Good Day #Cosmonauts! If you aren't a #LUNAtic already, you might not have heard about @marsprotocol yet! $MARS is a borrowing and lending platform in the #Terra Ecosystem.

*Sips Coffee*

While diving into the Litepaper we decided a thread was in order!

1/20 🧵

*Sips Coffee*

While diving into the Litepaper we decided a thread was in order!

1/20 🧵

Mars Protocol

@mars_protocol

marsprotocol.io

Lending / Borrowing Protocol

Terra Blockchain

LUNA / UST (Potential for Any Collateral)

Mars is a borrowing and lending platform in the Terra ecosystem.

2/x

@mars_protocol

marsprotocol.io

Lending / Borrowing Protocol

Terra Blockchain

LUNA / UST (Potential for Any Collateral)

Mars is a borrowing and lending platform in the Terra ecosystem.

2/x

What makes $MARS unique compared to most protocols is the diversity of assets you can offer as collateral to borrow against.

In most lending protocols these are limited to a few tokens.

$MARS opens this up to any token on the #Terra Blockchain and potentially across #IBC.

3/x

In most lending protocols these are limited to a few tokens.

$MARS opens this up to any token on the #Terra Blockchain and potentially across #IBC.

3/x

These assets will begin with $LUNA and $UST, but can be developed through Governance.

4/x

4/x

“At launch, $Mars is currently expected to support $UST and $LUNA for lending and borrowing. Since Mars is asset-agnostic — able to support any CW20 or native #Terra asset — the community will then be able to propose further assets to be added.”

(Section 2A)

5/x

(Section 2A)

5/x

Mars protocol is being developed by

@Delphi_Digital

@ideocolab

@terra_money

Which are some heavy hitters to say the least.

6/x

@Delphi_Digital

@ideocolab

@terra_money

Which are some heavy hitters to say the least.

6/x

Mars also allows for the creation of smart contract loans which can be used to help build the liquidity and rewards of the Mars protocol as a whole.

These loans are separate from those used by normal consumers in the protocol who borrowing against collateral.

7/x

These loans are separate from those used by normal consumers in the protocol who borrowing against collateral.

7/x

The strategies used in this protocol involve leveraging and pose HIGH RISK!

To be fair, these are automated leveraging strategies that many DeFi Degens already employ.

Ensure you DYOR before diving into any borrowing or lending protocols as they involve rather High Risk.

8/x

To be fair, these are automated leveraging strategies that many DeFi Degens already employ.

Ensure you DYOR before diving into any borrowing or lending protocols as they involve rather High Risk.

8/x

Reactive interest rates:

A big advancement in Mars compared to other similar protocols is the way interest rates are decided.

On most lending platforms rates can only be changed through governance, but with Mars protocol it can be regulated by algorithms.

9/x

A big advancement in Mars compared to other similar protocols is the way interest rates are decided.

On most lending platforms rates can only be changed through governance, but with Mars protocol it can be regulated by algorithms.

9/x

The protocol will begin with a traditional structure with structured interest determined by Governance.

Later reactive interest can be implemented through Governance once the protocol has matured enough to support it.

10/x

Later reactive interest can be implemented through Governance once the protocol has matured enough to support it.

10/x

Tokenomics Theory:

“The guiding principle behind MARS’s token economics is that of skin in the game: those making decisions should bear the consequences of those decisions, both positive and negative.

11/x

“The guiding principle behind MARS’s token economics is that of skin in the game: those making decisions should bear the consequences of those decisions, both positive and negative.

11/x

In order to provide the Martian Council with an incentive to assume responsibility for governance failures, Mars:

12/x

12/x

(1) requires that members of the Martian Council stake their Mars to activate governance power;

and

13/x

and

13/x

(2) continuously routes a portion of fees generated by Mars to a Safety Fund which can be tapped by the Martian Council to compensate users for Shortfall Events attributable to governance failures.”

(Section 4A)

14/x

(Section 4A)

14/x

All decisions for the lending and borrowing protocol are decided by stakers of the $MARS TOKEN.

Mars will have a 7 Day Unstaking period, which is not at all bad in the #Cosmos ecosystem.

Voting will be 1:1 with 1 token equaling 1 vote.

15/x

Mars will have a 7 Day Unstaking period, which is not at all bad in the #Cosmos ecosystem.

Voting will be 1:1 with 1 token equaling 1 vote.

15/x

Mars stakers are paid a percentage of the on chain fees and borrowed interest payout from the protocol.

There is also a penalty for bad governance built into the protocol.

This should be read up on in the litepaper (Section E) and addressed as a potential for risk.

16/x

There is also a penalty for bad governance built into the protocol.

This should be read up on in the litepaper (Section E) and addressed as a potential for risk.

16/x

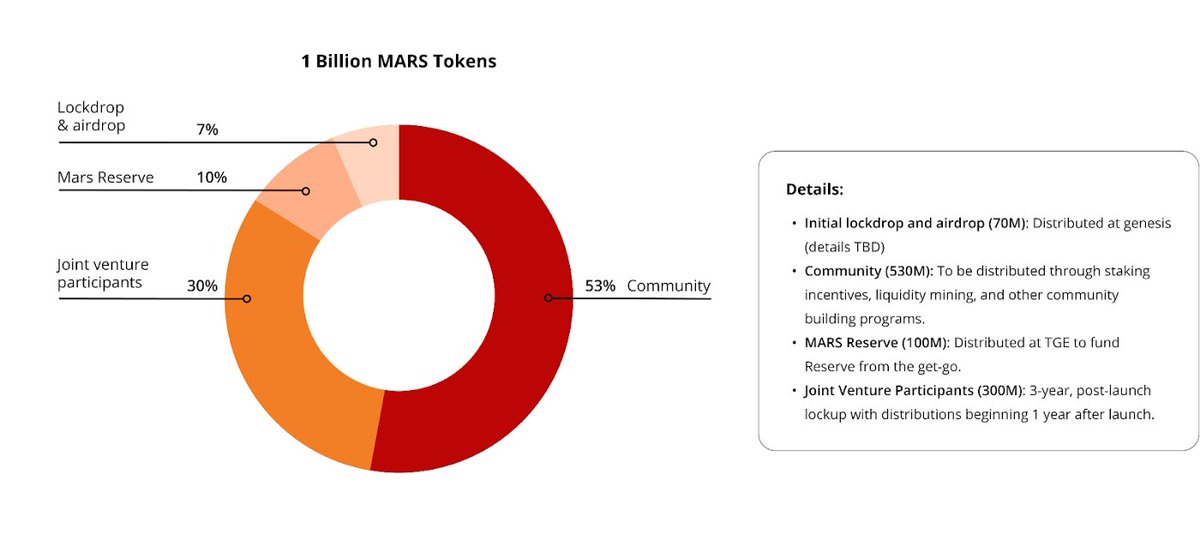

Tokenomics Distribution:

30% - 3 Year lockup w/ distributions starting after one year for the team and starting community.

10% - Mars Reserve

7% - Lockdrop / Airdrop

53% - Community Pool

17/x

30% - 3 Year lockup w/ distributions starting after one year for the team and starting community.

10% - Mars Reserve

7% - Lockdrop / Airdrop

53% - Community Pool

17/x

“As far as future plans go, Mars Protocol is a decentralized project; anyone can permissionlessly contribute to its development by making a proposal to the DAO.

18/x

18/x

Together, we aim to build the leading DeFi credit protocol; becoming the lender of choice for both consumers and dApps. We hope the vision we describe inspires teams across the space to join us and help contribute to Mars Protocol.”

19/x

19/x

If you found this Thread useful please Retweet the first tweet of this thread.

Keep up with the #Cosmos at TheCosmosCoffeehouse.com! ☕️

Support the Cosmos Coffeehouse and Grab some $LUNA Merch in the shop!

…e-cosmos-coffeehouse.myspreadshop.com

20/20

Keep up with the #Cosmos at TheCosmosCoffeehouse.com! ☕️

Support the Cosmos Coffeehouse and Grab some $LUNA Merch in the shop!

…e-cosmos-coffeehouse.myspreadshop.com

20/20

• • •

Missing some Tweet in this thread? You can try to

force a refresh