In recent days, rule based trading or mechanical trading system is on limelight. Every beginner considers that system trading is the sure shot way to profitable trading journey. But there are certain pitfalls in mechanical trading system that no one talks about. Here's a short 🧵

Time Drawdown hurts more:

Many traders after spending so much of time with backtest, when they finally get started with live trading all they have in their mind is metrics like Profits, max loss, max drawdown, losing streaks etc. But they hardly give importance to time drawdown

Many traders after spending so much of time with backtest, when they finally get started with live trading all they have in their mind is metrics like Profits, max loss, max drawdown, losing streaks etc. But they hardly give importance to time drawdown

When trading system is not performing well for months, first think that comes to our mind is

1. Is the system stopped working?

2. Should I stop using the system and paper trade it until it comes out of drawdown?

3. Should I tweak the system to adapt to current market condition?

1. Is the system stopped working?

2. Should I stop using the system and paper trade it until it comes out of drawdown?

3. Should I tweak the system to adapt to current market condition?

Even though your overall drawdown percentage is lower, if your time drawdown is higher it really puts a lot of pressure in our mind. A typical trend following or breakout system stays in drawdown most of the time.

Consider the below live performance of famous hedge fund manager Bill Dunn, where he has been trading live with millions of dollars using a trend following principle for 40+ years. There are 13 times where his drawdown was greater than -25%.

His funds equity curve hit all time high in the year 2002 and it took almost 8 years to get back to new equity high. How many fund managers out there can handle such a long time drawdown?

First few trades:

Even though we know trading outcome is completely random in nature, most of the traders abandon their trading system if it fails to make profits in first few trades. They are okay if it makes profit initially and then goes in drawdown or faces streaks of losses

Even though we know trading outcome is completely random in nature, most of the traders abandon their trading system if it fails to make profits in first few trades. They are okay if it makes profit initially and then goes in drawdown or faces streaks of losses

But if the system starts giving them losing streaks during the initial phase, then instantly dump that system and start looking for new trading system. This cycle keeps repeating. So never make hasty decisions based on the first few trades when you start using a trading system.

If you look back the history, be it trading or be it life in general, it's not our fear which does more damage, its always our greed which puts us in trouble most of the time. Winning streaks gives us overconfidence, it makes us beleive that we are in control.

So we tend to increase our position size or we start trading with higher lot size right after series of winning trades. A guy who trades with two lots, might jump to 20 lots. Then what happens? A series of losing trades follows which damage his confidence,

then he will get back to his old lot size. So do not increase your capital or lot size just because you are witnessing streaks of profits back to back.

Even though it is the system machine which executes your trades, where you just go by your own system rules, you cannot remove emotions completely. You can just manage your emotions to certain extent with system trading but you can't avoid emotions altogether.

Most system traders tend to check MTM, Pnl once in a while. And there are some system traders who switch off their Algo or trading system during event days. So emotions are not completely eliminated. Many still override their own system at times.

We really feel down during drawdown phase and feel super excited when our equity curve hits all time high. This feeling of ups and downs will be there with system trading as well. System trader go by rules, have a process and rely on law of large numbers.

So during drawdown phase, we keep telling ourself that we will eventually come out of this drawdown soon. There will be strong conviction which keep our discipline intact. But traders who don't follow system trading will not have any process.

When there is no process, it puts them in enormous pressure during drawdown phase or losing streaks. That's why having a trading system helps to certain extent in managing emotions.

Brokerage is not your transaction cost:Other than brokerage we end up paying 6 different charges

1. Exchange transaction charges

2. Securities Transaction cost

3. GST

4. Stamp Duty

5. Sebi fee

6. Clearing charges

1. Exchange transaction charges

2. Securities Transaction cost

3. GST

4. Stamp Duty

5. Sebi fee

6. Clearing charges

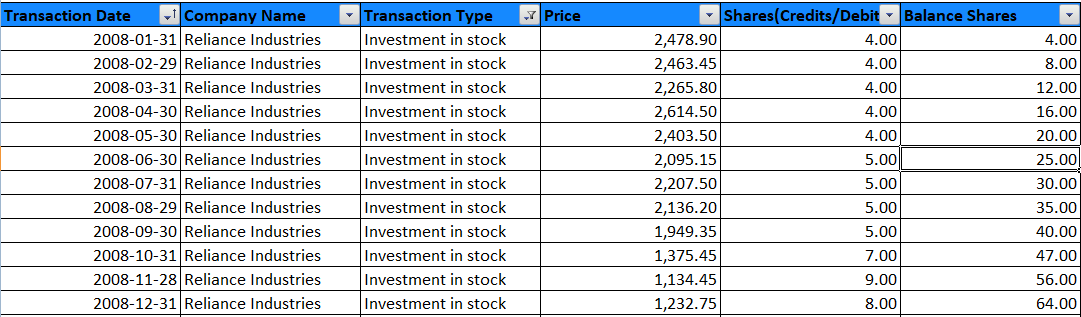

Lets assume, you bought and sold 1 lot Bank Nifty futures in Intraday. You buy at 32000 Bank Nifty futures and sell at 32010. a ten points profits. Considering, you are trading with 1 lot, which is 20 quantity, then your gross profit is 20*10=200 Rs.

But in 200 Rs. profit, there are multiple cost you end up paying. Rs.176 as total transaction cost, so simply we should not calculate only Rs.40 brokerage we pay is our transaction cost.

If you are spending so much of time in coming up with one perfect system which works in all sorts of market conditions, then you are actually wasting your time. It doesn't exist. Professional traders run uncorrelated strategies not to make profits on every market condition but

they run such multiple systems to reduce the volatility of their portfolio. They understood that only way to become a profitable trader is too survive during adverse period. That's the key. Here's the link to detailed article. squareoff.in/pitfalls-in-me…

• • •

Missing some Tweet in this thread? You can try to

force a refresh