The question for Investors (longer term horizon) is when do you sell $XLF ?

The answer is when Deposit Betas finally catch up to ~50% or 10Y3M Inverts Investors start to Pay Less & Less for every $1 of earnings power (driven by the Flow Through Rate of Inflation)….

The answer is when Deposit Betas finally catch up to ~50% or 10Y3M Inverts Investors start to Pay Less & Less for every $1 of earnings power (driven by the Flow Through Rate of Inflation)….

https://twitter.com/gamesblazer06/status/1265787113426968576

Long Term “Investors” who respect the Credit Cycle Started selling $XLF at the Peak of Price/TBV on $BKX in Jan 2018 at 2.1x & also long $ZROZ …as Deposit Betas were Peaking + Cyclicals/Commodity stocks like $CAT etc..

The other natural question that should pop up is…well if the Taper is coming & BKX is 1.8x…why shouldn’t 1 sell now? Won’t the Fed kill the Cycle w QT.. why on earth would 1 wait around… after doubling/tripling money from the March 20 bottom.. why wouldn’t 1 crystallize gains?

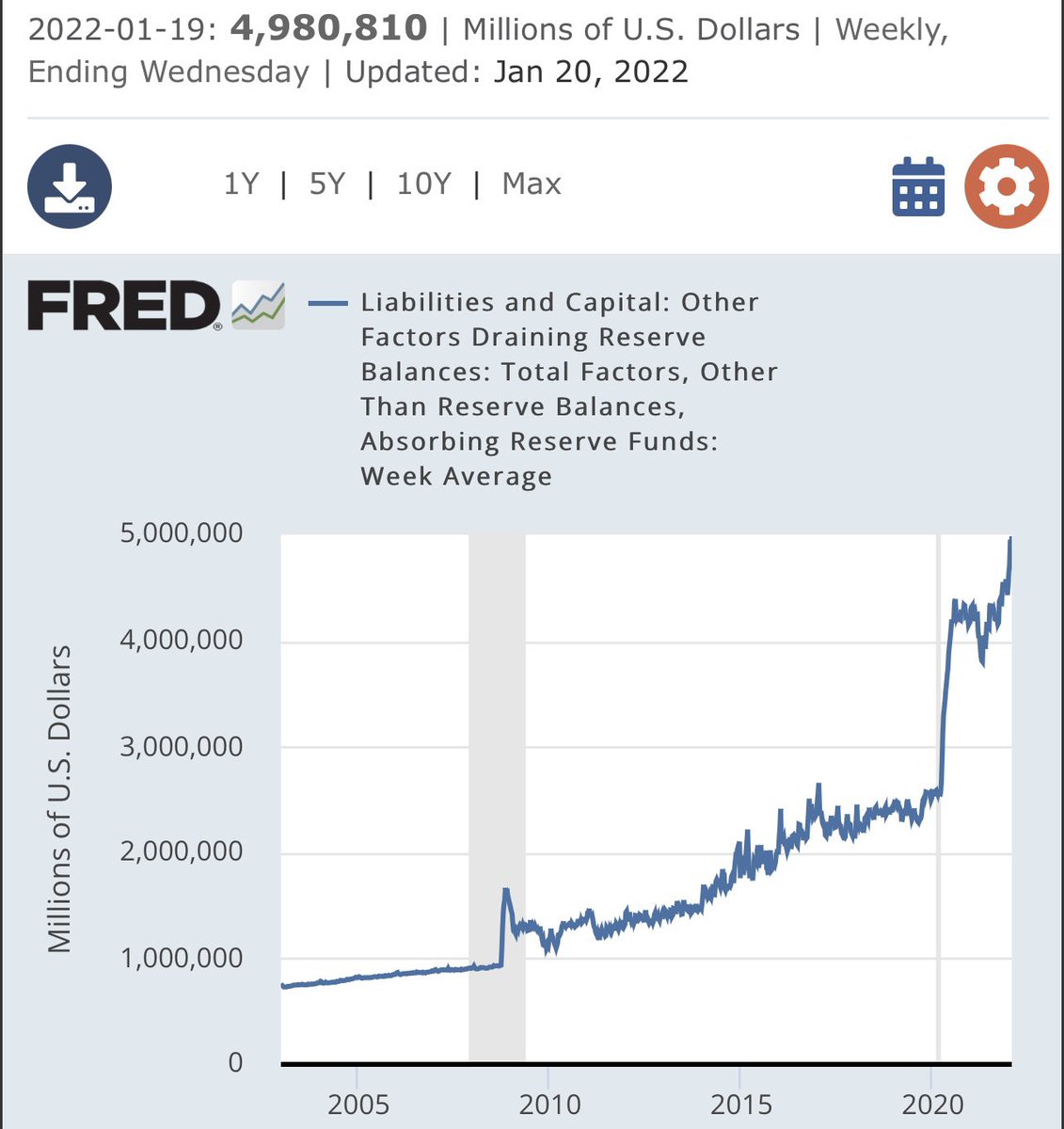

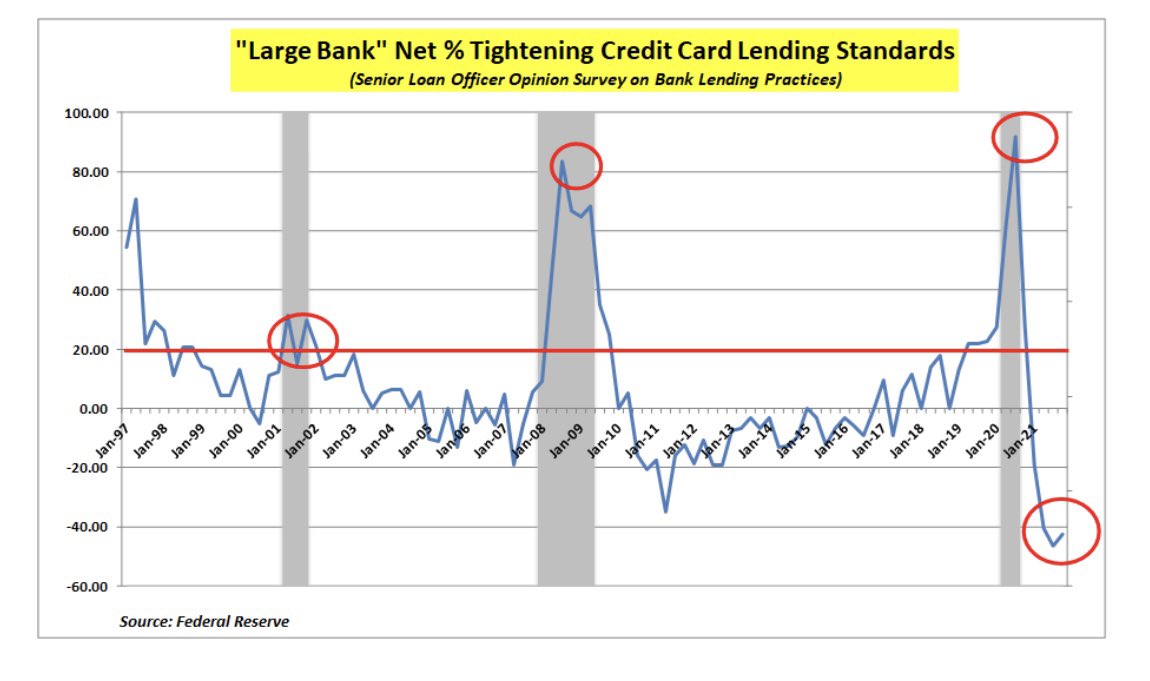

Imho answer is that we got to 1.8x TBV on BKX with v #EarlyCycle conditions (see previous thread) & Fed isn’t gonna Invert the Curve this year.. Commodities, Copper, Junk CCC Credit, Loan Credit.. all are acknowledging this with 10Y3M.. & we r still at ZIRP & Zero Deposit Betas.

Maybe $XLF is saying something about Inflation as well by getting to 1.8x on such #EarlyCycle conditions… perhaps the message is that one should abandon the Post 2008 GFC PTSD…& realize that the Upcoming Cycle looks a lot less like our #RecencyBias & more like previous cycles👇

Recently Howard Marks (one of the best investors of the last 50 years & the Michael Jordan of High Yield ).. said it best in his recent memo….

“Selling Out” 👇

oaktreecapital.com/insights/memo/…

“Selling Out” 👇

oaktreecapital.com/insights/memo/…

“I’m not saying investors shouldn’t sell appreciated assets and realize profits. But it certainly doesn’t make sense to sell things just because they’re up.”

- Howard Marks

1/13/22

$XLF #Reflation

- Howard Marks

1/13/22

$XLF #Reflation

• • •

Missing some Tweet in this thread? You can try to

force a refresh