Commodity markets are reacting to uncertainty in agricultural supply by sending futures through the roof. Will the #UkraineRussiaWar be a challenge to #FoodSecurity in the short to medium term? The short answer is YES. The long answer is a read through this thread ⬇️🧵 1/

#UkraineRussiaWar is disrupting physical, logistical & market dynamics in the Black Sea - a key hub for wheat, feed grains & sunflower seed to world markets. 🇺🇦 ports are all closed or blockaded by 🇷🇺 Navy. 🇺🇦 suspended port operations for commercial activities since 24/02. 2/

Most immediately, this will impact export of 🇺🇦 #corn, which has been harvested but not all shipped. Exports are predicted to drop by 18% due to trade disruptions and part of the stored grain being lost or damaged from shelling. 🇺🇦 exports 14% of all corn, so prices will raise 3/

Corn & barley are vastly used to feed livestock (esp. chicken). 🇨🇳 🇮🇳 source 84% & 70% of their imported corn from 🇺🇦, and 🇺🇦 corn is 50%+ of domestic corn supply for EU countries like 🇫🇮🇱🇻🇳🇱. Feed is ~55-65% of chicken production cost, so prices for European🐔 will increase 4/

Looking ahead, the next 🇺🇦 harvest could be severely compromised by the #UkraineRussiaWar. 🇺🇦 exports 10% of world's wheat, and 97% of Ukrainian wheat is winter-planted. This wheat is due to be harvested in summer 2022, but it is grown in areas that are now a battleground 5/

A large part of population in the areas where #wheat is grown has fled or taken up arms. Farmers need to put nutrients on winter-planted wheat during the spring, but the #UkraineRussiaWar is disrupting the process, with risk of abnormally low yield for the 2022 summer harvest. 6/

For corn, soy, sunflower & summer barley, #UkraineRussiaWar will disrupt sowing. Port blockages & transport issues mean farmers can't receiving the seed. FAO estimates that 20-30% of areas typically cultivated in 🇺🇦 will not be planted or be unharvested in the 2022/23 season 7/

All these factors will inflict a severe blow to 🇺🇦 grain production and export capacity. This comes on the back of severe droughts that compromised 🇺🇸🇨🇦 spring output, and record-breaking rains that damaged and delayed planting on about 30% of 🇨🇳total winter wheat acreage. 8/

The hit on food prices will be compounded by skyrocketing price of #fertilizers, of which 🇷🇺 is the world’s largest exporter. Fertilizers account for 35% of marginal cost of production for wheat & corn. A doubling of fertilizer prices leads to a ~44% increase in food prices. 9/

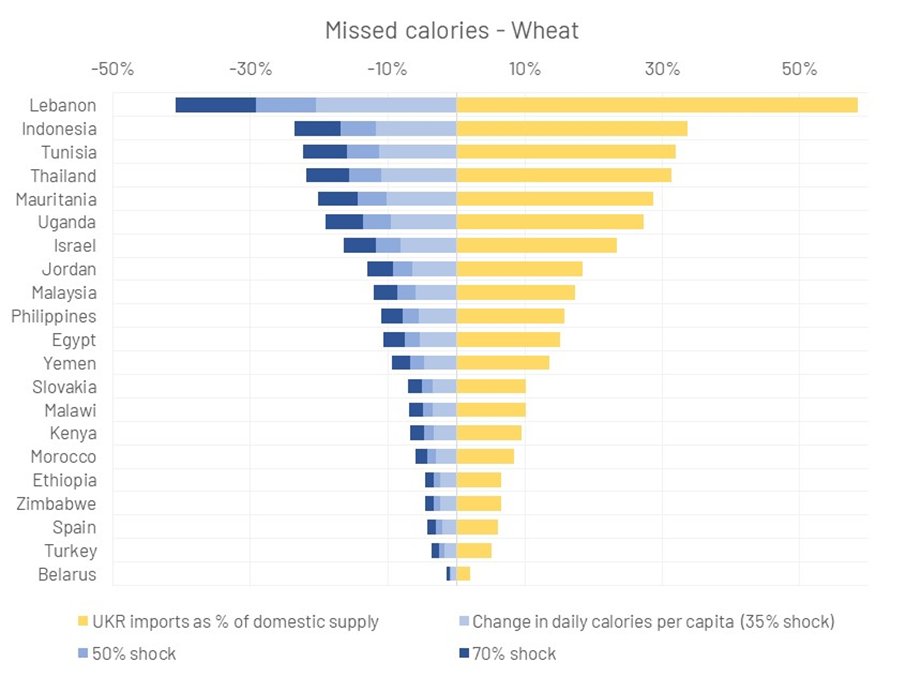

In poor countries, high fertilizer costs could lead to lower usage, with depressed yields adding to shortage of imports and putting #FoodSecurity at risk. Lebanon, Tunisia, Ethiopia are top of the list – relying on Ukraine for respectively 64%, 49% and 31% of wheat imports. 10/

Using FAO food balances, I calculate that a 50% cut in wheat imports from 🇺🇦 could reduce daily available food calories by ~30% in Lebanon, ~20% in Indonesia, Tunisia, Thailand. FAO estimates that undernourished people could increase by 7.6mn globally due to #UkraineRussiaWar 11/

Many poor countries have subsidies to shelter consumers from price fluctuations on wheat, but the fiscal cost is steep when supply is cut. #Egypt was recently forced to raise the price of subsidized bread for 1st time since 1980s. Geopolitical spillovers could hence be dire. 12/

So summing up: the #UkraineRussiaWar will continue to challenge grain supply well into next year. This will have an immediate effect on a number of low-income countries where food prices have proven to be a factor of significant political instability in the past. 13/

In the medium term, the combined effect of reduced grain supply with restrictions to export of fertilizers from 🇷🇺 will be to push farming costs and hence food prices higher – even in areas of the world that do not depend on Ukrainian exports for their food security. 14/

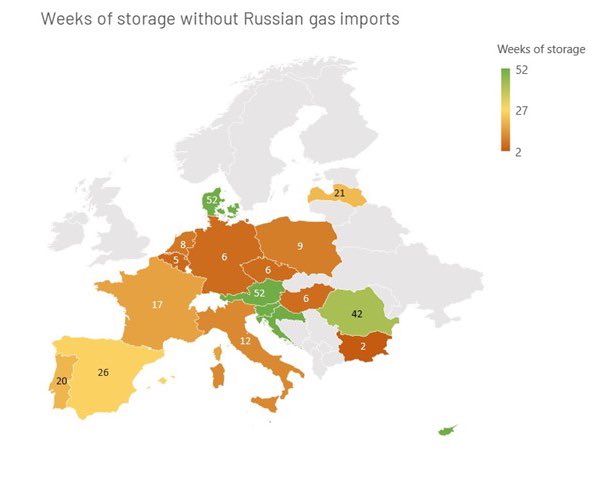

In the short term, EU countries have little room to counteract these effects. EC's proposal to let farmers temporarily grow crops on the 6% of EU agricultural 'fallow' land, as is the proposal to reduce blending of biofuel, and help package for farmers. 15/

For the longer term, this shock is an opportunity to focus on food & fertilizers security and on higher efficiency agriculture. The 'silver lining' is that innovative technique such as precision and vertical farming will likely receive a boost from this sad episode. end/

• • •

Missing some Tweet in this thread? You can try to

force a refresh