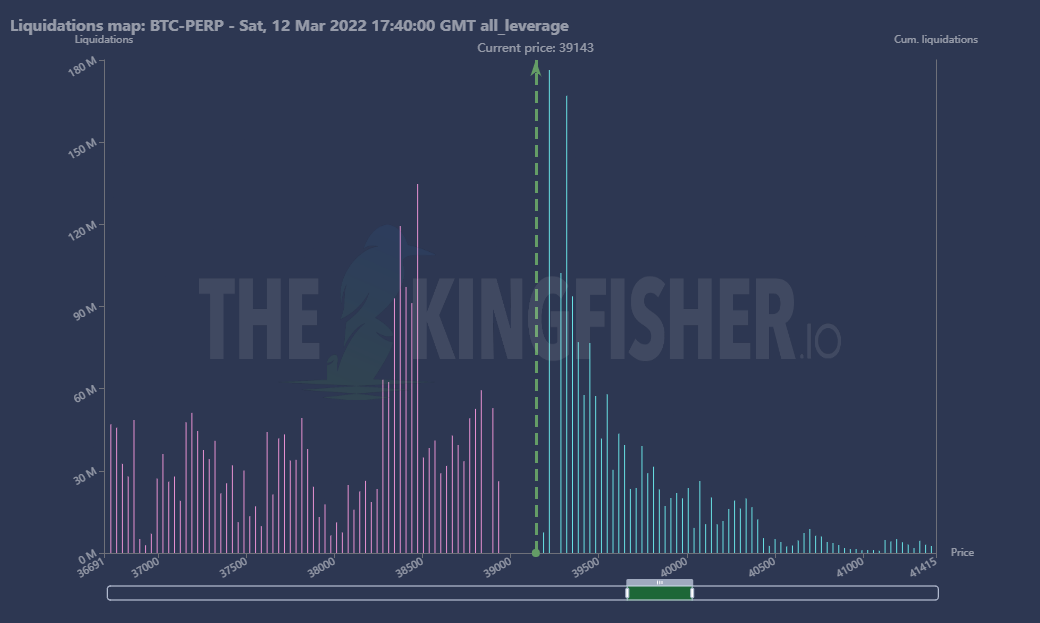

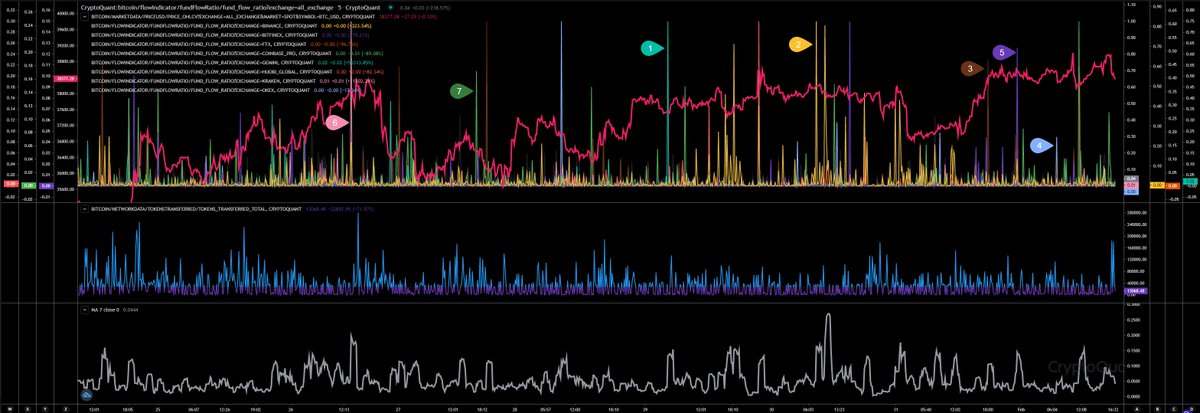

🚨Little update: Many longs just closed or liquidated, open interests declined, leverage ratio declined, funding rate dumped hard, but is almost neutral, we have CPI data release (volatility will rise!!) in almost 4 hours, big shorts liquidation cluster at 42k and

#BTC #ETH #XRP

#BTC #ETH #XRP

long liquidation cluster at 38.4k! Since we have reached our "local bottom" we can't detect any big flows, neither stablecoins nor #BTC spot. Whales ratio hourly maintains high level indicating sell pressure by whales.

Gamma dumped too. I would expect a pump and dump today again. Have closed my short already and will sit on my hands now until I see a solid trend.

Cipher is the only indicator I use sometimes just as last confirmation step. The indicator is imo the best you can get for free on tradingview. However, its pump and dump signals are very accurate, I would say 80% of times it was right. Checking the data, it looks today more

bullish than yesterday. Even then I wouldnt say its a solid trend, but then Cipher generated a huge pump signal. Because the last time we received such a pump signal was end of december and it was a high volatile period. Something I would also expect today. So, be careful and

adjust your risk management please! ❤️🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh