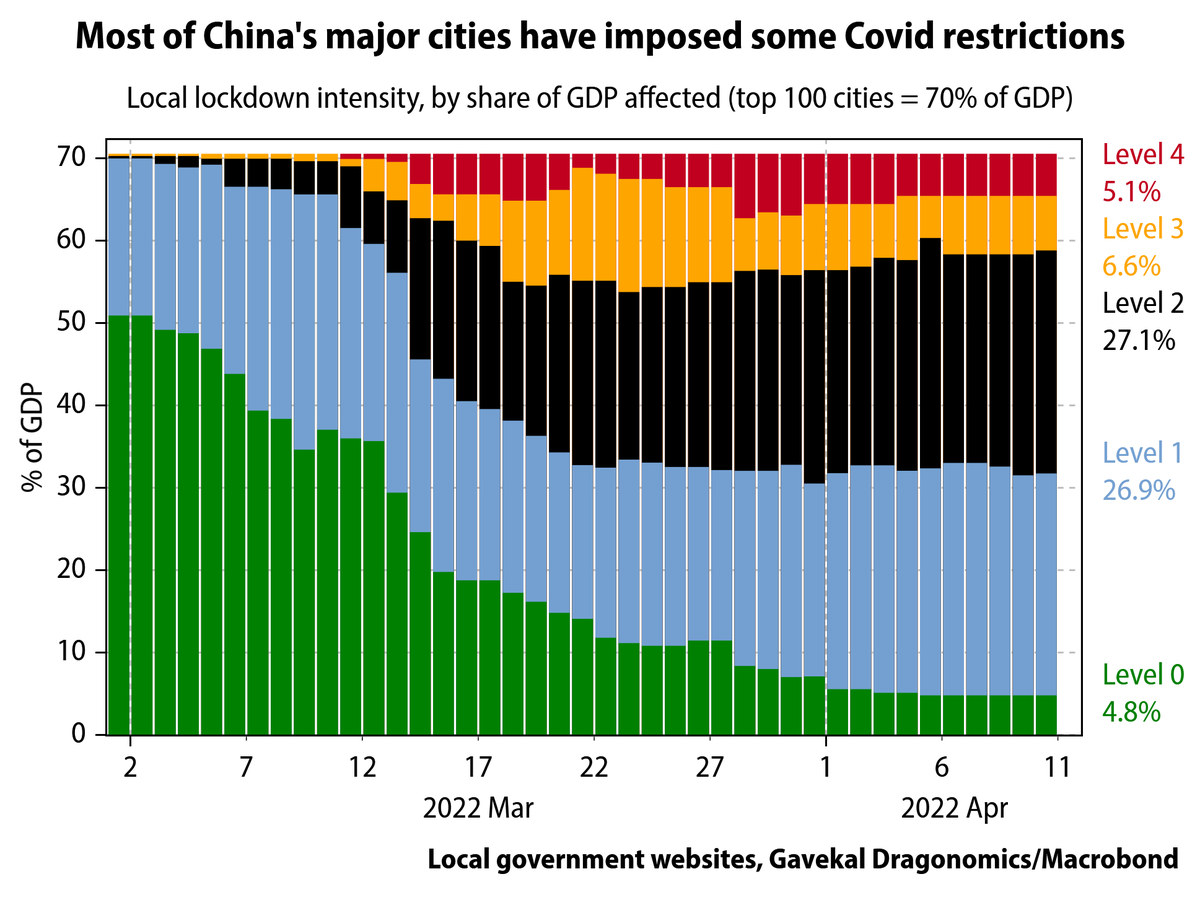

Gavekal's bottom-up analysis of China’s top 100 cities by GDP finds that all but 13 have imposed some form of quarantine restriction, and the intensity is increasing. We classified these cities from no restrictions (level 0) to full lockdown (level 4).

Shanghai and Jilin remain the worst-hit areas. In other places, lockdown measures no longer correlate well with actual case numbers, as cautious local officials impose more severe measures sooner (or keep them in place longer).

Early economic indicators for March show the impact of lockdowns in Shenzhen and other cities that preceded Shanghai’s. There is already significant disruption to the economy. Read more here: research.gavekal.com/teaser/the-sha… #chartoftheweek #covid #china #economy #lockdown

• • •

Missing some Tweet in this thread? You can try to

force a refresh