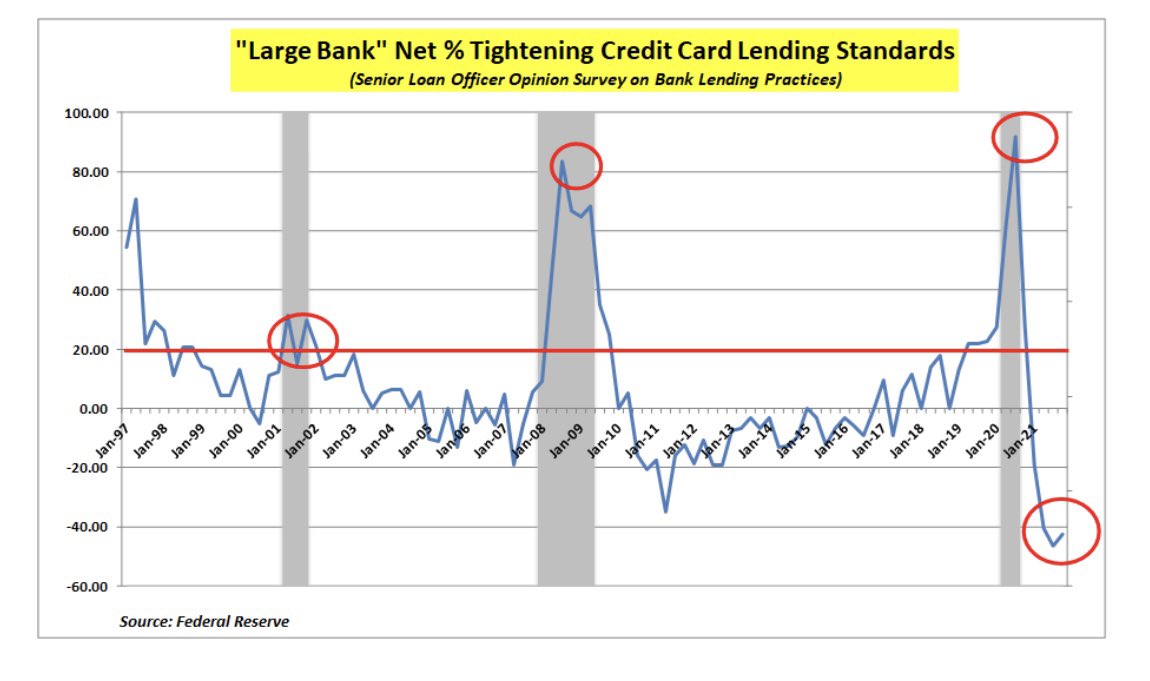

U nailed it imho….first thing people do is go back to the last episode (2018-2020) w/o a good understanding of the changing contextual backdrop as well as QT mitigants that are currently in place & evolving further.

$XLF #Reflation

$XLF #Reflation

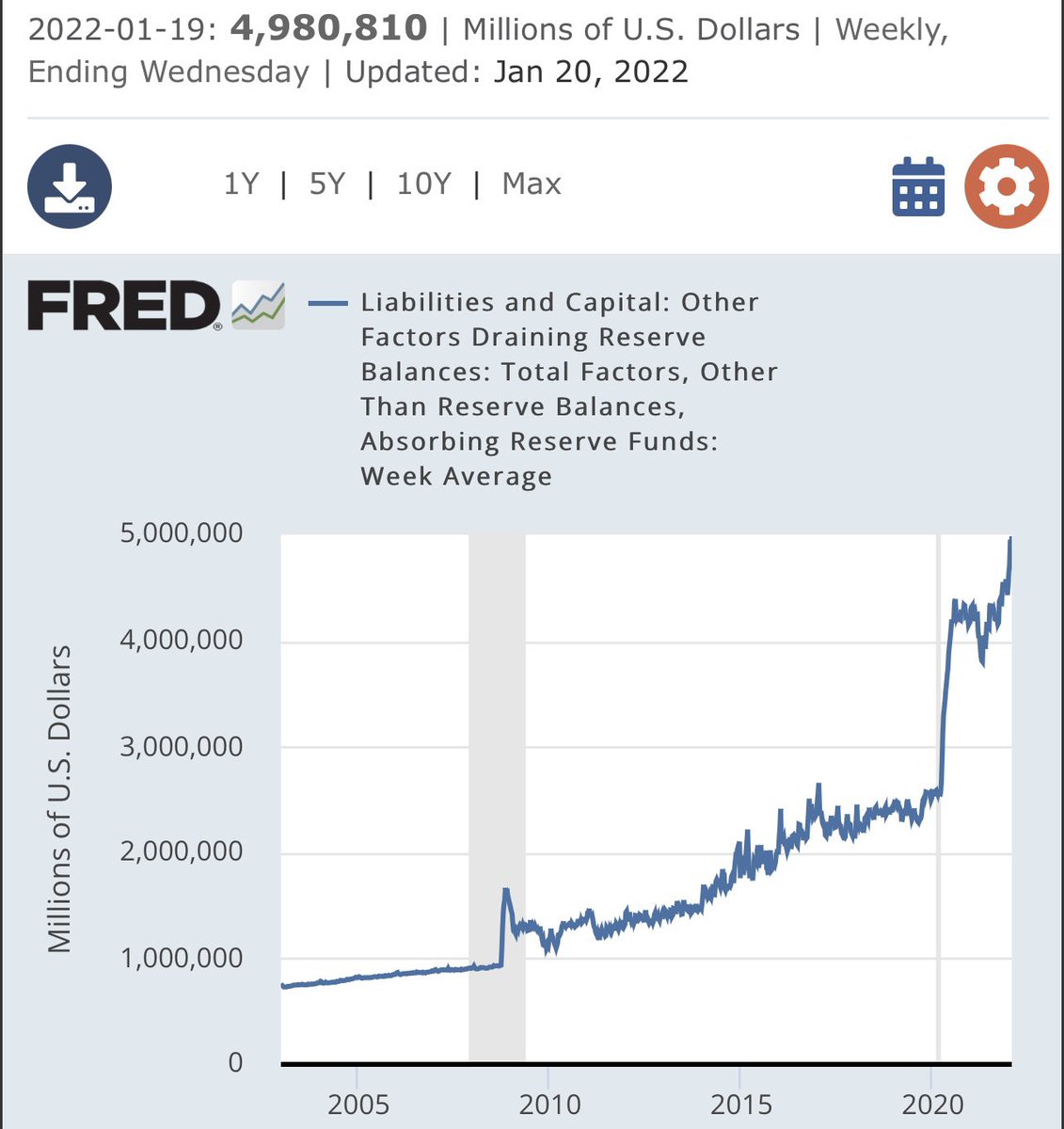

Another big time clue imho… $BAC did a 4.5% Pref Issuance a few days ago… if that ain’t a sign the Market has too much liquidity not sure what is….

$XLF #Reflation

$XLF #Reflation

Conclusion:

Inter-Bank Credit Risk is Declining Despite OIS/LIBOR Ripping with Multiple Rate Hikes getting priced in… to fight Unhinged Right Tail Inflation. The Fed is “Repairing” stuff not “Breaking” it with Rate Hikes… notwithstanding #TechPetrocks

$XLF #Reflation

Inter-Bank Credit Risk is Declining Despite OIS/LIBOR Ripping with Multiple Rate Hikes getting priced in… to fight Unhinged Right Tail Inflation. The Fed is “Repairing” stuff not “Breaking” it with Rate Hikes… notwithstanding #TechPetrocks

$XLF #Reflation

• • •

Missing some Tweet in this thread? You can try to

force a refresh