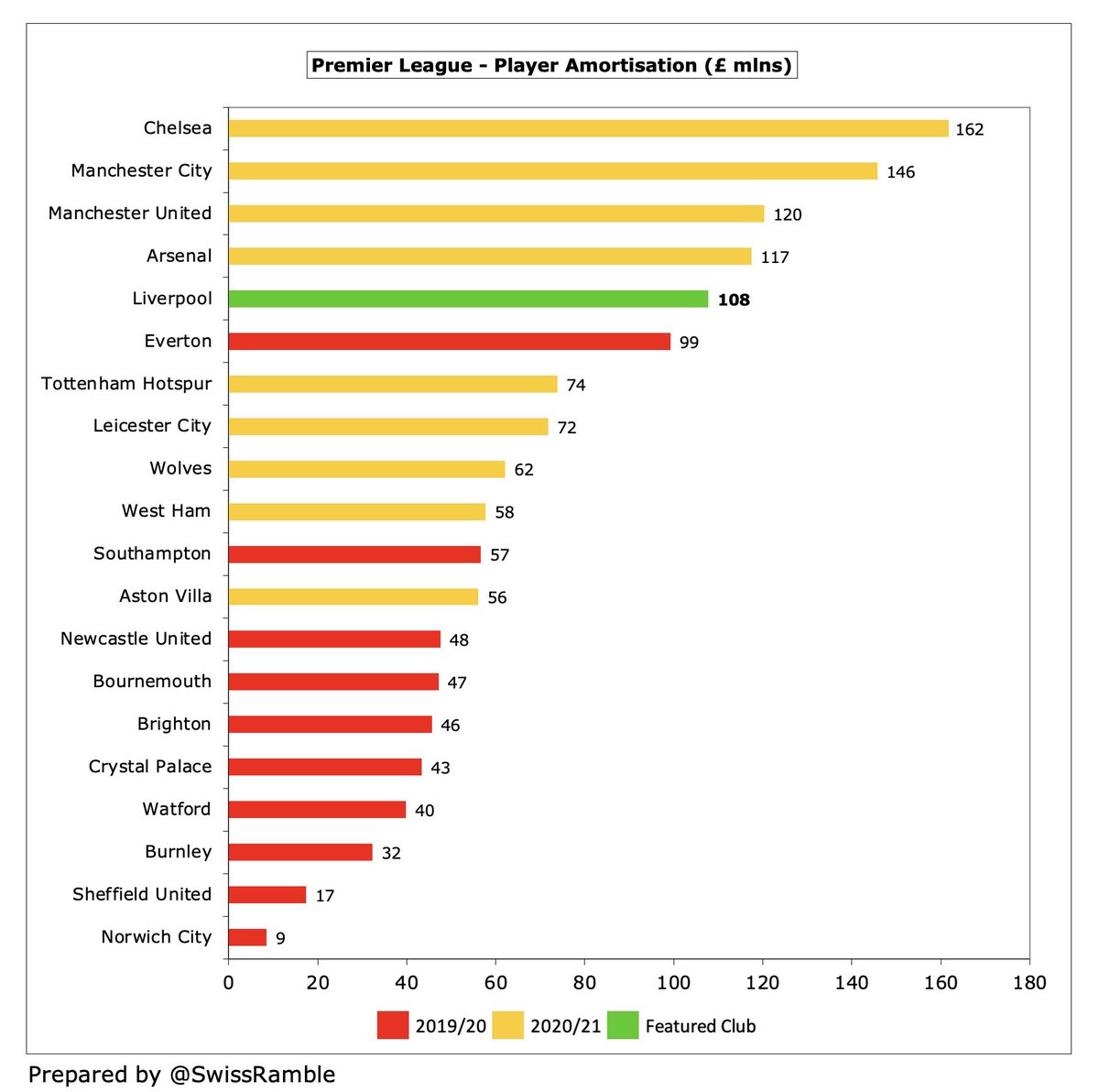

#LFC player amortisation, the annual charge to expense transfer fees over a player’s contract, rose £2m (2%) from £106m to £108m. Nearly doubled from £58m in 2017, but relatively low compared to the other Big Six clubs (except #THFC), especially #CFC £162m and #MCFC £146m.

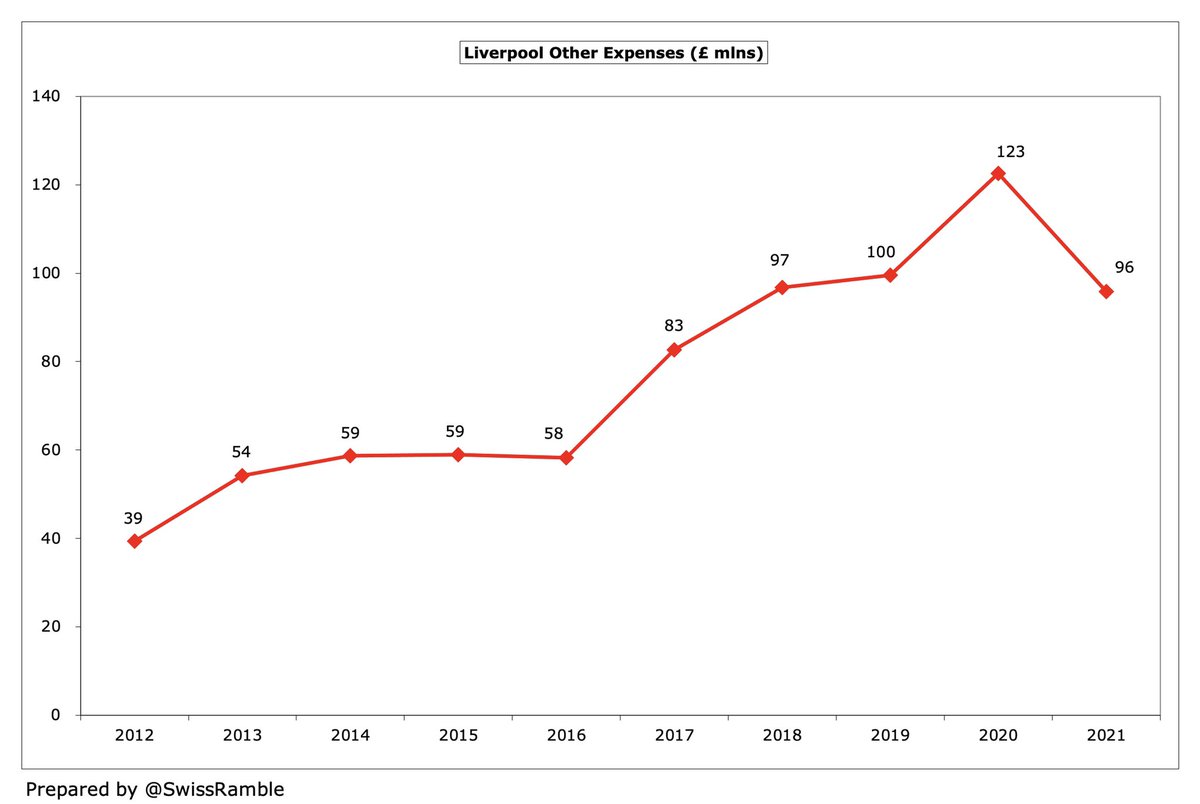

#LFC other expenses fell £27m (22%) from £123m to £96m, mainly due to reduced match day costs, as games were played behind closed doors. Up from £58m in 2016. Club said that costs associated with European Super League have been fully charged to FSG.

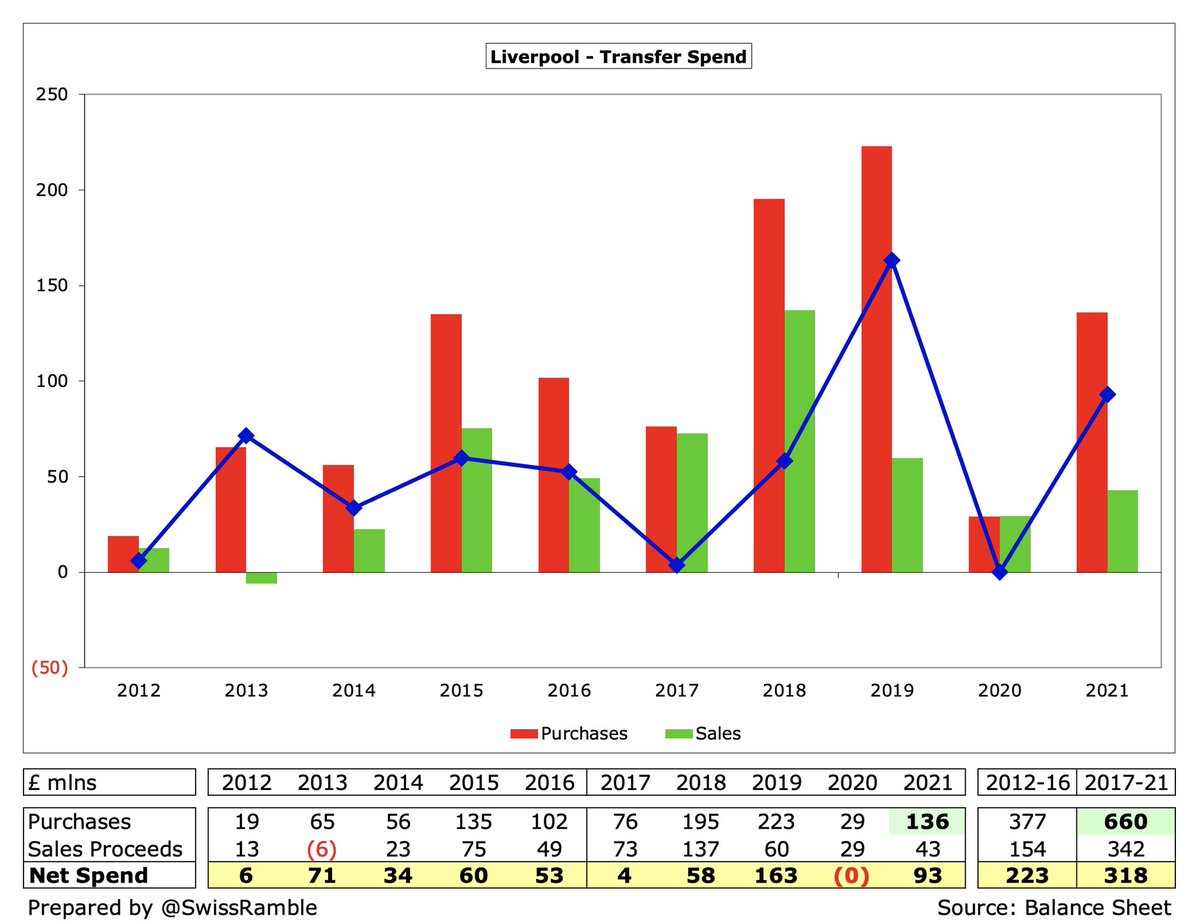

#LFC spent £136m on player purchases, including Diogo Jota, Thiago, Kostas Tsimikas and Ben Davies, with £93m net spend. This was much higher than prior season’s very low £29m, and was only surpassed by big-spending #CFC £221m and #MCFC £194m, but more than #MUFC £116m.

#LFC have spent a lot of money in the transfer market with a £660m outlay in the last 5 years, but only £318m net spend. Klopp said, “Our transfers have to hit the ground running, because we can’t make a £40-50m signing and say that if they are not playing, that is not important”

In fact, #LFC £278m net spend in 5 years up to 2020 was only 6th highest in the Premier League, far below #MCFC and #MUFC (around £700m). Gross spend of £626m was in 4th place, but around £300m less than #MCFC, #MUFC & #CFC. Spent £75m on Ibrahima Konaté & Luis Diaz this season.

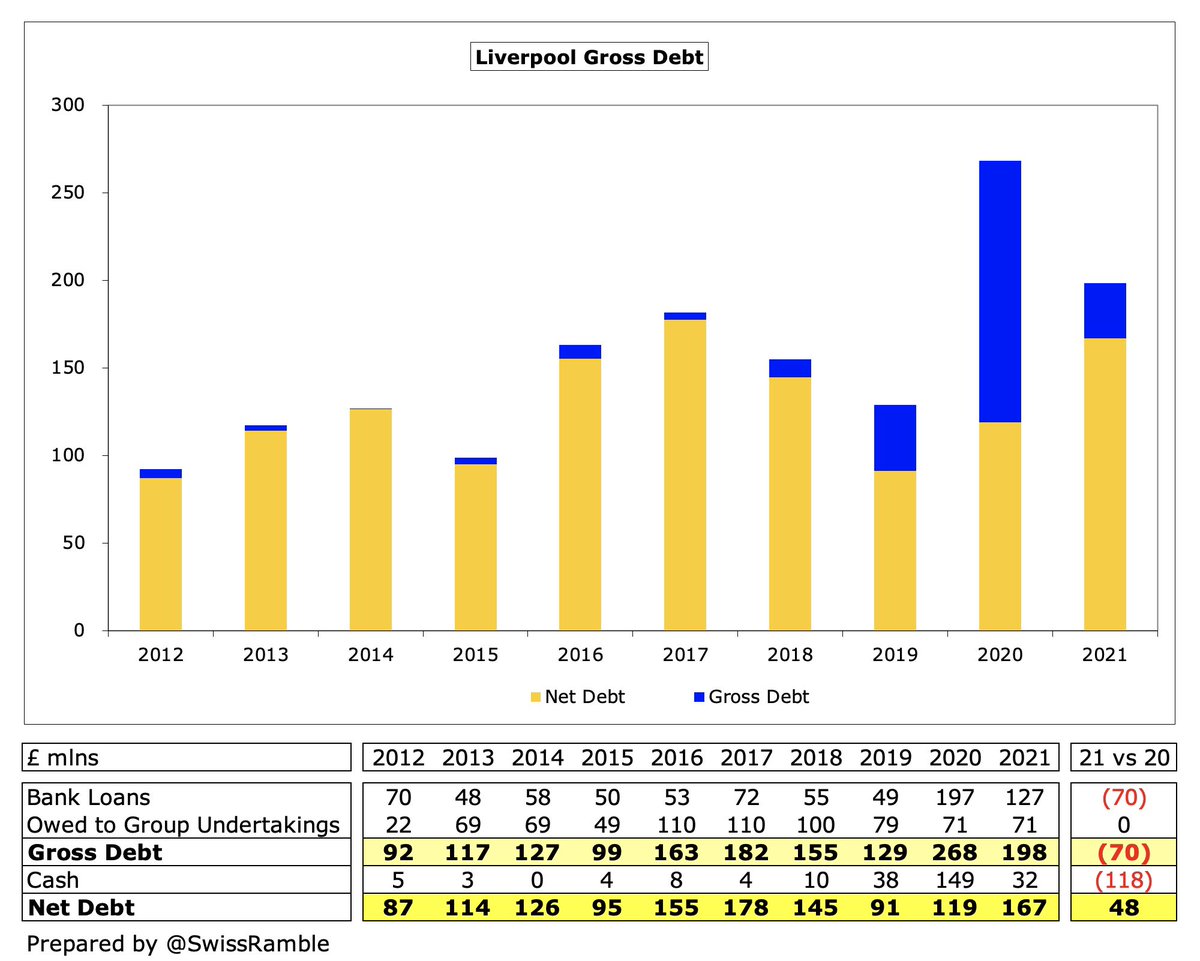

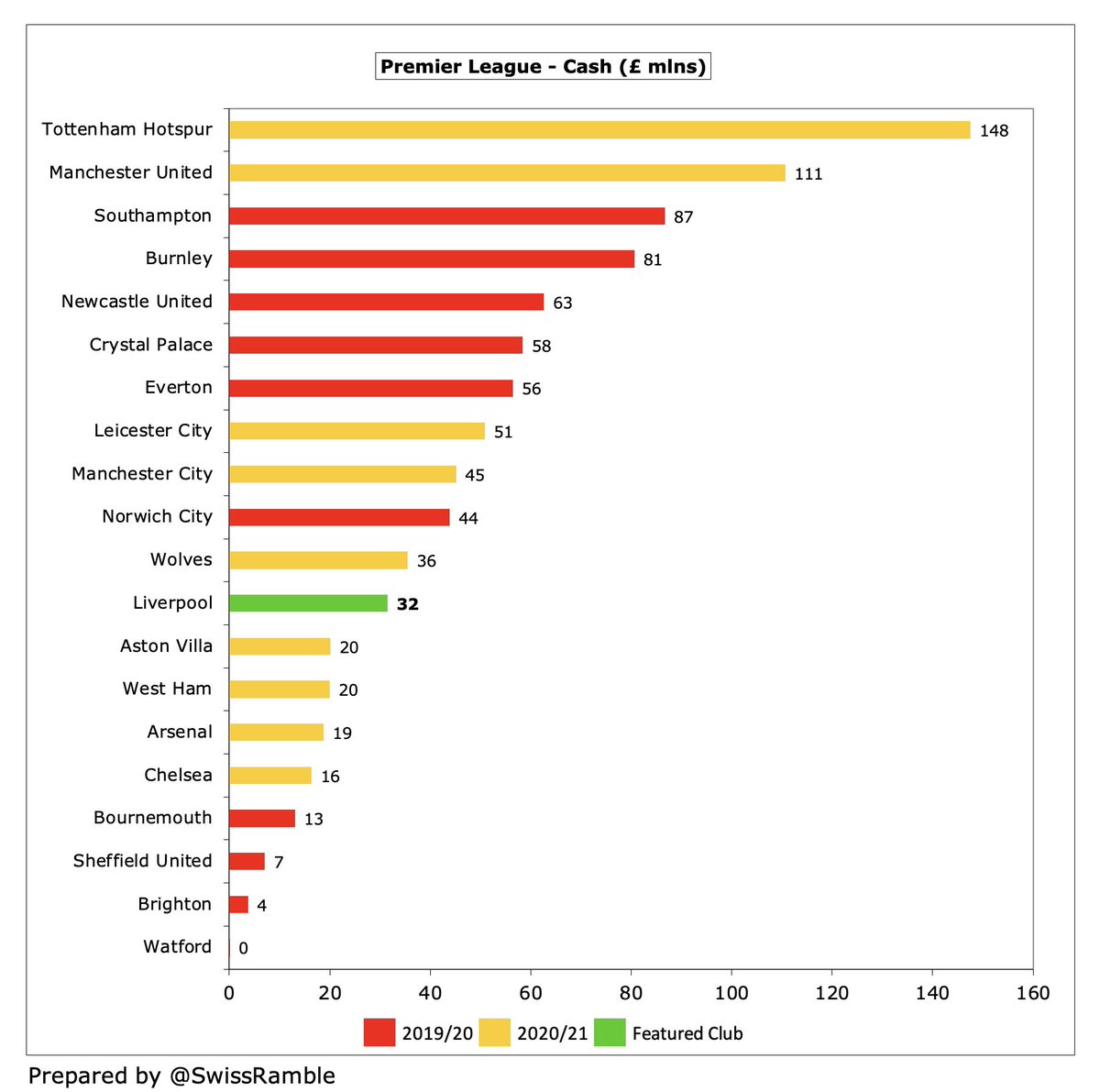

#LFC gross debt fell £70m from £268m to £198m, as the bank loan decreased from £197m to £127m, while the owner’s loan (to fund stadium expansion) was unchanged at £71m. Net debt increased from £119m to £167m, as cash dropped from £149m to £32m.

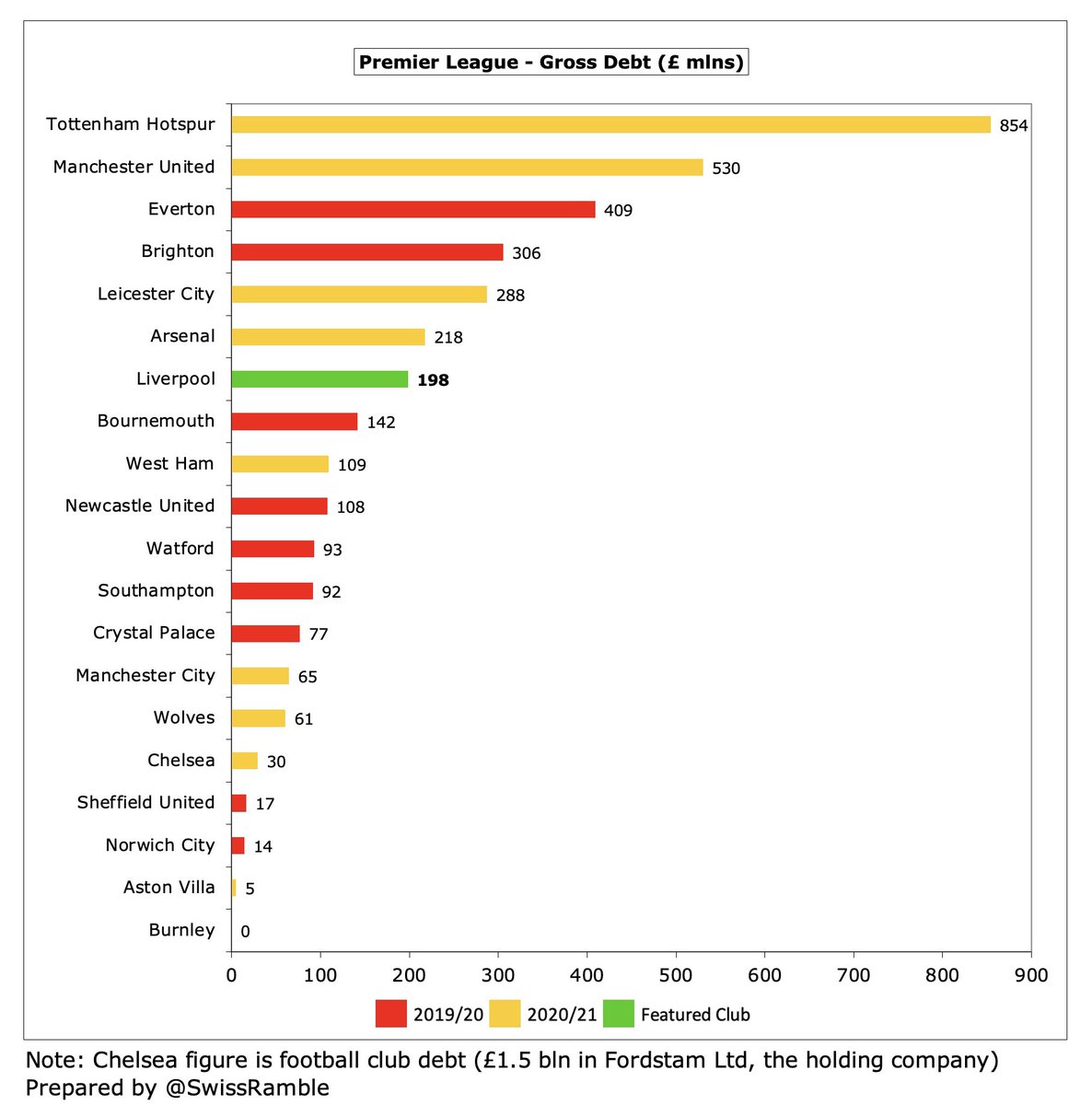

#LFC £198m debt is now 7th highest in the Premier League, a long way below #THFC £854m (new stadium), #MUFC £530m (Glazers’ leveraged buy-out), #EFC £409m (Moshiri funding) and #BHAFC £306m (new stadium and training ground).

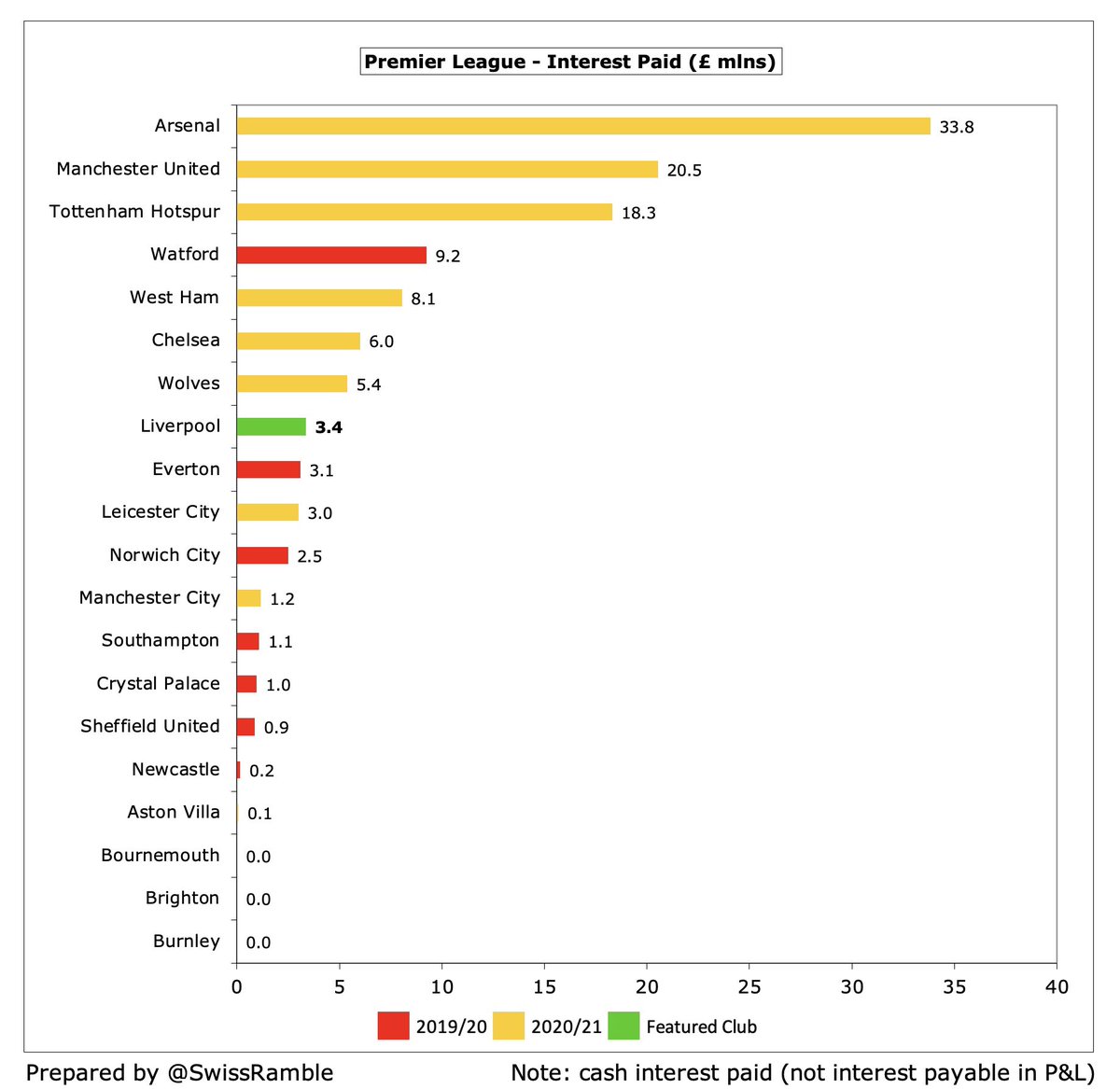

#LFC inter-company loan is interest-free, while the new bank loan is 2.04% (prior loan was at 1.21%), so #LFC only paid £3m interest, albeit up from prior year’s £2m. Significantly less than #AFC £34m (mainly debt refinancing break fee), #MUFC £21m and #THFC £18m.

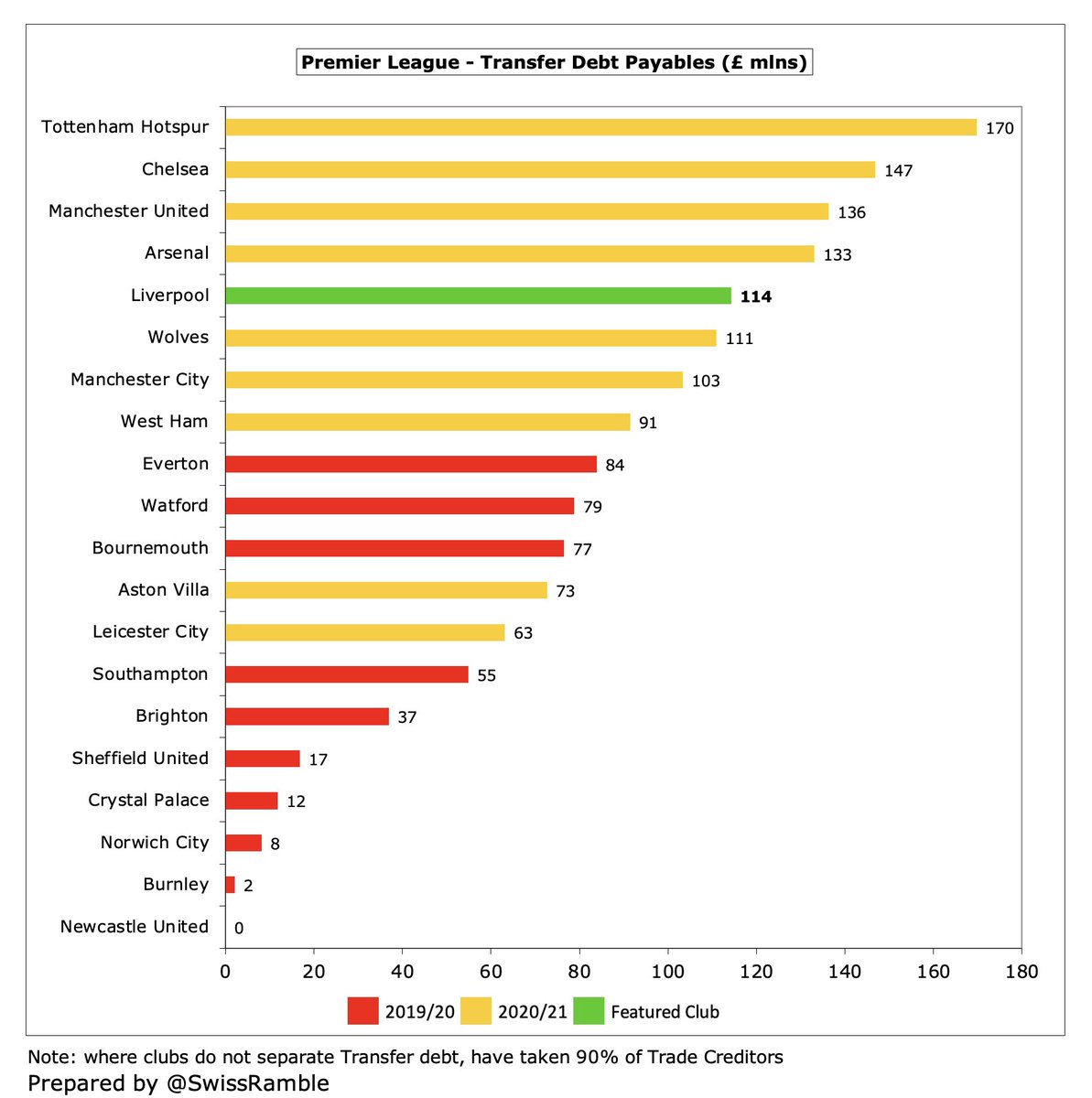

#LFC don’t separately report transfer debt, but assuming 90% of Trade Creditors, this rose from £76m to £114m, though still much lower than #THFC £170m and #CFC £147m. Like other clubs, many deals done with low payments upfront, e.g. Jota from #WWFC.

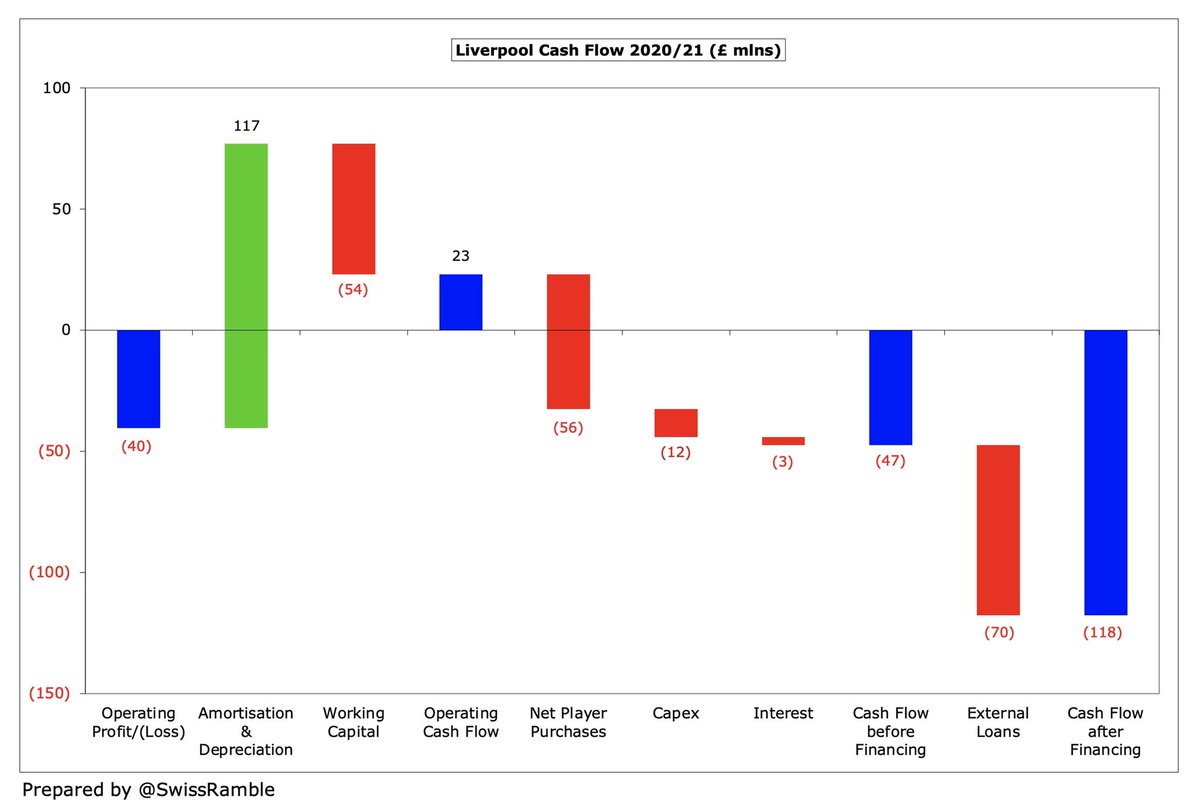

#LFC £40m operating loss became £23m cash flow after adding back £117m amortisation/depreciation, offset by £54m working capital movements. Spent £56m on players (purchases £90m, sales £35m), £12m on capex, £3m interest payments and £70m bank loan repayment.

As a result, #LFC cash balance decreased by £118m from £149m to £32m, which is on the low side for a leading Premier League club, e.g. #THFC and #MUFC have £148m and £111m respectively. Club has £200m bank facility available for working capital requirements.

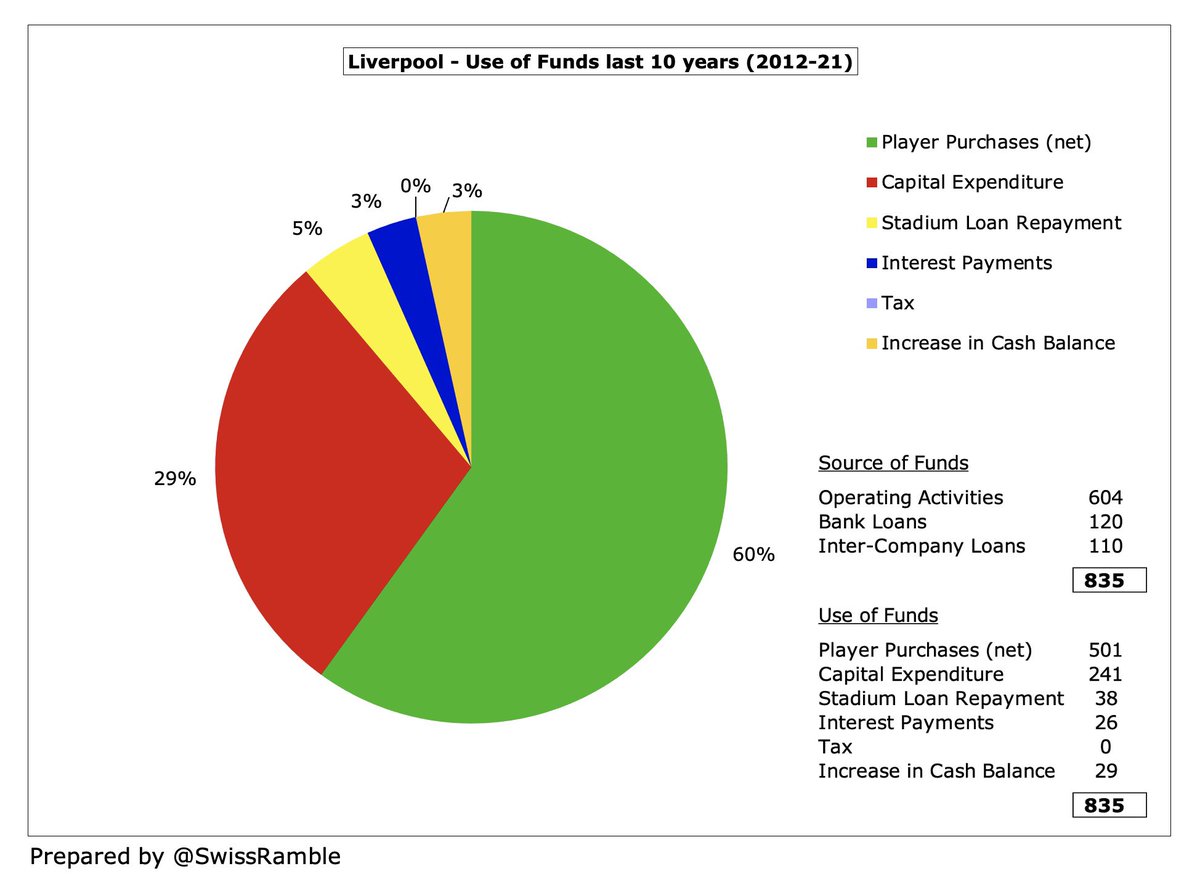

In the last 10 years #LFC had £835m available cash: £604m from operations, £120m from bank loans and £110m from owner loans. They spent half a billion on players (net), infrastructure (stadium & training ground) £241m, stadium loan repayment £38m and interest payments £26m.

Some #LFC fans will point to the relatively low financing provided by FSG, who have only put in £136m in the last 10 years, in stark contrast to the sums provided by the owners at #MCFC £837m and #CFC £559m. In fact, £37m (to finance the stadium) has been repaid since 2017.

Despite making losses in the last two years, #LFC have absolutely no problems with FFP, as they are still profitable over the 3-year monitoring period (with 2020 and 2021 averaged), even before the allowable deductions and adjustment for COVID impact.

FSG have sold 10% of their company to Red Bird Capital, which should help strengthen the #LFC balance sheet, cover COVID losses and fund Anfield expansion. This might facilitate some transfer spending, but is unlikely to go towards a massive “war chest”.

#LFC success on the pitch, both domestically and in the Champions League, has driven significant revenue growth, but they have been badly impacted by the pandemic. The sustainable strategy requires continued good performance on the pitch, so judicious transfer spend is required.

The #LFC business model was neatly summarised by Jürgen Klopp, “It’s not, as we say in Germany, that we swim in money. It’s a wealthy club, but the policy is clear: we spend what we earn. If we earn more, we can spend more; if we earn less, we spend less.”

The approach was reiterated by Andy Hughes, #LFC managing director, “It is imperative that we continue to live within our means and operate within football’s regulations and financial fair play. But we’ll continue to reinvest on and off the pitch to compete at the highest levels”

• • •

Missing some Tweet in this thread? You can try to

force a refresh