From most recent peak:

$XLF -7.5%

$QQQ -13%

YTD:

$HYG -1.8%

$XLF: -2.1%

$LQD -2.7%

$QQQ: -12%

$BKLN Flat

$XLF -7.5%

$QQQ -13%

YTD:

$HYG -1.8%

$XLF: -2.1%

$LQD -2.7%

$QQQ: -12%

$BKLN Flat

Let’s convert that into Recession Odds… They are well inside of 7%. Admittedly, the odds are higher than dying of Covid, but still relatively low.

$XLF #Reflation

$XLF #Reflation

10Y3M Curve is The Curve that matters 2Banks…none of them Fund at the 2 Year Point.. now more so than ever with Fed Basel III + RRP & SRF etc…

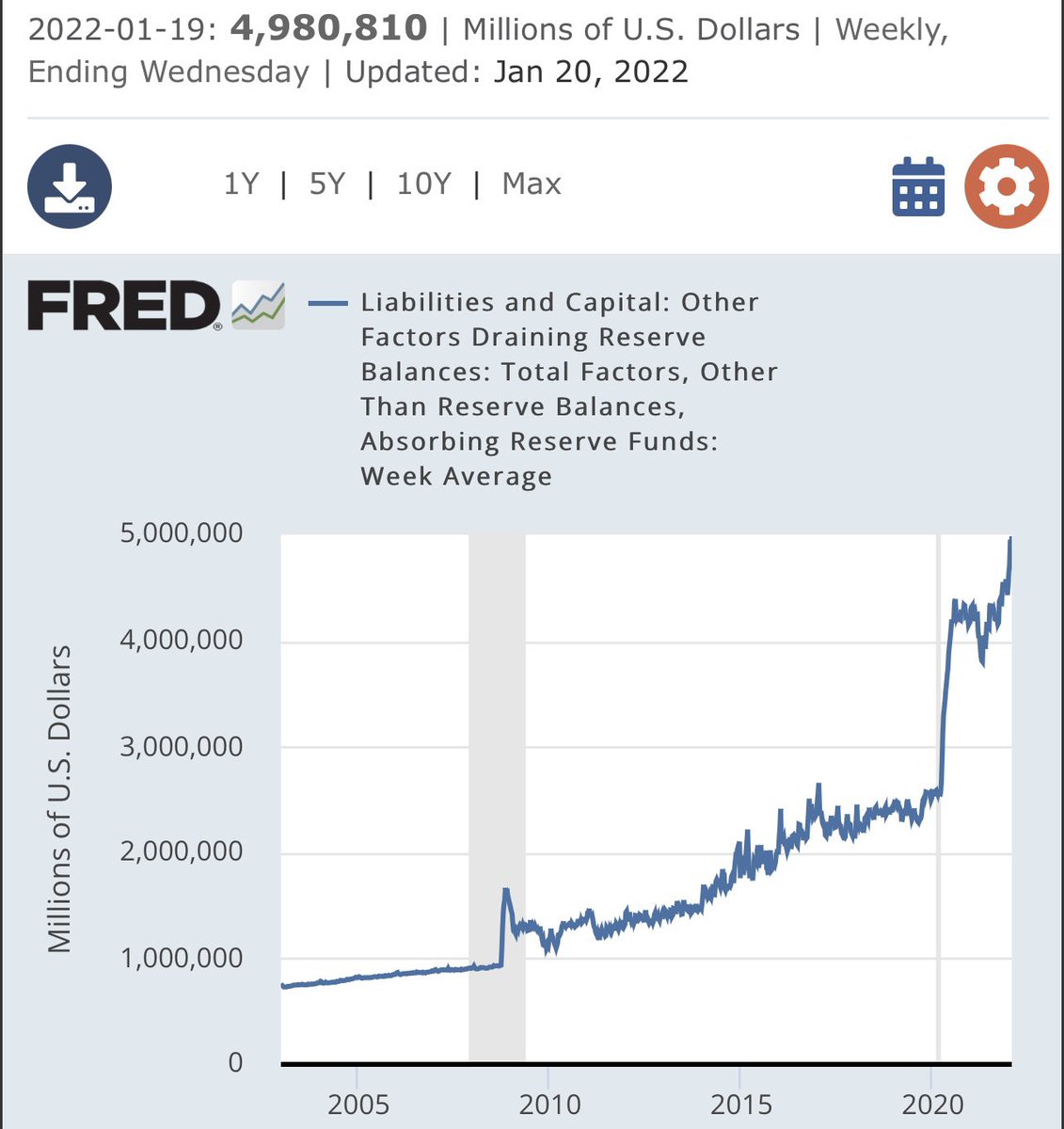

There’s V high likelihood we end up w Multiple Rate Hikes in 2022 w still a Ton of #Liquidity in the Markets…

$XLF #Reflation

There’s V high likelihood we end up w Multiple Rate Hikes in 2022 w still a Ton of #Liquidity in the Markets…

$XLF #Reflation

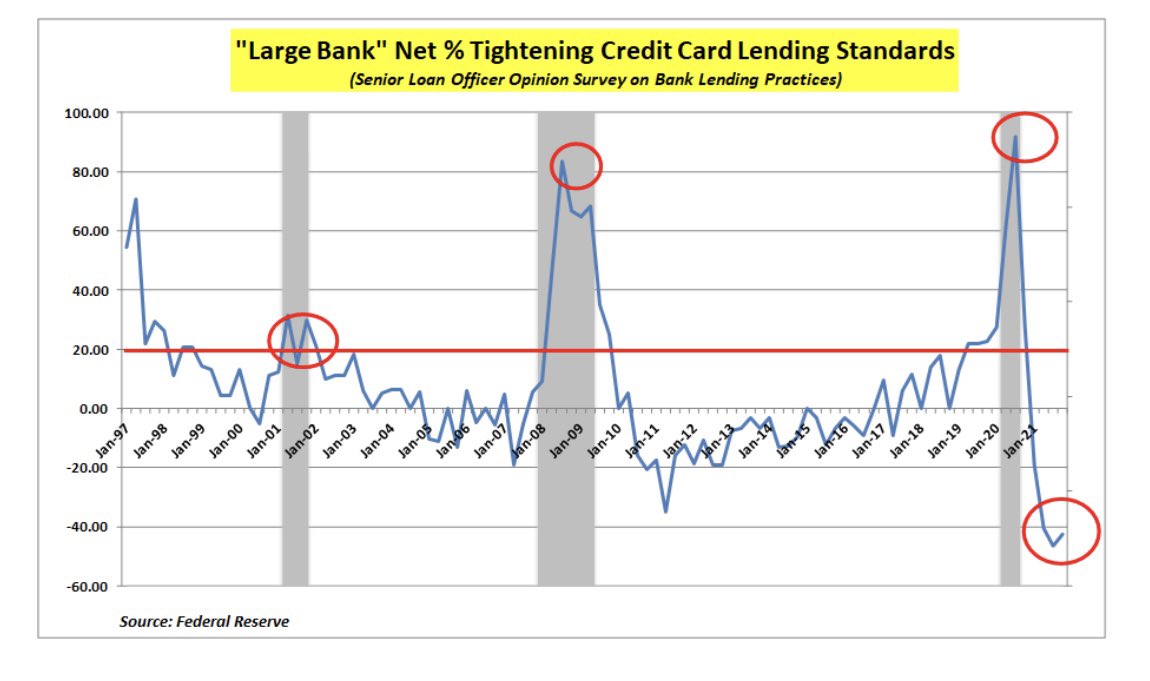

Recessions odds usually are dependent on Bank Lending (Credit based system)….so 2 year selling off says Hike Odds rising with OIS… take it FWIW

$XLF #Reflation

$XLF #Reflation

Unlike Potter, Lorie Logan gets $DXY Liquidity.. As the Fed IORB Floor rises.. liquidity is gonna move from Fed RRP to Bank Deposits that should continue to Steepen the Real Curve that matters.. As NIM/NII rise… should increase incentive to lend on a Risk Adjusted basis $XLF

….these Steepening Incentives are being induced at the exact same time as Inventory is at Trough for C&I (Demand picking up) as well as on the Consumer side (as Stimmy wanes) on Card loans.. Monetary Aggs Rise pushing inflation Higher & $ZROZ lower on improving fundamentals.

The system is already flush w liquidity w Sub 60% loan/deposit ratio & mid 40s for GSIBs… so incremental liquidity & capital deployment should go into the Real economy/loans…means their excess $DXY has no real $ZROZ bid… adds a -Ve Technical that self reinforces Steepening.

Let’s say even “if” 10Y3M flattens a bit…. Coz of IORB Hikes.. $XLF is still gonna lend more coz 75% of NII is levered to the Front End of the Curve & 25% to Back End…& we are at Trough Inventory… should push inflation higher as well as growth for the next 12-18 month imho.

Credit Cycles don’t End on these Financial Conditions…They Begin.

The Mkt lathered up by higher $XLF Compensation…relating 2 transient & slower Operating Leverage coz ironically Reserves Releases r slowing (the GAAP thing they hated in ‘21) as a driver of Contribution Margins.

The Mkt lathered up by higher $XLF Compensation…relating 2 transient & slower Operating Leverage coz ironically Reserves Releases r slowing (the GAAP thing they hated in ‘21) as a driver of Contribution Margins.

… but once IORB rate hikes get going… they should easily pay for higher Comp expense… & FinTech expenses should slow (as #TechPetrocks get deflated by IORB Hikes)…& u r left with the ability to grow your Loan Book with IORB Hikes with Lagging Deposit Betas..

$XLF #Reflation

$XLF #Reflation

The beauty of investing in $XLF is the ability to pass through inflation to customers via Loans (Volume) & Rates (Price) with Lagging Deposit Betas that rarely ever peak above 50%…people pay up for that (Higher P/Es over time)

$ZROZ can’t… they drill a hole in ur wallet.

$ZROZ can’t… they drill a hole in ur wallet.

This is why over time $XLF Real P/Es kill $ZROZ (#TrainWreck)

Real P/Es expand in Inflation for $XLF

Real P/E Multiples = 1/[(cost of equity) + (1-Inflation Flow Through Rate)*Inflation Rate)]

Real P/Es expand in Inflation for $XLF

Real P/E Multiples = 1/[(cost of equity) + (1-Inflation Flow Through Rate)*Inflation Rate)]

& Equity Risk Premium can be expressed as an Earnings Yield or a P/E.. 10 Year trades at a P/E of 57x v $XLF at ~14x…showing that $ZROZ are Rich v $XLF who’s Real P/Es actually can rise at Banks as Bond P/Es get pushed down… some other sectors… not so much like #TechPetrocks

Very few sectors are like $XLF & have a hugely positive “Inflation Flow Through Rate” $XLE as well… which is why their Real P/Es generally expand over time with Inflation… conversely both sectors hate Deflation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh