When you are designing a trading/investing strategy, here’s a list of things you need to keep in mind. A short thread🧵

1. Returns expectation - You need to set a realistic return expectations. Making 100% 200% year on year is not possible at all. Do not get fooled by MTM screenshots, do not just go by absolute numbers The average returns of the prominent traders/Investors are just 20% to 30%

2. Know what you don’t know - In Mahabharata, Duryodhana won the bet because he knows that he didn’t know how to gamble. So he used his uncle to play the game. Whereas Dharma lost the bet because he didn’t know how to play the game. This is so true with respect to trading as well

If you are good at equity trading doesn’t mean you can trade well with commodities or crypto. Both are altogether require a different market knowledge. If you do not have the required skill set, outsource it to the skilled person who can do that task for you.

3. Find what suits you - Just don’t look at the over all profitability of a trading system. Those high returns can’t be achieved if you cannot sustain the drawdown period. If you can’t stick to a system, then there is no use even if you have the most profitable system.

Trend following system or option buying systems will be in drawdown most of the time, just few trades are enough to overcome DD and get back to profitable zone. But how many of us can handle such long no income periods? Will it suit you?

So find out how many days a system goes underwater, calculate this ratio - total no of trading days divided by total no of drawdown days. Higher the ratio better it is.

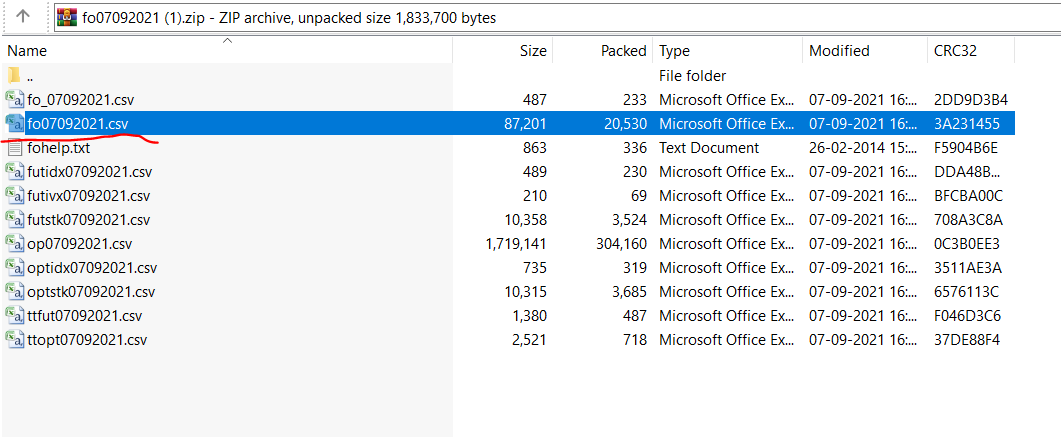

Define - Thanks to no code platforms like @stockmock_in where you can define your rules clearly. You should know clearly what you are going to trade, Target, stop loss, entry and exit rules. You cannot simply trade head & shoulder or cup & saucer patters, it cannot be quantified

Only when your trading rules can be quantified it can be backtested, visual chart patterns were developed years ago before the computer era and there’s a reach paper in SSRN where they published such well known chart patterns aren’t profitable at all.

These are Three most important elements in trading. Many lack a proper trading strategy, even if they have one, they lack discipline in sticking to the system and they are unable to stick to the system because they do not know “How much is too much”.

Backtest - Winning accuracy is the least important factor in a trading system. Famous Turtle Trader Richard Dennis was trading with less 30% winning accuracy still he was able to make millions because profits he made in winning trades were much higher the losses in losing trade

Optimise - it’s a never ending cycle. You can’t find a perfect system that works in all type of markets. It never exist. So don’t fine tune or add multiple parameters in the backtest. Keep it simple. If you can’t explain your trading rules in two lines, then it’s not robust

Forward test - Do not just paper trade, it’s waste of time. Instead test your strategy in live markets with one or two lots, only then you will realise how much live results deviate from your backtest. Then work on your execution logic to make it more robust.

Go live - Once you are done with one or two months of forward test, do not put in all your capital straight away. Instead trade with just one lot for 100 days. Our goal is to be a profitable trader in the long run not immediately. So first we need to follow a process.

Only when there is a process, there will be a progress. Keep a excel sheet, add a date column, next to that just Enter +1 if you follow the rules as per the system and enter -2 if you over ride the system. After 100 days, check out total summation.

If it’s greater than 90, then it means you are really a disciplined trader. Then you can increase your lot size, if your score is less than 90, never think of increasing your capital until you are disciplined enough.

If you keep these little things in mind when choosing a trading system or developing your own system, then definitely it would help you to become a consistent profitable trader.

• • •

Missing some Tweet in this thread? You can try to

force a refresh