16 FACTS PROVING THE CASE IS DOA

1) On February 8, 2012, @jespow & @JedMcCaleb received a legal opinion letter from Perkins Coie informing them if they sell #XRP to investors and use the money for operational costs, #XRP will likely be an investment contract aka, a security.👇

1) On February 8, 2012, @jespow & @JedMcCaleb received a legal opinion letter from Perkins Coie informing them if they sell #XRP to investors and use the money for operational costs, #XRP will likely be an investment contract aka, a security.👇

https://twitter.com/johnedeaton1/status/1498375803234574339

2) After receiving the above legal opinion letter, @chrislarsensf and Jed McCaleb scrap the old business model and instead seek VC funding for business operations. Investors will not receive #XRP, but instead, receive actual shares of stock in the company Ripple.

3) Larsen and McCaleb received a 2nd opinion from Perkins Coie on October 19, 2012. Based on the new business model, they are advised #XRP is most likely NOT a security.

The letter hints at risks related to Banking Secrecy Laws and being labeled a Money Services Business.👇

The letter hints at risks related to Banking Secrecy Laws and being labeled a Money Services Business.👇

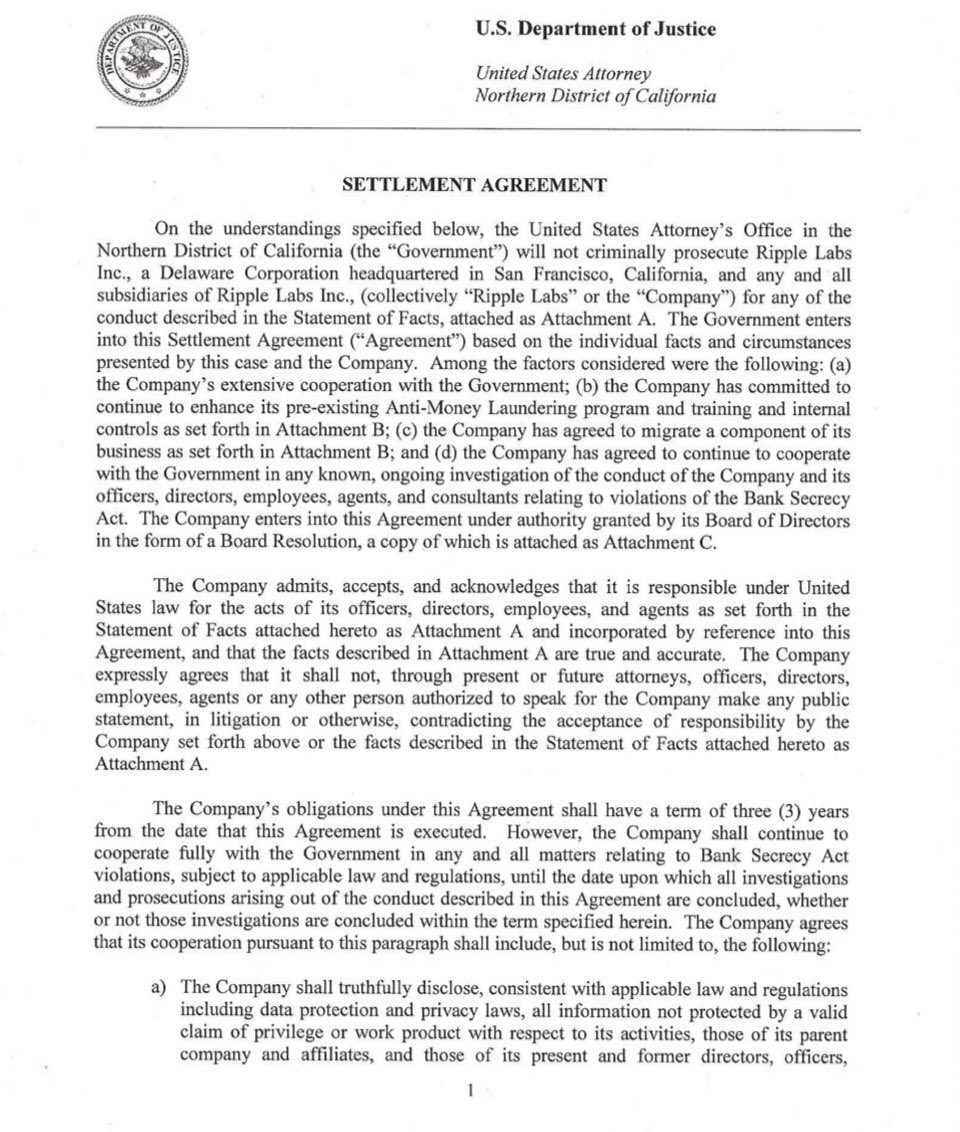

4) In 2015 Ripple was sued by FinCEN. Consistent with risks referenced in the legal memo, FinCEN declared a subsidiary of Ripple a Money Service Business and classified #XRP as:

“convertible virtual currency.”

Ripple settled for $700K and agreed to register sales w/ FinCEN.

“convertible virtual currency.”

Ripple settled for $700K and agreed to register sales w/ FinCEN.

Pursuant to the terms of the settlement w/ DOJ & FinCEN, Ripple agreed to register sales of #XRP ONLY through FinCEN. The agreement forces Ripple to comply with the Banking Laws of the United States - not securities laws. 👇

5) On June 13, 2018, SEC lawyers write ✍️ a legal memo analyzing w/r #XRP is a security and it DOES NOT recommend enforcement. Its clear the SEC’s own analysis did not conclude #XRP was a security. One, the SEC would turn the memo over. Two, they would’ve informed Ripple.

6) The June 14, 2018 Hinman Speech. The market absolutely viewed the speech as market guidance. Attorneys Nancy Wojtas & Wendy Moore participated in the SEC meetings and described its impact the best. If your platform is slightly more decentralized than #ETH, you’re free. 👇 👇

https://twitter.com/digitalassetbuy/status/1443162434156511232

In the clip above 👆 Wojtas said “if you can do just a little bit better than #ETH you’re golden.”

Perkins Coie lawyers helped write ✍️ the Hinman Speech and Wendy Moore, a lawyer from that firm, responded to Wojtas’ comment with:

“Then why isn’t Ripple?”

(Huge evidence)

Perkins Coie lawyers helped write ✍️ the Hinman Speech and Wendy Moore, a lawyer from that firm, responded to Wojtas’ comment with:

“Then why isn’t Ripple?”

(Huge evidence)

7) Because Hinman only blessed #BTC & #ETH in his speech, on August 20, 2018, @bgarlinghouse and @JoelKatz met with Clayton and Hinman to discuss #XRP. Brad informed them:

“Ripple is living in purgatory”

over #XRP’s lack of clarity.

“Ripple is living in purgatory”

over #XRP’s lack of clarity.

At this August 20, 2018 meeting neither Hinman nor Clayton informed Garlinghouse that they or the SEC considered #XRP a security.

It is absolutely fair to assume that if the SEC’s June 13, 2018 XRP Memo had concluded #XRP was a security, they would’ve informed Garlinghouse.

It is absolutely fair to assume that if the SEC’s June 13, 2018 XRP Memo had concluded #XRP was a security, they would’ve informed Garlinghouse.

8) The next month, September 2018, Garlinghouse met with Commissioner Elad Roisman. During this meeting, not only did Roisman NOT inform Brad that the SEC considered #XRP a security, Roisman made statements that gave Garlinghouse confidence that #XRP WASN’T viewed as a security.

Roisman’s lawyer (Estabrook) took notes 📝 during this meeting. Claiming privilege, the SEC refuses to turn over these notes. It should be noted, however, the SEC provided notes of other meetings between Garlinghouse and the SEC. The notes clearly corroborate Brad’s testimony.

9) The January 2019 @coinbase meeting w/ the SEC. Coinbase and its sophisticated securities lawyers informed the SEC they determined today’s XRP not to be a security and intended to list it unless the SEC disagreed. The SEC did not and XRP was listed on Coinbase in February 2019.

10) In June 2019 the SEC allowed Ripple to acquire a 9% stake of @MoneyGram. Ripple filed a notice w/ the SEC informing it about it’s intended use of #XRP and MG. In short, the SEC knew Ripple would transfer #XRP to MG, who would then sell it to retail holders via exchanges.

The SEC now claims the #XRP sold by MG to retail holders via exchanges are also sales of unregistered securities. (A totally absurd argument).

👇👇

👇👇

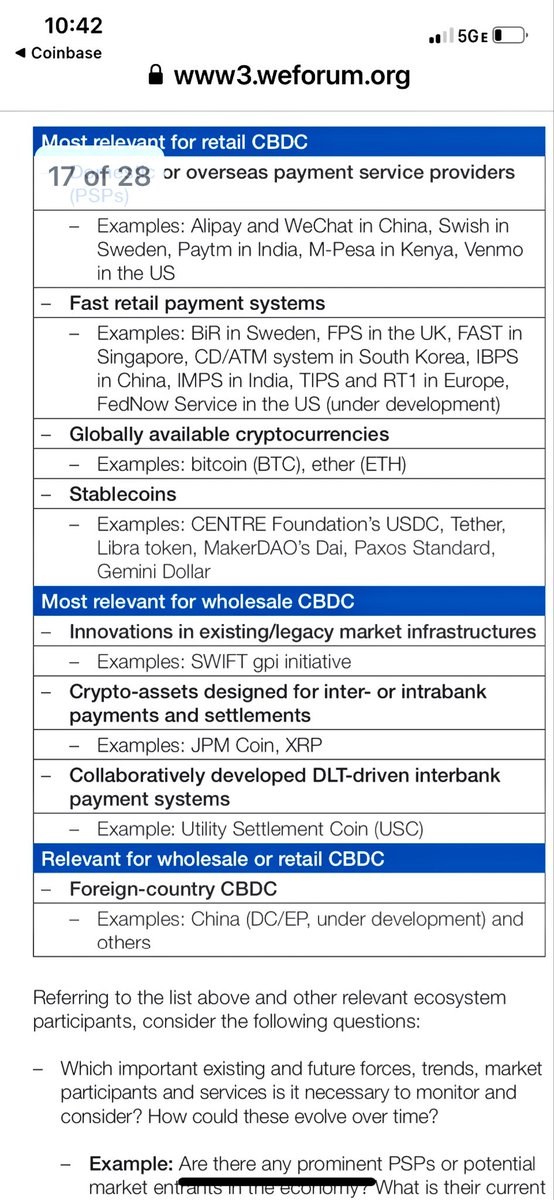

11) On December 4, 2019 the Financial Stability Oversight Council’s 2019 Annual Report is issued, which classifies #XRP a:

“currency.”

Clayton, as Chairman of the SEC, voted to approve the report and signed it.

👇👇

“currency.”

Clayton, as Chairman of the SEC, voted to approve the report and signed it.

👇👇

https://twitter.com/digperspectives/status/1450793119880990729

12) In January 2020 & 2021 (after the lawsuit was filed), Bailard Inc., a money manager business and perfect example of what a market participant believed, filed an ethics disclosure w/ the SEC.

Bailard assured the SEC it would only trade the cryptos generally accepted by the market and by the SEC as:

“currencies not subject to regulation by the SEC.”

The generally accepted currencies not regulated by the SEC are:

#BTC, #ETH, and #XRP.

👇👇

“currencies not subject to regulation by the SEC.”

The generally accepted currencies not regulated by the SEC are:

#BTC, #ETH, and #XRP.

👇👇

13) In October 2020, two months before Clayton filed the case on his last day, the SEC informed an #XRPHolder that the SEC had NOT made a determination that #XRP was a security.

This is more evidence that the June 13, 2018 XRP Memo was inconclusive at best.

👇👇

This is more evidence that the June 13, 2018 XRP Memo was inconclusive at best.

👇👇

https://twitter.com/frank14492100/status/1341988587471048704

14) The SEC claims all ongoing sales of #XRP are securities BUT didn’t issue a cease and desist against Co-founder McCaleb who has made over $2.6B in #XRP sales SINCE THE LAWSUIT WAS FILED.

McCaleb has made $1B more than the SEC seeks against Ripple!

👇

McCaleb has made $1B more than the SEC seeks against Ripple!

👇

15) Despite the absurd claim each and every sale of #XRP is illegal, the SEC failed to seek a preliminary injunction. If the SEC truly believed today’s #XRP is a security, would it allow Ripple to engage in ongoing sales of unregistered securities to help pay Ripple’s defense?

16) @bgarlinghouse & Ripple executives like @s_alderoty & @JoelKatz met w/ leaders of the SEC including the Chairman, Director of Corporation Finance, Commissioners, and others, multiple times & was NEVER informed XRP was a security except for a meeting just prior to the lawsuit.

I chose 16 facts off the top of my 👨🦲to prove the SEC can’t win this case - as alleged.

There’s a multitude of other evidence like @giancarloMKTS’s op-ed concluding #XRP IS NOT a security.👇

But the 16 facts👆, standing alone, should equal:

GAME OVER.

forbes.com/sites/michaeld…

There’s a multitude of other evidence like @giancarloMKTS’s op-ed concluding #XRP IS NOT a security.👇

But the 16 facts👆, standing alone, should equal:

GAME OVER.

forbes.com/sites/michaeld…

• • •

Missing some Tweet in this thread? You can try to

force a refresh