I just finished watching this amazing podcast from @vivbajaj. Loved it. Here’s a short thread on 10 most important lessons you can learn from @Nithin0dha

https://twitter.com/vivbajaj/status/1492830250102779904

How to get lucky in life?

Focus on that one thing you really love the most and go after it.

If you are someone who is not good at programming , you should start learning how to sell? That’s the most important skill in life.

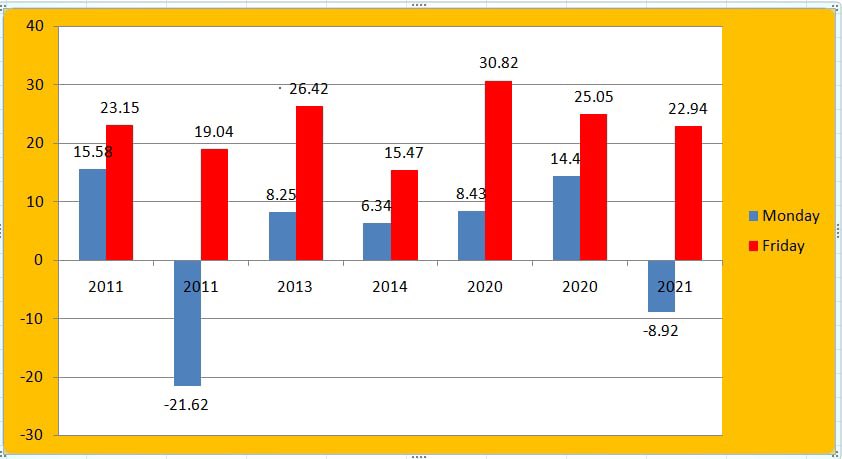

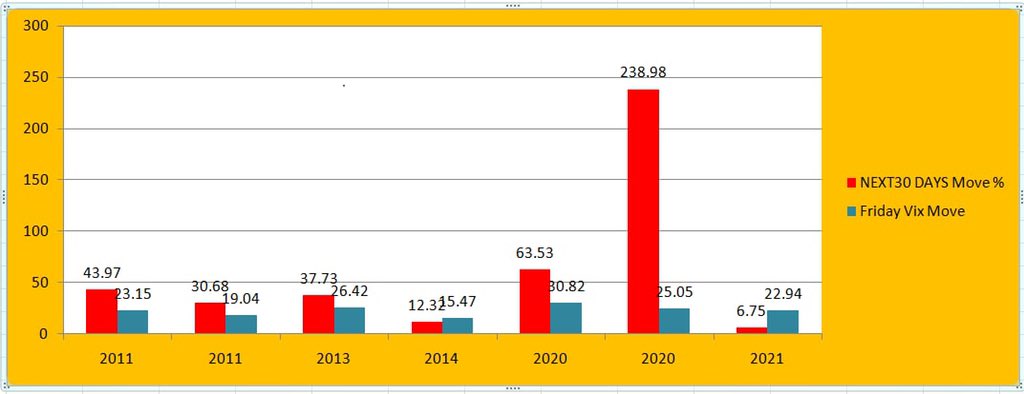

Markets are random, but how technical analysis still works?

The mistake that most traders do is…

How a client made 2.5 crores in two days with just one lac capital?

Biggest learning from Kailash - avoid technological debt

Advice for entrepreneurs who are looking to raise funds.

Our revenues go down 50% any day due to any external events, we are prepared for it since this is the most unpredictable industry.

What’s the USP of Zerodha? Pricing? Tech? No, it’s the credibility and transparency they built it over the years which competitors can’t replicate easily.

• • •

Missing some Tweet in this thread? You can try to

force a refresh