Would you take out a loan if you did not have to repay it? 👀

(with no liquidation)

Well… in few HOURS, it will slowly become possible on the #Terra blockchain!

Thanks to @kinetic_money and their self repaying loans protocol using @anchor_protocol and $UST 🙌🏼

HOW ?? 🧵⬇️

(with no liquidation)

Well… in few HOURS, it will slowly become possible on the #Terra blockchain!

Thanks to @kinetic_money and their self repaying loans protocol using @anchor_protocol and $UST 🙌🏼

HOW ?? 🧵⬇️

1/The Final launch for the "public” is 1 Month away.

The goal is to have a user-friendly web app providing self repaying loans on stable coins deposits, with no risk of liquidation.

The full launch of @Kinetic is happening in 3 Phases.

First one #Nucleus is starting today :

The goal is to have a user-friendly web app providing self repaying loans on stable coins deposits, with no risk of liquidation.

The full launch of @Kinetic is happening in 3 Phases.

First one #Nucleus is starting today :

2/ PHASE #Nucleus - Lockdrop

Happening in 10h here : lockdrop.kinetic.money

Users will be rewarded $KNTC tokens to lock up $UST for a period of 3 to 12 month

During this 7 days event, users can deposit & withdraw $UST for 5 Days, and then only partially withdraw in day 6-7

Happening in 10h here : lockdrop.kinetic.money

Users will be rewarded $KNTC tokens to lock up $UST for a period of 3 to 12 month

During this 7 days event, users can deposit & withdraw $UST for 5 Days, and then only partially withdraw in day 6-7

3/How the deposits of $UST will be used?

First, The locked $UST is deposited into the Vault and 50% of $kUST is being borrowed against it.

The debt position will be closed immediately, which will leave the #Lockdrop contract with 50% $kUST and 50% $UST.

First, The locked $UST is deposited into the Vault and 50% of $kUST is being borrowed against it.

The debt position will be closed immediately, which will leave the #Lockdrop contract with 50% $kUST and 50% $UST.

4/ Second, the funds (locked $UST) will be used to grow the liquidity on @astroport_fi for the $kUST / $UST pair.

It will also contribute to the funding of the Kinetic Phaser simultaneously.

(last step of the @kinetic_money launch planned for April 28th → see Tweet #11)

It will also contribute to the funding of the Kinetic Phaser simultaneously.

(last step of the @kinetic_money launch planned for April 28th → see Tweet #11)

5/ Pros of locking $UST in the #Nucleus launch today: 👀

- $KNTC tokens from LP (longer lock = more tokens)

- $kUST / $UST is a Stableswap pool.

-User can expect minimal to no impermanent loss.

-Guaranteed pre-access to borrow from the Kinetic Vault before the debt cap hits

- $KNTC tokens from LP (longer lock = more tokens)

- $kUST / $UST is a Stableswap pool.

-User can expect minimal to no impermanent loss.

-Guaranteed pre-access to borrow from the Kinetic Vault before the debt cap hits

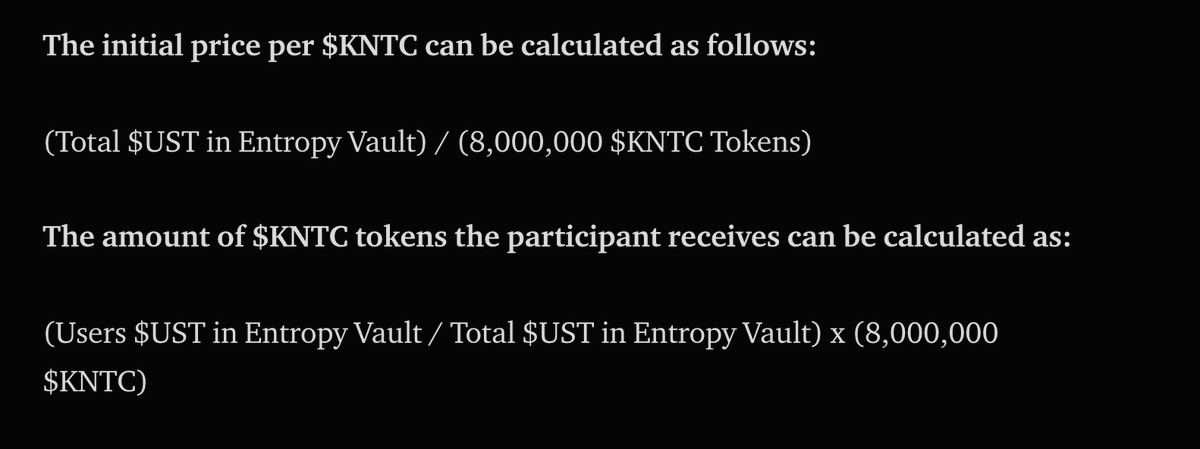

6/PHASE #Entropy - Public token launch in 7 days

A release event inspired by @prism_protocol launch mechanism.

A 5 days event where a total of 8 million $KNTC will be sold (8% of supply) and released to liquidity providers that deposit $UST into the Entropy Pool.

Details ⬇️

A release event inspired by @prism_protocol launch mechanism.

A 5 days event where a total of 8 million $KNTC will be sold (8% of supply) and released to liquidity providers that deposit $UST into the Entropy Pool.

Details ⬇️

7/ For 4 days, users can deposit unlimited $UST into the pool.

- During the last 24h, users will not be able to deposit any funds, but only withdraw one time an amount of $UST

-All the $KNTC tokens from this stage will be released immediately after Entropy.

No vesting periods

- During the last 24h, users will not be able to deposit any funds, but only withdraw one time an amount of $UST

-All the $KNTC tokens from this stage will be released immediately after Entropy.

No vesting periods

8/ Why join on the #Entropy launch in 7 days?

-Participating will be the only way for users to guaranteed their Vault Access on day 1 and borrow $kUST immediately

-After the deadline for $UST deposit, the Vault will open to any users, however, debt cap might be reached already

-Participating will be the only way for users to guaranteed their Vault Access on day 1 and borrow $kUST immediately

-After the deadline for $UST deposit, the Vault will open to any users, however, debt cap might be reached already

9/Now that you have locked your $UST and received $KNTC tokens, what to do with it?

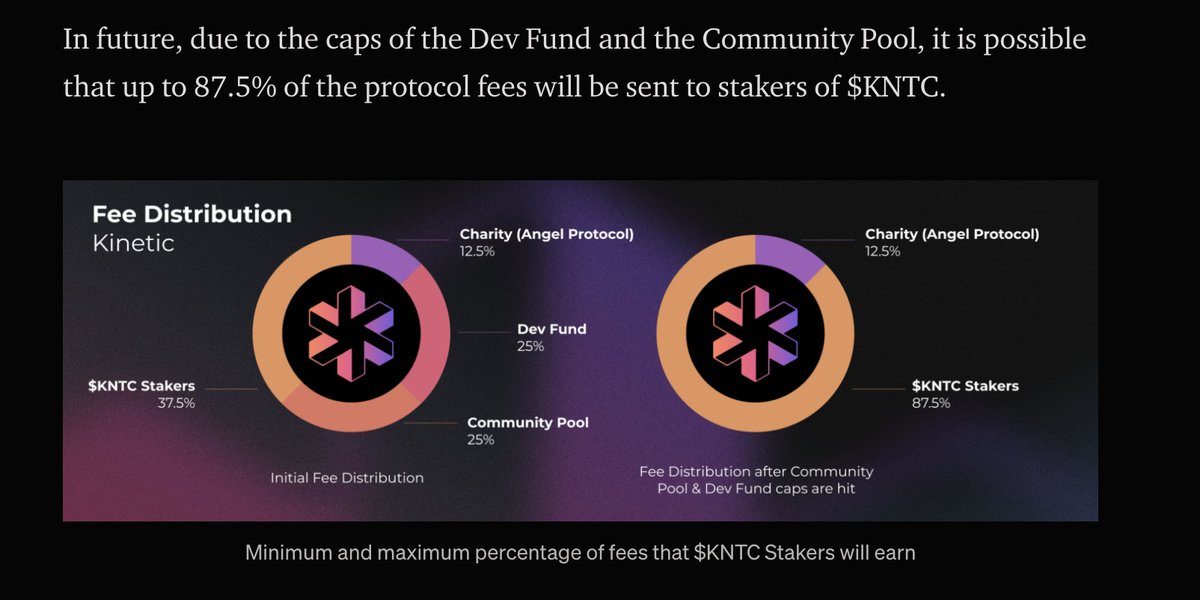

-Stake it from day 1 and receive at least 37,5% of the protocol fee + staking incentives

-The protocol will charge a 8% fee each time yield is harvested from the Vault, and will distribute:

-Stake it from day 1 and receive at least 37,5% of the protocol fee + staking incentives

-The protocol will charge a 8% fee each time yield is harvested from the Vault, and will distribute:

10/ PHASE 3 Launch of #Phaser ~ April 28th

This is the heart of the protocol for @Kinetic users:

It allows any user to swap $kUST to $UST at a 1:1 ratio, regardless of the peg on the $kUST/$UST pair on Astroport (Phaser can be a backup but the swap mechanism takes 3–4 days)

⬇️

This is the heart of the protocol for @Kinetic users:

It allows any user to swap $kUST to $UST at a 1:1 ratio, regardless of the peg on the $kUST/$UST pair on Astroport (Phaser can be a backup but the swap mechanism takes 3–4 days)

⬇️

11/Also, all funds in the #Phaser are being put to work.

The proceeds are used to help repay the outstanding loans of all @kinetic_money users which will boost the repayment rate beyond what the users collateral would generates of their own = Self repaying loan

The proceeds are used to help repay the outstanding loans of all @kinetic_money users which will boost the repayment rate beyond what the users collateral would generates of their own = Self repaying loan

12/ How solid is the The Phaser?

-Funded from the 2 previous Kinetic $UST lockdrops.

-Every time the protocol harvests yield from its strategies, it goes directly to the Phaser (-fees).

As long as the inflow is greater than the outflow (to maintain the peg), Phaser should grow

-Funded from the 2 previous Kinetic $UST lockdrops.

-Every time the protocol harvests yield from its strategies, it goes directly to the Phaser (-fees).

As long as the inflow is greater than the outflow (to maintain the peg), Phaser should grow

13/ Key Points:

-End up borrowing $UST against deposited $UST…etc

-Higher yield opportunity

-Loan management = Lower risk of liquidation, less stress!

-User friendly?

But,It seems like everything revolve around the $kUST peg. Would love to see tokenomics👀? @kinetic_money

-End up borrowing $UST against deposited $UST…etc

-Higher yield opportunity

-Loan management = Lower risk of liquidation, less stress!

-User friendly?

But,It seems like everything revolve around the $kUST peg. Would love to see tokenomics👀? @kinetic_money

14/How to use once fully launched?

-Deposit $UST or $aUST into @kinetic_money

-Collateral automatically deposited in @anchor_protocol earning current APY (~19.5%)

-Borrow on Kinetic up to 50% of the collateral value as a synth asset: $kUST (withdrawing your future yield)

-Swap

-Deposit $UST or $aUST into @kinetic_money

-Collateral automatically deposited in @anchor_protocol earning current APY (~19.5%)

-Borrow on Kinetic up to 50% of the collateral value as a synth asset: $kUST (withdrawing your future yield)

-Swap

• • •

Missing some Tweet in this thread? You can try to

force a refresh