1/x Would you support more onshore conventional #gas drilling in #Europe to replace Russian gas dependence?

Please vote as I want to share with European Commission. #EnergySecurity

Please vote as I want to share with European Commission. #EnergySecurity

2/x European onshore exploration was primarily focused on oil. From 60-70s focus shifted to the North Sea, especially for gas.

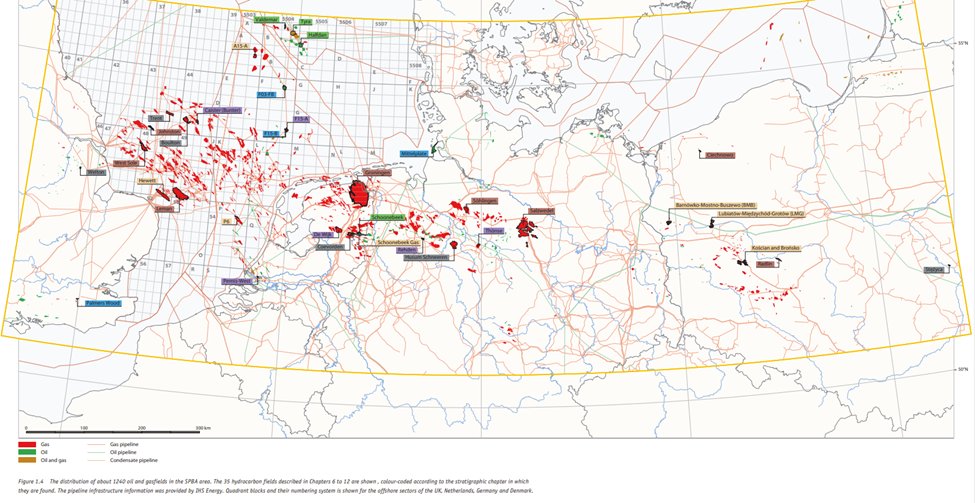

Below map of onshore oil & gas fields and pipelines in Europe's Southern Permian Basin. There are several other producing basins in Europe.

Below map of onshore oil & gas fields and pipelines in Europe's Southern Permian Basin. There are several other producing basins in Europe.

3/x Finding another elephant Grønningen (2740 bcm) could replace 17.5 years of Russian gas import to Europe.

If you do not look, you do not find.

If you do not look, you do not find.

Please retweet so we can get more votes 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh