10Y +4bps to 1.98%

30Y +4bps to 2.28%

30Y +4bps to 2.28%

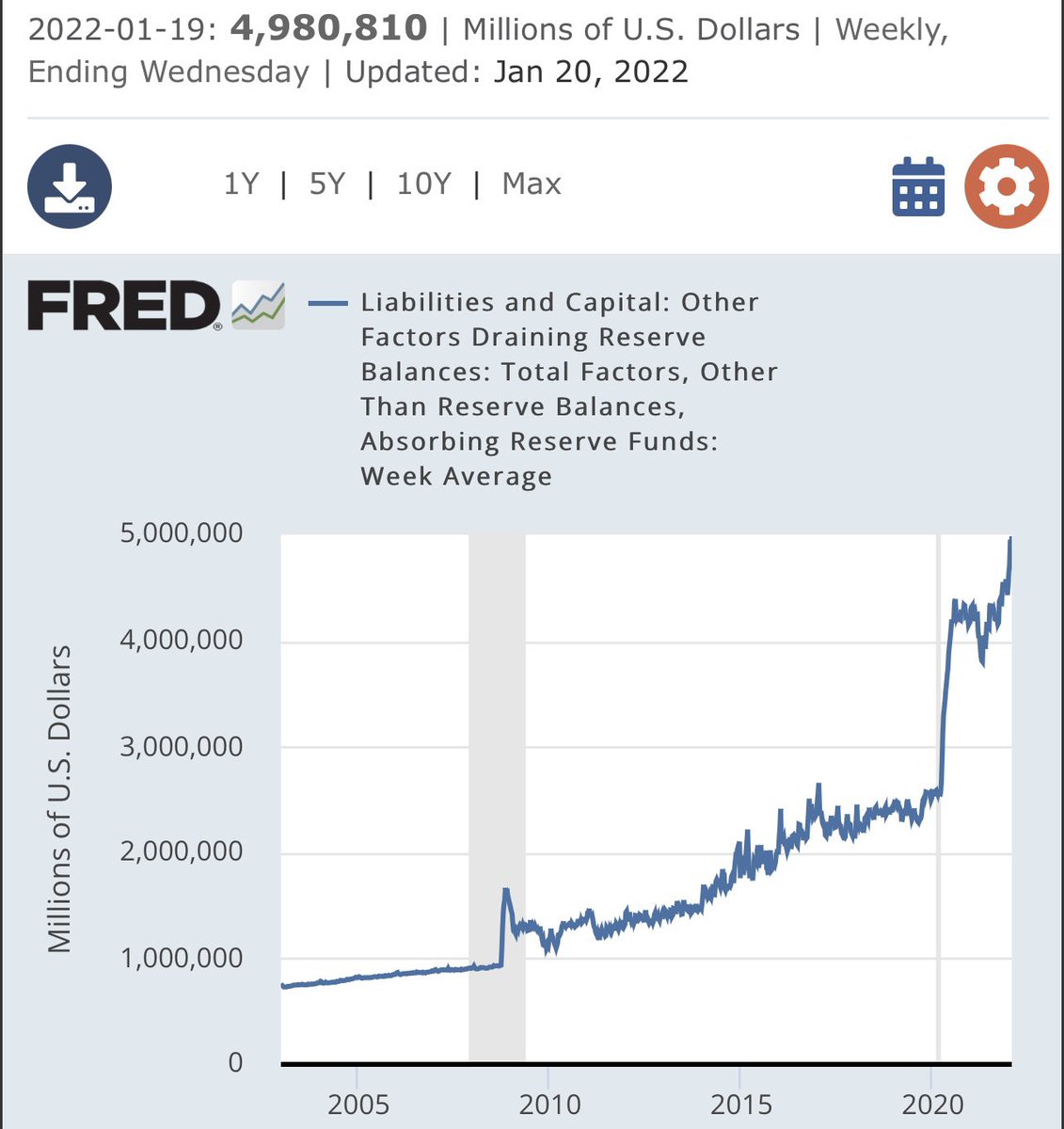

Growth rarely Decelerates meaningfully with $ZROZ down to this degree, unless This Time Is Different. Highly Doubt it

$XLF #Reflation

$XLF #Reflation

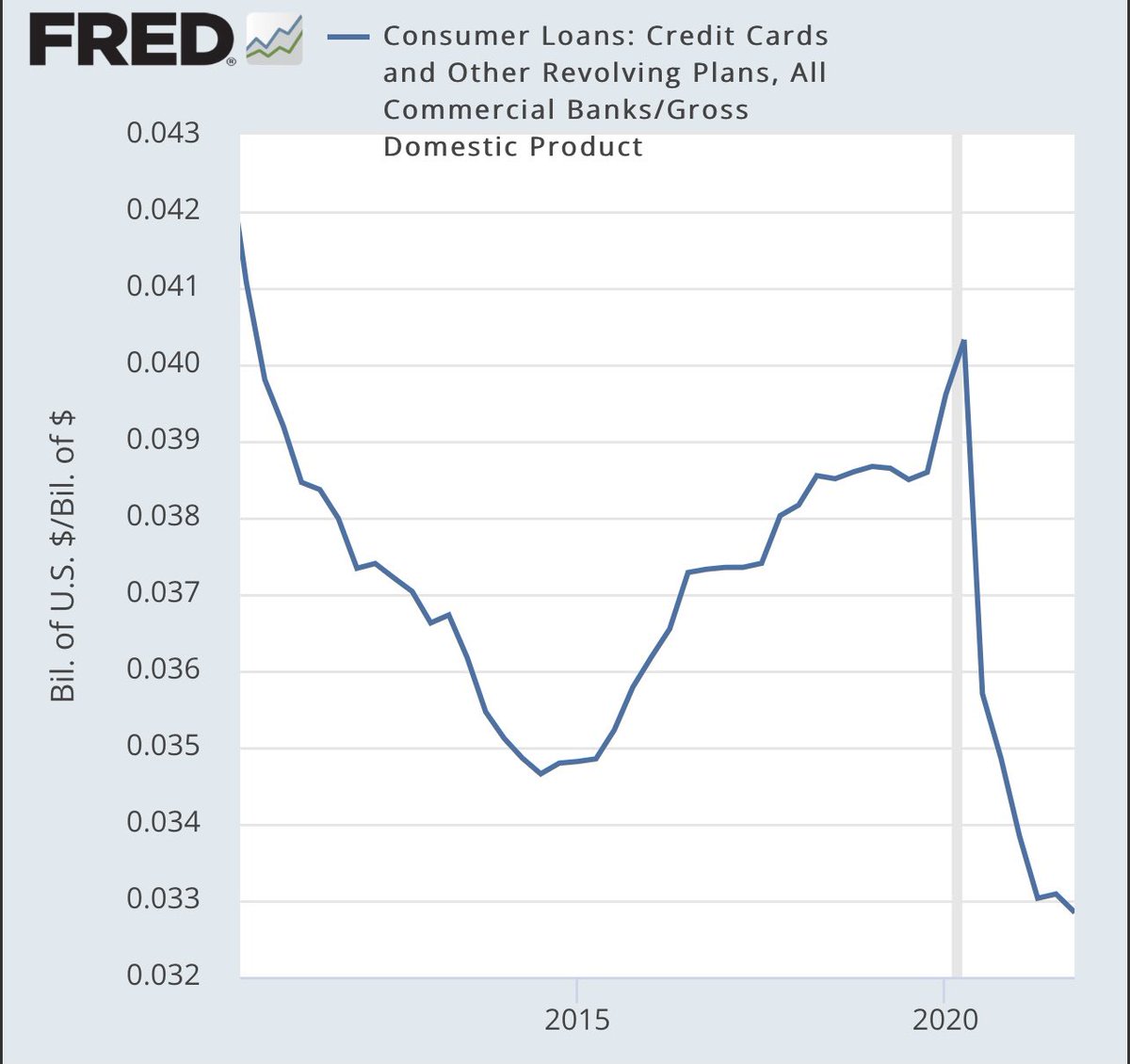

Margins usually Peak ~Year 3 (+/-) of a Recovery. For instance, Margins Peaked a Decade before the last Credit Cycle ended. Leadership changes…& Cycles usually Sequence.

$XLF #Reflation

$XLF #Reflation

In 2012… Corporate Profits After Tax (w/o IVA & CCAdj)/GDP was 11.7%… same as today. It took a Decade for the Credit Cycle to end at 8% of GDP in 2020.

$XLF #Reflation

$XLF #Reflation

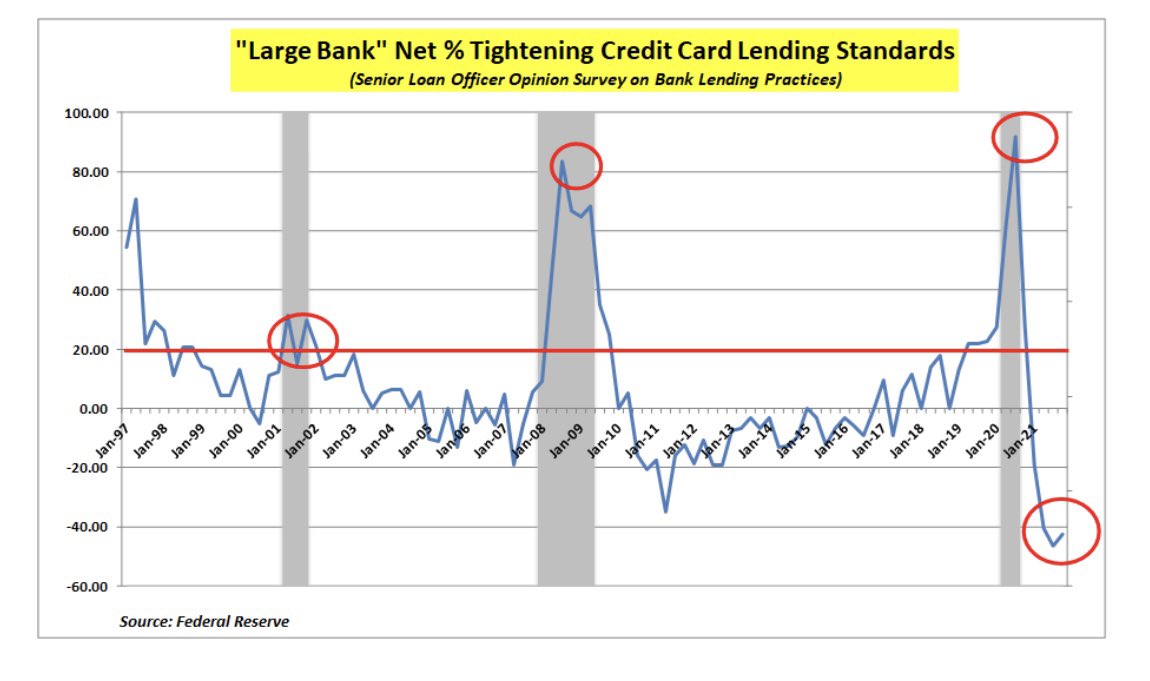

Consumer Savings are at 8% today… & Balance Sheets have De-Levered significantly at the Consumer & Corporate level. There’s a ton of room to Re-Lever & drive GDP higher despite Rate Hikes. Wages can easily counter hikes at Consumer & Corp EBITDA growth > IX.

$XLF #Reflation

$XLF #Reflation

Imho Sub 1-2% Post ‘08 GFC Deflation regime is gone… we r in #Reflation & now bad Inflation but prolly not 15-20% in Perpetuity either, further 2Fed Rate Hikes. That’s a wide band but people pricing in the Tails… either it’s Perma Deflation Camp or 20% Late 70s Camp.

Truth prolly somewhere in the middle… definitely skewed to more Inflation imho.

• • •

Missing some Tweet in this thread? You can try to

force a refresh