1/ I see a lot hopium on my feed, but its time for a cold shower.

Are we out of the bear market? Probably not.

Here are 10+ reasons why you don't want to drop the soap. 😂

🚨 Bearish divergence warning on multiple charts.

Lets dive deeper, a thread. 👇

Are we out of the bear market? Probably not.

Here are 10+ reasons why you don't want to drop the soap. 😂

🚨 Bearish divergence warning on multiple charts.

Lets dive deeper, a thread. 👇

2/ Lets start with stable coins first, then move to more "exotic" assets in crypto (e.g. NFTs/DeFI).

First, #USDC - best centralized stablecoin (aka, they can freeze your money).

See that beautiful top? USDC market cap falling since 1 Mar 2022 + double top = bearish.

Next 👇

First, #USDC - best centralized stablecoin (aka, they can freeze your money).

See that beautiful top? USDC market cap falling since 1 Mar 2022 + double top = bearish.

Next 👇

3/ Second, #DAI - best decentralized stablecoin (aka, they can't freeze your money).

"LOL you forgot about #UST." No I didn't, keep reading.

Again on DAI, double top + falling mcap = bearish.

Next 👇

"LOL you forgot about #UST." No I didn't, keep reading.

Again on DAI, double top + falling mcap = bearish.

Next 👇

4/ What about #UST and #USDT?!

These give FALSE signals. Why false? Because they can't be TRUSTED. Here's why.

UST/USDT = see those lines up. Its mostly fake money/demand.

Real money/collateral is in USDC/DAI.

Don't believe me? Next 👇

These give FALSE signals. Why false? Because they can't be TRUSTED. Here's why.

UST/USDT = see those lines up. Its mostly fake money/demand.

Real money/collateral is in USDC/DAI.

Don't believe me? Next 👇

5/ #LUSD - like DAI but ETH only as collateral.

Lower highs, falling mcap = bearish.

Still not convinced? OK, see next stablecoin. 👇

Lower highs, falling mcap = bearish.

Still not convinced? OK, see next stablecoin. 👇

6/ #FRAX - better than UST and less manipulation.

Falling mcap = bearish.

BTC is moving up in price while demand for trusted CEX/DEX stablecoins is falling = bearish divergence.

What is a bearish divergence? 👇

Falling mcap = bearish.

BTC is moving up in price while demand for trusted CEX/DEX stablecoins is falling = bearish divergence.

What is a bearish divergence? 👇

7/ Price makes a higher high & an indicator makes a lower high = bearish divergence.

Best example is a higher price with a lower volume than the previous high = time to be careful!

BTC price moving up with falling demand for stablecoins = CRASH???

Is this it? NO! Next 👇

Best example is a higher price with a lower volume than the previous high = time to be careful!

BTC price moving up with falling demand for stablecoins = CRASH???

Is this it? NO! Next 👇

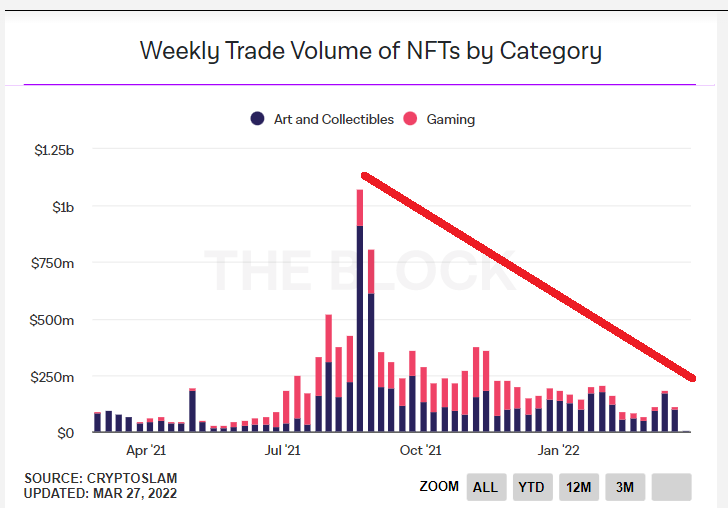

8/ Lets look at #NFTs next.

Overall market volume is tanking = bearish!

Where is all the hype and demand? GONE.

Lets look at some clear NFT examples, including BAYC 👇

Overall market volume is tanking = bearish!

Where is all the hype and demand? GONE.

Lets look at some clear NFT examples, including BAYC 👇

9/ My favorite, The #Sandbox, or DIGITAL land!

Sandbox land prices went from average of 5 #ETH to almost 2 for one square!

Volume and prices tanking = bearish!

What about avatar NFTs?

Sandbox land prices went from average of 5 #ETH to almost 2 for one square!

Volume and prices tanking = bearish!

What about avatar NFTs?

10/ Divine Anarchy, one of the best out there, 50% price crash!

Volume and prices crashing = bearish!

Just one random avatar went from 18 ETH listed price to a 0.4 ETH sale! All in 4 months.

What about the biggest name in NFT space - Bored Ape Yacht Club or #BAYC? 👇

Volume and prices crashing = bearish!

Just one random avatar went from 18 ETH listed price to a 0.4 ETH sale! All in 4 months.

What about the biggest name in NFT space - Bored Ape Yacht Club or #BAYC? 👇

11/ Oh look BAYC crashed 50% in sales value compared to Sep 2021 and 80% in NUMBER of sales!

How is this bullish exactly? It is not and you should be careful.

But lets look at #DeFI, surely it is bullish? 😂

How is this bullish exactly? It is not and you should be careful.

But lets look at #DeFI, surely it is bullish? 😂

12/ NOPE. #DeFI all time high was last year...

We still failed to exceed the old total value locked.

At best, maybe DeFI consolidates and won't fall lower.

There is no new money coming in right now.

What about... google trends? 👇

We still failed to exceed the old total value locked.

At best, maybe DeFI consolidates and won't fall lower.

There is no new money coming in right now.

What about... google trends? 👇

12/ Even google trends is bearish, wtf.

I mean, the current #Bitcoin all-time high from Nov 2021 (69k) made a lower high compared to May 2021 (65k) or Dec 2017 (20k)!

Very curious divergence here for BTC. Retail FOMO (e.g. 2017) has NOT returned since!

So what next? 👇

I mean, the current #Bitcoin all-time high from Nov 2021 (69k) made a lower high compared to May 2021 (65k) or Dec 2017 (20k)!

Very curious divergence here for BTC. Retail FOMO (e.g. 2017) has NOT returned since!

So what next? 👇

13/ Keep powder dry in case the market falls lower.

We appear to have topped in 2021, at least for now.

Money is not really coming to crypto right now.

It's all in BTC's hands. Can it rally in 2022 again?

Also see my other thread on this and 👇

We appear to have topped in 2021, at least for now.

Money is not really coming to crypto right now.

It's all in BTC's hands. Can it rally in 2022 again?

Also see my other thread on this and 👇

https://twitter.com/DU09BTC/status/1484810579940458498?s=20&t=ssq_zL2ULtaqEe6wcp3cYQ

14/ If you liked this thread, #retweet the first post to get more of this content in the future! 😍

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

Stay in touch + follow @DU09BTC:

Discord: bit.ly/3n2gng0

TradingView: bit.ly/3FUjwHj

YouTube: bit.ly/3p8vPdf

Newsletter: bit.ly/3BuXf13

• • •

Missing some Tweet in this thread? You can try to

force a refresh