Aston Villa’s 2020/21 account covered a season when they finished 11th in the Premier League. The “rebuilding” of the club continued apace, following the arrival of owners Nassef Sawiris & Wes Edens in July 2018, despite the challenges posed by COVID. Some thoughts follow #AVFC

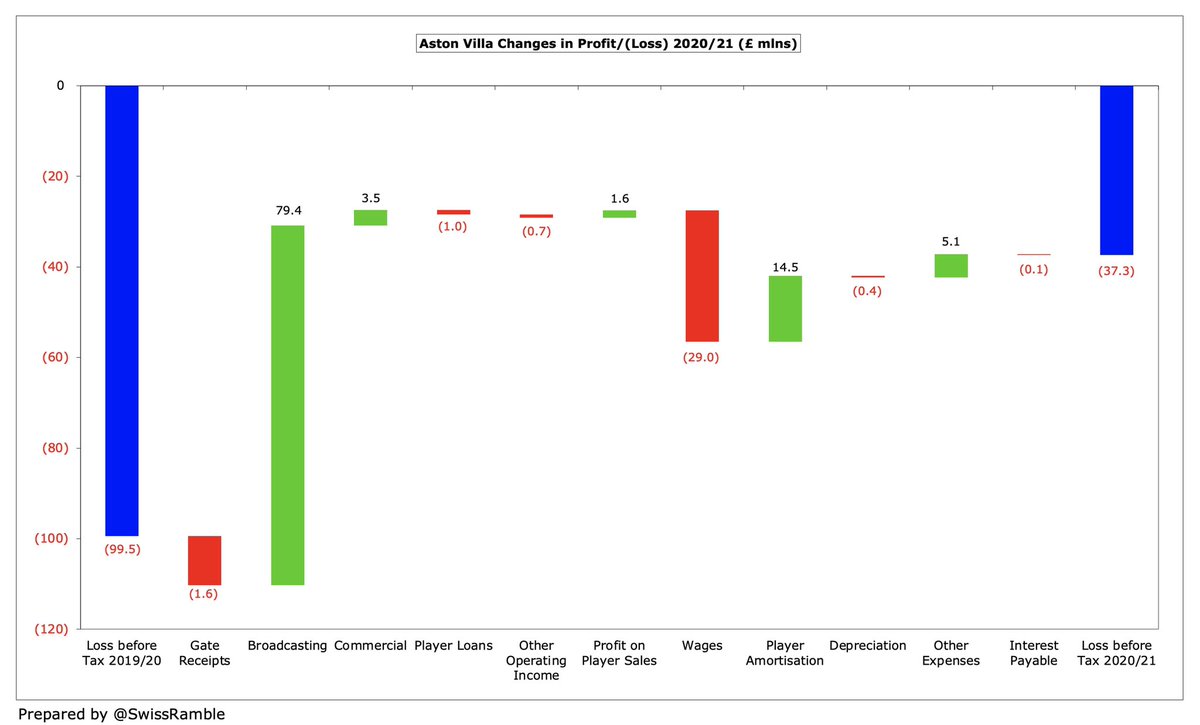

#AVFC pre-tax loss narrowed from £99m to £37m, as revenue rose £71m (63%) from £113m to club record £184m, though profit on player sales remained low at £1m. Investment in the squad increased operating expenses by £10m (5%).

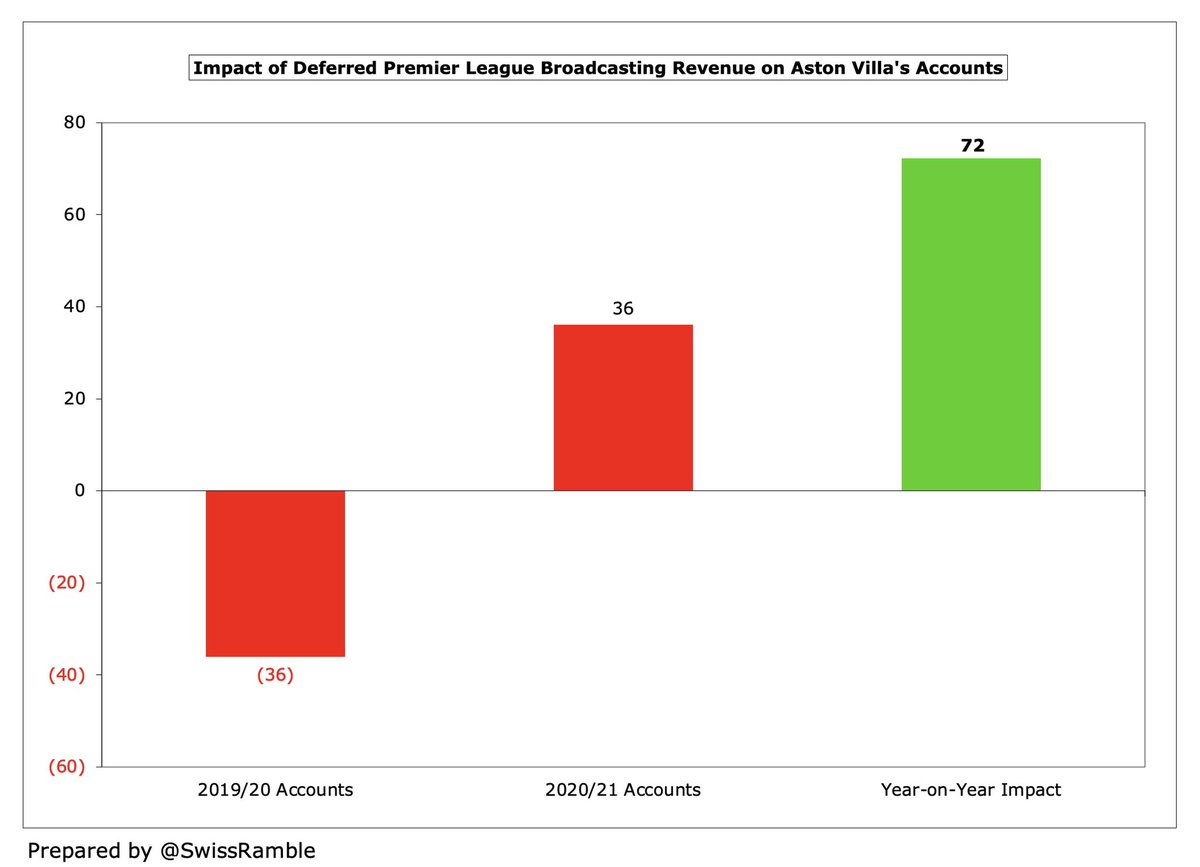

#AVFC broadcasting revenue more than doubled, rising £79m from £78m to £157m, mainly due to deferred money from 2019/20, which offset COVID driven reduction in match day, down £11m (97%) to just £311k. Commercial rose £3m (16%) to £25m, while player loans halved to £1m.

#AVFC wage bill rose £29m (27%) from £109m to £138m, but player amortisation fell £15m (21%) from £71m to £56m, while other expenses also decreased £5m (15%) to £29m, mainly due to the reduced cost of staging games.

While #AVFC £37m loss is obviously not great, the accounts were impacted by a full year of the pandemic, and others have reported much higher losses in 2020/21, e.g. #CFC £156m, #AFC £127m & #THFC £80m. #WWFC £145m profit is due to £127m owner loan write-off.

According to the club, COVID cost #AVFC £37m in 2020/21 (mainly match day £17m, broadcasting £8m, commercial £7m and player sales £6m), which gives a total of £56m lost over the last 2 years. Largely offset by £36m of TV money deferred from prior year accounts to 2020/21.

#AVFC only made £1.2m profit from player sales, albeit better than prior year £0.4m loss. Unsurprisingly, this is the worst player trading performance to date in 2020/21 PL, way below #MCFC £69m, #WWFC £61m and #LCFC £44m. The club blamed this on a “suppressed” transfer market.

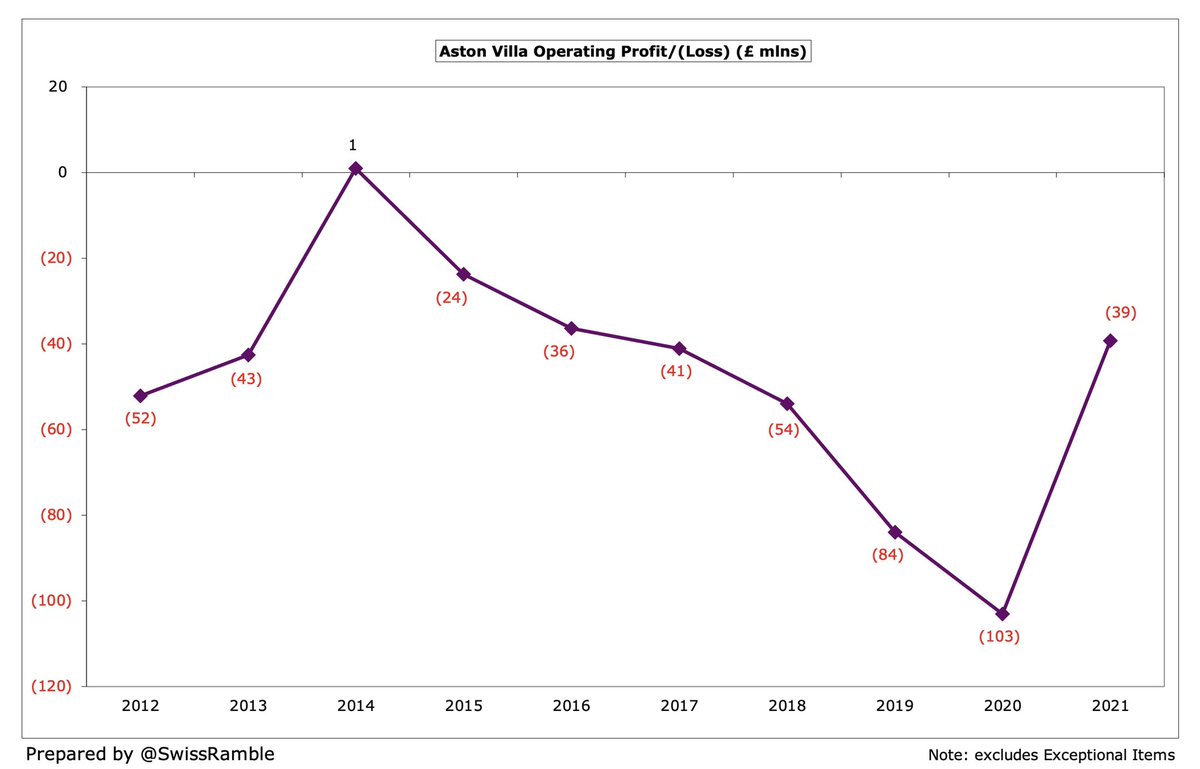

#AVFC have consistently lost money with their losses in the last decade adding up to a hefty £438m. In fact, in the 10 years up to 2020, Villa lost more money than any other club in the Premier League. Their 2019/20 £99m loss was the 10th highest ever in the top flight.

#AVFC bottom line has often been impacted by exceptional items. For example, 2019 benefited from £36m stadium sale profit and £14m HS2 compensation, but was adversely hit by £46m promotion payments: £16m bonuses and £30m to former owner, Randy Lerner, after Xia defaulted.

#AVFC had been poor at generating money from player sales, only making £1m gain in last 2 years, while profit had steadily been steadily declining since 2016, but that dramatically changed last summer with Jack Grealish’s £100m sale to #MCFC (pure profit as he was from academy).

#AVFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £(30)m to £20m, mid-table in the Premier League, but far below #MCFC £116m, #MUFC £95m and #THFC £95m.

#AVFC operating loss (i.e. excluding player sales and interest) narrowed from £103m to £39m, the club’s best for 5 years. Very few clubs deliver operating profits, while some have huge losses, e.g. #CFC £159m, #AFC £91m, #LCFC £66m, #THFC £60m and #MCFC £59m in 2020/21.

Despite the adverse impact of the pandemic, #AVFC revenue has still increased by £130m from £54m to £184m since promotion from the Championship two years ago, very largely due to higher broadcasting income, thanks to the far more lucrative TV deal in the Premier League.

Even after the significant revenue growth, #AVFC £184m revenue is only mid-table in the Premier League, just behind #WWFC £194m and #WHUFC £193m in 2020/21. To place that into perspective, it’s less than a third of #MCFC £570m, and more than £300m below #MUFC £494m & #LFC £487m.

#AVFC broadcasting income more than doubled, rising £79m from £78m to £157m, mainly due to revenue from games deferred from 2019/20 and higher merit payment (11th place vs 17th), partly offset by PL reductions (broadcasters’ rebates). Easily a club record for this revenue stream.

As 2019/20 season was extended, £36m revenue was booked in 2020/21 accounts. driving £72m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs like #AVFC with May year-end had largest revenue deferrals, while those with a July close had nothing deferred.

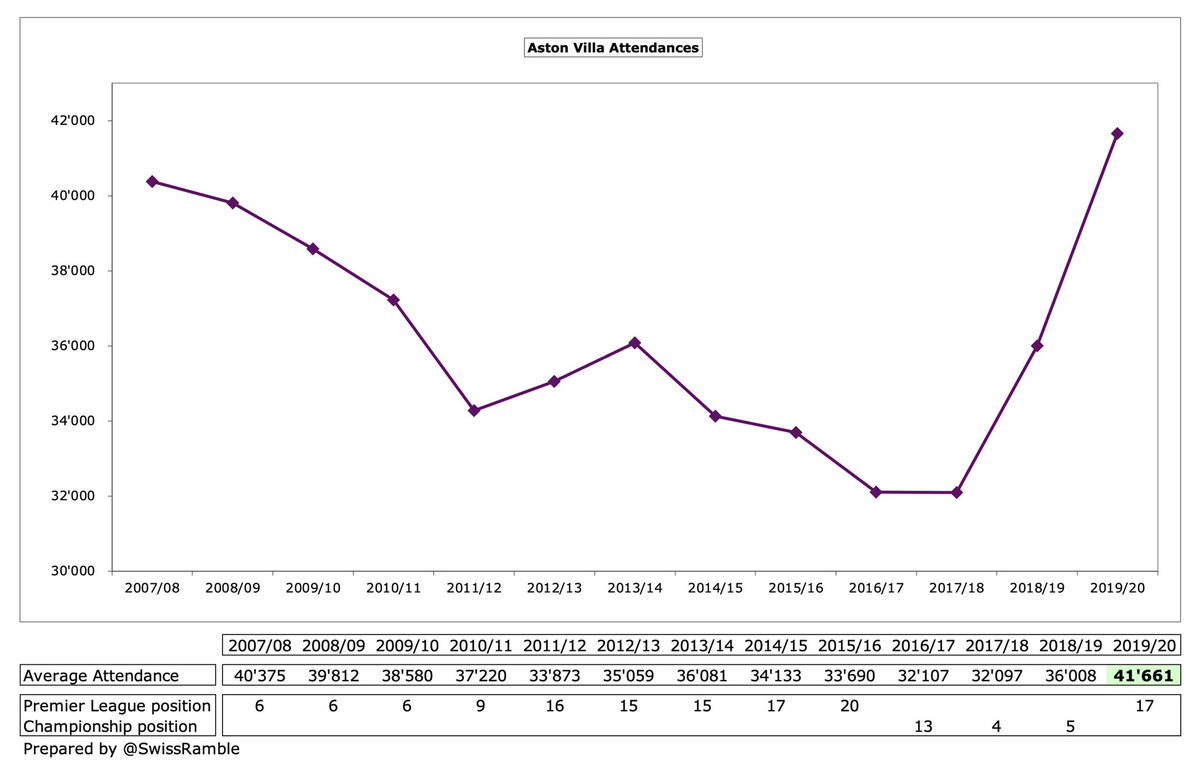

#AVFC gate receipts fell £11m (97%) to just £311k, as all home games were played behind closed doors (except one with restricted capacity). Peaked at £14m in 2015, which is in the bottom half of the PL, far below #THFC estimated £122m post-COVID, due to their new stadium.

#AVFC 2019/20 average attendance of 41,661 (for games played with fans), up from around 32,000 in the Championship, was the 9th highest in the Premier League, just above #CFC 40,563. Villa have 20,000 fans on their season ticket waiting list.

#AVFC have produced designs to increase capacity at Villa Park to 50,000 (after first phase), including building a new North Stand and modernising retail, merchandising and entertainment facilities. This would help boost both match day and commercial revenue.

#AVFC commercial income rose £3m (16%) to £25m, mainly due to sponsorship, up £4m (38%) to £14m, but this remains in the bottom half of the Premier League. This revenue stream has grown four years in a row, but still lower than the club’s £28m peak in 2016.

In 2020/21 car retailer Cazoo replaced W88 as #AVFC shirt sponsor in a 2-year deal, reportedly worth £7m a year. Kappa’s 3-year kit supplier deal is due to expire in 2002 with rumours that they will be succeeded by Castore. OB Sports is this season’s sleeve sponsor.

#AVFC other operating income fell from £3.2m to £2.5m. 2020/21 was for a business interruption insurance claim, while prior year was mainly due to land compensation (for the high-speed rail network). #CFC £12.6m was mainly due to unexplained recharges.

#AVFC wage bill rose £29m (27%) from £109m to £138m, as club invested in the first-team squad, which means that wages have more than doubled from £61m in 2017 for a new club record.

Following the increase, #AVFC wage bill of £138m was 10th highest in the Premier League, more or less in line with their league finish. Almost exactly the same as #WWFC £139m and ahead of #WHUFC £129m, but a fair way below #LCFC £192m.

#AVFC wages to turnover ratio decreased (improved) from 97% to 75%, the lowest since 2015. Mid-table in the Premier League, slightly better than #CFC 77%, though above UEFA’s recommended upper 70% limit.

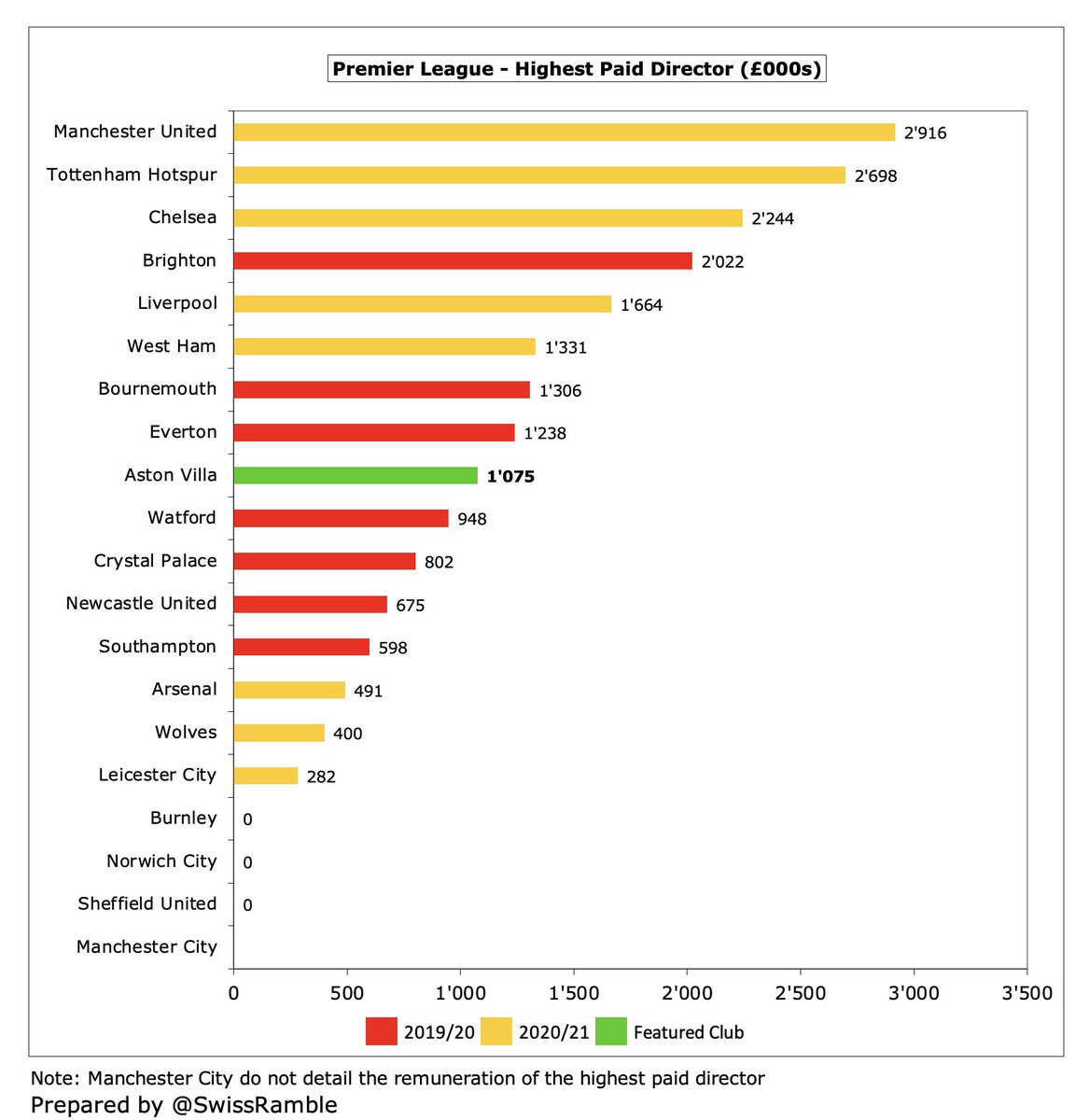

#AVFC highest paid director’s remuneration dropped 30% from £1.5m to £1.1m, presumably for chief executive Christian Purslow. That’s not too shabby, but in fairness it’s much less than Ed Woodward #MUFC and Daniel Levy #THFC, who earned £2.9m and £2.7m respectively.

#AVFC player amortisation, the annual charge to expense transfer fees over a player’s contract, fell £15m (21%) from £71m to £56m, 12th highest in the top flight, despite significant investment in the squad. Prior years’ huge rise from £26m to £71m is difficult to explain.

#AVFC spent £101m on player purchases, including Ollie Watkins, Bertrand Traoré, Emi Martinez, Morgan Sanson and Matty Cash. Not far behind #THFC £110m, #AFC £115m and #MUFC £116m in 2020/21.

#AVFC have really ramped up player investment, averaging £129m in the last two seasons, compared to just £32m in the preceding 8-year period. Spent another £141m after these accounts, which means they have splashed out nearly £400m since promotion.

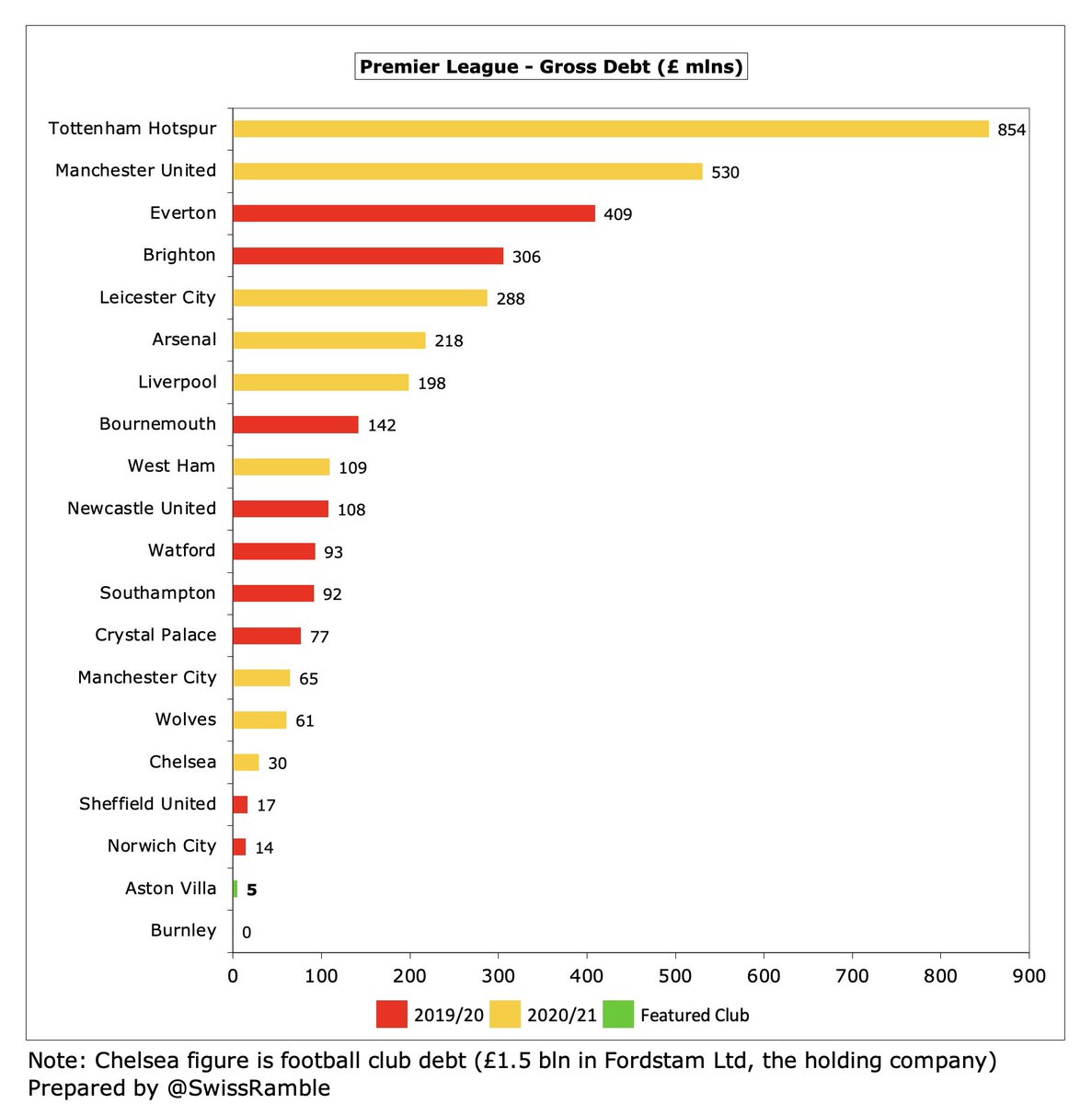

#AVFC have only £5m gross debt, all owed to group undertakings. cut from £50m four years ago, as the new owners have repaid old loans. In fact, debt has massively reduced from the £190m high in 2013 following £90m loan waiver and £85m conversion into equity.

#AVFC tiny debt is in stark contrast to many clubs in the Premier League, e.g. six owe more than £200m: #THFC £854m, #MUFC £530m, #EFC £409m, #BHAFC £306m, #LCFC £288m and #AFC £218m (mostly for stadium/training ground development).

Consequently, #AVFC paid almost no interest, which gives them a competitive advantage against many other clubs who have to pay interest on their loans, e.g. AFC £34m (mainly a debt refinancing break fee), #MUFC £21m and #THFC £18m.

#AVFC don’t separately report transfer debt, but assuming 90% of Trade Creditors, this rose from £62m to £73m, though still on the low side for Premier League, e.g. #THFC £170m. Owed £8m transfer fees by other clubs, so net payable is £65m.

#AVFC £39m operating loss was improved to £1m negative cash flow by £59m amortisation/depreciation, offset by £20m working capital moves. Spent £86m on players (purchases £90m, sales £4m) and £4m on infrastructure. Funded by £97m capital from owners, giving £7m net cash inflow.

As a result, #AVFC cash balance increased from £13m to £20m. This is on the low side for a Premier League club, e.g. #THFC and #MUFC have £148m and £111m respectively, but NSWE have confirmed their support.

In the last 10 years #AVFC owners (old and new) have provided over half a billion of funding (share capital £421m plus loans £85m). This has largely been spent on players (net) £272m, covering operating losses £153m and infrastructure investment £46m.

There is little doubt that Sawiris and Edens have “put their money where their mouth is”, as the owners have injected £399m capital since their arrival. The previous owners were also no slouches with £155m funding between 2012 and 2017.

In fact, over the 10 years up to 2020 only #MCFC and #CFC put in more money than the #AVFC owners. Furthermore, in the 5 years up to 2020 Villa were only surpassed by #EFC in terms of owner financing.

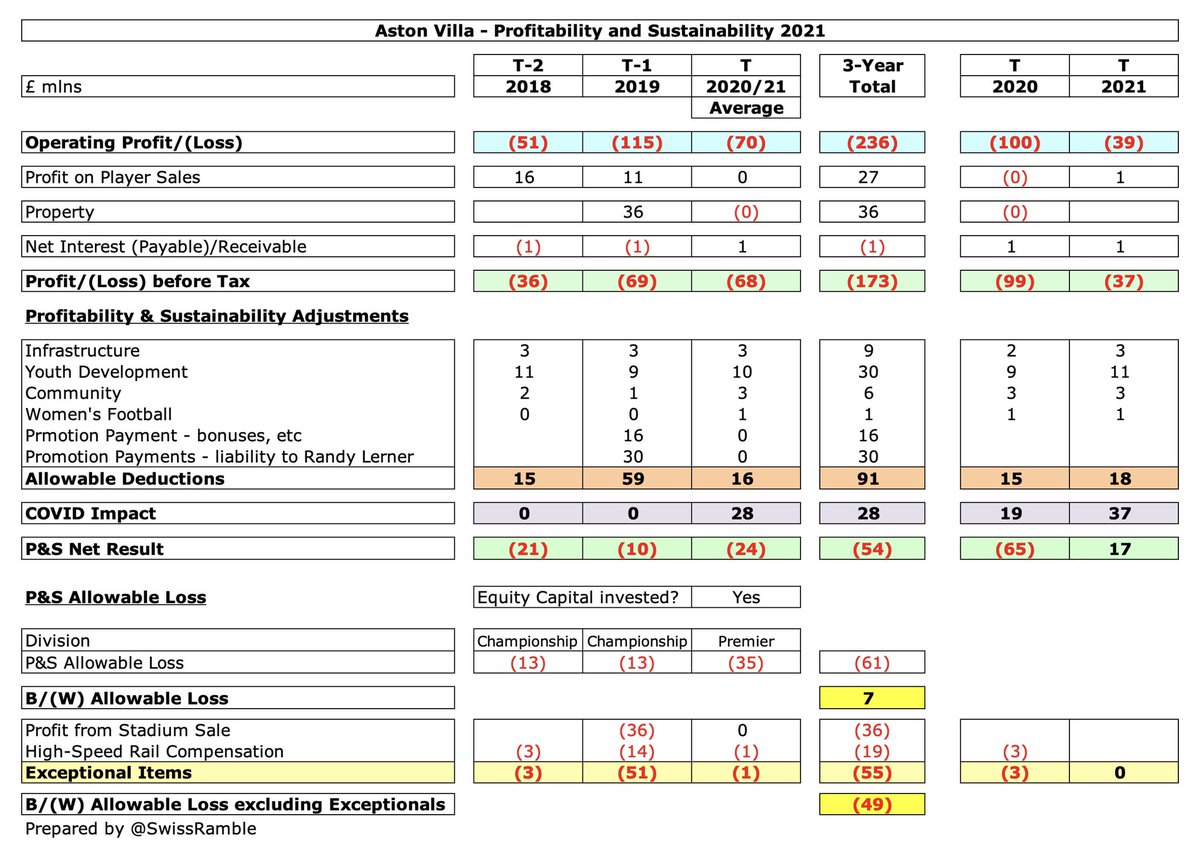

Despite the large losses, my calculations suggest that #AVFC are just about compliant with Profitability & Sustainability rules, thanks to allowable deductions (notably the academy and promotion bonuses), COVID impact and averaging 2019/20 and 2020/21 seasons.

While #AVFC continue to rely on the owners’ financial support, the turnaround in the club’s outlook has been striking, considering the awful situation they inherited from Tony Xia in 2018, when Villa were perilously close to entering administration.

#AVFC stated plan is “to develop, recruit and secure talented young players on long-term contracts to build asset value in our playing squad and to ensure long term sustainability”. There’s a long way to go, but there have been some encouraging signs under Steven Gerrard.

• • •

Missing some Tweet in this thread? You can try to

force a refresh