Illumina remains the market leader with the short-read SBS technology. They segment their products into high-throughput (NovaSeq $1M), mid-throughput (NextSeq $220-350K) and low-throughput (MiSeq, MiniSeq, iSeq $40-150K).

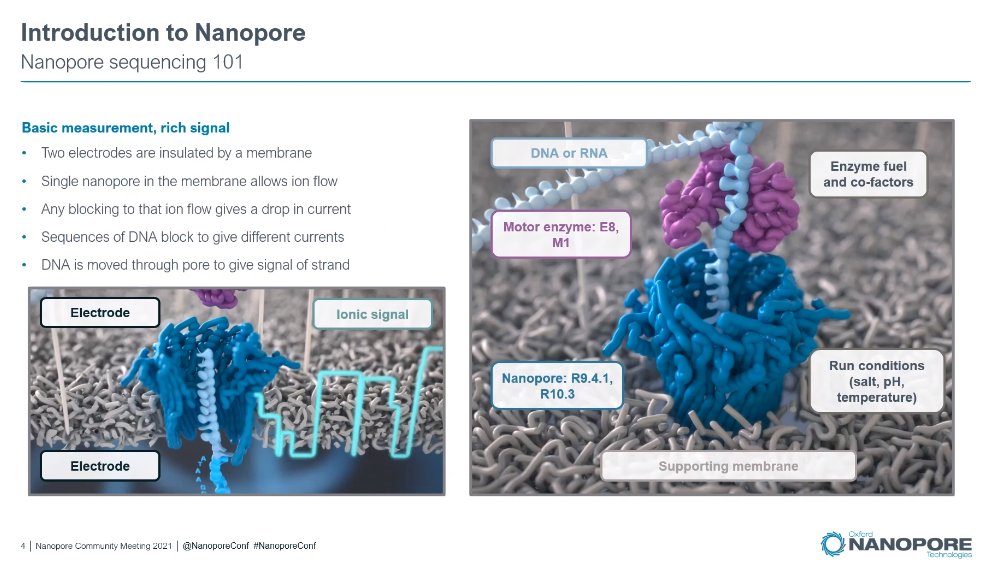

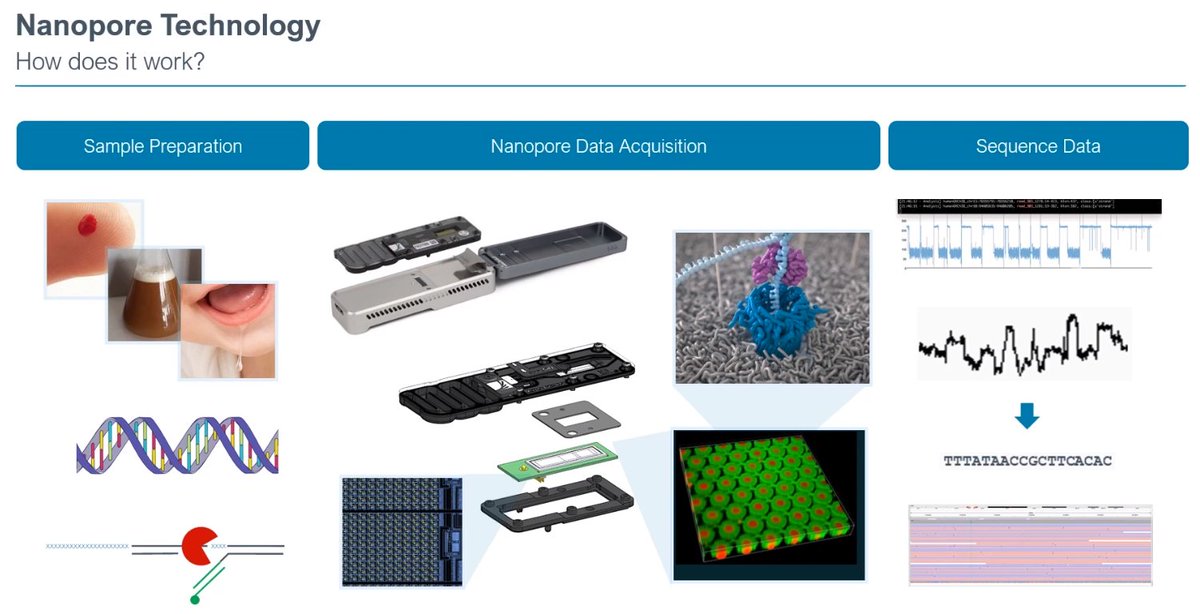

Then there are to large players, but smaller to Illumina in comparison, in the long-reads field: Oxford Nanopore, with their MinION, PromethION and other modes of sequencing, and PacBio, with their Sequel2 instrument, but with a future play on short-reads with Omnione.

Then we have a couple of companies with some market share, which could either stay at that level or potentially increase it: Thermo Fisher with their Ion Torrent technology, and MGI Tech in China, with their DNBSEQ nanoballs short-read sequencing tech.

More recently, $OMIC Singular Genomics and @ElemBio have released new instruments to try to displace Illumina's NextSeq/NovaSeq market share. This is a boost to the overall competition, and will make or should make prices better for NGS consumers.

There are other companies in line for a slice of the NGS market: Genapsys has a low throughput instrument in the market, and GeneMind also has a NextSeq-looking instrument available.

Beyond these, there are companies readying their technology to enter the market. One of them is Ultima Genomics: the company has been very secretive about their technology, with only a few patent document available to the general public.

One of their patents shows a diagram of a CD-ROM-looking reader device, where they have an imaging system with a single stable axis which could make it much cheaper to produce.

Given that imaging/lasers as well as valves/pumps makes up a large part of the COGS of the NGS instrumentation, any kind of innovation along these lines could mean a lower CAPEX instrument than the competition.

How much lower COGS and will it be competitive against e.g. an Illumina NextSeq? At the moment, it's anybody's guess until more information comes to light.

Coming back to the @ElemBio AVITI instrument. The technology is based on a new method of attaching biomolecules to a surface, in a way that enhances signal-to-noise, or contrast-to-noise (CNR) between what should bind to the surface and what shouldn't.

This means better COGS in utilization or reagents, as all the fluorophores and associated ligands are consumed at a much lower rate with respect to each insert that gets sequenced, and thus Element Bio can pass these savings to the consumers and offer a $5-7/Gb cost.

In terms of accuracy, the system is better than the average Illumina instrument, both in percentage of bases above Q30 and also average molecules above a certain Q-score threshold. This means lower sequencing is needed for the same discovery rate as an Illumina run.

There aren't any bottlenecks of adoption for AVITI other than subjective perceptions on the companies. In the computing world, the "nobody got fired from buying IBM" only lasted for so long, and nowadays people are quick to adopt new tech with demonstrably better specs.

Overall, I would say that Oxford Nanopore, PacBio, MGI Tech, Element Bio and Singular Genomics all pose an immediate threat to Illumina's dominance in the market share. The company's recent move towards vertical integration in the diagnostics space with Grail Bio could be their

best way to defend their dominance, barring any relaxation of the M&A rules from the regulators. Illumina will also become more aggressive on tech development, which they can do with their healthy financial position.

I think overall Illumina will lose market share in the RUO segment, but grow in the Liquid Biopsy segment with Grail Bio's screening assay. All the companies mentioned here can threaten Illumina in the RUO segment, but PacBio and MGI Tech already have plans to aggressively go

after the Liquid Biopsy market, both in cancer screening and cancer monitoring/recurrence. This is a market that can grow a lot in the next 3-5 years, and will immediately benefit from developments in NGS technologies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh