Many beginners give utmost importance to trading strategy but least bothered about position sizing. Knowing how much is too much in a trade? This information is very crucial which determines the long term success of a trader. In this thread will explain what is position sizing

We all know that people who invested after Paytm was listed lost 50% of their capital. But there is this one type of investor despite losing 50% in Pay Tm he is calm, it doesn’t affect him much.Whereas there is other guy who lost his sleep investing his hard-earned money in PayTm

We know that the stock lost 50% in short span of time, the outcome is same for both investor, but how come it doesn’t impact the first guy? The answer lies in position sizing.

The calm investor understood the importance of position sizing and know that investing all his capital in one trade is not the best idea. So he allocated only 10% of his capital in Pay Tm. His capital is 10 lacs, he wanted to risk 10% which is Rs.100000.

So be bought 67 shares of Pay Tm, 100000/1500=67. Even though Pay Tm is down around 50%, he is least bothered because the loss of Rs.47333 is just 5% of his capital. Even Pay TM goes to zero, he is going to lose just 1 lac, which is 10% of his capital.

Whereas the Panic investor who wanted to make quick gains ended up investing 10 lacs in PayTm stock buying 667 shares, by now he lost almost 50% of his capital, from here the stock has to move more than 100% just to breakeven.

The no of shares/lots we trade should vary based on the risk we take with every trade. When you are trading based on chart patterns, trend line, support & resistance, your stop loss changes every time. Sometimes we use narrow stop loss, sometimes wide stop loss.

But if you trade with same position size( no of shares), then it will affect your end result in the long run. When your risk is more, buy less. When your risk is less, buy more. That’s the key.

Consider same Paytm example, now both type of traders want to enter at 1500 with 1300 as stop loss. The calm trader first calculated his risk Entry price – Stop loss = 1500-1300. So risk is 200, he wanted to risk 2% of his capital in this trade

And 2% of his capital is 20k, if stop loss is hit, he does not want to lose more than 20k. So no of shares he needs to buy is 20,000/200= 100 shares. The Panic trader simply bought 667 shares, because with 10 lacs capital at the max he can buy 667 shares,

which he bought expecting the stock to move up. But unfortunately it moved down and hit the stop loss. But he lost 13%. The outcome was the same for both type of traders, but the end result varied because of the position sizing rules they followed.

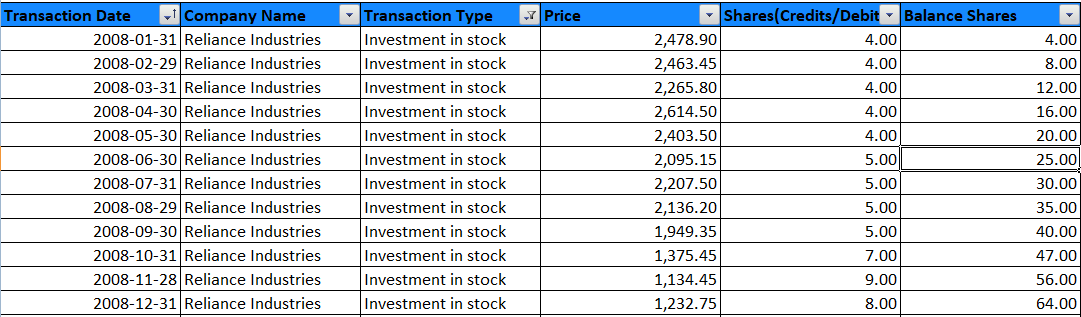

Trading the options right way: Many traders are trading the 920 Short straddle strategy.Lets see how we can apply position sizing rules here. In the below table we mentioned ATM option premium, since we use 25% stop loss in every trade, we mentioned how much is 25% sl,

next column is risk per trade, that 150*25(lot size)=3750, if both side stop loss is hit, then its 3750*2=7500. When stop loss is hit on both sides on Monday, he loses, 7500 per lot. Consider the trader has 10 lacs capital, with 2 lacs per lot, he would end up taking 5 lots.

When SL hit, his loss will be 7500 * 5 = 37500 which is 3.75% of his capital. Like wise, if we do the calculation from Monday to Friday, if all 5 days stop loss is hit on both sides, we end up losing -15.3% of our capital.

Instead, if we cap the max risk as 2% of our capital per day and decide the no of lots accordingly, then the end result would change. In the above example, 2% of capital 10 lacs, is 20k. If both side SL is hit on Monday, we lose, 7500. Divide 20,000/7500= 3 lots.

So if we trade with 3 lots, even if stop loss is hit on both sides, we lose only 2% of our capital. If premium is very high, we end up trading with lower lot size. With same outcome of SL hitting on all 5 days, the total loss was only -10%.

A lot of traders actually do their analysis right, but they end up blowing their account not because their judgement was wrong, they simply didn’t know how much is too much. Size your position properly! Here's the link to article squareoff.in/position-sizin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh