“The only thing that we learn from history is that we learn nothing from history.”

- Hegel

- Hegel

https://twitter.com/gamesblazer06/status/1502423621846798337

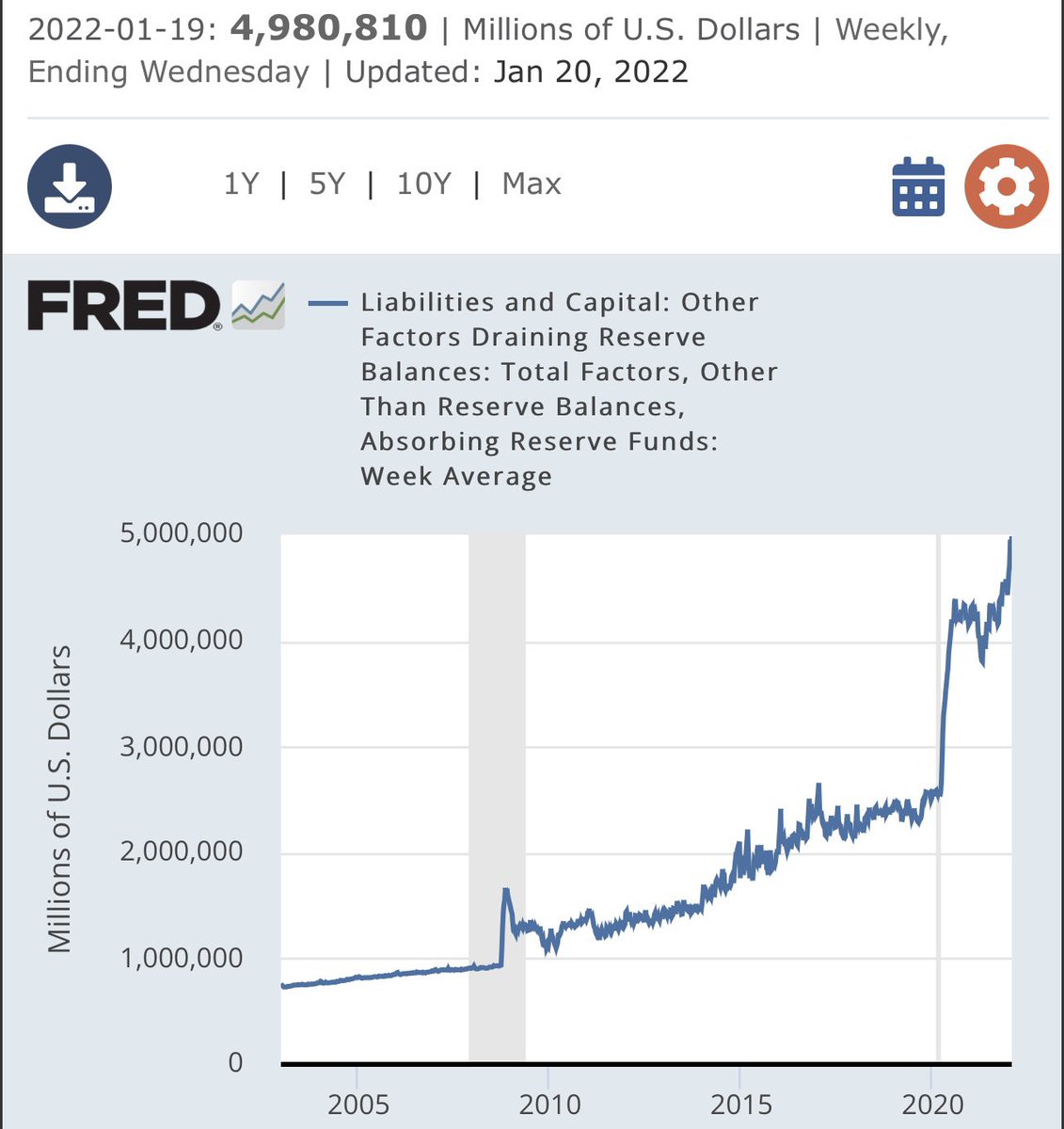

Hate to break it to some of these Perma Bears… but the Fed hasn’t run out of Bullets to fight inflation… they can continue to Hike rates & slow down QE or even step up RRP cash disbursements that make the Banking system even more ridiculously liquid.

The act of liquifying Banks in a Post Basel III & Gold Plated (including CCAR etc) world.. & creating M2 doesn’t in & of itself create inflation.. the Regulatory framework pushes money out of Banks on Supply side when it meets an optimal demand function. $XLF #Reflation

All those XS deposits are locked by Basel III LCR & Gold Plated RLAP… on Bank Cash flow statements… & Capital governs Sheet deployment… all the excess is just in HQLA & it’s release is fine tuned by a multitude of Regulations that are the true Money Supply Fulcrum.

• • •

Missing some Tweet in this thread? You can try to

force a refresh