Let's analyze Cement Sector in India and also check few companies with respect to their Relative #Valuation.

This learning Thread 🧵will give you detail information on #Cement Business Future outlook.

Like ❤️and Retweet 🔄 for more such learning thread in the future.

1/9

This learning Thread 🧵will give you detail information on #Cement Business Future outlook.

Like ❤️and Retweet 🔄 for more such learning thread in the future.

1/9

#India is the second largest producer of #Cement in the world.

It accounts for more than 7% of the global installed capacity. India has a lot of potential for development in the infra and construction sector and the cement sector is expected to largely benefit from it.

2/9

It accounts for more than 7% of the global installed capacity. India has a lot of potential for development in the infra and construction sector and the cement sector is expected to largely benefit from it.

2/9

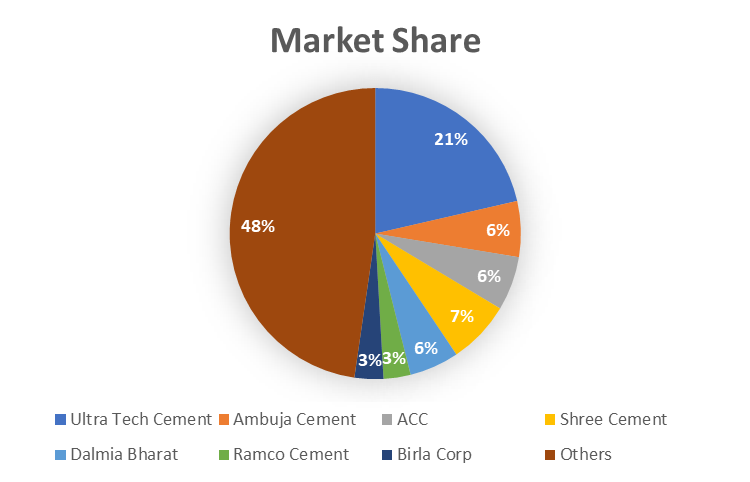

Major Cement Companies in India are:

⚡️Ultra Tech Cement

⚡️Shree Cement

⚡️Ambuja Cement

⚡️ACC

⚡️Dalmia Bharat

⚡️JK Cement

⚡️Ramco Cement

3/9

⚡️Ultra Tech Cement

⚡️Shree Cement

⚡️Ambuja Cement

⚡️ACC

⚡️Dalmia Bharat

⚡️JK Cement

⚡️Ramco Cement

3/9

Growth Projections:

Total Cement Production in FY 21 was 294 MT and it is expected to be 379 MT in FY 22.

Production is expected to grow to 550-600 MT by 2025 as per IBEF Report.

This means sector will grow by a CAGR of 16%-17% till Year 2025.

4/9

Total Cement Production in FY 21 was 294 MT and it is expected to be 379 MT in FY 22.

Production is expected to grow to 550-600 MT by 2025 as per IBEF Report.

This means sector will grow by a CAGR of 16%-17% till Year 2025.

4/9

Growth Driver:

The growth will be due to Rising Rural Housing Demand and government’s strong focus on infrastructure development.

The industry has been on a volume growth path, motivated by the government's Housing for All.

5/9

The growth will be due to Rising Rural Housing Demand and government’s strong focus on infrastructure development.

The industry has been on a volume growth path, motivated by the government's Housing for All.

5/9

Let's see companies valuation on the basis of Price to Earning Ratio:

⚡️Ultra Tech Cement = 30.0

⚡️Shree Cement = 37.3

⚡️Ambuja Cement = 26.2

⚡️ACC = 24.4

⚡️Dalmia Bharat = 26.3

⚡️JK Cement = 29.2

⚡️Ramco Cement = 19.5

6/9

⚡️Ultra Tech Cement = 30.0

⚡️Shree Cement = 37.3

⚡️Ambuja Cement = 26.2

⚡️ACC = 24.4

⚡️Dalmia Bharat = 26.3

⚡️JK Cement = 29.2

⚡️Ramco Cement = 19.5

6/9

Let's see companies valuation on the basis of Price to Book Value Ratio:

⚡️Ultra Tech Cement = 4.2

⚡️Shree Cement = 5.7

⚡️Ambuja Cement = 2.9

⚡️ACC = 3.0

⚡️Dalmia Bharat = 2.1

⚡️JK Cement = 5.2

⚡️Ramco Cement = 3.0

7/9

⚡️Ultra Tech Cement = 4.2

⚡️Shree Cement = 5.7

⚡️Ambuja Cement = 2.9

⚡️ACC = 3.0

⚡️Dalmia Bharat = 2.1

⚡️JK Cement = 5.2

⚡️Ramco Cement = 3.0

7/9

Also, Cement Sector is capital intensive business, we can check Debt to Equity ratio of all the companies:

⚡️Ultra Tech Cement = 0.4

⚡️Shree Cement = 0.12

⚡️Ambuja Cement = 0 (Debt Free)

⚡️ACC = 0

⚡️Dalmia Bharat = 0.2

⚡️JK Cement = 0.8

⚡️Ramco Cement = 0.5

8/9

⚡️Ultra Tech Cement = 0.4

⚡️Shree Cement = 0.12

⚡️Ambuja Cement = 0 (Debt Free)

⚡️ACC = 0

⚡️Dalmia Bharat = 0.2

⚡️JK Cement = 0.8

⚡️Ramco Cement = 0.5

8/9

This was the simple analysis of the Cement Sector and Listed Top Cement #Stocks in India.

I hope this short sectorial analysis will help you.

This is not a buy/sell reco for any cement stocks.

Also Like and Retweet the first tweet for wider reach⤵️

9/9

I hope this short sectorial analysis will help you.

This is not a buy/sell reco for any cement stocks.

Also Like and Retweet the first tweet for wider reach⤵️

https://twitter.com/chartians/status/1517473119060959238

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh