@THORChain is the perfect DEX for #BTC

For a long time #BTC maxis were excluded from the world of DeFi because of the lack of support on DEXs, and a lack of protocols supporting Bitcoin.

#THORChain offers a lot for Bitcoin holders.

A thread 🧵👇

For a long time #BTC maxis were excluded from the world of DeFi because of the lack of support on DEXs, and a lack of protocols supporting Bitcoin.

#THORChain offers a lot for Bitcoin holders.

A thread 🧵👇

2. Up until recently DEX’s have not supported Bitcoin. For a long time it wasn’t possible real bitcoin (or other top native chain assets) at scale in a decentralized way. Even now, most DEXs only support ERC-20 tokens.

3. THORChain pioneered the idea of cross chain DEXs. Now there’s Atlas, Synapse and others, but THORChain was one of the first.

4. THORChain also allows anyone to earn yield on their digital assets, and this is provided in a frictionless, decentralized, trust-minimized way.

5. THORChain is really attractive to Bitcoin holders in the way that it extends Bitcoin’s key attribute of immutability from the money layer to the exchange layer.

6. THORChain allows Bitcoin holders to:

• Trade native bitcoin with other digital assets in a decentralized way at scale

• Earn a yield on native bitcoin in a decentralized way at scale

• Trade native bitcoin with other digital assets in a decentralized way at scale

• Earn a yield on native bitcoin in a decentralized way at scale

7. THORChain enables native yield on Bitcoin. This is through the RUNE, BTC liquidity pool. Those who deposit bitcoin into this pool will earn a yield derived from the trading fees paid by those swapping in or out of bitcoin.

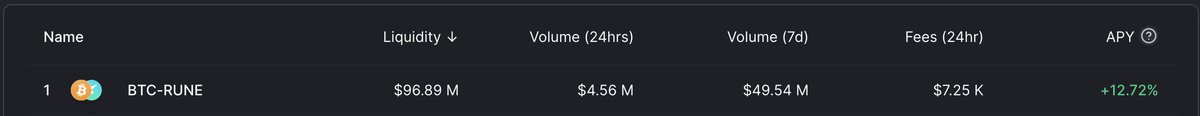

8. It’s easy to earn yield on your Bitcoin through THORChain’s liquidity pools. APY is currently ~13% for BTC RUNE LPs.

9. But RUNE must be paired with every BTC deposit. Every dollar of Bitcoin requires 1 dollar of RUNE to be paired with it. I like RUNE, but not everyone wants exposure to RUNE. This is a solvable problem though.

10. LPs can borrow RUNE rather than buy it. They can hedge RUNE to be risk-neutral. In the future Intermediaries (smart contracts) will be able to match RUNE holders with LPs, preventing either from needing to hold both assets.

11. There are central entities that offer yield to BTC holders. These include companies like BlockFi, Gemini, and Celsius.

12. But central custodians pose risks:

• Hacks, insider thefts, catastrophic bugs

• Operational risks (we don’t know what they’re doing with the bitcoin)

• Seizure and freezing risks (government or the company can prevent you from accessing your BTC).

• Hacks, insider thefts, catastrophic bugs

• Operational risks (we don’t know what they’re doing with the bitcoin)

• Seizure and freezing risks (government or the company can prevent you from accessing your BTC).

13. You’re compensated with a measly yield of up to 2% on these platforms. Trusting your BTC with a company for such a small yield does not make sense.

14. With any custodian, you lose the property of immutability. This is an aspect of Bitcoin that is extremely important to most Bitcoin maxis and Bitcoin holders in general.

15. #THORChain is great for #Bitcoin. It's led the charge for Bitcoin #DeFi. You can earn yield and make native swaps with ease through THORChain. It's the perfect partner for Bitcoin.

#THORChain accounts to follow:

@crypto_stevie @ChadThoreau @ConwellsClub @JaneDButterfly @THORmaximalist @AkuRypto @itsloganshippy @RuneMaxi @GrassRootsio @crypto_magix @BitStern @THORWalletDEX @Mastermined710 @THORChadsDAO @0xSmith

RT would mean a lot!

@crypto_stevie @ChadThoreau @ConwellsClub @JaneDButterfly @THORmaximalist @AkuRypto @itsloganshippy @RuneMaxi @GrassRootsio @crypto_magix @BitStern @THORWalletDEX @Mastermined710 @THORChadsDAO @0xSmith

RT would mean a lot!

More #THORChain accounts to follow:

@TheRuneRanger @CBarraford @CryptoVillain_ @Bull_Sander @Asian0xV @TehSlaw @NicolasFlamelX @crypto_magix @RimaSabila @THORChainLPU @Jatinkkalra @THORNOOBs @runebase_org @thorstarter @m0nkey_space @Cryptofriendlyy

RT would mean a lot!

@TheRuneRanger @CBarraford @CryptoVillain_ @Bull_Sander @Asian0xV @TehSlaw @NicolasFlamelX @crypto_magix @RimaSabila @THORChainLPU @Jatinkkalra @THORNOOBs @runebase_org @thorstarter @m0nkey_space @Cryptofriendlyy

RT would mean a lot!

More #THORChain accounts to follow:

@CryptoYodaGuru @Fakk2 @Jonbros01 @flyacro @CosmoGandalf @THORSwap @TusharJain_ @SpencerApplebau @DCA_Cryptoz @CryptosBatman @youssef_amrani @youssef_amrani @runebase_org @ninerealms_cap @0xSaigon

RT would mean a lot!

@CryptoYodaGuru @Fakk2 @Jonbros01 @flyacro @CosmoGandalf @THORSwap @TusharJain_ @SpencerApplebau @DCA_Cryptoz @CryptosBatman @youssef_amrani @youssef_amrani @runebase_org @ninerealms_cap @0xSaigon

RT would mean a lot!

Hope this was insightful. I regularly post 101s and breakdowns, follow to keep up. Check out my Medium for some of my past write ups:

medium.com/@pothu

medium.com/@pothu

• • •

Missing some Tweet in this thread? You can try to

force a refresh