Business has never been better for oil and gas producers.

Here's why share prices can move even higher from here, in this Golden Age of Oil and Gas Producers 🧵

Here's why share prices can move even higher from here, in this Golden Age of Oil and Gas Producers 🧵

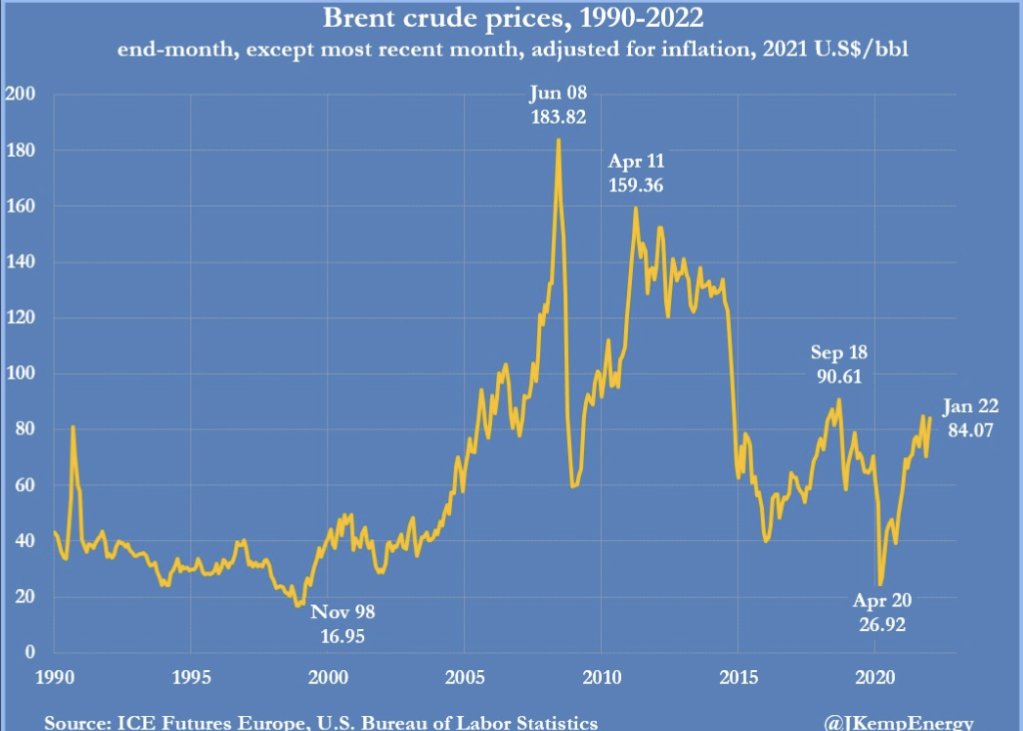

(1/13) Improving fundamentals have renewed interest in oil and gas equities, and a once left-for-dead sector is seeing share prices rising. Yet even with recent outperformance, there's room to run as oil equities catch up to Oil and the broader market:

(2/13) And while rising commodity prices have undeniably been a tailwind for E&Ps, their business models and balance sheets have improved markedly since the last cycle high. Cash flows have nearly doubled from levels achieved in 2014, a time with a similar oil price:

(3/13) Oil and gas producers are more profitable than ever. E&P management teams have "trimmed the fat" since the 2014 oil price crash, resulting in leaner cost structures, better capital deployment and higher cash flows. It is the Golden Age for Oil and Gas Producers

(4/13) With leaner cost structures, E&Ps have become more survivable in the event of another oil price downturn while generating more cash flow at higher oil and gas prices. This chart highlights the change in quarterly expenses of four indicative smaller E&Ps:

(5/13) Unlike the deluge of capital spending in the years leading up to the 2014 crash, E&Ps have been focused on minimizing expenditures to return capital to shareholders. Consequently, their capital efficiency has improved markedly, as can be seen here:

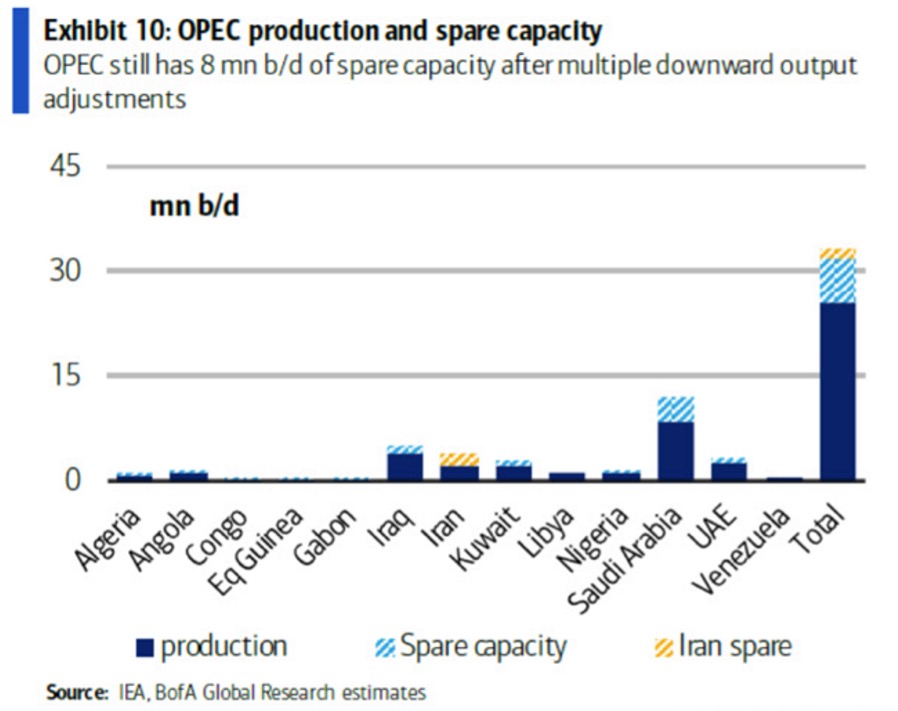

(6/13) In this new Golden Age for oil and gas producers, Canadian E&P’s shine particularly bright: a weaker Canadian dollar bolsters revenue for E&Ps selling their production in the US. Historically the CAD/USD moved in line with oil prices, but recently these have diverged:

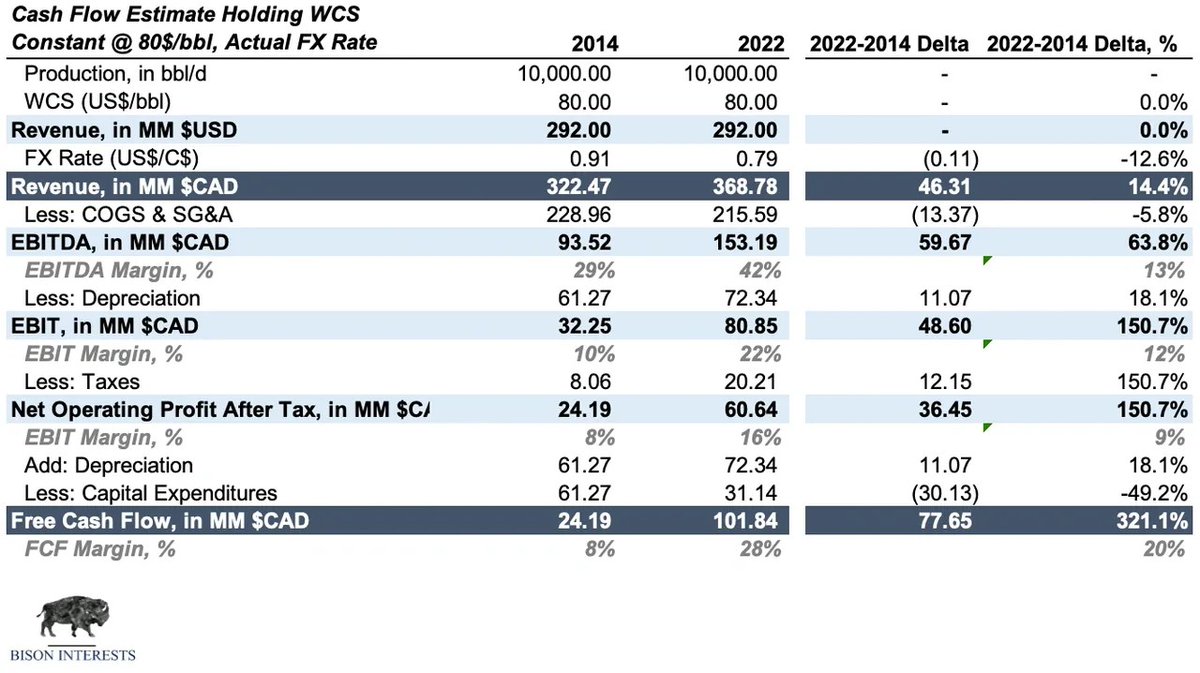

(7/13) To illustrate these effects of a weaker CAD, and lower costs and capital expenditure for Canadian E&Ps, we modeled the change in cash flow for a hypothetical 10,000 bbl/d oil-only producer between Q4 2014 and Q4 2021, assuming $80 WCS and using real exchange rates:

(8/13) As can be seen above, Canadian E&Ps may generate significantly higher cash flows than in 2014 due to poorly understood currency effects, structural cost reductions and lower capex. They remain exceptionally cheap and may outperform moving forward.

(9/13) However, these implications seem to be overlooked by the market. E&P EV/EBITDA multiples have compressed from 2014 and 2021, despite similar commodity pricing and higher EBITDA growth:

(10/13) Multiple compression can be explained by capital leaving the sector following 2014, and the ESG movement, which has artificially restricted the availability of capital and increased the regulatory burden to the industry. This has driven valuations near historic lows:

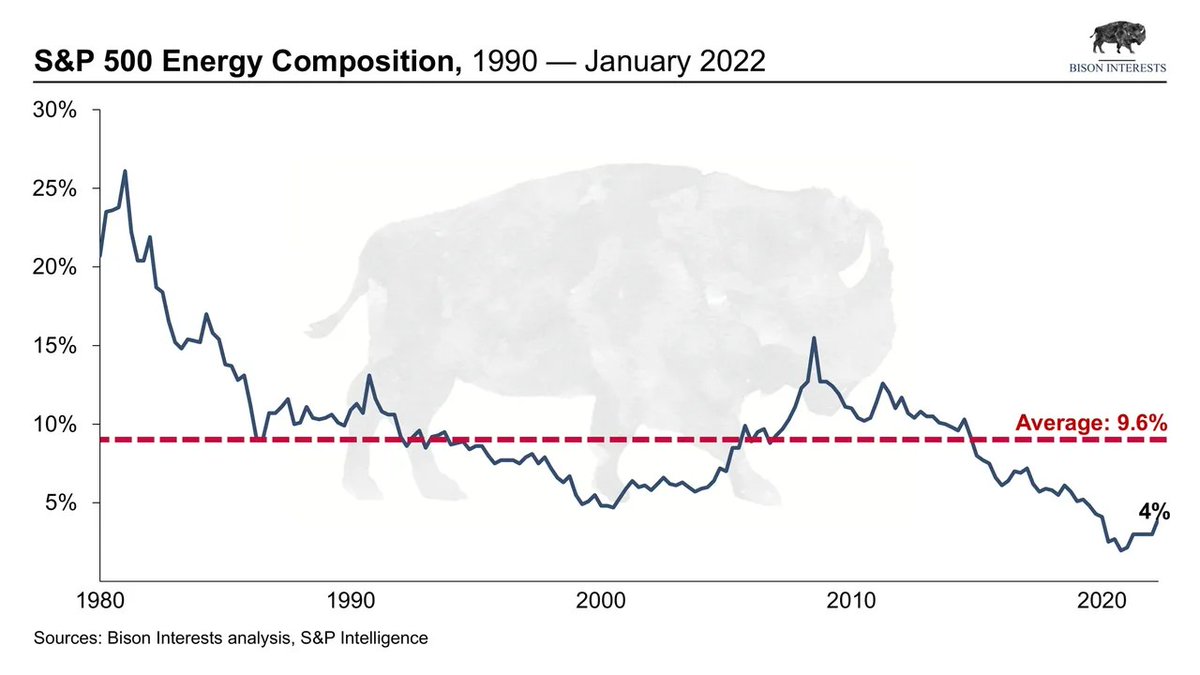

(11/13) Despite the ongoing rally in energy equities, they remain meaningfully undervalued, and there may be substantial upside even if they were only to revert to their mean composition percentage of the $spx index

(12/13) As cash flows become too costly to ignore, capital may return the industry and multiples could reflate. Even if institutional capital doesn't return, higher dividends and buybacks could drive strong returns for years to come in the Golden Age of oil and gas producers.

(13/13) To see our more detailed analysis, see the link below. Let us know what you think, and if you enjoyed this thread, please share it!

#com #eft #oott #oil #gas #golden #age

bisoninterests.com/content/f/the-…

#com #eft #oott #oil #gas #golden #age

bisoninterests.com/content/f/the-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh