Thanks for the thread @ChristianKopf. But why would you deliberately ignore our main macro analysis using the @DBaqaee-Farhi model which addresses some of your criticisms and features exactly the types of production chains that people are worried about in popular debate?

https://twitter.com/ChristianKopf/status/1505351058305994752

Point of "beer mat model": provide intuition and model some worst-case scenarios in a simple & transparent way.

The main @DBaqaee-Farhi model gives smaller numbers even in very pessimistic scenarios. What can we say?

https://twitter.com/ChristianKopf/status/1505351073715867656

The main @DBaqaee-Farhi model gives smaller numbers even in very pessimistic scenarios. What can we say?

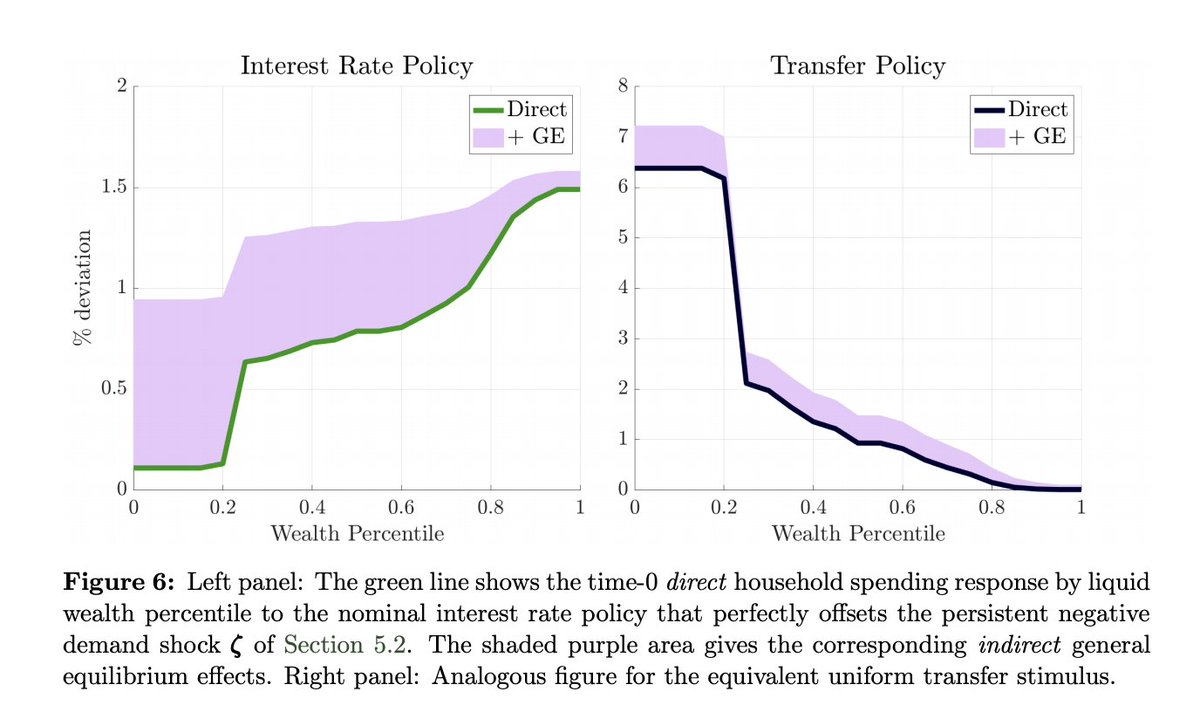

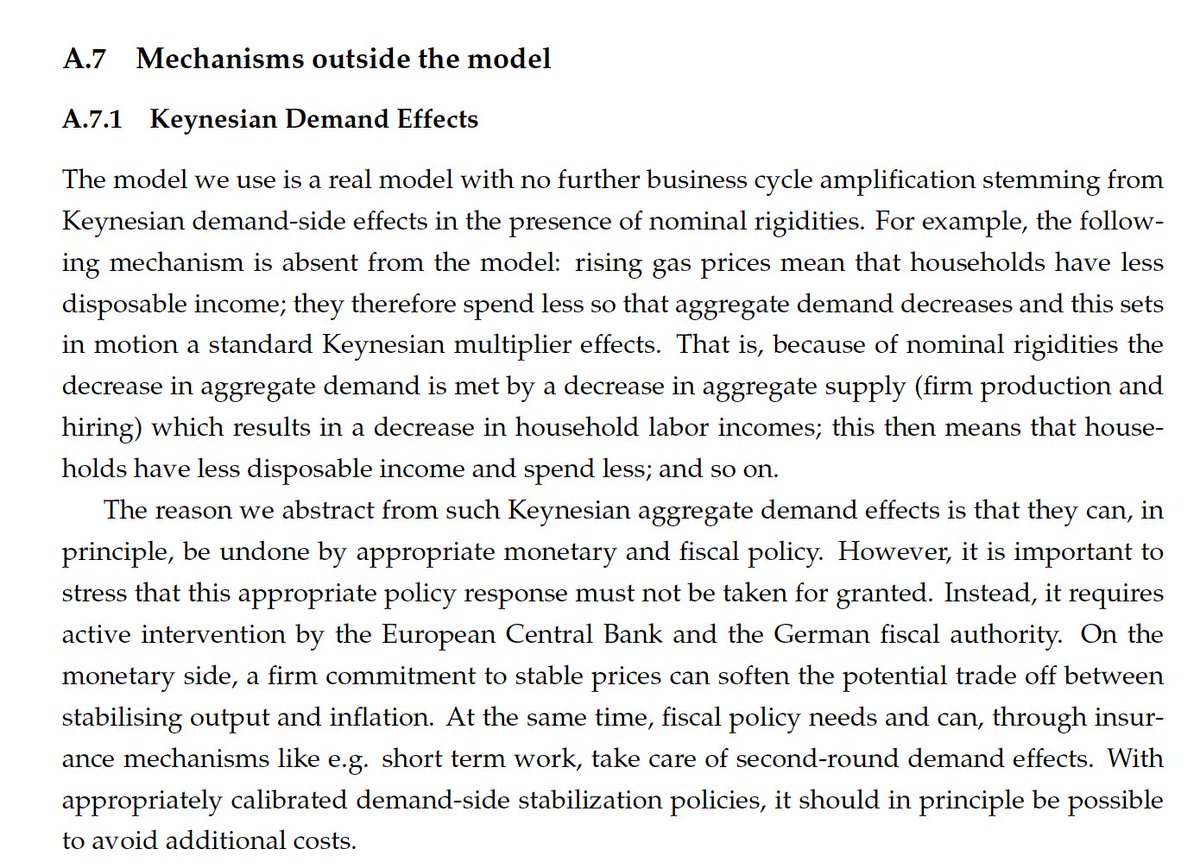

The criticism that we do not have nominal rigidities and ensuing Keynesian demand effects is fair. We are very clear about this in the paper.

These would need to be added on top of supply-side effects we model e.g. 0.5% or 3%.

It's important that they depend on policy though.

These would need to be added on top of supply-side effects we model e.g. 0.5% or 3%.

It's important that they depend on policy though.

But the point stands: I have not yet seen any modeling that gives substantially larger numbers than ours. The largest one is 3.5% (Goldman)

benjaminmoll.com/GS_Russian_Gas/

benjaminmoll.com/GS_Russian_Gas/

A final thought: I personally find simple & transparent models useful (and you seem to have too I think?). So I will take "beer mat model" as a compliment.

• • •

Missing some Tweet in this thread? You can try to

force a refresh