Southampton’s 2020/21 financial results covered a “mixed” season when they dropped from 11th to 15th in the Premier League, but reached the semi-finals of the FA Cup. Finances were significantly impacted by the COVID pandemic. Some thoughts in the following thread #SaintsFC

#SaintsFC pre-tax loss narrowed from £76m to £23m, as revenue rose £30m (24%) from £127m to £157m, profit on player sales increased £2m from £14m to £16m and operating expenses fell £25m (12%). Net interest payable was up £6m to £9m. Loss after tax was down from £62m to £15m.

#SaintsFC broadcasting revenue increased £43m (46%) from £93m to £136m, mainly due to money deferred from 2019/20 for games played after the accounting close, while commercial rose £2m (10%) to £21m. Offset COVID driven reduction in match day, down £14m (96%) to just £625k.

#SaintsFC wage bill fell slightly by £1m (1%) to £113m, while player amortisation dropped £9m (16%) to £47m and other expenses were cut £4m (14%) to £25m. There was no repeat of prior year’s £6m player impairment or £4m exceptional items (onerous contracts).

Although #SaintsFC £23m loss is not great, it’s one of the better financial results reported so far in 2020/21. A full year of the pandemic resulted in some very high losses, e.g. #CFC £156m, #AFC £127m & #THFC £80m. In contrast, #WWFC £145m profit driven by £127m loan write-off.

COVID cost #SaintsFC £29m in 2020/21 (mainly match day and commercial £23m, broadcasting £7m), partly offset by £17m deferred from prior year accounts. This gives net £12m impact, so loss would have been £11m without pandemic. Revenue loss over the last two years is £40m.

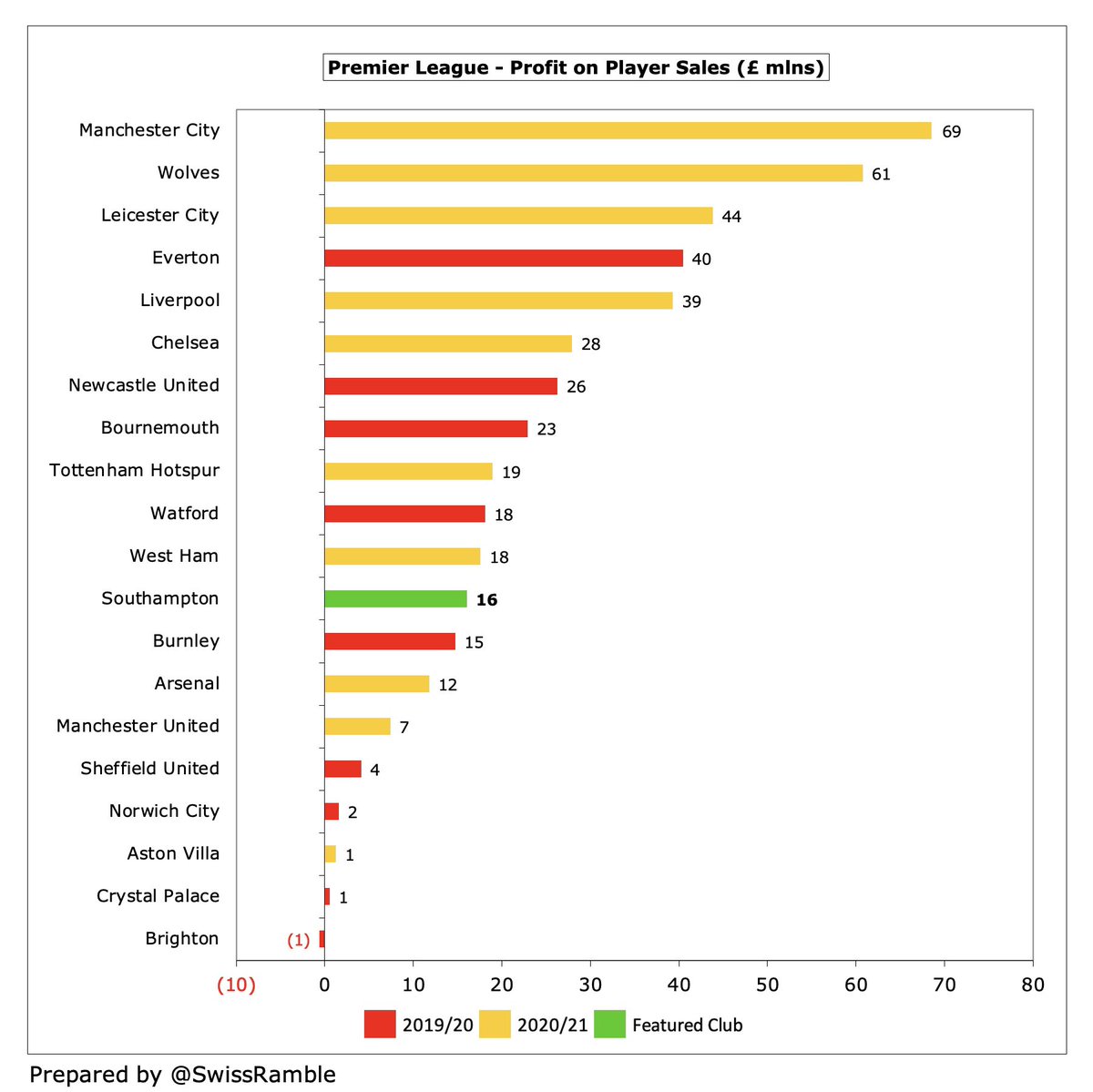

#SaintsFC profit on player sales rose £2m from £14m to £16m, mainly Pierre-Emile Hojberg to #THFC, Harrison Reed to #FFC and Angus Gunn to #NCFC plus contingent fees on previous deals. Transfer market depressed by COVID reducing clubs’ spending power.

#SaintsFC have now reported losses three years in a row, adding up to £140m, which has completely wiped out the preceding five years of profits. This profitable period was worth £126m in total, including £35m in 2018 and £42m in 2017.

The decline is partly due to #SaintsFC making less money from player trading, as profit in the past 3 years has averaged only £17m, compared to £42m between 2014 and 2018. This season will be much better, featuring sales of Ings to #AVFC, Vestergaard to #LCFC and Lemina to Nice.

#SaintsFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £(16)m to £21m, mid-table in the Premier League, but far below #MCFC £116m, #MUFC £95m and #THFC £95m.

#SaintsFC operating loss (excluding player sales and interest) narrowed from £83m to £30m, which is actually the best result to date in 2020/21 Premier League, as some clubs had very high losses: #CFC £159m, #AFC £91m and #LCFC £66m (five clubs were above £100m in prior season).

#SaintsFC £157m revenue is actually £8m (5%) higher than the 2019 pre-pandemic level, despite a significant £16m fall in match day, as broadcasting rose £23m (21%), largely due to deferred revenue from 2019/20. Down £25m (14%) from £182m peak in 2017 (Europa League participation)

#SaintsFC £157m revenue is the club’s second best ever, standing at 12th highest in the Premier League, just ahead of #NUFC £151m, but over £400m below #MCFC £570m. Rankings are distorted by the amount of revenue deferred from 2019/20 accounts.

According to the Deloitte Money League, which ranks clubs globally, #SaintsFC had the 27th highest revenue in 2020/21, sandwiched between Borussia Mönchengladbach and Napoli.

#SaintsFC broadcasting income rose £43m (46%) from £93m to £136m, mainly due to revenue from 6 games deferred to 2020/21 (played after June 2019/20 accounting close), partly offset by lower merit payment (15th place vs 11th) and PL reductions (broadcasters’ rebates).

As the 2019/20 season was extended, £19m revenue was booked in 2020/21 accounts. driving £38m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs with May year-end had largest revenue deferrals, while those with a July close deferred nothing.

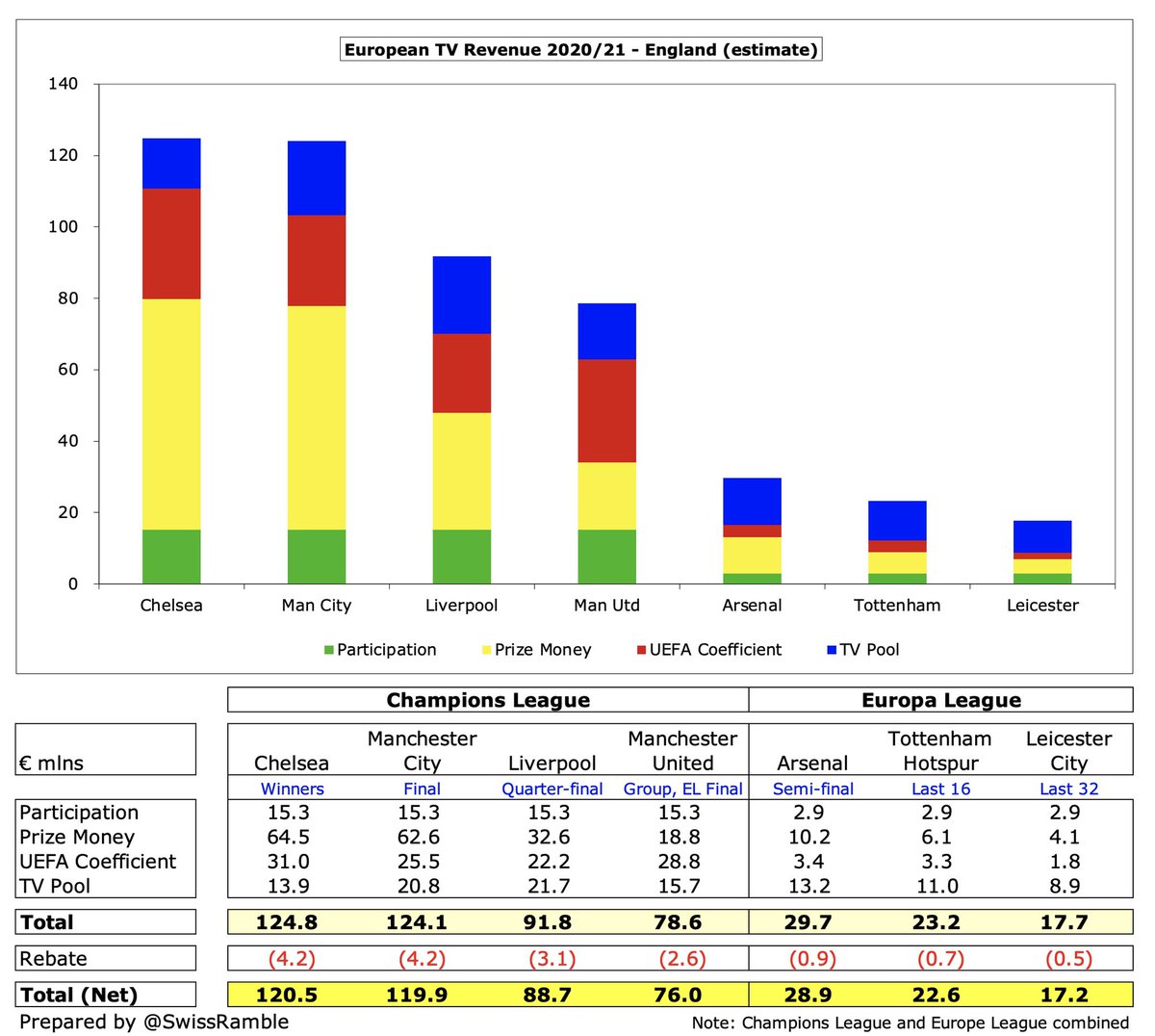

It is worth noting the impact of European qualification on a club’s broadcasting income, especially the Champions League, which was worth around €120m for finalists #CFC and #MCFC in 2021. Europa League participants earn less, but still ranged from €17m to €29m.

#SaintsFC match day income fell £14m (96%) to just £625k, as all home games were played behind closed doors (except three with very restricted capacity: 1 with 8,000 fans, 2 with only 2,000). Revenue has fallen four years in a row from £22m peak in 2017.

#SaintsFC 2019/20 average attendance of 29,675 (for games played with fans) was the 15th highest in the Premier League, just below fellow South Coast club #BHAFC 30,359.

#SaintsFC commercial income rose £2m (10%) from £19m to £21m, a new club record, mainly due to £1.6m revenue associated with games played after 2019/20 year-end deferred to 2020/21. Despite the growth, firmly in the bottom half of the Premier League.

#SaintsFC ended club record shirt sponsorship deal (reportedly £7.5m a year) with Chinese company LD Sports after only 12 months, replaced by Sportsbet. Kit supplier was Under Armour, since succeeded by Hummel in 2021/22, while Virgin Media is the sleeve sponsor.

#SaintsFC other operating income increased from £0.4m to £2.6m, including business interruption insurance claim £2.4m and Coronavirus job retention scheme grant £0.4m. #CFC £12.6m was mainly due to unexplained recharges.

#SaintsFC wage bill fell slightly by £1m (1%) to £113m, which means that wages have been essentially flat for the last 5 years. Year-on-year remuneration for the men’s first team decreased slightly from £90m to £89m.

Due to the lack of growth, #SaintsFC £113m wage bill is in the bottom half of the Premier League, the lowest reported to date in 2020/21. For some perspective, wages were around quarter of a billion less than #MCFC £355m.

#SaintsFC wages to turnover decreased (improved) from 90% too 72%, around mid-table in the Premier League. The club said the ratio would have been a respectable 66% if the impact of the pandemic were excluded.

#SaintsFC total directors remuneration increased from £1.2m to £1.6m with the highest paid director rising 62% from £598k to £971k. This is mid-table for the Premier League, though far below the likes of Ed Woodward at #MUFC £2.9m and Daniel Levy at #THFC £2.7m.

#SaintsFC player amortisation, the annual charge to write-down transfer fees over the life of a player’s contract, fell by £10m (16%) from £57m to £47m, which is on the low side in the top flight. No repeat of prior year £6m impairment charge to reduce some player values.

#SaintsFC spent £42m on player purchases, including Kyle Walker-Peters from #THFC, Mohammed Salisu from Real Valladolid and Ibrahima Diallo from Brest. Up from previous season’s £24m, but still one of the smallest outlays in the Premier League.

#SaintsFC gross transfer spend in last 5 years increased to £272m, compared to £216m in preceding 5-year period, but the taps have been largely turned off in last 2 seasons, due to restrictions on investment on their Chinese owner. Highest annual expenditure was £86m in 2018.

#SaintsFC gross debt fell slightly from £92m to £91m, due to CHF/GBP exchange rate. Largely comprises £78m loan from MSD Holdings repayable in 2025 and £12m bank loan repayable in 2 equal instalments over next 2 years. Net debt up from £5m to £62m, due to fall in cash balance.

#SaintsFC £92m gross debt is 12th largest in the Premier League, though miles below #THFC £854m (new stadium), #MUFC £530m (Glazers’ leveraged buy-out). #EFC £409m and #BHAFC £306m debt is very much in the form of “friendly” owner loans.

#SaintsFC interest paid shot up from £1.1m to £7.5m, as the MSD £78m loan charges a hefty 9.14% a year. The other £12m bank loan is at 1.065%. That’s on the high side for the Premier League, but much less than AFC £34m (mainly debt refinancing break fee), #MUFC £21m & #THFC £18m.

#SaintsFC reduced transfer fees debt from £55m to £41m, down from £90m two years ago. One of the lowest in top flight. There is £21m owed by other clubs, so net payable is £20m. In addition, £25m contingent liabilities potentially payable, mainly dependent on player appearances.

#SaintsFC £30m operating loss became £13m negative cash flow (after adding back £51m amortisation & depreciation, offset by £34m working capital movements), then spent net £35m on players (purchases £55m, sales £20m), £7m interest payments and £3m on infrastructure.

As a result, #SaintsFC cash dropped by £58m from £87m to £29m. Prior year’s high balance was a bit misleading, as it was due to the new MSD loan, which was then used to cover operational losses (partly driven by the impact of the pandemic).

Since 2016 #SaintsFC have not received any owner funding, which is a big change from the previous approach. Instead had £62m from bank loans and £50m from operations. Spent £46m (net) on player, £21m on infrastructure, made £17m interest payments and repaid £13m owner loans.

In fact, in the last 5 years #SaintsFC have actually repaid £13m of owner loans, as Katharina Liebherr sold up and Gao Jishen was unwilling (or unable) to provide funding following Chinese law changes. Over that period only #THFC and #NUFC have repaid more to their owners.

This might change under new owner, Serbian businessman Dragan Solak, who bought 80% of the club for £100m in Dec 2021 via Sport Republic Ltd. He said, “We will really try to give support. I can’t tell you how much that would cost, but definitely adequate support to the team.”

Despite reporting losses in the last 3 years, my calculations suggest that #SaintsFC are fine with Profitability & Sustainability rules, thanks to allowable deductions (infrastructure, academy and community), adjusting for COVID impact and averaging 2019/20 and 2020/21 seasons.

On the one hand, #SaintsFC did well to reduce their loss despite a full year of the pandemic; on the other hand, they still lost a substantial £23m pre-tax, funded by a high-interest loan. To return to a sustainable model, they need to again make good money from player trading.

• • •

Missing some Tweet in this thread? You can try to

force a refresh