During an uptrend people rush to buy and sell with a sense of desperation, not wanting to be left out of valuations.

Such holders move the Network at these times, creating UTXO/spending UTXO at a profit.

#Bitcoin

1/5🧵

Such holders move the Network at these times, creating UTXO/spending UTXO at a profit.

#Bitcoin

1/5🧵

After a spent output is realized, the price in USD of the UTXO created/UTXO spent shows whether the UTXO realized profit/loss.

With one more variable (lifespan) included, in the realization it categorizes whether it is STH(age 1h~155days) or LTH(age >155days).

2/5🧵

With one more variable (lifespan) included, in the realization it categorizes whether it is STH(age 1h~155days) or LTH(age >155days).

2/5🧵

That said, when demand is hot in the short to medium term, the reflection in the chain by Short Term Holders (STH) is shown by the #SOPR.

3/5🧵

3/5🧵

The behavior of Long Term Holders (LTH) is cyclical based on the long term (Halving to Halving), as so far even at -55% since the last ATH, this category spends UTXO with profit.

During the period of price depression after parabolic top (corrective average -80%) ... 4/5🧵

During the period of price depression after parabolic top (corrective average -80%) ... 4/5🧵

5/5🧵

... sustaining the floor gain over total cost to maintain grid security, is that LTH spends UTXO at a loss.

#Bitcoin

Read also at Quicktake:

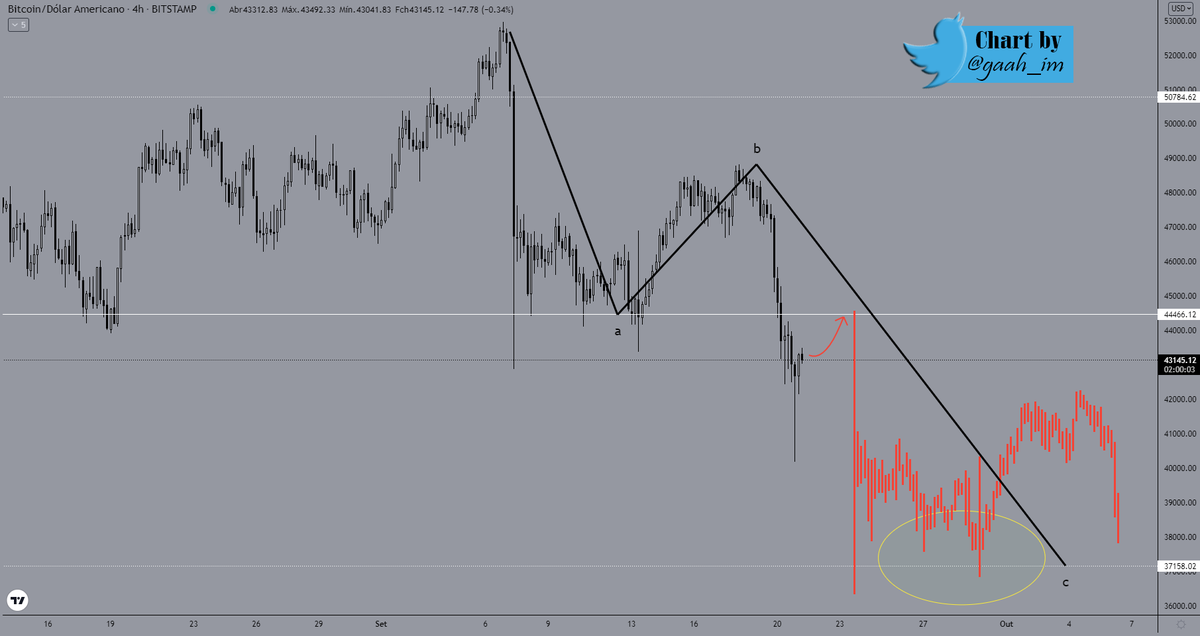

- So, uptrend or downtrend? it depends on the timeframe...

cryptoquant.com/quicktake/6233…

... sustaining the floor gain over total cost to maintain grid security, is that LTH spends UTXO at a loss.

#Bitcoin

Read also at Quicktake:

- So, uptrend or downtrend? it depends on the timeframe...

cryptoquant.com/quicktake/6233…

• • •

Missing some Tweet in this thread? You can try to

force a refresh