Leeds United’s 2020/21 accounts cover their first season back in the Premier League after a 16-year absence, when they finished an impressive 9th under Marcelo Bielsa, recently replaced by Jesse Marsch. Finances impacted by COVID. Some thoughts follow #LUFC

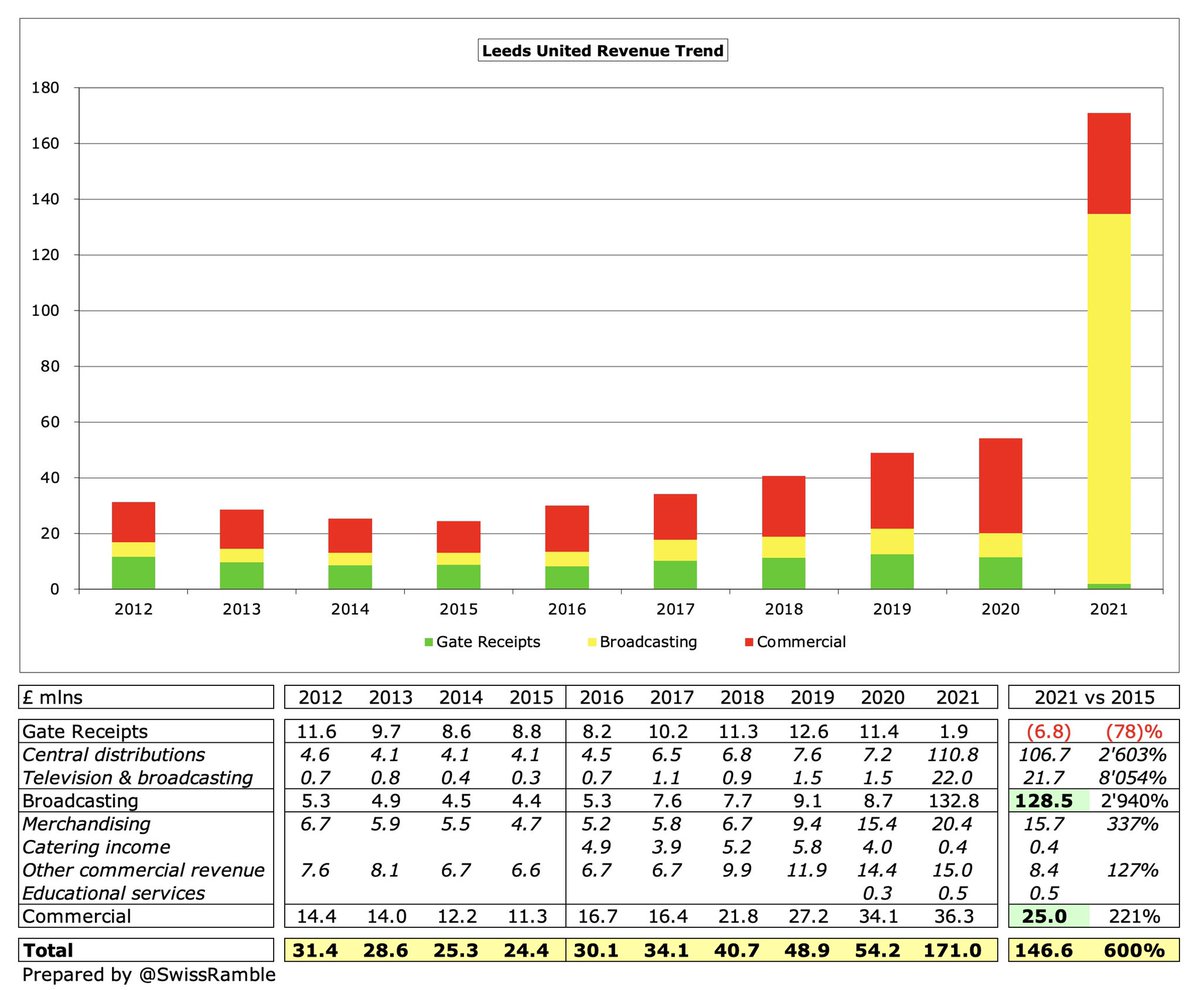

#LUFC swung from a £62m pre-tax loss in the Championship to £26m profit in the Premier League, thanks to revenue more than tripling from £54m to club record £171m, though competing in the top flight increased expenses by a third (£44)m. Bottom line boosted by £21m loan write-off.

Main driver of #LUFC £117m revenue increase was broadcasting, up £124m from £9m to £133m, due to much more lucrative Premier League TV deal, though commercial also grew £2m (6%) to £36m. This offset the COVID driven reduction in gate receipts, down £10m (83%) to just £1.9m.

However, #LUFC saw significant cost growth, as wages rose £30m (38%) from £78m (including £20m promotion bonus) to £108m, while player amortisation/impairment rose £27m from £11m to £38m. Other expenses fell £12m (41%) to £18m. No repeat of £7m broadcasting rebate.

#LUFC £26m profit is 2nd highest in the Premier League, only below #WWFC £145m (£127m loan write-off). Even if Leeds’ £21m waived loan were excluded, net profit would still be £5m. A full year of the pandemic meant some very high losses, e.g. #CFC £156m, #AFC £127m & #EFC £121m.

As a technical aside, the #LUFC 2020/21 accounts only covered 11 months, as the previous 2019/20 accounts were extended by a month to match the longer season, so covered a 13 month period. Revenue not significantly impacted, but this meant one month less of expenses.

COVID meant that #LUFC lost £22.8m profits in 2020/21, due to significant losses in match day (ticketing, concessions & hospitality), stadium events and conference & banqueting. Prior season adverse impact was £8.5m, including £7m for Premier League TV rebate as a promoted club.

#LUFC profit would have been even higher if they had sold some of their talent. As it was, profit on player sales fell from £10m to a £1m loss. Unsurprisingly, this was the worst player trading result in the Premier League, miles below #MCFC £69m, #WWFC £61m and #LCFC £44m.

#LUFC 2021 £26m profit is the first they have reported since 2017 – and that was only £1m. Losses had been increasing following the arrival of owner Andrea Radrizzani, as Leeds invested big sums to help secure promotion, leading to £84m deficit in the previous two years.

#LUFC exceptional items improved by £28m, as 2021 benefited from a £21m loan write-off (presumably from Radrizzani), while 2020 included a £7m Premier League broadcasters’ rebate (which was Leeds’ share as a promoted club).

#LUFC have made very little from player sales, actually registering a £1m loss in 2021. Their £51m profit in last 5 years is on the low side for the Premier League (though in Championship for most of that time). Will be similar this season, as departures mainly free transfers.

#LUFC were one of only two Premier League clubs to make an operating profit in 2021 (excluding player sales & loan waiver) with their £6m surplus a significant improvement on £65m loss in the Championship. Others made huge losses: #CFC £159m, #EFC £118m, #FFC £94m and #AFC £91m.

#LUFC £171m revenue is six times as much as 2015 £24m low in the Championship. Obviously most of the growth has been driven by broadcasting, up £129m due to PL TV deal, but commercial has also increased £25m to £36m. Would have been higher without COVID fall in gate receipts.

#LUFC £171m revenue is 12th highest in the Premier League, sandwiched between #AVFC £184m and #SaintsFC £157m. Despite the growth it’s still less than a third of #MCFC £570m. This season’s rankings are distorted by the different amounts of revenue deferred from 2019/20 accounts.

As the 2019/20 season was extended, many clubs deferred revenue into 2020/21 for games played after the accounting close. Those clubs with a May year-end benefited the most with the largest deferrals, while those with a July close (like #LUFC) deferred nothing.

#LUFC £171m revenue was enough to secure them 23rd place in the Deloitte Money League, which ranks clubs globally. This put them just behind Sevilla £177m, who have won the Europa League six times, but ahead of AS Roma £169m and Atalanta £166m.

#LUFC broadcasting income shot up by £124m from £9m to £133m, the club’s highest ever from this revenue stream. Although they did not benefit from revenue deferrals in the same way as other clubs, their merit payment was boosted by Bielsa guiding them to 9th.

#LUFC gate receipts fell £10m (83%) to just £1.9m, as all home games were played behind closed doors (with the exception of one with 8,000 restricted capacity). Their match day revenue was the highest in the Championship, but is in the bottom half of the Premier League.

#LUFC 2019/20 average attendance of 35,321 (for games played with fans) was comfortably the best in the Championship and would have placed them above half the clubs in the Premier League, including #LCFC and #WWFC.

#LUFC commercial income rose £2m (6%) from to £36m, mainly driven by merchandising sales, up a third from £15m to £20m. Would have been higher without £4m fall in catering (due to COVID). Even so, 9th highest in the Premier League, though £100m below 6th placed #AFC.

#LUFC signed “record-breaking” new sponsorship deals in 2020/21. Betting firm SBOBET shirt sponsorship worth £6.5m a year, while Adidas replaced Kappa in 5-year kit supplier deal, reportedly as high as £10m. Sleeve sponsor JD Sports and training kit partnership with Clipper.

#LUFC also had £1.1m other operating income for a government grant, down from prior year £3.5m, which included £2.5m business interruption insurance claim for COVID losses. Highest amount reported here was #CFC £12.6m, mainly due to unexplained recharges.

#LUFC wages rose significantly by £30m (38%) from £78m (including £20m promotion bonus) to £108m, so they are 5 times as much as £21m just 4 years ago. Only covers 11 months, so would have been £118m on an annualised basis, which means 63% growth on an underlying basis.

Despite the increase, #LUFC £108m wage bill is the second lowest in 2020/21 Premier League to date, only above #SUFC. Even if we take the £118m wages (for annualised 12 months) this would still place them firmly in the bottom half of the table.

#LUFC wages to turnover ratio decreased (improved) from 144% to 63%, the club’s lowest for 5 years and one of the best in the Premier League. It would obviously be higher if the wage bill covered 12 months; on the other hand, ratio was adversely impacted by COVID revenue losses.

#LUFC directors’ remuneration increased from £400k to £577k, though still below the £794k peak in 2013 during the Ken Bates/David Haigh era. Also on the low side in the Premier League, far below the likes of Ed Woodward at #MUFC £2.9m and Daniel Levy at #THFC £2.7m.

#LUFC other expenses fell £12m (41%) from £30m to £18m, mainly due to lower cost of staging games (prior year also included £2.2m debtor write-off). Radrizzani previously bought back the Elland Road stadium, leased from another group company until June 2032.

#LUFC player amortisation, the annual charge to write-off transfer fees over a player’s contract, nearly quadrupled from £10m to £38m, though still one of the lowest in the Premier League. No repeat of prior year’s £1.2m impairment (write-down of player values).

#LUFC spent £99m on player purchases, as they “invested significantly” to bring in Rodrigo from Valencia, Diego Llorente from Real Sociedad, Rapinha from Rennes and Robin Koch from Freiburg. This was 8th highest in the Premier League as the club strived to be competitive.

Radrizzani has loosened the purse strings at #LUFC since his arrival, leading to gross transfer spend of £195m in the last 5 years (£145m in last 2 years alone), compared to only £21m in the preceding 5-year period. Still very low compared to other Premier League clubs.

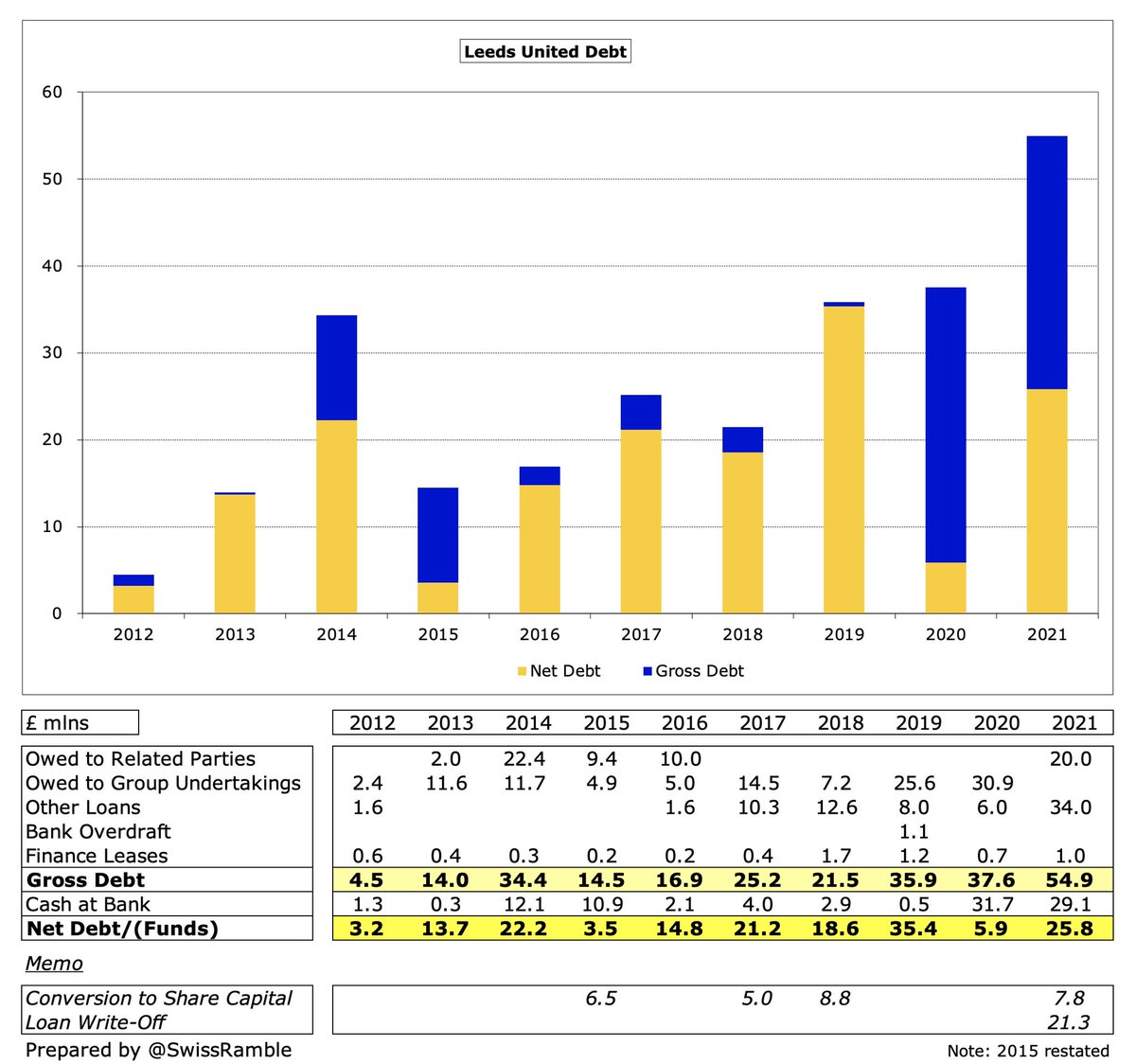

#LUFC gross debt rose £17m from £38m to £55m, including £34m external loans (secured on TV money), £20m from related parties and £1m finance leases. Would have been higher without the owners waiving £21m of loans and converting £8m of debt to capital in 2021 (£28m since 2015).

Despite the increase, #LUFC £55m debt is pretty low for the Premier League, far below #THFC £854m (stadium), #MUFC £530m (Glazer’s leveraged buy-out), #EFC £379m and #BHAFC £374m (latter two largely in the form of “friendly” owner loans).

#LUFC interest payment increased from £0.9m to £3.7m, as they took out a large external loan to fund the summer transfer campaign following promotion. This is 9th highest in the Premier League, but much less than AFC £34m (debt refinancing break fee), #MUFC £21m and #THFC £18m.

#LUFC transfer debt (for remaining stage payments on transfer fees) increased from £49m to £85m (it was only £14m two years ago), which is in the top 10 in the Premier League. Only owed £3m by other clubs, so £82m net payable.

#LUFC also have £54m contingent liabilities, mainly a £48m bonus for retention of Premier League status. This incentive scheme meant that Leeds 2020/21 wages included £35m bonus payments for the same objective, so underlying wages are very low.

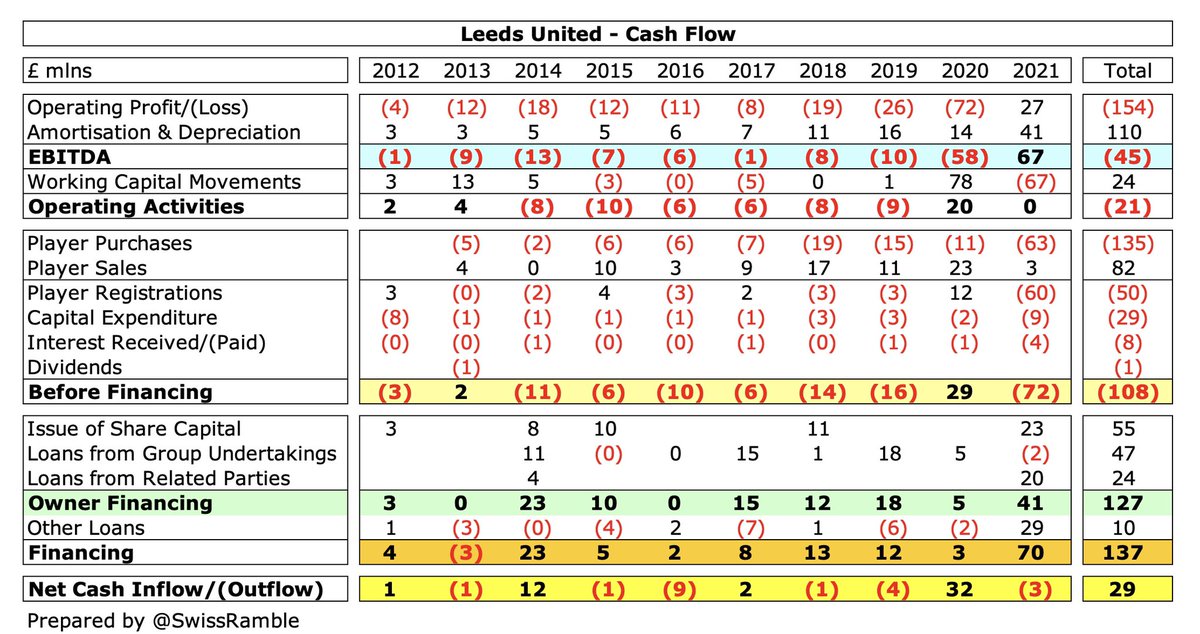

#LUFC operating profit became zero cash flow (after adding back amortisation & depreciation, offset by working capital moves), then spent net £60m on players, £9m capex (stadium improvements) & £4m interest. Funded by £23m share capital, £18m owner loans and £29m external loans.

As a result, #LUFC cash balance decreased £3m from £32m to £29m, which was around mid-table in the Premier League. However, for some context, this is a lot less than #THFC and #MUFC, who had £148m and £111m respectively,

In the last decade #LUFC have received £127m funding from various owners (£55m share capital and £71m loans). This has mainly been spent on players £50m (net), capital expenditure £29m, funding operating losses £21m and £8m interest.

Most of #LUFC owner funding has come in the last 5 years, though the £91m provided is not that high in the Premier League. Over that period those with the highest financing are aspirational clubs similar to Leeds, e.g. #EFC £448m, #AVFC £400m and #FFC £347m.

The £23m share capital injection in 2020/21 came from the investment arm of the San Francisco 49ers, who have since increased their stake in #LUFC to 44%. Media reports suggest that the 49ers have an option until January 2024 to buy the club for more than £400m.

By my calculations, #LUFC have no problems with Premier League’s Profitability & Sustainability rules, as their losses over 3-year monitoring period are well within the limit after making allowable deductions for academy, community & infrastructure, promotion bonus & COVID impact

Promotion to the Premier League has clearly transformed #LUFC finances, even when impacted by COVID (though the loan write-off also helped). Leeds enjoy a structural competitive advantage from being the only club in UK’s third biggest city, leading to good commercial prospects.

• • •

Missing some Tweet in this thread? You can try to

force a refresh