1/5 The EU Parliament vote on the de facto POW-ban will take place tomorrow at 1:45-2pm CET. You can follow it via live stream.

I will also share a quick summary here on twitter.

Reminder: This is not the final vote on the regulation.

europarl.europa.eu/committees/en/… #Bitcoin #BTC

I will also share a quick summary here on twitter.

Reminder: This is not the final vote on the regulation.

europarl.europa.eu/committees/en/… #Bitcoin #BTC

2/ Even if the ECON committee votes in favor, it is unlikely that the amendment will find its way into the final agreement that becomes law.

Both the EU Commission & the Council would in all likelihood squash it in the upcoming "trilogue" negotiations.

Both the EU Commission & the Council would in all likelihood squash it in the upcoming "trilogue" negotiations.

3/ BUT:

1. You never know. The macro-environment (Ukraine, inflation etc.) changes rapidly and energy (prices, usage etc.) might soon become policy topic #1.

Nobody expected this amendment to make it even this far in the EU Parliament.

1. You never know. The macro-environment (Ukraine, inflation etc.) changes rapidly and energy (prices, usage etc.) might soon become policy topic #1.

Nobody expected this amendment to make it even this far in the EU Parliament.

4/

2. The mere message/symbol of the EU Parliament calling for a POW-ban would already be detrimental to the industry and have negative consequences on investments, the attraction of talent, businesses etc.

2. The mere message/symbol of the EU Parliament calling for a POW-ban would already be detrimental to the industry and have negative consequences on investments, the attraction of talent, businesses etc.

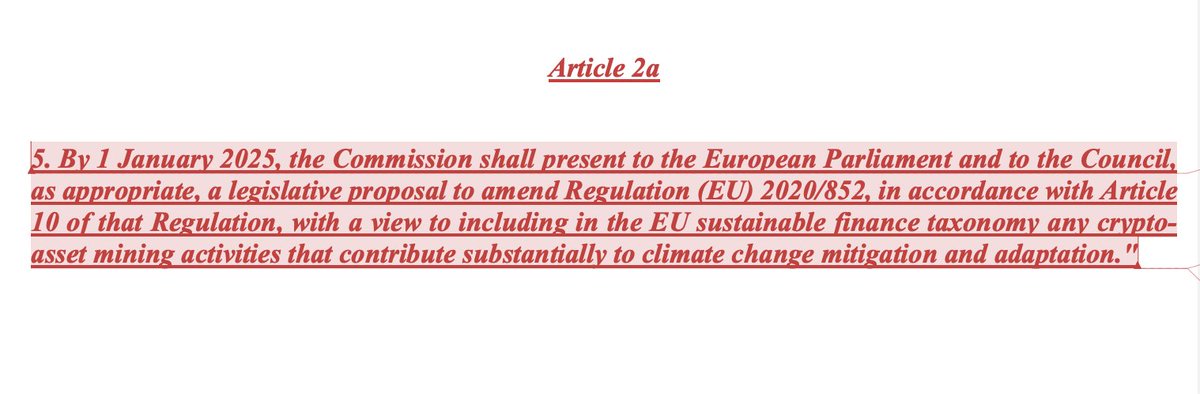

5/ Here is a recap of the two key amendments that are at stake tomorrow and who is supporting them in the Parliament.

After many discussions over the weekend, I am by now more hopeful that the POW-ban won't get a majority, but the margins are very thin.

After many discussions over the weekend, I am by now more hopeful that the POW-ban won't get a majority, but the margins are very thin.

https://twitter.com/paddi_hansen/status/1502597421783830529?s=20&t=tKTgxUB9T2gir3NPsW8dOA

• • •

Missing some Tweet in this thread? You can try to

force a refresh