Everton’s 2020/21 financial results covered a season when they finished 10th in the Premier League and reached the quarter-finals of both domestic cups under Carlo Ancelotti. The COVID-19 pandemic had a “dramatic” impact on the accounts. Some thoughts follow #EFC

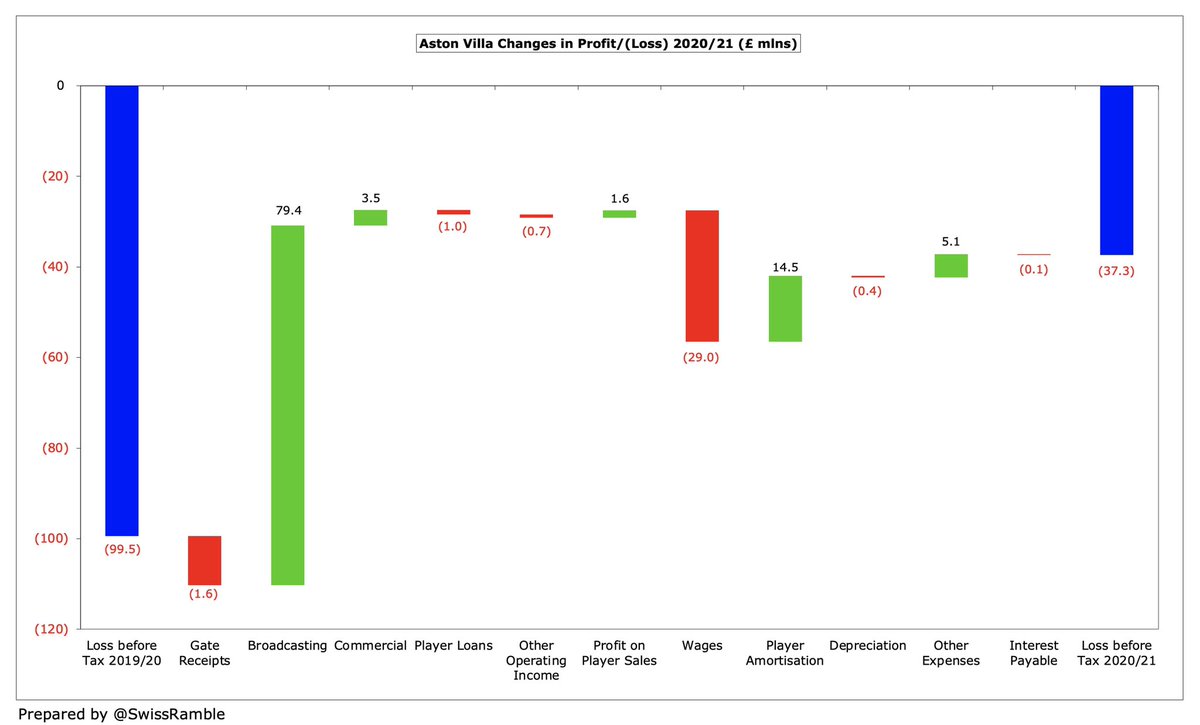

#EFC loss narrowed from £140m to £121m, as revenue rose £7m (4%) from £186m to a club record £193m, though profit on player sales dropped £27m to £13m. Total expenses, including exceptional items, fell £42m (12%), but interest payable increased £3m to £9m.

#EFC broadcasting income rose £48m (49%) from £98m to £146m, mainly due to money deferred from 2020 for games played after accounts. This offset COVID driven reduction in match day, down £12m (98%) to just £222k, and £29m (39%) fall in commercial to £47m (naming rights option).

Following further squad investment, #EFC wage bill increased £18m (11%) to £183m, but there were reductions in other categories. Player amortisation fell £18m to £81m, impairment was down £11m to £15m, other expenses cut £8m to £25m and exceptional items decreased £24m to £7m.

Despite the improvement, #EFC £121m loss is still an awful result, albeit “beaten” by both #CFC £156m and #AFC £127m in 2021. A full year of the pandemic resulted in some very high losses, e.g. #FFC £93m and #THFC £80m. The #WWFC £145m profit was driven by £127m loan write-off.

The club said COVID has caused £170m losses to #EFC over last 2 years (£103m in 2021) with a further £50m to be added (based on market analysis), though the accounts only list £82m impact, split between 2020 £67m and 2021 £15m (net of deferring £26m revenue from 2020 to 2021).

Based on #EFC strategic report, we can analyse the £82m COVID impact between £48m revenue loss (match day £22m, broadcaster rebate £9m, commercial £17m) and £34m additional expenses (player impairment £42m, onerous contracts £12m, offset by £20m savings for games without fans).

Excluding impact of pandemic, #EFC loss would have increased from £73m in 2020 to £106m in 2021.

Remaining COVID loss is due to significant deterioration in transfer market, leading to inability to generate player sales profits plus more costs incurred (wages and amortisation).

Remaining COVID loss is due to significant deterioration in transfer market, leading to inability to generate player sales profits plus more costs incurred (wages and amortisation).

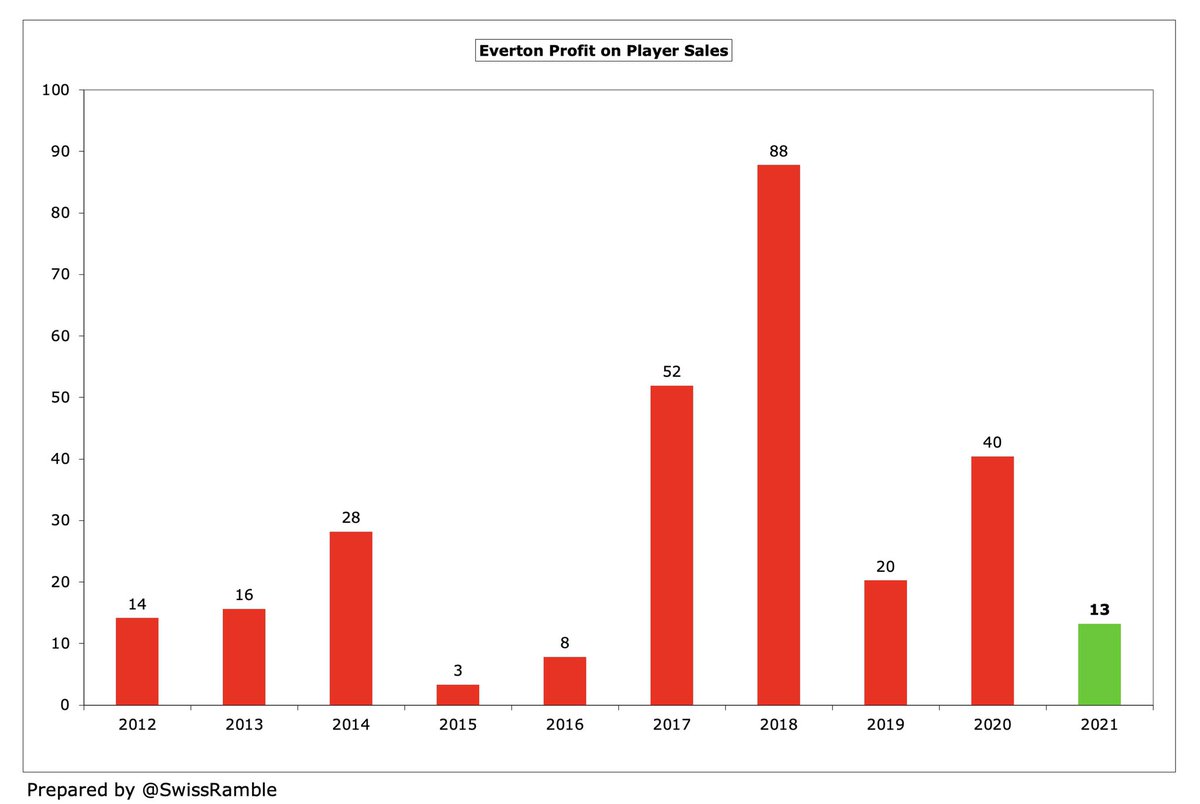

As a result, #EFC profit from player sales dropped from £40m to £13m, though some might argue that it was also difficult to offload under-performing players on inflated salaries. Indeed, a few clubs did manage to make good money, e.g. #MCFC £69m, #WWFC £61m and #LCFC £44m.

After many years following a frugal approach, #EFC have pushed the boat out in recent times, losing a colossal £373m over the last three years. Their deficit has been well over £100m in each of those seasons: 2018 £112m, 2019 £140m and 2021 £121m.

In fact, #EFC £373m loss over the last 3 years is by some distance the largest in the Premier League, miles above #CFC £222m, #AFC £213m and #AVFC £206m. In this period, they have reported three of the worst losses ever in England (4th, 8th and 9th highest).

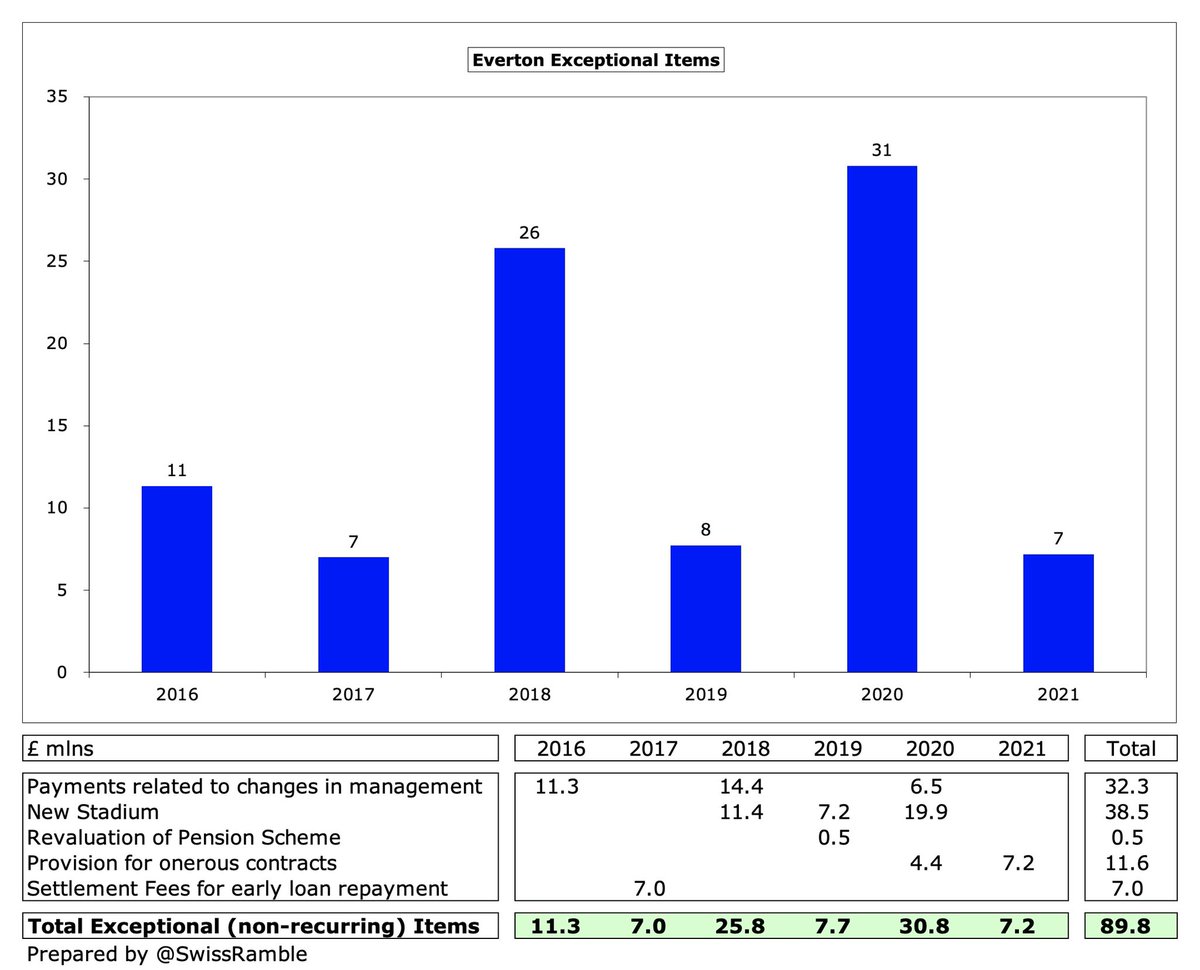

#EFC figures hit by £90m exceptional costs in last 6 years, including £32m payments for management changes. Also £39m costs on new stadium (£20m in 2020) with another £20m in 2021that were capitalised – now more certainty around project completion (planning permission granted).

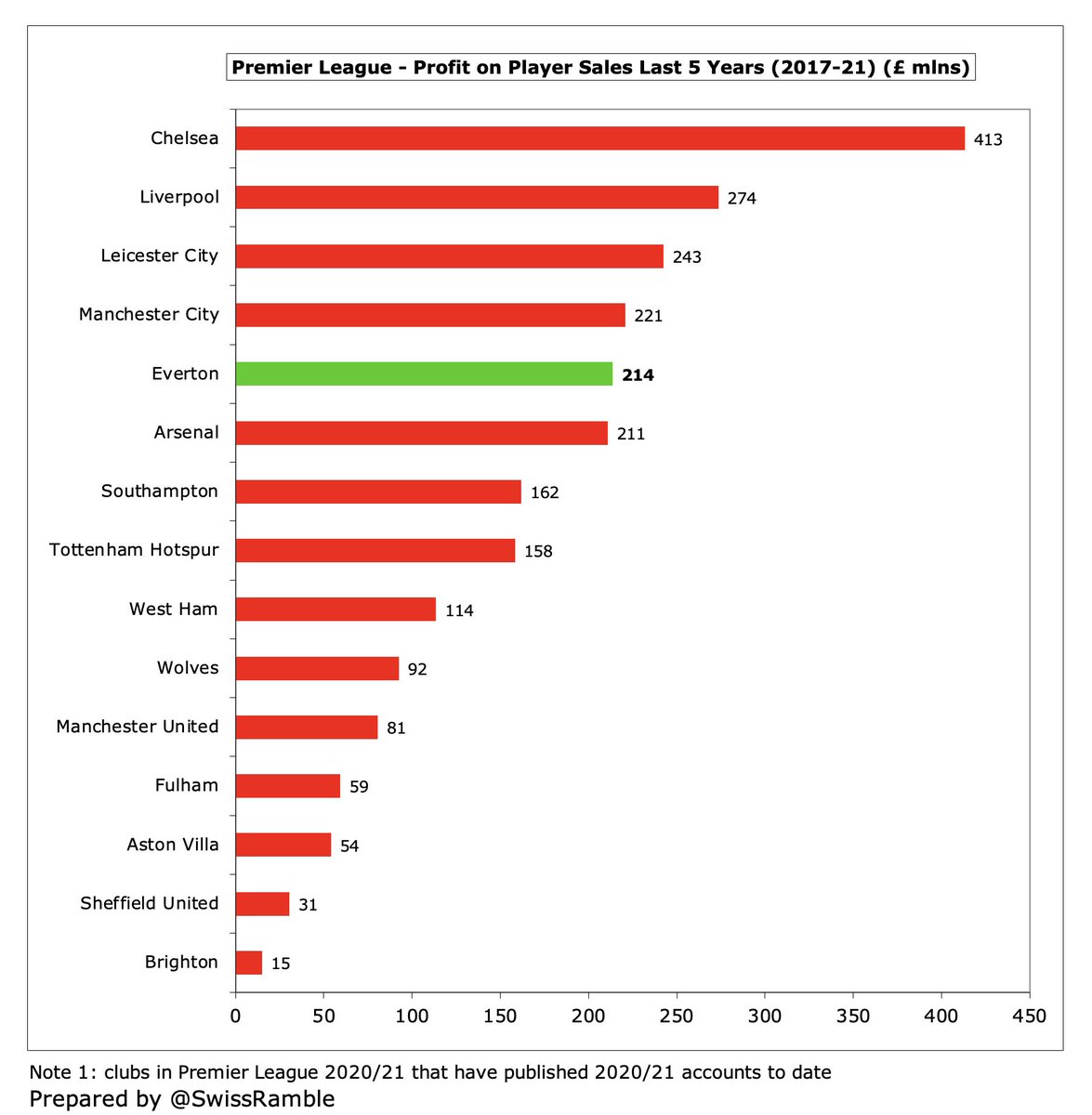

On the other hand, #EFC boosted by £214m profit from player sales in last 5 years, which is 5th highest in the Premier League. However, £140m of this came back in 2017 and 2018, which helps explain large net losses in last 3 years. This year’s figure will include Digne to #AVFC.

#EFC operating loss (excluding player sales, interest & exceptionals) reduced from £144m to £118m, though this is still the 2nd worst result in Premier League in 2021, only better than #CFC £159m. Almost all clubs make losses at operating level, but Everton are particularly high.

#EFC £193m revenue is £5m (3%) higher than 2019 pre-pandemic level, despite significant £14m fall in match day, as broadcasting rose £14m, due to deferred revenue from 2020, and commercial is up £5m. Revenue has plateaued in last 4 years, but would be above £200m without COVID.

#EFC £193m revenue is down to 9th highest in the Premier League, having been overtaken by #LCFC £226m and #WWFC £194m, though both of those clubs are boosted in 2020/21 by high deferred income (31st May close). Everton are only around a third of #MCFC £570m.

That said, according to the Deloitte Money League, #EFC £193m means they have the 18th highest revenue in the world. They dropped a place in 2020/21, but their revenue is still above the likes of Milan, Sevilla, Roma and Napoli, who have all performed well on the pitch recently.

#EFC broadcasting income rose £48m (49%) from £98m to £146m, as revenue from 7 games was deferred to 2020/21 (played after end-June 2019/20 accounting close) & higher Premier League merit payment for finishing 10th (prior year 12th), partly offset by higher broadcasters’ rebate.

As the 2019/20 season was extended, £23.5m revenue was booked in #EFC 2020/21 accounts. driving £47m year-on-year growth (reduction in 1st year plus increase in 2nd year). Clubs with May year-end had largest revenue deferrals, while those with a July close deferred nothing.

#EFC strategy is to spend big in the hope of securing regular European football, worth £70-100m in 2021 for Champions League & £15-25m for the Europa League. Everton have earned €14m from Europe in last 5 years, which can be contrasted to another aspirational club, #THFC €293m.

#EFC commercial revenue fell £29m (39%) from £76m to £47m, as prior year included once-off £30m payment from USM (where owner Farhad Moshiri is a shareholder) for an option on new stadium naming rights. More than doubled from £21m in 2016 to club record (excluding one-offs).

#EFC £47m is the 7th highest commercial revenue in England. That said, their £25m growth since 2016 is still lower than all of the Big Six (except #MUFC) in absolute terms. For example, #LFC, #MCFC and #THFC have all grown this revenue stream by around £100m in the same period.

#EFC had two new sponsorships in 2020/21: Cazoo replaced SportPesa (shirt) for a similar amount, £10m a year, though they will not take up the option to extend deal; while Hummel pay £10m for kit deal, an uplift on previous Umbro agreement £6m. No sleeve sponsor.

#EFC have recently suspended commercial agreements with Alisher Usmanov, the Russian oligarch, who is Moshiri’s business partner. These were reportedly worth £20m a year, including Finch Farm training complex. Everton will also lose out on likely future stadium naming rights.

#EFC gate receipts fell £12m (98%) to just £222k, as all home games played behind closed doors except 4 with restricted capacity (3 with only 2,000 fans). Revenue has steadily fallen since £18m peak in 2015, but even that is very low compared to others, e.g. #THFC £95m in 2020.

#EFC 2019/20 average attendance of 39,103 (for games played with fans) was mid-table in the Premier League, just below #AVFC and #CFC. Some of the “most competitive” prices in top flight, but Everton recently announced their first season ticket price increase since 2014/15.

Work has started on #EFC new 52,000 capacity stadium at Bramley-Moore Dock after planning permission was granted in 2021. The estimated cost is over £500m, to be funded by a combination of Moshiri and the capital markets, but it could be a game-changer when it opens in 2024/25.

#EFC wage bill rose £18m (11%) from £165m to club record £183m, which means that wages have more than doubled (up almost £100m) under Moshiri. Should fall, as many expensive players have left since these accounts, e.g. James, Walcott, Digne, Bernard, Bolasie and Kean (on loan).

Following this growth, #EFC £183m wage bill is 8th highest in the Premier League, only surpassed by the Big Six and #LCFC £192m. There is then a big gap to #WWFC £139m and #AVFC £138m, so it is clear that Everton have punched well below their weight this season.

#EFC reported wages to turnover ratio increased from 89% to 95%, partly due to COVID. This is the second highest (worst) in the Premier League, only “beaten” by #FFC 98%. Even if we adjust for outsourced catering and retail revenue, the ratio would only fall to 91%.

#EFC directors’ remuneration increased from £3.5m to £4.2m with the highest paid director rising 65% from £1.2m to £2.0m. Incredibly, this was 4th highest in the Premier League, which begs the question: just how much would they be paid if they actually did a good job?

#EFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, fell £18m (18%) from £99m to £81m. However, this expense has still nearly quadrupled in 5 years, and is 6th highest in Premier League (even above #THFC £75m).

In addition, #EFC booked £15m player impairment to reflect lower values in a COVID-impacted transfer market. That makes £42m in the last 2 years, which is twice as much as the next highest club in the Premier League – and a good indication of poor recruitment.

#EFC other operating costs fell £8m (23%) from £33m to £25m, driven by “ongoing tight management of operational costs” and reduced costs from staging fixtures at Goodison Park without fans in attendance.

#EFC spent £81m on player purchases, including Allan, Abdoulaye Doucouré and Ben Godfrey, taking their expenditure in the past 5 years to an amazing £647m, compared to only £139m in the preceding 5-year period, thanks to Moshiri providing funds to invest in the squad.

In the last 5 years #EFC £647m is the 6th highest gross transfer spend in the Premier League. In fact, their £359m net spend is almost unbelievably the 5th highest, placing them above both #LFC £318m and #THFC £265m.

However, the taps have been largely turned off since then in the transfer market. #EFC only spent £2m last summer to bring in Demarai Gray (and a few free transfers, such as Rondon, Townsend and Begovic), plus £34m on Mykolenko and Patterson in the January window.

Per club #EFC gross debt more than doubled from £59m to £128m, being facilities from Rights and Media £100m & Metro Bank £30m. Everton classify Moshiri’s £250m interest-free loan as equity, as no agreed repayment date, but other clubs treat such “friendly” loans as debt.

If the Moshiri loan is considered as debt, #EFC £379m is 3rd highest in England, only below #THFC £854m and #MUFC £530m. It would be even higher without the owner converting £100m debt into equity in 2021. Will significantly rise as new loans are taken out to fund the stadium.

#EFC paid £4.8m interest on their loans, up from prior year £3.1m, even though Moshiri’s loans are interest-free. Much less than AFC £34m (mainly debt refinancing break fee), #MUFC £21m & #THFC £18m, but will surely increase as stadium debt grows.

#EFC don’t separately report transfer debt, but assuming 90% of Trade Creditors, this fell from £84m to £69m, much lower than #THFC £170m and #CFC £147m. Club also has £77m contingent liabilities, based on things like number of appearances, signing-on fees and loyalty bonuses.

#EFC £126m operating loss became £64m negative cash flow (adding back £104m amortisation & depreciation, offset by £42m working capital moves), then spent net £67m on players (purchases £115m, sales £48m), £22m stadium and £5m interest. Funded by £100m from Moshiri and £71m debt.

As a result, #EFC cash balance increased by £14m from £56m to £70m. This is actually the 4th highest in the Premier League, though much of this will be reserved for further stadium development.

In the last 5 years #EFC money has largely come from Moshiri £448m with a further £70m from bank loans. The majority of this (£320m) has been spent on the squad, with £55m on capex, £47m to cover losses, £23m interest payments and £73m increase in cash balance.

Since these accounts were finalised, the owner has added another £97m loan, which means he has provided £545m of funding to #EFC since his arrival. As an example of Moshiri’s commitment, no owner in the Premier League has provided more funding in the last 5 years.

Despite their hefty losses, #EFC are confident of meeting Premier League Profitability & Sustainability rules, though my calculations suggest they are a long way off, even after adjusting for infrastructure, women’s team, academy, community, stadium development and COVID impact.

#EFC are “working formally with the Premier League” on FFP compliance, but this could only be achieved by some fancy financial footwork, involving hypothetical player trading losses (not detailed in accounts), as Everton’s estimate for COVID impact is far higher than other clubs.

While it is true that #EFC have faced a perfect storm of COVID and expensive stadium development in recent times, their investment in the squad and management has left an awful lot to be desired, leading to huge player write-offs and high turnover in coaching staff.

#EFC said, “we remain in a secure financial position thanks to the unwavering support of Farhad Moshiri”, but the losses are staggering with the significant investment yet to deliver success. Far from it, in fact, as the threat of relegation currently hangs over the club.

• • •

Missing some Tweet in this thread? You can try to

force a refresh